Search Market Research Report

Paper and Paperboard Packaging Market Size, Share Global Analysis Report, 2022 – 2030

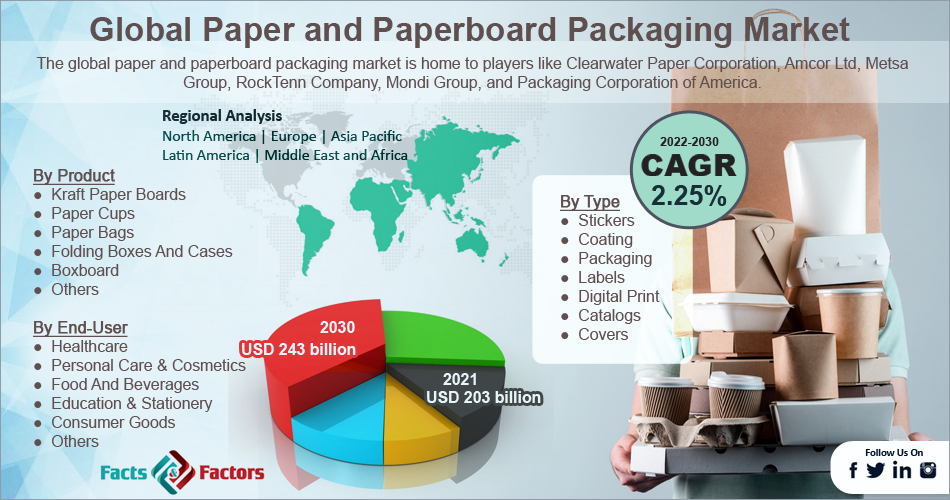

Paper and Paperboard Packaging Market Size, Share, Growth Analysis Report By Type (Stickers, Coating, Packaging, Labels, Digital Print, Catalogs, and Covers), By Product (Kraft Paper Boards, Paper Cups, Paper Bags, Folding Boxes & Cases, Boxboard, and Others), By End-User (Healthcare, Personal Care & Cosmetics, Food & Beverages, Education & Stationery, Consumer Goods, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2030

Industry Insights

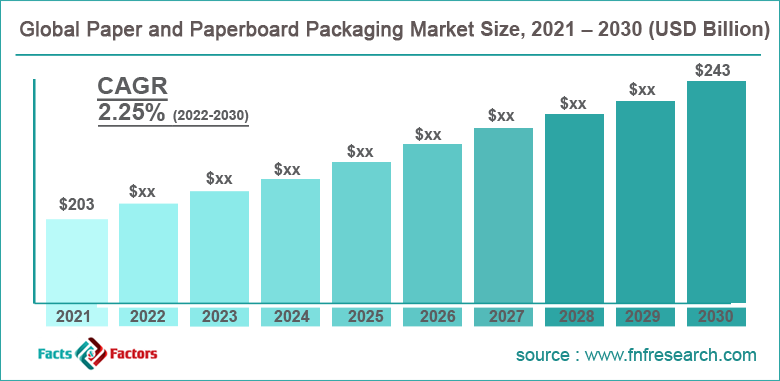

[219+ Pages Report] According to the report published by Facts Factors, the global paper, and paperboard packaging market size was worth around USD 203 billion in 2021 and is predicted to grow to around USD 243 billion by 2030 with a compound annual growth rate (CAGR) of roughly 2.25% between 2022 and 2030. The report analyzes the global paper and paperboard packaging market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the paper and paperboard packaging market.

Market Overview

Market Overview

Packaging is the process of applying arts, science, and technology to protect and enclose a product for sale, distribution, storage, or any other purpose. It also refers to the process of creating, designing, analyzing, and manufacturing packages. It is a system that requires complete coordination between the transportation, warehousing, and sale, followed by the end-use of the packaged product.

As the packaging industry has applications across industries and products, with time, the global market players have invested heavily in constantly redeveloping effective packaging solutions and the latest trend is the use of paperboards or papers to package any goods. Both of these options are highly versatile as they can be created using either parchment paper or they can take the shape of bags to store loose food items.

One of the most common forms of paperboard is carton board which is used to store and transport liquid and dry food products, along with fast food and frozen items. Papers and paperboards may be reinforced with strengthening material to use them for packaging heavy products as well but currently, the widest applications of these packaging materials lie in the consumer goods segment along with the food & beverages industry and healthcare.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global paper and paperboard packaging market is estimated to grow annually at a CAGR of around 2.25% over the forecast period (2022-2030)

- In terms of revenue, the global paper and paperboard packaging market size was valued at around USD 203 billion in 2021 and is projected to reach USD 243 billion, by 2030.

- The market is projected to grow at a significant rate due to the growing emphasis on sustainable packaging solutions

- Based on type segmentation, packaging was predicted to show maximum market share in the year 2021

- Based on end-user segmentation, food & beverages was the leading user in 2021

- On the basis of region, Asia-Pacific was the leading revenue generator in 2021

Growth Drivers

Growth Drivers

- Growing emphasis on sustainable packaging solutions to propel market growth

The global paper and paperboard market is projected to grow owing to the increasing emphasis on developing sustainable methods of packaging products. The world is currently battling the high negative impacts of commercialization, globalization, and industrialization. The impact can be witnessed in the increasing water, air, and soil pollution categorizing the environmental impact into three broad categories.

The packaging industry is known to be one of the highest contributors to environmental pollution as the majority of the materials used for packaging go to waste and remain unregulated in the ecosystem for longer durations. The most commonly used material for packaging is plastic, which is non-biodegradable. It takes between 20 to 500 years to decay depending on the exact components of the plastics. The Environmental Protection Agency in the United States claimed that more than 30% of the country’s annual waste is generated from the packaging sector. Styrofoam is the worst enemy of the environment.

As the awareness rate amongst the general population about the impact of consumer habits has increased in recent times, people have become more responsible leading to changing preference toward eco-friendly packaging solutions which in turn has pressured the global market players to choose better options. Companies have increased spending on creating more versatile forms of paper and paperboard packaging to deal with changing consumer preferences.

Restraints

Restraints

- Strict government regulations to restrict market expansion

The global market may face growth restrictions owing to the strict rules laid down by governments to regulate the use of paper and paperboard as packaging materials. Since paper originates from trees means that for more paper to be used, more trees have to be cut. It is difficult to maintain a balance between the two since this could lead to deforestation in various areas thus causing severe environmental impact and leading to an increased carbon footprint. Hence the players in the market have to be sure that the benefits associated with the use of paper stay ahead of the problems caused due to the use.

Opportunities

Opportunities

- Growing the e-commerce industry to provide growth opportunities

The global paper and paperboard packaging market may witness higher growth opportunities owing to the growing applications of paper and paperboard packaging in the expanding e-commerce industry. The increasing number of sellers present online as well as the shifting amongst brands toward websites for sales are the leading cause of growth in the e-commerce sector.

Selling products online helps companies reduce added costs like rents and utility bills while it is beneficial to the customer owing to less hassle associated with making a purchase and the availability of larger sets of options. In this industry, most of the goods transported can be packaged using paper or paperboard which is the main reason for higher application.

Challenges

Challenges

- Managing paper quality to act as a challenge for the market players

One of the major challenges faced by the global market players is the management of paper quality used for packaging. Since random paper or paperboard cannot be used for protecting the object and special papers are required, service providers have to invest in using only high-grade paper otherwise the chances of the product getting damaged remains high in probability.

Segmentation Analysis

Segmentation Analysis

The global paper and paperboard packaging market is segmented based on type, product, end-user, and region

Based on type, the global market divisions are stickers, coating, packaging, labels, digital print, catalogs, and covers. The global market was led by the packaging segment in 2021 owing to the increasing use of paperboard to package and transport food & beverage products. Paperboards have found wide applications in the healthcare sector, one of the fastest-growing and crucial industries. The healthcare packaging industry is projected to cross USD 190 billion by 2030.

Based on end-user, the global market segments are healthcare, personal care & cosmetics, food & beverages, education & stationery, consumer goods, and others. During the projection period, the global market is anticipated to be dominated by the food & beverages segment due to the growing demand for products as a result of the increasing population. The global population reached 8 billion in 2022 and is projected to grow exponentially in the coming years as well.

Recent Developments:

Recent Developments:

- In March 2022, the Mumbai Food and Drugs Administration authority instructed street vendors to stop using newspapers for packaging food items as the ink may contain toxic content

- In February 2022, Amcor, a leading responsible packaging solution provider, launched a new platform to support paper-based packaging

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 203 Billion |

Projected Market Size in 2030 |

USD 243 Billion |

CAGR Growth Rate |

2.25% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2030 |

Key Market Players |

Clearwater Paper Corporation, Amcor Ltd, Metsa Group, RockTenn Company, Mondi Group, Packaging Corporation of America., and others. |

Key Segment |

By Type, Product, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia-Pacific to register the highest growth rate during the projection period

The global paper and paperboard packaging market is projected to witness unprecedented growth in Asia-Pacific due to the growing use of alternative packaging solutions in countries like China, India, Japan, Hongkong, Singapore, and others. India is home to a population of 1.2 billion with crores of street vendors using papers to sell street food and other items. The unintentional use of paper is high in the country. China has topped the regional revenue scale as demand for consumer goods has increased considerably.

To cater to the growing demand, the Chinese government has implemented various measures to upgrade packaging solutions which have resulted in higher use of paper and paperboards. Europe may also register a high CAGR due to the growing shift toward eco-friendly packaging as opposed to plastic packaging. European territories are weighing heavily on banning the use of single-use plastics.

Competitive Analysis

Competitive Analysis

- Clearwater Paper Corporation

- Amcor Ltd

- Metsa Group

- RockTenn Company

- Mondi Group

- Packaging Corporation of America.

The global paper and paperboard packaging market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Stickers

- Coating

- Packaging

- Labels

- Digital Print

- Catalogs

- Covers

By Product Segment Analysis

By Product Segment Analysis

- Kraft Paper Boards

- Paper Cups

- Paper Bags

- Folding Boxes And Cases

- Boxboard

- Others

By End-User Segment Analysis

By End-User Segment Analysis

- Healthcare

- Personal Care & Cosmetics

- Food And Beverages

- Education & Stationery

- Consumer Goods

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Clearwater Paper Corporation

- Amcor Ltd

- Metsa Group

- RockTenn Company

- Mondi Group

- Packaging Corporation of America.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors