Search Market Research Report

IoT in Defense Market Size, Share Global Analysis Report, 2024 – 2032

IoT in Defense Market Size, Share, Growth Analysis Report By Component (Hardware, Software, and Services), By Connectivity Technology (Cellular, Wi-Fi, Satellite Communication, and Radio Frequency), By Deployment Mode (On-premises, and Cloud-based), By Application (Fleet Management, Inventory Management, Equipment Maintenance, Security, and Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

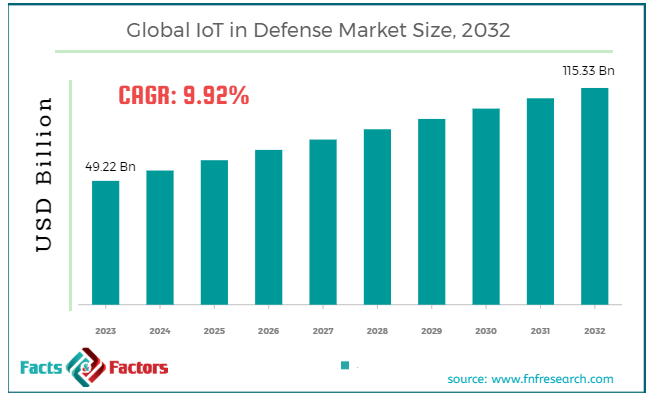

[228+ Pages Report] According to Facts & Factors, the global IoT in defense market size in terms of revenue was valued at around USD 49.22 billion in 2023 and is expected to reach a value of USD 115.33 billion by 2032, growing at a CAGR of roughly 9.92% from 2024 to 2032. The global IoT in defense market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

The Internet of Things (IoT) is revolutionizing many sectors and defense is no exception. Also sometimes called Defense IoT (dIoT), it refers to the use of interconnected devices embedded with sensors and software in military applications. These devices collect and exchange data, providing valuable insights for various defense purposes.

Some key areas where IoT is used in defense are a network of sensors on land, air, and sea platforms that can provide real-time data on troop locations, enemy movement, and environmental conditions. This allows commanders to make quicker and more informed decisions. Soldiers can wear sensors that track vital signs, fatigue levels, and even emotional states. This data can help prevent injuries, optimize troop deployment, and even provide early intervention for mental health concerns.

Sensors on vehicles and equipment can monitor performance, predict maintenance needs, and optimize supply chains. This reduces downtime and keeps military operations running smoothly. IoT sensors can be deployed along borders and at military bases to detect intrusions, trigger alarms, and provide real-time surveillance data.

Overall, IoT in defense has the potential to significantly improve efficiency, safety, and decision-making capabilities. However, security concerns and the need for robust communication networks in often challenging environments remain important considerations.

Key Highlights

Key Highlights

- The IoT in defense market has registered a CAGR of 9.92% during the forecast period.

- In terms of revenue, the global IoT in defense market was estimated at roughly USD 49.22 billion in 2023 and is predicted to attain a value of USD 115.33 billion by 2032.

- The growth of the IoT in defense market is being propelled by IoT technologies that enable real-time data collection and analysis from a multitude of sensors and devices across different domains (land, air, sea, and cyber), significantly improving situational awareness and decision-making capabilities.

- On the basis of Component, the hardware segment contributed 42% revenue share in 2023 and is expected to dominate the global market due to the importance of sensors and actuators in IoT networks.

- Based on Application, the fleet management segment is projected to swipe the largest market share.

- By region, North America currently dominates the market with a 27% revenue share in 2023 due to its advanced technological infrastructure and substantial investments in defense.

Growth Drivers:

Growth Drivers:

- Increased Demand for Operational Efficiency and Cost Reduction: Military forces are constantly seeking ways to streamline operations and reduce costs. IoT solutions offer real-time data collection and analysis, enabling predictive maintenance, optimized logistics, and improved resource allocation.

- Evolving Threats and Security Concerns: The rise of asymmetric warfare and cyber threats necessitates advanced defense capabilities. IoT-powered systems enhance situational awareness, border security, and threat detection, leading to a more proactive defense posture.

- Growing Focus on Connectivity and Communication: Modern warfare relies heavily on seamless communication and data exchange across different platforms. IoT facilitates secure and reliable data sharing between troops, vehicles, and headquarters, fostering a more coordinated response.

Restraints:

Restraints:

- Data Security and Privacy Concerns: Integration of IoT devices creates a vast network susceptible to cyberattacks. Data breaches can expose sensitive military information, necessitating robust cybersecurity measures, which can be expensive and complex.

- Standardization and Interoperability Issues: Military equipment from various vendors may not operate seamlessly due to a lack of standardized protocols. This hinders interoperability and creates integration challenges.

- High Initial Investment and Integration Costs: Deploying and maintaining an extensive IoT network requires significant upfront investment in sensors, infrastructure, and expertise. Additionally, integrating IoT solutions with existing legacy systems can be costly.

Opportunities:

Opportunities:

- Artificial Intelligence (AI) and Machine Learning (ML) Integration: Combining IoT with AI and ML can create intelligent systems for threat analysis, predictive maintenance, and autonomous operations, leading to a significant leap in defense capabilities.

- Advancements in Low-Power Wide-Area Networks (LPWAN): LPWAN technologies enable efficient data transmission over long distances with minimal power consumption. This is crucial for battlefield applications where power sources may be limited.

- Emerging Applications in Battlefield Management and Soldier Wearables: IoT offers vast potential for real-time battlefield monitoring, troop health and performance tracking, and improved situational awareness through soldier-worn sensor networks.

Challenges:

Challenges:

- Data Overload and Analytics Capabilities: The sheer volume of data generated by IoT devices can overwhelm existing systems. Developing robust data analytics tools and personnel expertise to interpret this data effectively is crucial.

- Spectrum Availability and Regulation: The increased number of connected devices creates pressure on radio frequency spectrum availability. Regulatory frameworks need to adapt to accommodate the growing demands of military IoT applications.

- Physical Environment and Security Risks: Defense equipment operates in harsh environments and faces increased vulnerability to physical damage and hacking attempts. Ensuring the durability and security of IoT devices in these demanding conditions is essential.

IoT in Defense Market: Segmentation Insights

IoT in Defense Market: Segmentation Insights

The global IoT in defense market is segmented based on component, connectivity technology, deployment mode, application, and region.

Component Segmentation Analysis

Component Segmentation Analysis

Based on Component, the global IoT in defense market is bifurcated into hardware, software, and services. Hardware traditionally dominates due to the essential role of physical devices in IoT networks, including sensors and actuators with a contribution of 42% revenue share in 2023.

However, services are expected to witness significant growth as the demand for integration, maintenance, and consulting services rises. Hardware Segment is the backbone of IoT in defense, including devices like sensors, which collect and transmit data crucial for military operations. The IoT in defense market is evolving rapidly, with technological advancements driving significant changes in how military operations are conducted. The emphasis on hardware reflects the current need for physical IoT devices in defense.

Connectivity Technology Segmentation Analysis

Connectivity Technology Segmentation Analysis

Based on Connectivity Technology, the global IoT in defense market is categorized into cellular, Wi-Fi, satellite communication, and radio frequency. The cellular connectivity segment accounted for 42.2% of revenue share in 2023 often due to its widespread availability and reliability, facilitating robust and secure communication channels for military operations. It offers a more consistent and reliable allocation of bandwidth for many real-time applications including audio and data.

Deployment Mode Segmentation Analysis

Deployment Mode Segmentation Analysis

Based on Deployment Mode, the global IoT in defense market is categorized into on-premises and cloud-based. Cloud-based solutions are projected to grow at an impressive CAGR, driven by the flexibility, scalability, and efficiency they offer for military IoT applications. Cloud-based deployment offers cost-efficiency, scalability, and ease of updating, which are vital for dynamic defense environments. The growing interest in cloud-based deployment and services highlights a shift towards more flexible, scalable, and efficient military operations.

Application Segmentation Analysis

Application Segmentation Analysis

Based on Application, the global IoT in defense market is categorized into fleet management, inventory management, equipment maintenance, security, and others. Real-time fleet management is highlighted as a key area of application, given its importance in enhancing operational effectiveness and logistics within defense settings. Real-time fleet management ensures efficient management of military assets and personnel, improving situational awareness and operational readiness. The focus on real-time fleet management underlines the critical importance of situational awareness and asset management in modern warfare.

Recent Developments

Recent Developments

AeroVironment and HAPSmobile have launched a joint venture with a contract for USD 65 million. The purpose of the partnership is to generate solar-powered high-altitude unmanned aircraft systems and facilitate their production.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 49.22 Billion |

Projected Market Size in 2032 |

USD 115.33 Billion |

CAGR Growth Rate |

9.92% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Lockheed Martin, Northrop Grumman, Radisys, Raytheon Technologies, BAE Systems, Boeing Defense, Airbus Defence and Space, IBM, Microsoft, AT&T, General Atomics Aeronautical Systems, Textron Systems, Honeywell International Inc., Elbit Systems, Prox Dynamics, and Others. |

Key Segment |

By Component, By Connectivity Technology, By Deployment Mode, By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

IoT in defense Market: Regional Insights

IoT in defense Market: Regional Insights

The IoT in defense market is segmented regionally to understand the geographical dynamics and how different areas are adopting IoT technologies within the defense sector. Each region's market is influenced by factors such as technological advancements, government policies, defense budgets, and the presence of key market players. Below is a brief regional analysis, including the dominating region based on its Compound Annual Growth Rate (CAGR) and a general description of market trends in each area.

- North America: North America, particularly the United States, has traditionally dominated the IoT in defense market with a 27% revenue share. This dominance is attributed to significant investments in R&D, a strong technological infrastructure, and the presence of leading defense contractors and IoT technology providers. The region's emphasis on enhancing national security and defense capabilities through advanced technologies contributes to its leading position. The region's mature market and ongoing investments in IoT applications for defense signal steady growth, although the exact CAGR might vary depending on the source.

- Europe: Europe's IoT in defense market is driven by a strong focus on security and defense modernization accounted 22% revenue share, especially in countries like the UK, France, and Germany. European defense agencies are increasingly investing in IoT to enhance operational efficiency, cybersecurity, and surveillance capabilities. Europe shows a promising CAGR, reflecting its commitment to incorporating IoT technologies into defense and security strategies.

- Asia-Pacific: The Asia-Pacific region is expected to witness the fastest growth with a 48% revenue share in the IoT in defense market. This growth is fueled by increasing defense budgets in countries like China and India, coupled with rising tensions in the South China Sea and border areas. The region's rapid technological advancement and digitalization efforts also contribute to the fast-paced adoption of IoT in defense. Asia-Pacific is projected to exhibit the highest CAGR, driven by significant investments in defense infrastructure and a keen interest in adopting cutting-edge technologies.

- Latin America and Middle East & Africa (MEA): These regions are emerging markets for IoT in defense, with 11% revenue share growth driven by the need to improve military capabilities and border security. While the adoption rate is slower compared to other regions, there is a growing interest in leveraging IoT for surveillance, monitoring, and operational efficiency. Although the CAGR for these regions may be lower than that of Asia-Pacific and North America, there is potential for significant growth as these markets develop and open up to new technologies.

IoT in defense Market: Competitive Landscape

IoT in defense Market: Competitive Landscape

Some of the notable companies that dominate global IoT in defense market include:

- Lockheed Martin

- Northrop Grumman

- Radisys

- Raytheon Technologies

- BAE Systems

- Boeing Defense

- Airbus Defence and Space

- IBM

- Microsoft

- AT&T

- General Atomics Aeronautical Systems

- Textron Systems

- Honeywell International Inc.

- Elbit Systems

- Prox Dynamics

The global IoT in defense market is segmented as follows:

By Component

By Component

- Hardware

- Software

- Services

By Connectivity Technology

By Connectivity Technology

- Cellular

- Wi-Fi

- Satellite Communication

- Radio Frequency

By Deployment Mode

By Deployment Mode

- On-premises

- Cloud-based

By Application

By Application

- Fleet Management

- Inventory Management

- Equipment Maintenance

- Security

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Lockheed Martin

- Northrop Grumman

- Radisys

- Raytheon Technologies

- BAE Systems

- Boeing Defense

- Airbus Defence and Space

- IBM

- Microsoft

- AT&T

- General Atomics Aeronautical Systems

- Textron Systems

- Honeywell International Inc.

- Elbit Systems

- Prox Dynamics

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors