Search Market Research Report

Logistics Market Size, Share Global Analysis Report, 2023 – 2030

Logistics Market Size, Share, Growth Analysis Report By Model (1PL, 2PL, 3PL, and 4PL), By Transportation (Road, Sea, Rail, and Air), By End-User (Automotive, Industrial Machinery & Equipment, Healthcare, FMCG, and Energy & Utilities), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

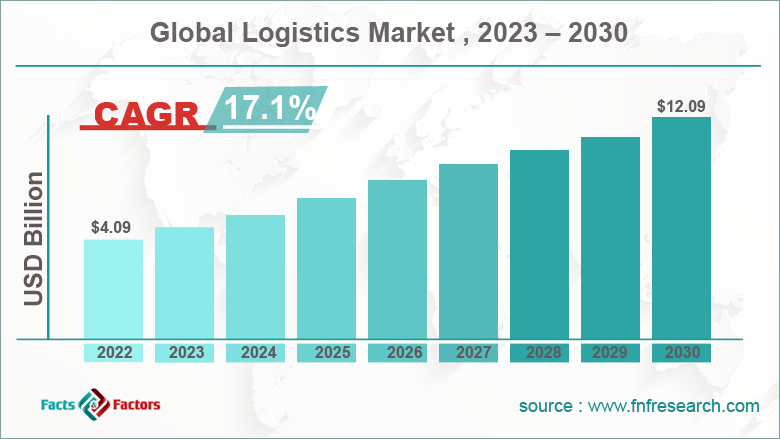

[225+ Page Report] According to the report published by Facts & Factors, the global logistics market size was evaluated at $4.09 billion in 2022 and is slated to hit $12.09 billion by the end of 2030 with a CAGR of nearly 17.1% between 2023 and 2030. The market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global marketspace. The logistics industry report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, PESTEL analysis, SWOT analysis, Porter’s five force analysis, and value chain analysis. Additionally, the logistics market report explores the investor and stakeholder space to help companies make data-driven decisions.

Market Overview

Market Overview

Logistics is referred to as a strong network of roads, airways, railways, and seaways. Moreover, it is involved in the storage, management, transportation, and delivery of goods from the place of production to the destination. In addition to this, the use of RFID sensors, Bluetooth, and GPS trackers in cargo monitoring systems has prompted the demand for logistics in recent years. Breakthroughs in computing technologies including machine learning, IoT, big data, and artificial intelligence are projected to spearhead the demand for logistics in the coming years. For the record, logistics comprises services such as inbound logistics, third-party logistics, reverse logistics, fourth-party logistics, green logistics, digital logistics, military logistics, and other kinds of logistics services.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global Logistics market is projected to expand annually at the annual growth rate of around 17.1% over the forecast timespan (2023-2030)

- In terms of revenue, the global Logistics market size was evaluated at nearly $4.09 billion in 2022 and is expected to reach $12.09 billion by 2030.

- The global logistics market is anticipated to record massive growth over the forecast period owing to the acceptance of new technologies based on data analytics.

- Based on the model, the 4PL segment is predicted to contribute majorly towards the global market share over the forecast timeline.

- In terms of transportation, the air segment is projected to account for a major share of the global market in 2023-2030.

- On the basis of end-user, the healthcare segment is set to register the fastest CAGR over the period from 2023 to 2030.

- Region-wise, the Asia-Pacific logistics market is projected to register the highest CAGR during the assessment period.

Industry Growth Factors

Industry Growth Factors

- Increase in e-commerce activities globally to boost the demand for logistics across the globe

The thriving e-commerce sector and increase in reverse logistics operations have propelled the growth of the global logistics market. Apart from this, an increase in trade agreements and a surge in tech-driven logistics solutions will embellish the business space.

Furthermore, the growing IoT trend and its use in various industries have enhanced the popularity as well as the use of logistics in a slew of industries. Integration of logistics management for improving operational efficiency will steer the global logistics market trends.

Furthermore, the acceptance of new technologies based on data analytics will boost the expansion of the logistics market across the globe. In addition to this, data analytics enables cloud-calling intending to confirm the order, real-time tracking of the good, and choosing the most cost-efficient carrier partner depending on various kinds of key metrics. Such initiatives will steer the growth of the market globally.

Restraints

Restraints

- Changing government laws to impede the expansion of the logistics industry globally

The lack of uniform governance laws witnessed in the fragmented logistics industry can impede the growth of the logistics industry globally. Furthermore, less control of manufacturing units on logistics services, lack of infrastructure facilities, and huge logistics costs can put further brakes on the global industry surge.

Opportunities

Opportunities

- Growing demand for automation in logistics activities to open new vistas of expansion for the global market

The evolution of logistic automation techniques along with just-in-time deliveries will open new growth opportunities for the global logistics market. Furthermore, the use of multi-modal systems for lead-time reduction has assisted the global market in exploring new facades of expansion in the near future.

Challenges

Challenges

- Digitization of logistics operations to be a challenging task in the global industry growth

High upfront costs of implementation of new logistics technologies have posed a huge challenge to the global logistics industry surge. Apart from this, the digitization of logistics functions needs massive capital funding, thereby posing a big challenge to the growth of the global industry.

Segmentation Analysis

Segmentation Analysis

The global logistics market is sectored into the model, transportation, end-user, and region.

In terms of model, the global logistics market is sectored into 1PL, 2PL, 3PL, and 4PL. Furthermore, the 4PL segment, which accounted for more than 62% of the global market share in 2022, is set to hold its segmental dominance in the forecasting timespan.

The segmental growth in the ensuing eight years can be a result of the beneficial features of the 4PL model. Moreover, 4PL logistics service providers help in reducing overhead as well as labor costs, minimize inventory costs, eliminate wasteful procedures, and enhance purchase leverage through an extended supplier base. Apart from this the 4PL service provider helps in reducing supply chain complexity, improves operational efficiencies, and enables cost-savings.

Based on transportation, the logistics industry across the globe is divided into rail, road, sea, and air segments. Moreover, the air segment, which garnered nearly 45% of the global industry share in 2022, is slated to dominate the global industry expansion even in the forecasting years. The growth of the segment in the coming years can be due to the ability of air transportation to rapidly manage processes & documenting them in a structured manner.

Apart from this, air cargo requires less handling and there is no necessity for heavy packaging. Moreover, a firm can easily ship goods & cargo to many countries in lesser time in comparison to other modes of logistics transportation without causing damage to cargo.

Based on end-user, the global logistics market is divided into automotive, industrial machinery & equipment, healthcare, FMCG, and energy & utilities segments. Moreover, the healthcare segment, which accounted for a major share of the global market in 2022, is predicted to register the fastest CAGR in the ensuing years. The segmental expansion over the forecast timespan can be subject to an increase in the significance of fast-track guidance in the healthcare sector.

Recent Breakthroughs:

Recent Breakthroughs:

- In the third quarter of 2021, DHL, a Germany-based logistics firm, compiled a list of 40 trends that are likely to leverage the growth of the logistics sector across the globe. Some of these trends are diversification of supply chain activities, decarbonization, alternate energy solutions, and big data analysis. The move will enlarge the scope of growth of the logistics industry across the globe.

- In the second half of 2022, FedEx Corporation, a U.S.-based firm in the transport and e-commerce business, joined hands with Ford Pro, a key player in the manufacture of commercial fleet automotive and telematics. The strategic move is aimed at developing green transportation tools and improving delivery processes with effective door-to-door delivery of products.

- In the fourth quarter of 2019, Microsoft Corporation deployed AI and cloud for Maersk, a global logistics firm. The move will help Maersk in monitoring each vessel of the fleet and optimize its routes across 350 ports in real-time. The initiative will expand the scope of growth of the logistics business of Maersk across the globe.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 4.09 Billion |

Projected Market Size in 2030 |

USD 12.09 Billion |

CAGR Growth Rate |

17.1% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

FedEx Corp., United Parcel Service Inc., XPO Logistics Inc., J.B. Hunt Transport Services, Americold Logistics LLC, Expeditors International of Washington Inc., C.H. Robinson Worldwide Inc., Kenco Group, Deutsche Post DHL Group, Ceva Holdings LLC, DSV Air & Sea Inc., and others. |

Key Segment |

By Model, Transportation, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Logistics Market: Regional Insights

Logistics Market: Regional Insights

- Asia-Pacific logistics market to register the highest CAGR over the forecast period

Asia-Pacific, which accounted for more than 75% of the global logistics market revenue in 2022, is anticipated to record the highest CAGR during the assessment timeline. The regional market expansion over 2023-2030 can be due to the swift expansion of trade routes and the rise in industrial production in Asia.

Furthermore, the North American logistics industry is set to witness a noteworthy surge in the forecasting timeframe. The factors that are likely to determine the growth of the regional market include the presence of giant players in the countries such as the U.S. along with massive demand for 4PL logistics in the region.

Competitive Space

Competitive Space

- FedEx Corp.

- United Parcel Service Inc.

- XPO Logistics Inc.

- J.B. Hunt Transport Services

- Americold Logistics LLC

- Expeditors International of Washington Inc.

- C.H. Robinson Worldwide Inc.

- Kenco Group

- Deutsche Post DHL Group

- Ceva Holdings LLC

- DSV Air & Sea Inc.

The global Logistics market is segmented as follows:

By Model Segment Analysis

By Model Segment Analysis

- 1PL

- 2PL

- 3PL

- 4PL

By Transportation Segment Analysis

By Transportation Segment Analysis

- Road

- Sea

- Rail

- Air

By End-User Segment Analysis

By End-User Segment Analysis

- Automotive

- Industrial Machinery & Equipment

- Healthcare

- FMCG

- Energy & Utilities

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- FedEx Corp.

- United Parcel Service Inc.

- XPO Logistics Inc.

- J.B. Hunt Transport Services

- Americold Logistics LLC

- Expeditors International of Washington Inc.

- C.H. Robinson Worldwide Inc.

- Kenco Group

- Deutsche Post DHL Group

- Ceva Holdings LLC

- DSV Air & Sea Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors