Search Market Research Report

Laminating Adhesives Market Size, Share Global Analysis Report, 2022 – 2028

Laminating Adhesives Market Size, Share, Growth Analysis Report By Application (Medical Packaging, Food Packaging, Industrial Packaging, and Others), By Product Type (Water-Based, and Solvent Based), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

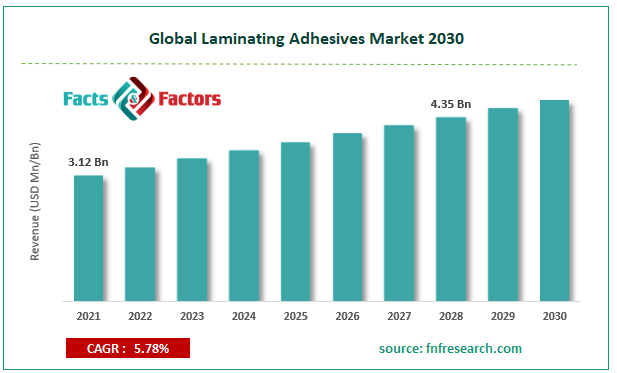

[207+ Pages Report] According to Facts and Factors,The global laminating adhesives market size was worth around USD 3.12 billion in 2021 and is predicted to grow to around USD 4.35 billion by 2028 with a compound annual growth rate (CAGR) of roughly 5.78% between 2022 and 2028. The report analyzes the global laminating adhesives market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the laminating adhesives market.

Market Overview

Market Overview

Laminated adhesives are a layer of, generally extremely thin, adhesives that are set on a release liner or release paper which acts as a preventive barrier against premature adhering of sticky material. Post applying the adhesive to the intended object, the paper is stripped away, which leaves the adhesive stuck to the surface of the object. Laminating adhesives are used in sensitive industries like food processing, pharmaceutical, and medicine to name a few. Hence it is mandatory for laminating adhesives to undergo quality & safety checks and only once it has received the necessary approval from the United States Food and Drugs Administration or other regulatory bodies in their respective countries, they can be used for commercial purposes. Laminating adhesives are created using either heat or a mixture of heat & pressure like the hot melt adhesives. These agents are on a high popularity trend since they offer strong bonding while also providing remarkable resistance to high temperatures and protection against lower-risk environmental phenomena.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global laminating adhesives market is estimated to grow annually at a CAGR of around 5.78% over the forecast period (2022-2028).

- In terms of revenue, the global laminating adhesives meat market size was valued at around USD 3.12 billion in 2021 and is projected to reach USD 4.35 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on product type segmentation, water-based was predicted to show maximum market share in the year 2021

- Based on application segmentation, food packaging was the leading revenue-generating application in 2021.

- On the basis of region, Asia-Pacific was the leading revenue generator in 2021

Covid-19 Impact

Covid-19 Impact

The global market cap was severely impacted during the peak of the pandemic. One of the major reasons was the unavailability of raw materials and in cases where manufacturers could access the product, the prices of primal matter had skyrocketed as a direct consequence of the increase in oil prices that was witnessed across the globe.

Growth Drivers

Growth Drivers

- Growth in the packaging industry to propel market expansion

The global laminating adhesives market is projected to grow owing to the increasing packaging industry. Laminating adhesives are widely used in the packaging of food items as well as in the healthcare and pharmaceutical sector owing to the various benefits offered by these adhesives that help in upgrading the packaging quality. The outer covering of any product is one of the key aspects when it comes to marketing and advertisement of the product. It also plays an important role in safeguarding the product from external or environmental damage by acting as a protective cover. This is one of the main reasons why companies spend a hefty amount on product packaging, which is known to have a direct impact on the final sales revenue. Companies do not generally compromise on the quality of packaging, and since laminating adhesives form an integral part of the product’s outer cover, its demand is expected to grow as the packing industry grows. For instance, as reported by the Indian Institute of Packaging (IIP), the consumption in the segment grew by over 200% in the last 12 years growing to 8.6 kilograms per person per annum from 4.3 kilograms per person per annum.

Restraint

Restraint

- Fluctuating prices of raw materials to restrict the market growth

The global market size may witness restricted growth trends because of the extremely fluctuating prices of the raw material required to create laminating adhesives. Some of these raw materials include solvents, glycols, and acids. Due to political turmoil, the prices of all these primary products have increased drastically thus discouraging producers against the global market. The prices of these products have always been extremely volatile and dependent on external factors causing an unprecedented increase in the final cost involved.

Opportunities

Opportunities

- Growing efforts to curb the impact of raw material prices may provide market growth opportunities

The global laminating adhesives market cap is anticipated to benefit from the growing efforts to help laminate adhesives producers resistant to changes in raw materials by innovating ways to substitute these materials altogether. For instance, the ongoing endeavors are undertaken by Brilliant Polymers, a producer of specialty polymers in India, to develop a solvent-free laminating adhesive as a means of achieving a sustainable growth trajectory. The products manufactured at their site do not contain any trace of solvent making them free of volatile organic compounds that tend to escape into the atmosphere which remains unchecked in many situations.

Challenges

Challenges

- Use of environment-polluting basic materials to challenge market growth

One of the most challenging aspects of the global market cap is the use of raw materials which leave a long and negative impact on the environment. Solvent-based adhesives are 35% solids, and the rest 65% is made of mixed adhesives which evaporate in the air causing air pollution.

Segmentation Analysis

Segmentation Analysis

- The global laminating adhesives market is segmented by application, product type, and region

Based on application, the global market is segmented into medical packaging, food packaging, industrial packaging, and others. The food packaging segment leads the global market growth with the packaging of food products global market at a current value of USD 339 billion.

Based on product type, the global market is divided into water-based and solvent based, with water-based laminating adhesives leading the global market and may cover up to 89.85% of the market share by 2028.

Recent Developments:

Recent Developments:

- In September 2022, Toyo-Morton, Ltd., a leading Japan-based manufacturer of laminating adhesives, announced the upgrade of its portfolio by adding food-safe products that are claimed to contain any trace of organic tin compounds and epoxy silanes. The company is also a member of the Toyo Ink Group.

- In August 2022, Brilliant Polymers Invested in a large plant specially designed for the manufacturing of laminating adhesives in India. The new facility may help the company grow its profit by 5% as claimed by industry experts. The company has invested around USD 12.5 million in the development of the plant resulting in increasing the site’s capacity by two times the existing volume size of 45,600 tons.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 3.12 Billion |

Projected Market Size in 2028 |

USD 4.35 Billion |

CAGR Growth Rate |

5.78% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

TOYOCHEM CO. LTD., The DOW Chemical Company, 3M, KGaA, Ashland Global Specialty Chemicals Inc., Arkema S.A, and Others |

Key Segment |

By Application, Product Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia-Pacific to sweep market growth with highest CAGR

The global laminating adhesives market is projected to be led by Asia-Pacific during the forecast period as it was in the previous years. The regional market share may reach up to 49% by 2028 which is anticipated to be driven majorly by the flexible plastic packaging industry which is related to the growing trend of demand for on-the-go food items as a part of the busy lifestyle in countries like India, China, and Japan. The revenue from these countries may also be aided by the rising investments toward setting up large-scale manufacturing units which are in line with the intention of the Chinese and Indian governments to become self-reliant and world leaders in the coming years. North America may also enlist a high CAGR, with the United States leading the regional expansion which can be attributed to the high demand for packaged food items as well as the growth of the pharmaceutical sector which dominated the world market in 2019 with a revenue closing up to USD 500 billion.

Competitive Analysis

Competitive Analysis

- TOYOCHEM CO. LTD.

- The DOW Chemical Company

- 3M

- KGaA

- Ashland Global Specialty Chemicals Inc.

- Arkema S.A

The global laminating adhesives market is segmented as follows:

By Application

By Application

- Medical Packaging

- Food Packaging

- Industrial Packaging

- Others

By Product Type

By Product Type

- Water Based

- Solvent Based

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- TOYOCHEM CO. LTD.

- The DOW Chemical Company

- 3M

- KGaA

- Ashland Global Specialty Chemicals Inc.

- Arkema S.A

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors