Search Market Research Report

Phosphorus & Derivatives Market Size, Share Global Analysis Report, 2022 – 2028

Phosphorus & Derivatives Market Size, Share, Growth Analysis Report By Type (Ammonium Phosphate, Industrial Phosphate, Purified Phosphoric Acid, Phosphorus Chloride, Phosphorus Pentoxide, Phosphorus Pentasulfide, and Other), By Application (Fertilizers, Detergents, Food Industry, Water Treatment Chemicals, Metal Finishing, Flame Retardant Material, and Other), By End-Use Industry (Automotive, Building & Construction, and Agriculture), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

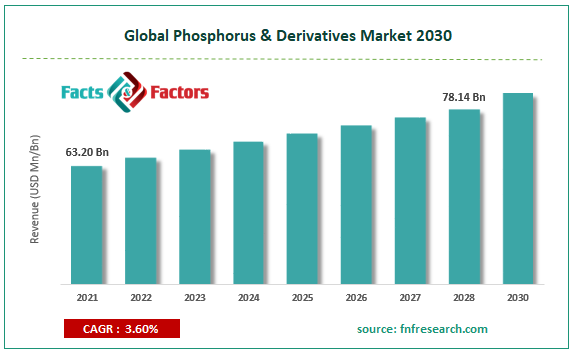

[239+ Pages Report] According to the report published by Facts & Factors, the global phosphorus & derivatives market size was worth USD 63.20 billion in 2021 and is estimated to grow to USD 78.14 billion by 2028, with a compound annual growth rate (CAGR) of approximately 3.60% over the forecast period. The report analyzes the phosphorus & derivatives market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the phosphorus & derivatives market.

Phosphorus & Derivatives Market: Overview

Phosphorus & Derivatives Market: Overview

Phosphorus is a combustible non-metal and generally has two allotropes: white phosphorus and red phosphorus. Phosphorus derivatives include phosphoric acid, phosphorus oxychloride, phosphorus pentachloride, phosphorus tribromide, sodium hypophosphite, tributyl phosphate, triethyl phosphate, and the like. The industry's rapid expansion is due to increased demand for fertilizers, detergents, food sector, water treatment chemicals, metal finishing, and halogen-free flame retardants. The main demand drivers for phosphorus and derivatives such as phosphorus tribromide, phosphorus pentachloride, adenosine triphosphate, ammonium phosphate, and purified phosphoric acid are driven by increasing demand for water treatment and the difficulty in development and adoption of halogen-free fire retardants (HFFR).

Covid-19 Impact:

Covid-19 Impact:

Most industries have been hit by the global crisis caused by the COVID-19 epidemic, but the fertilizer business has shown the resilience of its supply chain during the crisis. Fertilizer usage has increased significantly. The uncertainty caused by the COVID-19 pandemic can make forecasting growth beyond the agricultural year more difficult than usual. Most of the world's economies have been forced to comply with government-imposed measures, causing disruptions to food chains and supply networks and affecting the fertilizer industry.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global phosphorus & derivatives market value is expected to grow at a CAGR of 3.60% over the forecast period.

- In terms of revenue, the global phosphorus & derivatives market size was valued at around USD 63.20 billion in 2021 and is projected to reach USD 78.14 billion, by 2028.

- The rapid growth of the agricultural industry has also increased the demand for fertilizers, the major factor driving the market's growth.

- By type, the ammonium phosphate category dominated the market in 2021.

- By application, the fertilizers category dominated the market in 2021.

- Asia Pacific dominated the global phosphorus & derivatives market in 2021.

Phosphorus & Derivatives Market: Growth Drivers

Phosphorus & Derivatives Market: Growth Drivers

- Increased applications of phosphorus and derivatives to drive market growth

The global phosphorus & derivatives market is expanding rapidly with increasing demand for fertilizers, detergents, food, water treatment chemicals, metal finishing, and non-halogen flame retardants. Water treatment demand is the main driver of the demand for phosphorus and its derivatives, such as phosphorus tribromide, phosphorus pentachloride, adenosine triphosphate, ammonium phosphate, and purified phosphoric acid. Many pyrotechnics such as fireworks and flares use the element phosphorus. In addition, it is used in the metallurgical sector to produce pesticides, industrial oils, and metal alloys such as phosphorous brass. As a phosphating agent and ingredient in some beverages, phosphoric acid is used to clean metals. As a result, the growth of numerous applications is expected to accelerate the market expansion during the forecast period.

Phosphorus & Derivatives Market: Restraints

Phosphorus & Derivatives Market: Restraints

- Associated drawbacks to hinder the market growth

Eutrophication, often known as the overgrowth of algae and large aquatic plants, is caused by excess phosphorus. High phosphate levels can also cause algal blooms, producing toxins that are dangerous to human and animal health. These drawbacks further hamper the growth of the market.

Phosphorus & Derivatives Market: Opportunities

Phosphorus & Derivatives Market: Opportunities

- Adoption of halogen-free flame retardants and increased usage across the electric vehicle

The development and adoption of halogen-free flame retardants (HFFR) and the use of biofuels continue to improve product applications and increase revenue opportunities for global phosphorus & derivatives market participants. In addition, the increasing use of phosphorus in electric vehicle batteries such as rechargeable lithium iron phosphate batteries will further expand the future growth of the phosphorus and derivatives market.

Phosphorus & Derivatives Market: Segmentation

Phosphorus & Derivatives Market: Segmentation

The global phosphorus & derivatives market has been segmented into type, applications, food, end-use, and region.

Based on type, the market is classified into ammonium phosphate, industrial phosphate, purified phosphoric acid, phosphorus chloride, phosphorus pentoxide, phosphorus pentasulfide, and others. In 2021, the ammonium phosphate category dominated the global market.

Based on application, the market is classified into fertilizers, detergents, water treatment chemicals, metal finishing, flame retardant materials, and others. In 2021, the fertilizers category dominated the global market. The expansion of the agriculture industry globally due to the rising need for food globally as the increasing population supports the growth of the fertilizers segment during the forecast period.

Based on the end-use industry, the market is classified into automotive, building & construction, and agriculture. In 2021, the agriculture category dominated the global market. The high use of phosphorous and derivatives in the agriculture industry is expected to dominate the segment in the end-use industry during the forecast period.

Recent Developments

Recent Developments

- November 2020: AgroLiquid has added liquid phosphorus product spring to its plant nutrition portfolio. This immediate-release product is readily available and helps growers get their crops off to a good start.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 63.20 Billion |

Projected Market Size in 2028 |

USD 78.14 Billion |

CAGR Growth Rate |

3.60% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Bayer AG Solvay, Merck KGaA, LAXNESS, PCC Rokita Spólka Akcyjna, ICL, SANDHYA GROUP, Parchem fine & specialty chemicals, Xuzhou Jianping Chemical Co. Ltd, Anhui Guangxin Agrochemical Co. Ltd., Excel Industries Ltd, Shandong Futong Chemical Co. Ltd., Henan Qingshuiyuan Technology Co. Ltd., Jiangsu Tianyuan Chemical Co. Ltd., Jiangsu Yoke Technology Co. Ltd., Shandong Yangmei Hengtong Chemical Co. Ltd., UPL Limited, Xuzhou Jianping Chemical Co. Ltd., Xuzhou Yongli Fine Chemical Co. Ltd., Zhejiang Xinan Chemical Industrial Group Co. Ltd., and Others |

Key Segment |

By Type, Application, End-Use Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Phosphorus & Derivatives Market: Regional Landscape

Phosphorus & Derivatives Market: Regional Landscape

- Asia Pacific dominated the phosphorus & derivatives market in 2021

Asia Pacific is anticipated to govern the global phosphorus & derivatives market during the forecast period owing to the rising R&D spending and high demand for halogen-free flame retardants in emerging markets. The growing regional electrical and electronics industry is driving demand for halogen-free flame retardants. Increasing crop production to meet the needs of a growing population has pushed Asia to the forefront of the phosphorus and derivatives market. High production and consumption of ammonium phosphate in Asia are expected to boost the market growth.

Phosphorus & Derivatives Market: Competitive Landscape

Phosphorus & Derivatives Market: Competitive Landscape

- Bayer AG Solvay

- Merck KGaA

- LAXNESS

- PCC Rokita Spólka Akcyjna

- ICL

- SANDHYA GROUP

- Parchem fine & specialty chemicals

- Xuzhou Jianping Chemical Co. Ltd

- Anhui Guangxin Agrochemical Co. Ltd.

- Excel Industries Ltd

- Shandong Futong Chemical Co. Ltd.

- Henan Qingshuiyuan Technology Co. Ltd.

- Jiangsu Tianyuan Chemical Co. Ltd.

- Jiangsu Yoke Technology Co. Ltd.

- Shandong Yangmei Hengtong Chemical Co. Ltd.

- UPL Limited

- Xuzhou Jianping Chemical Co. Ltd.

- Xuzhou Yongli Fine Chemical Co. Ltd.

- Zhejiang Xinan Chemical Industrial Group Co. Ltd.

The global Phosphorus & Derivatives Market is segmented as follows:

By Type

By Type

- Ammonium Phosphate

- Industrial Phosphate

- Purified Phosphoric Acid

- Phosphorus Chloride

- Phosphorus Pentoxide

- Phosphorus Pentasulfide

- Other

By Application

By Application

- Fertilizers

- Detergents

- Water Treatment Chemicals

- Metal Finishing

- Flame Retardant Material

- Other

End-Use Industry

End-Use Industry

- Automotive

- Building and Construction

- Agriculture

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Bayer AG Solvay

- Merck KGaA

- LAXNESS

- PCC Rokita Spólka Akcyjna

- ICL

- SANDHYA GROUP

- Parchem fine & specialty chemicals

- Xuzhou Jianping Chemical Co. Ltd

- Anhui Guangxin Agrochemical Co. Ltd.

- Excel Industries Ltd

- Shandong Futong Chemical Co. Ltd.

- Henan Qingshuiyuan Technology Co. Ltd.

- Jiangsu Tianyuan Chemical Co. Ltd.

- Jiangsu Yoke Technology Co. Ltd.

- Shandong Yangmei Hengtong Chemical Co. Ltd.

- UPL Limited

- Xuzhou Jianping Chemical Co. Ltd.

- Xuzhou Yongli Fine Chemical Co. Ltd.

- Zhejiang Xinan Chemical Industrial Group Co. Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors