Search Market Research Report

Molded Pulp Packaging Market Size, Share Global Analysis Report, 2023 – 2030

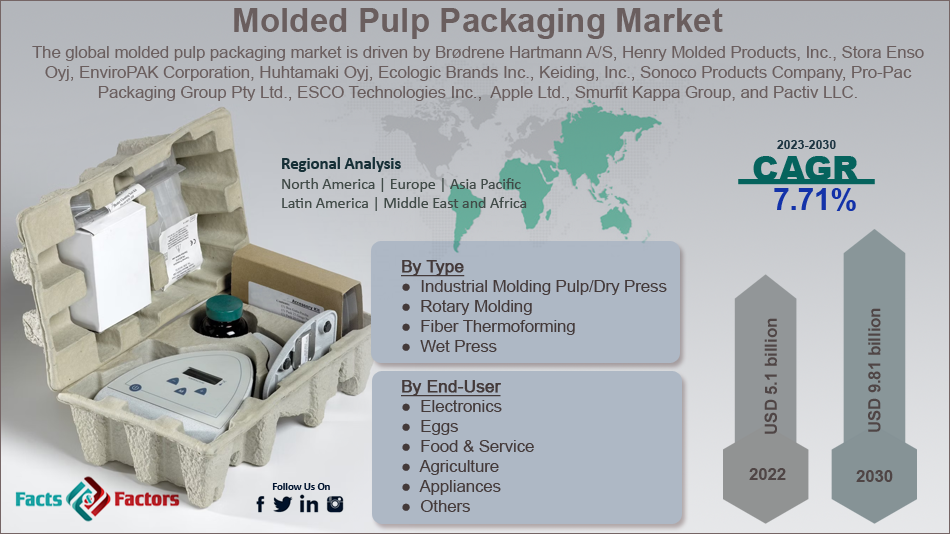

Molded Pulp Packaging Market Size, Share, Growth Analysis Report By Type (Industrial Molding Pulp/Dry Press, Rotary Molding, Fiber Thermoforming, and Wet Press), By Product Type (Splitters, Trays, Cups, Plates, Clamshells, and Others), By End-User (Electronics, Eggs, Food & Service, Agriculture, Appliances, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

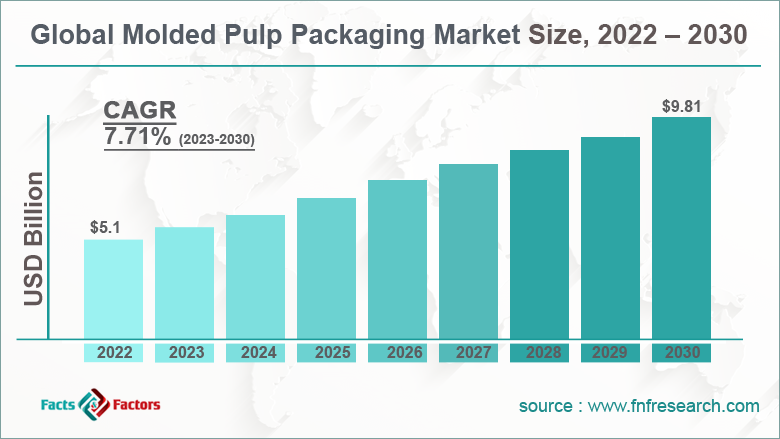

[229+ Pages Report] According to the report published by Facts and Factors, tthe global molded pulp packaging market size was worth around USD 5.1 billion in 2022 and is predicted to grow to around USD 9.81 billion by 2030 with a compound annual growth rate (CAGR) of roughly 7.71% between 2023 and 2030. The report analyzes the global molded pulp packaging market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the molded pulp packaging market.

Market Overview

Market Overview

The industry revolves around packaging material with recycled paper products acting as the main resource. These main materials include newspapers, cardboard, or any other type of paper products. Molded pulp packaging is made by creating a mixture of recycled paper materials with water along with a binding agent that gives rise to a slurry. The final packaging material is created by molding the slurry in the last step in desired size or shape.

Further processes include drying, trimming, and occasional coating with another layer of protective material to improve the overall resistance and durability of the product. The industry has wide applications in end-user verticals like medical supplies, electronics, and food & beverages and the popularity of the packaging material is due to its exceptional durability along with being cost-effective and lightweight, making it ideal for shipping or other transportation-related activities.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global molded pulp packaging market is estimated to grow annually at a CAGR of around 7.71% over the forecast period (2022-2030)

- In terms of revenue, the global molded pulp packaging market size was valued at around USD 5.1 billion in 2022 and is projected to reach USD 9.81 billion, by 2030.

- The market is projected to grow at a significant rate due to the growing demand for sustainable packaging solutions

- Based on end-user segmentation, food & service were predicted to show maximum market share in the ear 2022

- Based on type segmentation, the dry press was the leading type in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Growth Drivers

Growth Drivers

- Growing demand for sustainable packaging solutions to drive market demand

The global molded pulp packaging market is projected to grow owing to the rising demand for sustainable packaging solutions. As enterprises and consumers become more aware of the environmental impact that business operations or irresponsible consumption patterns have on the environment, the demand for sustainable solutions has increased rapidly over the last few years. This change in responsibility ownership is attributed to the intensive initiatives undertaken by domestic and international environmental agencies along with the other government and non-government bodies that have worked consistently toward spreading information and knowledge about the drastic changes in the environment that are becoming more visible caused by commercialization, urbanization, and industrialization.

The packaging sector is one of the highest environmental-pollution-causing industries owing to the kind of materials it deals with and the lack of a proper disposable system. The packaging industry is now being held responsible for its action which has led to multiple businesses investing in developing sustainable packaging solutions.

Restraints

Restraints

- Limited and restricted applications of the products to restrict market expansion

Currently, molded pulp packaging materials are used for protecting or covering products like electronic goods, fruits, and eggs which means that their applications are highly restricted as of the current timeline. This acts as a crucial growth restraint for the global industry since other materials like plastic, metals, cardboard, paper, styrofoam, and glass offer higher flexibility in terms of packaging solutions and have wider applications. Businesses operating in the industry should invest in expanding the applications of these materials and make them more versatile to penetrate deeper into the market.

Opportunities

Opportunities

- Increasing product innovation and development to provide multiple growth opportunities

The global market size can expect more opportunities for further expansion owing to the rising investment towards the development of new products with the adoption of new manufacturing technology along with research on material science to understand the aspects of the mixture that can assist in improving the application of the packaging material. Additionally, the rising interest of the players to tap into the unexplored segment of the market at the regional level could work for the benefit of the industry.

Challenges

Challenges

- Growing competition from alternatives to challenge market growth

The packaging industry is full of materials that provide similar efficiency as that of molded pulp at a reasonable cost. They may not be as environment-friendly or sustainable as the molded pulp material but the consumer database of alternative solutions is relatively higher. The industry players find it challenging to replace the exponentially rising demand for substitutes due to their long-term dominance in the packaging sector.

Segmentation Analysis

Segmentation Analysis

The global molded pulp packaging market is segmented based on type, product type, end-use, and region.

Based on type, the global market segments are industrial molding pulp/dry press, rotary molding, fiber thermoforming, and wet press.

- The industry witnessed the highest growth in the dry press and wet press segments in 2022

- The former uses a hydraulic press whereas the latter uses a vacuum for the removal of water from the pulp mixture and providing it with desired shape or size

- These methods are used for creating packaging solutions for producing egg cartons, food trays, and other protective or cushioning materials

- Fiber thermoforming is a relatively new technology and uses heat energy to create a packaging structure

- As per data submitted by the Ellen MacArthur Foundation, the food industry generated almost 46% of the plastic waste worldwide

Based on product type, the global market segments are splitters, trays, cups, plates, clamshells, and others.

Based on end-use, the global market divisions are electronics, eggs, food & service, agriculture, appliances, and others.

- The largest end-user for the industry in 2022 was food & service since molded pulp packaging is used extensively as a cushioning packaging material for food products

- Eggs were the second-most significant segment due to the growing demand for egg and associated edibles across the globe

- The demand for molded pulp packaging is rising in the electronics and agriculture segments

- As per the Food and Agriculture Organization of the United Nations (FAO), China produced more than 466 billion eggs in 2020

Recent Developments:

Recent Developments:

- In January 2023, Knoll Packaging, a US-based packaging solutions provider, introduced a range of new packaging materials made using 100% Knoll Ecoform molded pulp which is derived from sugarcane fibers, wood, and bamboo. The new product is pending patent and can be used as an alternative for thermoformed plastics

- In July 2022, Transcend Packaging, one of Europe’s largest producers of paper straws, announced its collaboration with Zume. The deal with multi-million dollars and the companies, under the new vision, will strive to substitute billion of plastic with more sustainable solutions in form of molded fiber

- In February 2021, Brødrene Hartmann A/S, a Danish player in the industry, announced its intention to invest in the US region by developing a new production facility

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 5.1 Billion |

Projected Market Size in 2030 |

USD 9.81 Billion |

CAGR Growth Rate |

7.71% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Brødrene Hartmann A/S, Henry Molded Products Inc., Stora Enso Oyj, EnviroPAK Corporation, Huhtamaki Oyj, Ecologic Brands Inc., Pacific Pulp Molding Inc., Dana Plast Nigeria Ltd., Keiding Inc., Fibercel Packaging LLC, Sonoco Products Company, Pro-Pac Packaging Group Pty Ltd., UFP Technologies Inc., Brodrene Hartmann India Pvt Ltd., Proto Labs Inc., ESCO Technologies Inc., Genpak LLC, Apple Ltd., Smurfit Kappa Group, Pactiv LLC., and others. |

Key Segment |

By Type, Product Type, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the market growth

The global molded pulp packaging market is expected to register the highest growth in North America. The regional market may be driven by the contributions of the US and Canada due to higher product awareness rates along with rapidly rising adoption initiatives undertaken by consumers at the grass-root level along with the emergence of multiple players who are consistently working toward developing new products and services.

Furthermore, the US is investing heavily in ensuring sustainable replacements in the packaging sector as the demand in end-user verticals is growing rapidly. In addition to this, the rising egg consumption leading to more demand for egg cartons is essential to regional expansion. Europe is the second-largest region for the global market and it is attributed to the presence of some of the most prominent solution providers in Europe like Huhtamaki Oyj. Moreover, the growing food & beverages sector is essential to the region during the forecast period.

Competitive Analysis

Competitive Analysis

- Brødrene Hartmann A/S

- Henry Molded Products Inc.

- Stora Enso Oyj

- EnviroPAK Corporation

- Huhtamaki Oyj

- Ecologic Brands Inc.

- Pacific Pulp Molding Inc.

- Dana Plast Nigeria Ltd.

- Keiding Inc.

- Fibercel Packaging LLC

- Sonoco Products Company

- Pro-Pac Packaging Group Pty Ltd.

- UFP Technologies Inc.

- Brodrene Hartmann India Pvt Ltd.

- Proto Labs Inc.

- ESCO Technologies Inc.

- Genpak LLC

- Apple Ltd.

- Smurfit Kappa Group

- Pactiv LLC.

The global molded pulp packaging market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Industrial Molding Pulp/Dry Press

- Rotary Molding

- Fiber Thermoforming

- Wet Press

By Product Type Segment Analysis

By Product Type Segment Analysis

- Splitters

- Trays

- Cups

- Plates

- Clamshells

- Others

By End-User Segment Analysis

By End-User Segment Analysis

- Electronics

- Eggs

- Food & Service

- Agriculture

- Appliances

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Brødrene Hartmann A/S

- Henry Molded Products Inc.

- Stora Enso Oyj

- EnviroPAK Corporation

- Huhtamaki Oyj

- Ecologic Brands Inc.

- Pacific Pulp Molding Inc.

- Dana Plast Nigeria Ltd.

- Keiding Inc.

- Fibercel Packaging LLC

- Sonoco Products Company

- Pro-Pac Packaging Group Pty Ltd.

- UFP Technologies Inc.

- Brodrene Hartmann India Pvt Ltd.

- Proto Labs Inc.

- ESCO Technologies Inc.

- Genpak LLC

- Apple Ltd.

- Smurfit Kappa Group

- Pactiv LLC.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors