Search Market Research Report

HVDC Transmission Market Size, Share Global Analysis Report, 2025 - 2034

HVDC Transmission Market Size, Share, Growth Analysis Report By Type (High-power Rating Projects, Low-power Rating Projects), By Technology (Line Commutated Converter [LCC], Voltage Source Converter [VSC]), By Application (Subsea, Underground, Overhead, Mixed), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

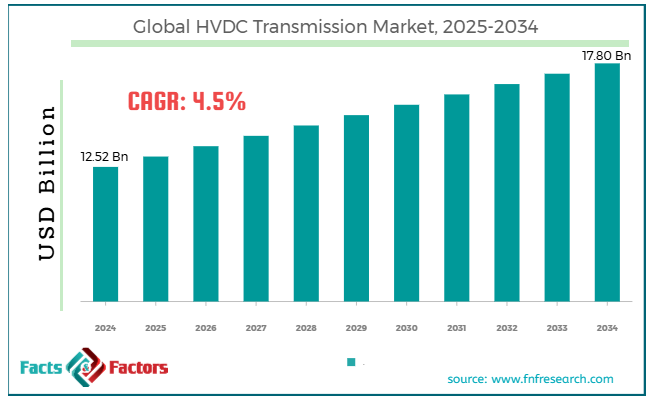

[221+ Pages Report] According to Facts & Factors, the global HVDC transmission market size was worth around USD 12.52 billion in 2024 and is predicted to grow to around USD 17.80 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.5% between 2025 and 2034.

Market Overview

Market Overview

HVDC, which stands for High Voltage Direct Current, is a technology that transmits electricity over long distances with minimal losses. These systems are widely used in offshore wind farm connections, interconnecting grids through regions, and offering stable energy flow between locations with diverse AC frequencies. The global HVDC transmission market is projected to progress remarkably over the forecast period due to rising demand for efficient power transmission, the incorporation of offshore wind farms, and the need for grid stabilization and interconnection. With the growing global emphasis on decreasing energy losses and enhancing grid stability, HVDC systems offer greater efficiency for large-distance transmission than AC systems. This notably fuels the global market growth.

Moreover, offshore wind farms, situated far from the populace, depend highly on HVDC transmission to connect to onshore grids. This industry's speedy growth is a leading driver for HVDC usage. Furthermore, HVDC systems are vital for interconnecting grids that function at diverse frequencies, offering grid stability by monitoring power flow better than AC systems.

However, a few restraining factors to the market growth include technological complexity and scarcity of skilled labor. HVDC systems are technically complicated to install, design, and maintain. The proficiency needed to operate and maintain these systems may restrict the speed of HVDC system deployment. Also, the dedicated nature of HVDC technology denotes a restricted group of experts proficient in the installation, design, and operation of these systems. This may limit the adoption and eventually, the growth of the global market.

Yet, the market will progress substantially over the estimated period owing to opportunities like the development of offshore wind farms and incorporation with the smart grid. Offshore wind farms are progressing globally, and HVDC transmission offers a practical and efficient solution for transmitting energy produced from these facilities to onshore grids. Incorporating smart grid solutions enables enhanced control and better management of energy transmission. Smart grids optimize energy distribution, support energy storage, and reduce losses, thus creating opportunities for HVDC technologies.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global HVDC transmission market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2025-2034)

- In terms of revenue, the global HVDC transmission market size was valued at around USD 12.52 billion in 2024 and is projected to reach USD 17.80 billion by 2034.

- The HVDC transmission market is projected to grow significantly owing to the surging demand for efficient energy transmission over large distances, the growing need for grid stability, and the assimilation of renewable energy sources.

- Based on type, the freestanding racks segment is expected to lead the market, while the double-sided racks segment is expected to register considerable growth.

- Based on technology, the metal segment is the dominating segment among others, while the plastic segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the retail segment is expected to lead the market as compared to the food & beverages segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Growth Drivers

Growth Drivers

- Will the growing electricity demand due to industrialization and urbanization spur the HVDC transmission market growth?

The electricity demand is surging globally due to industrialization, speedy urbanization, and the growing dependency on electricity for daily routines. The demand for electricity is burgeoning in emerging nations, especially in Africa and Asia. This elevated demand pressurizes the present transmission infrastructure, and HVDC provides an effective solution for managing larger distance power transfers with reduced energy loss.

As per the IEA, the worldwide electricity demand surged by nearly 2.4% in 2022.

With the growth of urban centers, economies like Brazil and China are heavily investing in HVDC to address electricity scarcity in industrial and urban zones.

- Technological improvements in HVDC systems extensively fuel the market growth

Improvements in HVDC technology, especially the development of voltage source converter HVDC systems, have increased the adaptability and flexibility for diverse applications. These HVDC systems enable simplified and easy incorporation of renewable sources, such as connecting isolated areas, small grids, or offshore wind farms.

Moreover, improvements in power electronics and semiconductor technology are increasing the cost efficiency of HVDC systems. These are key driving factors of the global HVDC transmission industry.

Hitachi ABB Power Grids launched a novel generation of HVDC converters in March 2024. They are dedicated to significantly decreasing the HVDC system footprint while improving energy efficiency, thus benefiting long-distance terrestrial and offshore transmission.

Restraints

Restraints

- Are public opposition and environmental concerns negatively impacting the progress of the HVDC transmission market?

While HVDC technology is considered cleaner than conventional AC systems because of fewer transmission losses, building HVDC transmission lines, mainly in protected areas or underwater, may have significant ecological impacts. Environmental groups or local communities primarily raise concerns regarding the consequences on ecosystems, human health, and wildlife. These stresses may result in public opposition, delays, and protests in the approval of projects.

The Norway-United Kingdom HVDC interconnector project, commonly known as 'North Sea Link', raises ecological concerns due to potential disturbances to marine life during the construction of subsea cables. These issues resulted in prolonged consultations with local fishing and environmental advocacy groups before proceeding with the projects.

Opportunities

Opportunities

- Does the transformation of aging power grids contribute to the HVDC transmission market growth?

Several nations, primarily developed nations, are modernizing their aging energy grids. The HVDC technology is crucial in this procedure, as it enhances the reliability and efficiency of the existing systems while allowing the incorporation of renewable energy sources. By renovating former AC lines with HVDC infrastructure, utilities may majorly decrease power losses over considerable distances and enhance grid stability.

European and the U.S. power grids are among the oldest, with above 70% of transmission lines constructed more than 40 years ago. This sparks huge investment in HVDC infrastructure to switch obsolete systems.

Challenges

Challenges

- Competition from AC transmission systems for short distances restricts the growth of the HVDC transmission market

Since HVDC transmission is incredibly efficient for longer distance transmission, mainly with renewable energy interconnection and integration of asynchronous grids, AC systems remain cost-efficient for shorter regions and distances with the present systems. This may hamper the broader adoption of HVDC systems, mainly in locations where AC infrastructure already exists, and power transmission needs are met.

AC transmission systems are usually 40% cheaper than High Voltage Direct Current systems for distances below 400 km. This cost difference is still a key barrier for HVDC systems, especially in regions with dense AC networks.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 12.52 Billion |

Projected Market Size in 2034 |

USD 17.80 Billion |

CAGR Growth Rate |

4.5% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

ABB, Siemens, General Electric (GE), Toshiba, Schneider Electric, Mitsubishi Electric, Hitachi Energy, Siemens Energy, Crompton Greaves, Prysmian Group, Huawei, Dongfang Electric Corporation, XJ Electric, S&C Electric Company, Eaton, and others. |

Key Segment |

By Type, By Technology, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global HVDC transmission market is segmented based on type, technology, application, and region.

Based on type, the global HVDC transmission industry is divided into high-power rating projects and low-power rating projects. The ‘high-power rating projects' segment registered a significant market share owing to the renewable energy integration, cross-border interconnections, and significance of UHVDC. With the worldwide shift towards renewable energy, large solar plants and offshore wind farms are heavily demanded to link geographically distant power sources to energy grids. Nations actively seek to link national grids across borders to streamline energy trading and promise a better balance of power supply. Furthermore, UHVDC systems are crucial for transmitting power over longer distances, needing high-power ratings for optimal efficacy.

Based on technology, the global HVDC transmission industry is segmented into Line Commutated Converter (LCC) and Voltage Source Converter (VSC). Due to cost-efficiency, long-distance and bulk energy transmission, and sophisticated technology, the LLC or Line Commutated Converter technology held a notable share of the global market. LCC-based HVDC systems are highly economical for high-power applications and long-distance transmission, particularly in large-scale projects. LLC is largely used for large-scale transmission projects like those in India, China, and Europe, where there is a huge emphasis on linking isolated generation centers to distant load centers. Also, LCC is a well-developed technology with major applications in high-power capacity projects due to its proven operational strength.

Based on application, the global market is segmented into subsea, underground, overhead, and mixed. The subsea segment held a substantial market share in 2024 and will lead in the future as well. The reasons for the growth include the expansion of offshore wind farms, the integration of renewable energy, and the establishment of intercontinental power links. Expanding offshore wind farms, mainly in Europe, North America, and Asia, have resulted in heavy demand for subsea HVDC solutions. Several utilities and governments have emphasized renewable power generation, mainly offshore wind energy, which is propelling the demand for efficient and reliable transmission systems. Subsea also enables power transmission over longer distances, thereby aiding nations in balancing energy demand and supply, and simplifying energy trading.

Regional Analysis

Regional Analysis

- What factors will help Asia Pacific lead in the HVDC transmission market over the forecast period?

The Asia Pacific held a dominant share of the HVDC transmission market in 2024 and is expected to continue leading over the forecast period. The key factors for the regional growth comprise rising demand for energy and growing industrialization, government initiatives and policies, and major HVDC projects. Asia Pacific is home to several of the world's fastest progressing nations, like India, Southeast Asia, and China. This growth is fueling the energy demand.

Additionally, as a growing number of individuals migrate to urban cities, the demand for electricity increases. HVDC transmission helps satisfy this demand by enabling more effective energy transfer over great distances. The Asia Pacific region is also experiencing healthy governmental backing for HVDC transmission solutions to balance regional energy imbalances. The region also holds some of the most innovative HVDC projects. Most projects comprise underground and subsea HVDC transmission to link remote areas and offshore wind farms to the key grids. Furthermore, the region emphasizes developing cross-border high-voltage direct current links.

North America is poised for significant growth, with the second-largest share in the HVDC transmission market. The notable regional growth is attributed to the rising demand for efficient and reliable energy transmission, renewable energy assimilation and sustainability initiatives, innovative grid development, and improved grid technology. North America, primarily Canada and the United States, is experiencing a surge in electricity demand due to steady population growth, increasing demand for electric vehicles, electric appliances, and data centers, as well as growing industrialization.

North America has been progressing in using renewable energy, especially solar and wind. Canada holds massive hydropower potential, and the United States is among the leading wind energy generators. HVDC transmission is vital for linking remote power sources to urban centers, mainly for larger distances. North America also heavily invests in smart grid solutions, comprising HVDC systems to innovate grid systems. Smart grids enhance energy flow control, enable better incorporation of energy sources, and optimize energy efficiency.

Competitive Analysis

Competitive Analysis

The global HVDC transmission market is led by players like:

- ABB

- Siemens

- General Electric (GE)

- Toshiba

- Schneider Electric

- Mitsubishi Electric

- Hitachi Energy

- Siemens Energy

- Crompton Greaves

- Prysmian Group

- Huawei

- Dongfang Electric Corporation

- XJ Electric

- S&C Electric Company

- Eaton

Key Market Trends

Key Market Trends

- Ultra-High Voltage Direct Current projects:

UHVDC technology is progressing in key regions like China, thus allowing massive amounts of power to be transmitted over longer distances with reduced losses. The said technology is also broadly used to link distant renewable power sources with urban areas.

- Emergence of (VSC) Voltage Source Converter technology:

The adoption of VSC-HVDC solutions is surging on a global scale. This is backed by their ability to handle energy flow efficiently, the integration of smart grids and offshore wind energy, and their flexibility.

The global HVDC transmission market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- High-power Rating Projects

- Low-power Rating Projects

By Technology Segment Analysis

By Technology Segment Analysis

- Line Commutated Converter (LCC)

- Voltage Source Converter (VSC)

By Application Segment Analysis

By Application Segment Analysis

- Subsea

- Underground

- Overhead

- Mixed

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- ABB

- Siemens

- General Electric (GE)

- Toshiba

- Schneider Electric

- Mitsubishi Electric

- Hitachi Energy

- Siemens Energy

- Crompton Greaves

- Prysmian Group

- Huawei

- Dongfang Electric Corporation

- XJ Electric

- S&C Electric Company

- Eaton

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors