Search Market Research Report

Car Rental Market Size, Share Global Analysis Report, 2024 – 2032

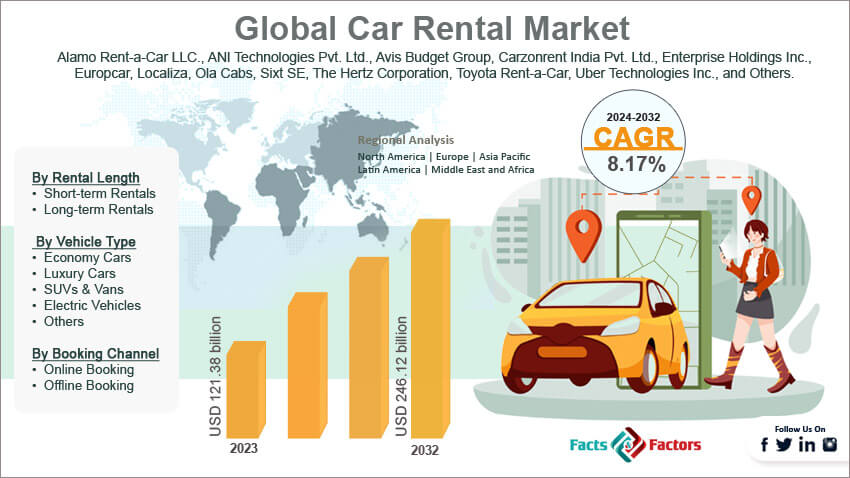

Car Rental Market Size, Share, Growth Analysis Report By Rental Length (Short-term Rentals and Long-term Rentals), By Vehicle Type (Economy Cars, Luxury Cars, SUVs & Vans, Electric Vehicles and Others), By Booking Channel (Online Booking and Offline Booking), By Application (Leisure Rentals and Business Rentals), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

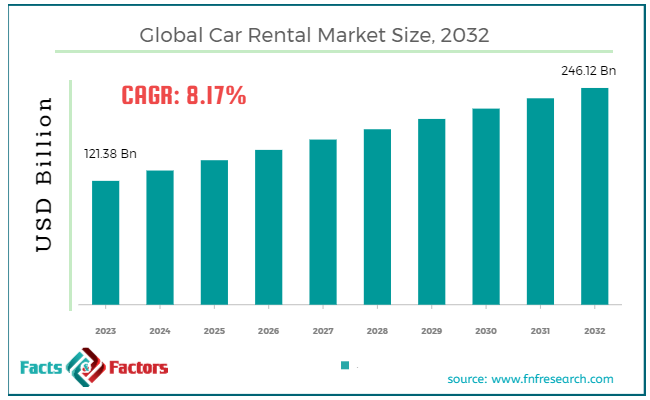

[216+ Pages Report] According to Facts & Factors, the global car rental market size in terms of revenue was valued at around USD 121.38 billion in 2023 and is expected to reach a value of USD 246.12 billion by 2032, growing at a CAGR of roughly 8.17% from 2024 to 2032. The global car rental market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Car rental, also known as car hire in some regions, is a service that allows individuals or businesses to rent a vehicle for a temporary period. Rental companies offer a wide range of car types and sizes to cater to diverse needs – from compact cars for city driving to SUVs for road trips or vans for larger groups. Rentals can range from a few hours to weeks or even months, depending on the renter's requirements.

This service is often organized with numerous local branches, which are generally located near airports or busy city areas and are supplemented by a website allowing online reservations.

Key Highlights

Key Highlights

- The car rental market has registered a CAGR of 8.17% during the forecast period.

- In terms of revenue, the global car rental market was estimated at roughly USD 121.38 billion in 2023 and is predicted to attain a value of USD 246.12 billion by 2032.

- The car rental market is poised for growth driven by global travel demands, technological advancements, and evolving consumer preferences.

- The market is dominated by large international car rental companies with extensive networks of branches and vehicle fleets. Technological advancements are transforming the car rental experience. Online booking platforms and mobile apps are making the rental process faster and more convenient.

- On the basis of Vehicle Type, the economy cars segment is growing at a high rate and is projected to dominate the global market.

- Based on Booking Channel, the online booking segment is particularly dominant due to their widespread accessibility and cost-effectiveness.

- By region, North America holds the leading position in the car rental market.

Growth Drivers:

Growth Drivers:

- Expansion of Global Tourism: Increased global travel, especially in tourism-heavy regions, directly boosts the demand for car rental services. As international and domestic travel volumes rise, so does the need for car rentals at airports and tourist destinations.

- Technological Advancements: The integration of technology such as mobile apps, GPS systems, and online booking platforms has made renting cars more accessible and user-friendly. These technologies improve customer experience and operational efficiency, driving market growth.

- Rise in Urbanization and Economic Growth: As urbanization increases, especially in emerging economies, more people are moving to cities where car ownership may be less practical due to high costs and parking issues, increasing reliance on rental services.

Restraints:

Restraints:

- Regulatory Challenges: Car rental companies face stringent regulations regarding vehicle safety, emissions, and insurance requirements, which can vary greatly by country and region. Compliance with these regulations can be costly and complex.

- High Operational Costs: The need to maintain, service, and update vehicle fleets incurs significant expenses. Additionally, fluctuations in fuel prices and the costs associated with parking and storage of vehicles can impact profitability.

- Impact of Ride-Sharing Services: The rise of ride-sharing companies like Uber and Lyft has intensified competition in the transport sector, offering alternatives to traditional car rentals and potentially limiting market growth.

Opportunities:

Opportunities:

- Green Vehicles: There is a growing demand for eco-friendly transportation options. Car rental companies expanding their fleets to include hybrid and electric vehicles can attract environmentally conscious consumers and benefit from government incentives.

- Partnerships with Airlines and Hotels: Collaborations with travel and hospitality businesses can open new channels for customer acquisition. Package deals and loyalty programs with airlines and hotels can significantly boost rental volumes.

- Technological Integration: Advancements in vehicle technology, such as telematics, electric vehicle charging infrastructure, and autonomous cars, provide new avenues for enhancing service offerings and operational efficiencies.

Challenges:

Challenges:

- Vehicle Depreciation: The value of vehicles depreciates rapidly, affecting the return on investment for car rental companies. Managing fleet composition and turnover is crucial to minimizing financial losses.

- Cyclical Nature of the Industry: The car rental industry is highly susceptible to economic downturns, which can reduce travel frequency and demand for rental services.

- Data Security Concerns: With the increase in digital transactions, car rental companies must invest in securing their platforms against data breaches, which can be costly and damage customer trust.

Car Rental Market: Segmentation Analysis

Car Rental Market: Segmentation Analysis

The global car rental market is segmented based on rental length, vehicle type, booking channel, and application.

By Rental Length Insights

By Rental Length Insights

Based on Rental Length, the global car rental market is categorized into short-term rentals and long-term rentals. Short-term rentals typically range from a few hours to a week and are ideal for airport transportation, weekend getaways, or running errands. This segment is driven by factors like Rise of ride-sharing alternatives for short urban trips, Increasing demand for car rentals and Convenience of online booking platforms for quick rentals. Long-term rentals lasting weeks or months are often preferred for business travel or temporary relocation needs.

By Vehicle Type Insights

By Vehicle Type Insights

Based on Vehicle Type, the global car rental market is bifurcated into economy cars, luxury cars, SUVs & vans, electric vehicles, and others. The economy cars segment has captured a market share of around 36.2% revenue share in 2023. Economy cars are the most commonly rented vehicle types due to their cost efficiency and sufficient features for typical travel needs. This segment usually shows robust growth as it serves the broadest customer base, including budget travelers and small families. Luxury cars include premium brands that offer superior comfort, performance, and luxury.

This segment is expanding at a CAGR of 5.8% during the forecast period. They are preferred by business travelers and tourists who demand high standards. Growth in this segment is driven by increasing disposable income and the popularity of luxury travel experiences. SUVs and vans are popular for road trips, group travel, or customers needing extra cargo space. Electric vehicles growing trend as companies strive for sustainability and cater to environmentally conscious renters.

By Booking Channel Insights

By Booking Channel Insights

Based on Booking Channel, the global car rental market is segmented into online booking and offline booking. The online booking segment includes bookings made via websites and mobile apps. It is becoming the dominant channel due to the convenience and accessibility it offers. The highest growth is observed in online bookings, fueled by the digitalization of services and the increasing use of smartphones and internet services.

The offline booking segment includes bookings made through travel agents or direct bookings at rental facilities. This traditional method is preferred by less tech-savvy customers and in regions with limited internet penetration. While growing slower than online bookings, this segment benefits from personalized services and direct customer engagement.

By Application Insights

By Application Insights

On the basis of Application, the global car rental market is categorized into leisure rentals and business rentals. Leisure rentals for personal travel, tourism, and leisure activities. This segment caters to holiday-goers and families. Leisure travel is a major growth driver, especially with rising tourism globally. Business rentals include rentals for business and corporate purposes. Clients include companies and professionals who travel for work. This segment is influenced by the economic conditions and the volume of business travel.

Car Rental Market Trends:

Car Rental Market Trends:

- Shift Towards Mobility-as-a-Service (MaaS): The concept of MaaS that integrates various forms of transport services into a single mobility service accessible on demand is becoming more popular and includes car rental services.

- Increase in Eco-friendly Vehicles: With rising environmental awareness, there is an increasing demand for rental options for hybrid and electric vehicles.

Recent Developments:

Recent Developments:

- On January 26, 2023, Avis Budget Group Inc. teamed up with SK Group to launch a comprehensive electric vehicle charging solution at Houston Airport. This partnership is designed to fast-track the adoption of electric vehicles and enhance sustainability efforts.

- In May 2023, Car Karlo Mobility Technologies, based in Pune, India, ventured into the Indian car rental market by launching its self-driven car rental services. The company introduced a user-friendly website and mobile app aimed at simplifying the car rental process for its customers.

- In August 2023, Albatha Automotive Group, a subsidiary of AGMC, formed a strategic alliance with Avis Budget Group. This collaboration aims to broaden their mobility services by integrating the Budget Rent a Car and Payless Car Rental brands into Albatha’s newly formed division, thereby expanding their market presence.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 121.38 Billion |

Projected Market Size in 2032 |

USD 246.12 Billion |

CAGR Growth Rate |

8.17% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Alamo Rent-a-Car LLC., ANI Technologies Pvt. Ltd., Avis Budget Group, Carzonrent India Pvt. Ltd., Enterprise Holdings Inc., Europcar, Localiza, Ola Cabs, Sixt SE, The Hertz Corporation, Toyota Rent-a-Car, Uber Technologies Inc., and Others. |

Key Segment |

By Rental Length, By Vehicle Type, By Booking Channel, By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Rental Market: Regional Analysis

Rental Market: Regional Analysis

In 2023, the North American region accounted for around 54.2% of the market. North America, particularly the United States, has a well-established car rental market, bolstered by a robust travel and tourism industry that hold the largest market share. The U.S. car rental market is growing at a CAGR of 9.2% from 2023 to 2032. The market is mature, with high penetration of technology and innovative mobility solutions like car-sharing and electric vehicle rentals. The region shows a stable growth rate, with technological innovations and a high volume of air travelers driving demand.

Europe has a diverse car rental market with strong growth in both Western and Eastern Europe. The presence of numerous tourist destinations, coupled with a relatively high preference for rental cars as a mode of transport, supports the market. Recent regulatory changes aimed at reducing emissions have also spurred the adoption of electric vehicles in rentals. The market is growing steadily, driven by increasing tourism and the shift towards green vehicles.

Asia-Pacific region is experiencing the fastest growth in the car rental industry. This region is projected to grow at a CAGR of 7.8% from 2023 and 2032. Economic development, increasing urbanization, and the expanding middle class contribute to a surge in both leisure and business travel. Countries like China, India, and Indonesia are leading this growth, with local companies and international players expanding their operations. Asia-Pacific is expected to exhibit the highest CAGR, fueled by rapid economic advancements and increasing acceptance of rental services as a convenient form of transportation.

Latin America's car rental market is growing, driven by the increasing number of air travelers and improvements in the regional economy. Major sports events and international conferences also boost the demand for car rentals. Countries like Brazil and Mexico, in particular, see significant activity in this sector. The growth rate is promising, with tourism and business travel providing substantial market opportunities.

The Middle East and Africa (MEA) region shows significant potential in the car rental market, especially in the Middle East, where an influx of tourists and business professionals drives the demand for rental services. The UAE and Saudi Arabia are the standout markets, with considerable investments in tourism infrastructure. While starting from a lower base compared to other regions, the MEA region is poised for rapid growth, especially with the upcoming global events and initiatives to diversify oil-dependent economies.

Car Rental Market: List of Key Players

Car Rental Market: List of Key Players

Some of the main competitors dominating the global car rental market include;

- Alamo Rent-a-Car LLC.

- ANI Technologies Pvt. Ltd.

- Avis Budget Group

- Carzonrent India Pvt. Ltd.

- Enterprise Holdings Inc.

- Europcar

- Localiza

- Ola Cabs

- Sixt SE

- The Hertz Corporation

- Toyota Rent-a-Car

- Uber Technologies Inc.

The global car rental market is segmented as follows:

By Rental Length Segment Analysis

By Rental Length Segment Analysis

- Short-term Rentals

- Long-term Rentals

By Vehicle Type Segment Analysis

By Vehicle Type Segment Analysis

- Economy Cars

- Luxury Cars

- SUVs & Vans

- Electric Vehicles

- Others

By Booking Channel Segment Analysis

By Booking Channel Segment Analysis

- Online Booking

- Offline Booking

By Application Segment Analysis

By Application Segment Analysis

- Leisure Rentals

- Business Rentals

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Alamo Rent-a-Car LLC.

- ANI Technologies Pvt. Ltd.

- Avis Budget Group

- Carzonrent India Pvt. Ltd.

- Enterprise Holdings Inc.

- Europcar

- Localiza

- Ola Cabs

- Sixt SE

- The Hertz Corporation

- Toyota Rent-a-Car

- Uber Technologies Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors