Search Market Research Report

Polyvinyl Chloride Market Size, Share Global Analysis Report, 2022 – 2028

Polyvinyl Chloride Market Size, Share, Growth Analysis Report By Application (Pipes & Fittings, Profiles, Films & Sheets, Cables, Pastes, and Others), By Type (Rigid, Flexible, and Others), By End-use Industry (Construction, Electrical Cables, Packaging, Transportation, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

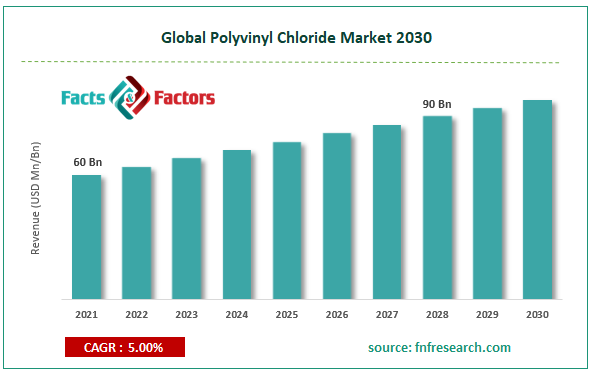

[230+ Pages Report] According to the report published by Facts Factors, the global polyvinyl chloride market size was worth around USD 60 billion in 2021 and is predicted to grow over USD 90 billion by 2028 with a compound annual growth rate (CAGR) of roughly 5% between 2022 and 2028. The report analyzes the global polyvinyl chloride market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the polyvinyl chloride market.

Market Overview

Market Overview

Polyvinyl Chloride or PVC is a kind of polymer that is manufactured broadly after polyethylene and polypropylene. Polyvinyl chloride is mostly preferred in the area of conventional materials like iron, copper, or wood in various applications due to its profits and operational productivity. The purest form of PVC is white, brittle solid, and resolvable marginally in tetrahydrofuran and insoluble in alcohol. Polyvinyl chloride demand in consumer applications such as clothing, footwear, furniture, and sportswear will provide an immense opportunity owing to its water resistance and low-cost properties compared to rubber and leather. Rising disposable income in developing nations of China, India, and Brazil have been acting as major factors in consumer applications.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global polyvinyl chloride market is estimated to grow annually at a CAGR of around 5% over the forecast period (2022-2028).

- In terms of revenue, the global Polyvinyl Chloride market size was valued at around USD 60 billion in 2021 and is projected to reach over USD 90 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type segmentation, the rigid segment was predicted to show maximum market share in the year 2021

- Based on application segmentation, pipes & fittings were the leading revenue-generating segment in 2021.

- Based on region, Asia Pacific was the leading revenue generator in 2021.

Covid-19 Impact

Covid-19 Impact

COVID-19 resulted in an economic crisis across the globe. The demand for the market is linked directly to a country's GDP. Globally, the major PVC-consuming markets, like electrical and electronics, automotive, and construction & building, were affected severely by the pandemic. Disappointing results from the chips and systems output resulted in a slowdown in the production of consumer electronics, mobile phones, servers, PCs, etc. Over the medium term, the dominant position of PVC in the construction sector and the rising applications in the healthcare market are likely to propel the market of PVC.

Growth Drivers

Growth Drivers

- Rising demand from the construction and building sector to boost market growth

PVC is lightweight, strong, durable to weathering, chemical corrosion, rotting, and abrasion, easy to use, and versatile, as it can be shaped, welded, cut, and joined in any form. These features make it ideal for several applications, such as windows, flooring, pipes, and roofing. PVC flooring has some advantages, such as freedom of aesthetic effects, durability, ease in cleaning, installation, and recyclability. Therefore, PVC flooring has been employed over the years. Furthermore, PVC is also used in roofing in the construction and building industry. It is employed for its low-maintenance and long-lasting nature requirements. The rising infrastructure construction activities are the key driver in the Middle East, Asia-Pacific, and North America.

China has the biggest construction market across the globe, encompassing 20% of all construction investments. According to the National Bureau of Statistics of China, in 2020, the construction industry in China generated an added value of approximately CNY 7.3 trillion. The United States has one of the world’s largest construction industries. However, residential construction declined in 2020 due to COVID-19, which affected the PVC market. In 2021, according to the US Census Bureau, the total value of residential housing during April 2020-2021 was USD 217,30 million, up by 21.8%, compared to USD 178,362 million for FY 2019-2020. This trend is expected to continue during the forecast period.

Increase in the technological advancements to drive market expansion

Increase in the technological advancements to drive market expansion

Rising advancements in technology pertaining to manufacturing are inducing further growth in the value of the market. Rising technological advancements driven in order to minimize production wastage and costs combined with industrialization growth have expanded the roofing materials used for sustaining the effectiveness of machinery ensuring a bright future further for the market. Conventional building materials like clay and wood concrete are being recoupled by PVC in many nations of the world. The most recent technology of employing 3D printing makes use of the market for injecting, printing, and molding structures for swift construction as it can easily be shaped, molded, colored, and processed according to the need of the user which makes it the most necessary plastic in the market. When compared to other materials, assembling PVC is economical and very cheap.

Segmentation Analysis

Segmentation Analysis

- The global polyvinyl chloride market is segmented based on type, application, end-use industry, and region.

Based on type, the global market segments are rigid, flexible, and others. The rigid segment is likely to hold a significant market share. Rigid PVC is a stiff, strong, low-cost PVC that is easy to bond and fabricate using solvents or adhesives. It is a common type of PVC used in the manufacturing of fittings, valves, pipes, sheets, ducts, and machining shapes. Rigid polyvinyl chloride offers benefits for piping owing to its high strength-to-weight ratio and low cost.

Based on application, the global market segments are pipes & fittings, profiles, films & sheets, cables, pastes, and others. Pipes & Fittings held the largest share of the revenue. It is likely to maintain its lead during the forecast period. The demand for PVC fittings and pipes is substantially high owing to their endurance and durability in rough conditions.

Based on end-use industry, the global market segments are construction, electrical cables, packaging, transportation, and others. Construction held the largest share of the revenue. This trend is likely to continue in the coming years as well. The construction segment is projected to expand at a steady pace. PVC is employed in diverse end-use sectors, due to its suitable chemical, physical, and mechanical characteristics. PVC is a common material utilized in the construction industry, due to its ease of processing, low production cost, and lightweight.

Recent Developments:

Recent Developments:

- In Oct 2020, AGR resin of Xinjiang Zhongtai Chemical Fukang Energy Company successfully passed the National Standard Project Evaluation. AGR resin is a special anti-scour polyvinyl chloride resin developed due to the disadvantage of the low impact strength of universal polyvinyl chloride resin. It is a modified polyvinyl chloride resin.

- In July 2020, KEM ONE partnered with Polyloop to develop PVC recycling. This partnership will result in the combination of their skills and expertise to develop new PVC recycling solutions at the Balan site.

- In Feb 2020, INEOS and UPM Biofuels announced a long-term agreement to supply a renewable raw material for new and innovative bio-attributed polymers produced at INEOS Köln, Germany. The world’s first commercially available bio-attributed PVC uses the residue from wood pulp manufacturing.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 60 Billion |

Projected Market Size in 2028 |

USD 90 Billion |

CAGR Growth Rate |

5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Braskem S.A., China General Plastics Corp, China National Chemical Corporation, Ercros SA, Finolex Industries Limited, Formosa Plastics Corporation, Hanwha Chemical Corp, INEOS Group AG, Kaneka Corporation, LG Chem, Mexichem S.A.B de C.V., Mitsubishi Chemical Corporation, and others. |

Key Segment |

By Application, Type, End-use Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia Pacific to lead owing to the dominance of electronics market in China

Asia Pacific dominated the global polyvinyl chloride market. China has the biggest electronics production base. It gives tough competition to the upstream producers which are already existing, like Singapore, South Korea, and Taiwan. Electronic goods, such as OLED TVs, smartphones, and tablets, saw the highest growth in the segment of consumer electronics in the PVC market.

The medical device industry in China is one of the fastest-growing markets. Private hospitals in the nation are fewer, and the procurement of healthcare goods is driven majorly by large public hospitals, resulting in rising usage of medical equipment in public hospitals. Such determinants drove the polyvinyl chloride (PVC) demand in the market. The Indian government is taking various measures to develop the country's local electronics manufacturing and exports. For instance, exports in India for electronic goods were valued at USD 11.7 billion in Financial Year 2021. In May 2021, exports of electronic goods were valued at USD 950.17 million. This development in electronic products in the nation is expected to fuel the demand for PVC in the electronic market over the coming years.

Competitive Analysis

Competitive Analysis

- Braskem S.A.

- China General Plastics Corp

- China National Chemical Corporation

- Ercros SA

- Finolex Industries Limited

- Formosa Plastics Corporation

- Hanwha Chemical Corp

- INEOS Group AG

- Kaneka Corporation

- LG Chem

- Mexichem S.A.B de C.V.

- Mitsubishi Chemical Corporation.

The global polyvinyl chloride market is segmented as follows:

By Application

By Application

- Pipes & Fittings

- Profiles

- Films & Sheets

- Cables

- Pastes

- Others

By Type

By Type

- Rigid

- Flexible

- Others

By End-use Industry

By End-use Industry

- Construction

- Electrical Cables

- Packaging

- Transportation

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Braskem S.A.

- China General Plastics Corp

- China National Chemical Corporation

- Ercros SA

- Finolex Industries Limited

- Formosa Plastics Corporation

- Hanwha Chemical Corp

- INEOS Group AG

- Kaneka Corporation

- LG Chem

- Mexichem S.A.B de C.V.

- Mitsubishi Chemical Corporation.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors