Search Market Research Report

Sugar Substitute Market Size, Share Global Analysis Report, 2025 – 2034

Sugar Substitute Market Size, Share, Growth Analysis Report By Types (High-Intensity Sweeteners And Low-Intensity Sweeteners), By Applications (Food, Beverage, Health, And Personal Care), By Origin (Artificial And Natural), By Form (Solid, Liquid, And Syrup), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

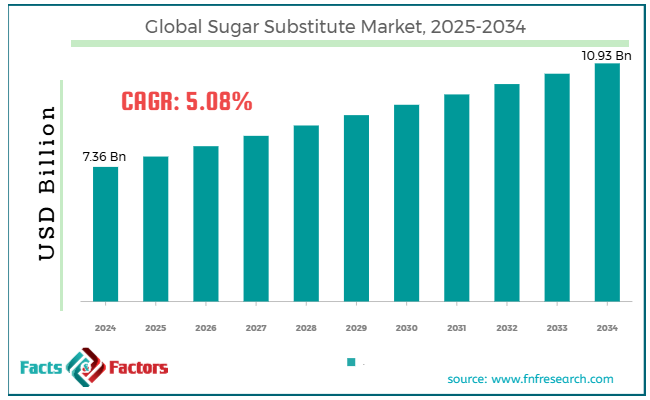

[215+ Pages Report] According to Facts & Factors, the global sugar substitute market size was valued at USD 7.36 billion in 2024 and is predicted to surpass USD 10.93 billion by the end of 2034. The sugar substitute industry is expected to grow by a CAGR of 5.08% between 2025 and 2034.

Market Overview

Market Overview

Sugar substitutes refer to natural and artificial compounds that can replace sucrose in food and beverages, offering sweetness with negligible calories. Sugar substitutes are derived from both natural and synthetic sources. However, they are classified based on the intensity of sweetness as high-intensity or low-intensity sweeteners. They are more in demand among consumers because of their zero and low glycemic index, longer shelf life, non-carcinogenic nature, and thermal stability.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global sugar substitute market size is estimated to grow annually at a CAGR of around 5.08% over the forecast period (2025-2034).

- In terms of revenue, the global sugar substitute market size was valued at around USD 7.36 billion in 2024 and is projected to reach USD 10.93 billion by 2034.

- High prevalence of diabetes is driving the growth of the global sugar substitute market.

- Based on the type, the high-density sweetener segment is growing at a high rate and is projected to dominate the global market.

- Based on applications, the food segment is anticipated to grow with the highest CAGR in the global market.

- Based on the origins, the natural segment is projected to swipe the largest market share.

- Based on forms, the liquid segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- How does the high prevalence of diabetes drive the growth of the global sugar substitute market?

The global population is facing issues like diabetes and obesity, which are emerging as key reasons people are looking forward to sugar substitutes. According to IDC, the global diabetes population is likely to surpass 643 million by 2030. Such staggering statistics underscore a significant need for effective sugar substitutes. Moreover, such a landscape boasts a culture of consuming LI sweeteners, such as stevia. Consumers have a strong preference for sugar substitutes because they offer low-calorie intake and help people maintain glycemic control.

Moreover, the industry's future is poised for growth, primarily due to a significant shift towards clean label and natural ingredients. Brands are working on blending stevia with other substitutes, such as monk fruit, to achieve a better-tasting and more functional final product.

Additionally, many countries implementing sugar taxes to reduce consumption have stringent government regulations. For instance, Canada has forced front-of-the-pack labels for high sugar content. The FSSAI in India is encouraging people to reduce their sugar intake through educational campaigns. All these factors are anticipated to fuel the growth of the global sugar substitute market.

For instance, Tata & Lyle introduced OPTIMIZER STEVIA 8.10 in 2023. It is an innovative product under the premium category. It is a versatile product ideal for use in yogurt, gummies, and functional beverages, providing nutritional benefits.

Restraints

Restraints

- Consumer skepticism is expected to hinder the growth of the global market.

Some synthetic sweeteners are under debate due to controversy over their health effects, primarily driven by negative media coverage. These sweeteners are said to affect gut microbiome balance and metabolic disruption. Therefore, people were quite skeptical about replacing their table sugar, which is expected to restrain the growth of the sugar substitute industry during the forecast period.

Opportunities

Opportunities

- Will rapid expansion of food and beverage applications foster growth opportunities in the global sugar substitute market?

Sugar substitutes are being increasingly used in sausages, breakfast cereals, functional bars, healthy snacks, and many other products, thereby expanding their application. However, the pharmaceutical sector is also utilizing sugar substitutes in its products, which further expands the global sugar substitute market's scope. Many personal care products, such as lozenges and toothpaste, contain xylitol, a sugar substitute.

However, the ongoing innovation and research & development breakthroughs in next-gen sweeteners are likely to further foster growth opportunities in the market. Manufacturers have developed allulose and tagatose to mask the aftertaste and enhance the functionality of these products.

However, the changing lifestyle of people worldwide is emerging as a primary factor driving the market's growth in the coming years. For instance, Ingredion collaborated with Better Juice in 2024 to expand its sugar-reducing technology in the US. Better Juice company technology reduces the sugar content by 30% to 80% while preserving the nutrients of the items.

Challenges

Challenges

- Does aftertaste negatively impact the growth of the global sugar substitute market

These sugar substitutes often have a bitter aftertaste, posing a significant challenge to the sugar substitute industry. However, manufacturers are blending different sweeteners and working on taste masking technology to improve their metallic aftertaste.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 7.36 Billion |

Projected Market Size in 2034 |

USD 10.93 Billion |

CAGR Growth Rate |

5.08% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

E. I. DuPont de Nemours, PureCircle, The NutraSweet Company, JK Sucralose Inc., Ajinomoto Co., Roquette Frères, Ingredion Incorporated, Archer Daniels Midland Company (ADM), Cargill Incorporated, Tate & Lyle, and others. |

Key Segment |

By Types, By Applications, By Origin, By Form, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global sugar substitute market can be segmented by type, application, origin, form, and region.

Based on types, the market can be segmented into high-intensity sweeteners and low-intensity sweeteners. The high-density sweetener segment is likely to account for the largest share of the sugar substitute industry during the forecast period. These sweeteners are much sweeter than sucrose, thereby allowing companies to offer similar functionality with smaller quantities. It also eliminates the problem of calorie count, which attracts end-users.

High-intensity sweeteners have a wide range of applications across various industries, including pharmaceuticals, beverages, dairy, frozen desserts, tabletop sweeteners, bakery, confectionery, and others. Such sweeteners easily get approval from authorities, thereby increasing the viability of the product.

Based on applications, the market can be segmented into food, beverage, health, and personal care. The food segment is expected to be the fastest-growing in the global sugar substitute market during the forecast period. Many food products, such as sausages, confectionery, baked goods, and breakfast cereals, are increasingly being substituted with natural and artificial sweeteners instead of sugars, which is a significant factor fueling the growth of the segment.

However, the increasing education and awareness among people regarding health-conscious consumption are also creating demand for diabetic-friendly, low-glycemic, and sugar-free food products globally.

Based on origins, the market can be segmented into artificial and natural. The natural segment is likely to dominate the sugar substitute industry during the predicted period. Natural sugars are derived from plant sources, including stevia, yacon syrup, coconut sugar, and honey, among others. A significant factor driving the segment's growth is the increasing demand for clean-label products.

Naturally occurring sweeteners do not contain many chemical additives and are therefore viewed as safer alternatives to aspartame and saccharin. These are plant-based foods that are organic and non-GMO, making them more appealing to consumers. The rising trend of using fermentation-derived stevia is likely to reshape the future of the industry. Additionally, manufacturers are combining these naturally derived low-calorie sweeteners, such as stevia and erythritol, for enhanced functional performance. Therefore, such factors are likely to contribute to the segment's growth.

Based on forms, the market can be segmented into solid, liquid, and syrup. The liquid segment is likely to witness significant growth with a high CAGR during the forecast period. The liquid segment refers to sugar substitutes that can be easily dissolved in sauces, marinades, beverages, syrups, desserts, and other similar applications.

Additionally, there is a growing trend of using liquid sugar substitutes in food service and industrial applications, making them a more scalable option. Moreover, many health-conscious consumers are adopting the DIY trend, which is boosting the sales of liquid sweeteners in the retail space. Liquid sweeteners have a smooth taste delivery, and therefore, they are more preferred in beverages and functional drinks.

Regional Analysis

Regional Analysis

- North America is likely to dominate the global market.

North America is expected to be the fastest-growing region in the global sugar substitute market during the forecast period. Stevia is in high demand in North America due to its potent blending with monk fruit or erythritol, which is particularly sought after because it is considered a natural supplement.

However, liquid-based sugar substitutes are gaining momentum in North America, which is also expected to fuel the growth of the regional market. However, the United States is leading the North American market with a high CAGR because of the highest obesity rate.

Moreover, the high prevalence of diabetes is further creating demand for low-carb, keto-friendly, and diabetic friendly options. Canada is also a significant market in North America, following the United States, with a substantial contribution to the regional market's sales revenue. The front-of-the-pack nutrition label rule by Health Canada is expected to be a transformative force in the growth of the regional market. Mexico is also expected to witness significant developments in the market due to its sugar tax policy, which was implemented in 2014.

- Where will the Asia Pacific region stand in the sugar substitute industry?

The Asia-Pacific region is also expected to witness substantial growth in the sugar substitute industry, following North America. The food service sector is making a significant contribution to the development of the regional market. China is emerging as a regional leader in the APAC region due to the increasing awareness among people about the side effects of sugar on the human body.

Moreover, it is becoming the largest producer and consumer of stevia, which is also expected to have a positive influence on the market. India is also an emerging market with a higher demand for high-intensity sweeteners.

Another major factor driving the market's growth is the rising urbanization and increasing disposable income of people in the region. South Korea is also expected to witness significant growth in the coming years due to the high influx of investment in allulose production, as it is known for its closest taste to table sugar.

For instance, Ingredion is expanding its production facility in Malaysia, named PureCircle, in 2023. This strategy aims to enhance the capacity of its bioconversion technology.

Competitive Analysis

Competitive Analysis

The key players in the global sugar substitute market include:

- E. I. DuPont de Nemours

- PureCircle

- The NutraSweet Company

- JK Sucralose Inc.

- Ajinomoto Co.

- Roquette Frères

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- Cargill Incorporated

- Tate & Lyle

For instance, Cargill Incorporated is likely to expand its operations in South India with an investment of USD 35 million in 2023. The company is expected to focus on strengthening its supply chain and ensuring long-term sustainable growth.

The global sugar substitute market is segmented as follows:

By Types Segment Analysis

By Types Segment Analysis

- High-Intensity Sweeteners

- Low-Intensity Sweeteners

By Applications Segment Analysis

By Applications Segment Analysis

- Food

- Beverage

- Health

- Personal Care

By Origin Segment Analysis

By Origin Segment Analysis

- Artificial

- Natural

By Form Segment Analysis

By Form Segment Analysis

- Solid

- Liquid

- Syrup

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- E. I. DuPont de Nemours

- PureCircle

- The NutraSweet Company

- JK Sucralose Inc.

- Ajinomoto Co.

- Roquette Frères

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- Cargill Incorporated

- Tate & Lyle

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors