Search Market Research Report

Oilfield Services Market Size, Share Global Analysis Report, 2020–2026

Oilfield Services Market By Service (Pressure Pumping Services, Oil Country Tubular Goods, Wireline Services, Well Completion Equipment & Services, Well Intervention Services, Drilling & Completion Fluid Services, Drilling Waste Management Services, and Coiled Tubing Services) and By Application (Offshore, and Onshore) and Type (Equipment rental, Field operation, and Analytical services): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

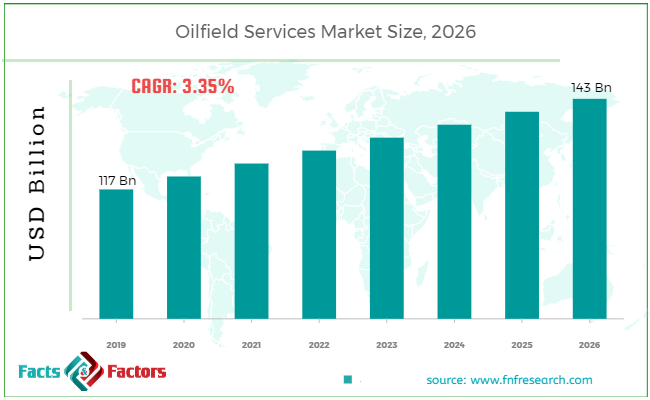

[189+ Pages Report] According to the report published by Facts Factors, the global oilfield services market size was worth around USD 117 billion in 2019 and is predicted to grow to around USD 143 billion by 2026 with a compound annual growth rate (CAGR) of roughly 3.35% between 2020 and 2026. The report analyzes the global oilfield services market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the oilfield services market.

The oilfield services market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire oilfield services market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of both volume (Units) and value (USD Million) from FY 2016 – 2026.

Key Insights from Primary Research

Key Insights from Primary Research

- As per our primary respondents, the global oilfield services market is set to grow annually at a rate of around 3.35%

- It was established through primary research that the oilfield services market was valued at around USD 117 Million in 2019

- Americas was the leading market for oilfield services market in 2019.

- On basis of the application segment, ‘onshore’ dominated the global oilfield services market in 2019.

- The global oilfield services market is expected to reach around USD 143 Million by 2026.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, the global oilfield services market is expected to grow significantly over the forecast period.

- The strategic and competitive advantage provided by the technological developments in oilfield services is anticipated to be the key factor driving this market globally.

- As per analysts, due to the depletion of onshore resources, operators are looking for offshore applications as an alternative.

- Our team of analysts has identified new exploration and production activities in both onshore and offshore areas that will support the growth of the market.

- Among regions, the americas is expected to be the fastest-growing market for oilfield services in the years to come.

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the oilfield services industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the oilfield services industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the oilfield services market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the oilfield services industry. The oilfield services market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market positions in the oilfield services sector. Key strategic developments in the oilfield services market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the oilfield services market are appropriately highlighted in the report.

The global oil field services market has witnessed significant growth in recent years due to an increase in exploration and production (E&P) activities coupled with the increasing growth in the activities related to offshore areas across the globe. The completion and production services segment is a major part of the global oil field services market. Mostly in the discovery, appraisal, or development phase, the proportion of oil produced from deep water fields is expected to grow significantly during the future years. Deepwater projects are among the riskiest and most technologically complex in the industry.

As a result, they are extremely capital-intensive and typically take five to eight years to bring into production. Although, considerable technological progress has been made oilfield service companies believe that there is still much scope to reach greater depths and make production more cost-effective. Moreover, technological advancement is likely to set new avenues for the market participants operating in the market over the analysis period.

The oilfield services market research report delivers an acute valuation and taxonomy of the oilfield services industry by practically splitting the market on the basis of different types, applications, and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 117 Billion |

Projected Market Size in 2026 |

USD 143 Billion |

CAGR Growth Rate |

3.35% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Baker Hughes Incorporated, Halliburton Company, Schlumberger Limited, Weatherford International PLC, National Oilwell Varco, Inc., China Oilfield Services Limited (COSL), Superior Energy Services, Inc., Technipfmc.PLC, Trican Well Service, Ltd., Welltec International APS, Nabors Industries, Ltd., and Nordic Well Services, LLC, and Others |

Key Segment |

By Service, Application, Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

The regional segmentation of the oilfield services industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa. Further, country-wise data for the oilfield services industry is provided for the leading economies of the world.

The oilfield services market is segmented based on service, type, and application. On the basis of service, the market has been fragmented into pressure pumping services, oil country tubular goods, wireline services, well completion equipment & services, well intervention services, drilling & completion fluid services, drilling waste management services, and coiled tubing services. In terms of application, it has been classified into offshore, and onshore. On the basis of type, the market is divided into equipment rental, field operation, and analytical services.

Some of the essential players operating in the oilfield services market, but not restricted include:

Some of the essential players operating in the oilfield services market, but not restricted include:

- Baker Hughes Incorporated

- Halliburton Company

- Schlumberger Limited

- Weatherford International PLC

- National Oilwell Varco Inc.

- China Oilfield Services Limited (COSL)

- Superior Energy Services Inc.

- Technipfmc.PLC

- Trican Well Service Ltd.

- Welltec International APS

- Nabors Industries Ltd.,

- Nordic Well Services LLC

The taxonomy of the oilfield services industry by its scope and segmentation is as follows:

By Service Segmentation Analysis

By Service Segmentation Analysis

- Pressure Pumping Services

- Oil Country Tubular Goods

- Wireline Services

- Well Completion Equipment & Services

- Well Intervention Services

- Drilling & Completion Fluid Services

- Drilling Waste Management Services

- Coiled Tubing Services

By Application Segmentation Analysis

By Application Segmentation Analysis

- Offshore

- Onshore

By Type Segmentation Analysis

By Type Segmentation Analysis

- Equipment rental

- Field operation

- Analytical services

Regional Segmentation Analysis (Customizable)

Regional Segmentation Analysis (Customizable)

- North America

- The U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Industry Major Market Players

- Baker Hughes Incorporated

- Halliburton Company

- Schlumberger Limited

- Weatherford International PLC

- National Oilwell Varco Inc.

- China Oilfield Services Limited (COSL)

- Superior Energy Services Inc.

- Technipfmc.PLC

- Trican Well Service Ltd.

- Welltec International APS

- Nabors Industries Ltd.,

- Nordic Well Services LLC

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors