Search Market Research Report

Graphic Film Market Size, Share Global Analysis Report, 2022 – 2028

Graphic Film Market Size, Share, Growth Analysis Report By Film Type (Transparent, Opaque, Translucent, and Reflective), By End-Use (Promotion & Advertising, and Protection), By Polymer Type (Polyvinyl Chloride (PVC), Polyethylene (PE), and Polypropylene (PP)), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

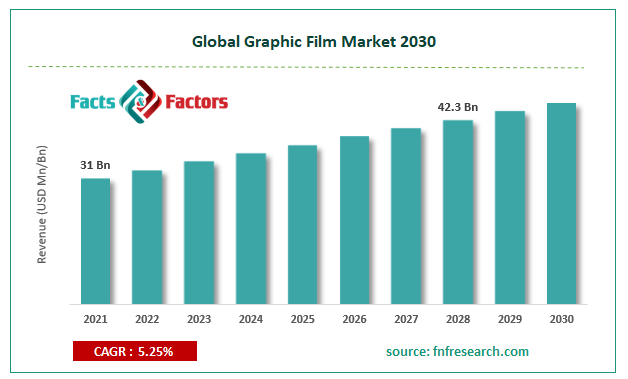

[220+ Pages Report] According to the report published by Facts Factors, the global graphic film market size was worth around USD 31 billion in 2021 and is predicted to grow to around USD 42.3 billion by 2028 with a compound annual growth rate (CAGR) of roughly 5.25% between 2022 and 2028. The report analyzes the global graphic film market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the graphic film market.

Market Overview

Market Overview

Graphic films are used in printing images on products. They are polyester based and exhibit adhesive properties making them transferable to other objects like glasses, walls, vehicles, floors, and others providing end-consumers with excellent branding opportunities. With the growing number of players as well as the adoption of advanced technology in the production of graphic films, the product innovation in this segment has grown multifold in the last few years revolutionizing the entire visual communications industry. For instance, graphic films produced by 3M, an United States multinational conglomerate feeling in fields like consumer goods, worker’s safety, US healthcare, and others, create one of the finish forms of graphic films that can practically stick to all surfaces and have shown applications for smooth and textured walls, watercraft, fleet, floor, signage, and as vehicle wraps amongst other uses.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global graphic film market is estimated to grow annually at a CAGR of around 5.25% over the forecast period (2022-2028)

- In terms of revenue, the global graphic film market size was valued at around USD 31 billion in 2021 and is projected to reach USD 42.3 billion, by 2028

- Due to a variety of driving factors, the market is predicted to rise at a significant rate

- Based on film type segmentation, opaque was predicted to show maximum market share in the year 2021

- Based on end-use segmentation, promotion & advertising were the leading end-uses in 2021.

- On the basis of region, North America was the leading revenue generator in 2021

Covid-19 Impact:

Covid-19 Impact:

During the pandemic, the global market was severely impacted for multiple reasons. On one hand, there were a few positive signs, for instance, growth in packaged food items resulting in producing companies investing in printing materials, but on the other hand, a large section of the end-consumers showed no signs of utilization, the prime example being office printing. As offices were globally closed, the segment suffered drastically and did not exhibit any growth trend until the 2nd quarter of 2021.

Growth Drivers

Growth Drivers

- Growth in fast moving consumable goods (FMCG) industry to propel market demand

The global graphic film market is expected to benefit from the growing FMCG industry which is one of the largest consumers of graphic films, as the outer package is one of the most important aspects of branding and marketing in the FMCG sector that deals with all types of consumer goods. Some of the products included in this industry include toiletries, cosmetics, and detergents, while in some countries like India, other items like soft drink packaged goods, consumer electronics, chocolates, etc. are included in the global market cap. All of these industries and others rely heavily on branding to reach a larger consumer database. This trend is applicable across industries and company sizes. For instance, in the 1st QN of 2021, Colgate-Palmolive India spent over INR 163 crore on advertising alone. Since graphic films have huge scope in delivering businesses the kind of branding they need at a reasonable price, the demand for the product may increase propelled by the FMCG sector.

Restraints

Restraints

- Fluctuation of raw material prices to restrict market expansion

One of the key factors that graphic film manufacturers constantly deal with is the frequently changing prices of the raw materials required, paper is one of them. Most of the materials are imported and the cost of which can vary depending on the prices of oil & gas, and the political and economic stability of the exporting country amongst other factors. However, in recent types, these two factors have changed drastically cursing manufacturers to use dynamic strategies for reducing losses.

Opportunities

Opportunities

- Growing research & development to provide more growth opportunities

The global graphic film market cap may witness more growth opportunities owing to the increasing R & D undertaken by manufacturers and key players to tackle the various challenges and restrictions surrounding the dwindling demand for graphic films. These activities involve developing more sustainable resources as well as finding ways to reduce the impact of frequent price fluctuations. The slow but steady introduction of Polyvinyl Chloride (PVC)-free films may open the door for higher acceptance amongst the consumer group.

Challenges

Challenges

- Concerns over environmental sustainability to act as a major challenge

Graphic films have been witnessing phasing out in the last few years, especially in developed countries where discussions over sustainable growth have gained momentum in the last decade. Companies are slowly moving toward other modes of branding including printing materials that are more eco-friendly. Unless the market players act fast to stay in the game by developing a viable approach, the global market may lose a large section of the consumer group.

Segmentation Analysis

Segmentation Analysis

The global graphic film market is segmented based on film type, end-user, polymer type, and region

Based on film type, the global market segments are transparent, opaque, translucent, and reflective. The global market is led by the opaque segment as non-transparent and non-translucent films are widely used in the FMCG sector not only to act as a means of the advertisement but also to protect packaged goods. Nestle, one of the world’s biggest FMCG companies, spent over USD 2.4 billion on advertisements for the US region.

Based on end-use, the global market is divided into promotion & advertising, and protection, with the former generating the highest global market revenue in 2021. Every company has a certain allocated budget for marketing and advertising purposes and the budget is a certain percentage of the total revenue. In most cases, the percentage value should be between 2% to 5% of the final revenue generated.

Based on polymer-type, polyvinyl chloride (PVC), polyethylene (PE), and polypropylene (PP) are the global market segments with polyethylene leading the market cap. It is a mixture of different polymers of ethylene with a melting point of 115-135°C.

Recent Developments:

Recent Developments:

- In April 2022, 3M announced the launch of 3M™ Print Wrap Film IJ280. The product is a vehicle wrap designed especially for installers and converters expecting exceptional performance along with [productivity and print quality. The print warp is being claimed as the best in the market and has become popular amongst automobile enthusiasts in no time

- In February 2021, Innovia Films, a multinational producer and supplier of biaxially-oriented polypropylene (BOPP) designed especially for labeling, packaging, industrial products, and tobacco overwrap, launched Rayoart developed for extended outdoor use with associated benefits like print performance, color, along with an improved environmental footprint

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 31 Billion |

Projected Market Size in 2028 |

USD 42.3 Billion |

CAGR Growth Rate |

5.25% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

E.I. Du Pont De Nemours and Company, 3M, ACCO Brands Corporation, Constantia Flexibles Group, LG Hausys, Ultraflex Systems Inc., Orafol Europe GMBH, Kay Premium Marking Films Ltd , and others. |

Key Segment |

By Film Type, End-Use, Polymer Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to generate the highest revenue during the forecast period

The global graphic film market is projected to generate the highest revenue in North America with the US acting as the major source of revenue generation owing to the presence of key market players and the growing R & D activities to navigate through the challenges faced in the global market. The developmental activities directed toward eco-friendly films that can help retain more customers while attracting new ones may act as an important contributing factor. The region is home to some of the largest consumer industries like FMCG, automobile, and other conglomerates dealing in multiple divisions. Asia-Pacific may also grow with a high CAGR where China may lead the regional growth.

Competitive Analysis

Competitive Analysis

- E.I. Du Pont De Nemours and Company

- 3M

- ACCO Brands Corporation

- Constantia Flexibles Group

- LG Hausys

- Ultraflex Systems Inc.

- Orafol Europe GMBH

- Kay Premium Marking Films Ltd

The global graphic film market is segmented as follows:

By Film Type

By Film Type

- Transparent

- Opaque

- Translucent

- Reflective

By End-Use

By End-Use

- Promotion & Advertising

- Protection

By Polymer Type

By Polymer Type

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polypropylene (PP)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- E.I. Du Pont De Nemours and Company

- 3M

- ACCO Brands Corporation

- Constantia Flexibles Group

- LG Hausys

- Ultraflex Systems Inc.

- Orafol Europe GMBH

- Kay Premium Marking Films Ltd

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors