Search Market Research Report

Exhaust System Market Size, Share Global Analysis Report, 2024 – 2032

Exhaust System Market Size, Share, Growth Analysis Report By Sales Channels (OEM And Aftermarket), By Fuel (Gasoline And Diesel), By Vehicle Type (Commercial Vehicles And Passenger Cars), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

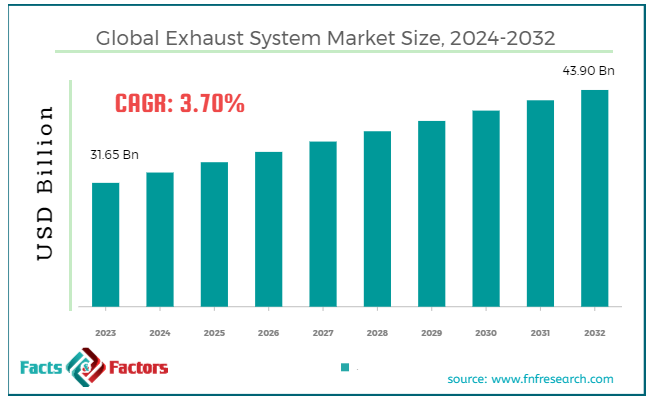

[219+ Pages Report] According to Facts & Factors, the global exhaust system market size was valued at USD 31.65 billion in 2023 and is predicted to surpass USD 43.90 billion by the end of 2032. The exhaust system industry is expected to grow by a CAGR of 3.70% between 2024 and 2032.

Market Overview

Market Overview

The exhaust system is a critical component that blows the exhaust gasses away from the engine to reduce the emission of harmful pollutants into the atmosphere. It is fixed in the internal combustion engines in the vehicles & machinery and plays an important role in improving the engine performance.

The key components in an exhaust system include an exhaust pipe, resonator, muffler, catalytic converter, oxygen sensor, tailpipe, and many others. It improves fuel efficiency and dissipates heat generated by the engine. However, there are different types of exhaust systems available on the market, such as performance exhaust systems, dual exhaust systems, and single exhaust systems.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global exhaust system market size is estimated to grow annually at a CAGR of around 3.70% over the forecast period (2024-2032).

- In terms of revenue, the global exhaust system market size was valued at around USD 31.65 billion in 2023 and is projected to reach USD 43.90 billion by 2032.

- Growing automotive production is driving the growth of the global exhaust system market.

- Based on the sales channels, the OEMs segment is growing at a high rate and is projected to dominate the global market.

- Based on the fuel, the diesel segment is projected to swipe the largest market share.

- Based on vehicle type, the passenger car segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing automotive production is driving the growth of the global market.

The automotive sector is seeing significant growth in emerging markets, which is the major reason for the high growth rate of the global exhaust system market. Increased vehicle production will increase the demand for exhaust systems.

Also, growing vehicle ownership across the globe is another reason responsible for the high growth rate of the industry. However, the increased ownership rate is due to the growing disposable income of people and global urbanization. Also, there is growing demand from people for vehicles with better fuel efficiency, which in turn is further posing a huge requirement for exhaust systems in the market.

Additionally, the regulatory pressure on manufacturers to come up with advanced systems to lower the emissions from vehicles is also expected to support the growth of the industry. The growing popularity of hybrid vehicles that require specialized exhaust systems is also likely to widen the scope of the industry in the coming years.

For instance, Futaba Industrial Co Ltd. unveiled its plan to get involved in the Automotive Engineering Exposition in 2021. The company said it would manufacture components with reduced weight, increased fuel efficiency, and lower emissions in support of SDGs.

Restraints

Restraints

- High cost of advanced technologies is likely to hamper the growth of the global market.

Advanced exhaust systems are quite expensive. Also, exhaust systems with technologies like diesel particulate filters, selective catalytic reduction systems, and many others involve high costs, which is a big barrier for small manufacturers. Moreover, the rising prices of raw materials like rhodium, palladium, and platinum are further expected to hinder the growth of the global exhaust system industry.

Opportunities

Opportunities

- Technological advancements are likely to foster growth opportunities in the global market.

Innovation in material science is a major factor behind the high growth rate of the industry. Manufacturers are coming up with more durable and lightweight exhaust components made from advanced materials to optimize vehicle performance. Also, the advancements in emission technologies, like the development of highly sophisticated catalytic converters, are expected to foster growth opportunities in the global exhaust system market.

Furthermore, the fast expansion of the aftermarket segment is likely to open new opportunities in the coming years. The growing number of commercial vehicles in the market is also anticipated to push the demand for efficient exhaust systems. For instance, Purem AAPICO introduced a new facility in Rayong in 2023 in Thailand. The production unit will manufacture an exhaust system for a pickup truck model.

Challenges

Challenges

- Technological limitation is a big challenge in the global market.

The latest exhaust technologies are not compatible with all existing vehicles, and therefore, they create compatibility issues. Also, many emission control technologies are still in their nascent age. Therefore, all these factors are likely to be a big challenge for the exhaust system industry.

Segmentation Analysis

Segmentation Analysis

The global exhaust system market can be segmented into sales channels, fuel, vehicle type, and region.

On the basis of sales channels, the market can be segmented into OEM and aftermarket. The OEM segment accounts for the largest share of the global market. OEMs are collaborating with automotive manufacturers, which is a major reason for the high demand for exhaust systems in the market. However, OEMs have the ability to customize exhaust systems according to the requirements of their vehicle models.

However, advancements in materials like stainless steel and titanium are expected to improve the performance of exhaust systems. Strict emission regulations all across the globe are another crucial factor likely to widen the scope of the segment. OEMs largely have a global presence and, therefore, are the largest supplier of exhaust systems to manufacturers in different locations.

However, investments in research and development activities are likely to revolutionize exhaust system technologies with new models and advanced features. All these factors are likely to contribute immensely towards the growth of the segment during the forecast period.

On the basis of the fuel, the market can be segmented into gasoline and diesel. Diesel is the fastest-growing segment in the global exhaust system market. Diesel is widely used in heavy-duty trucks, commercial vehicles, and industrial machinery because of its torque advantages and fuel efficiency.

However, the growing demand to lower diesel engine emissions is driving the demand for exhaust systems. However, the rising demand for commercial vehicles and trucks is propelling the demand for exhaust systems in the logistics sector. Diesel is known to be a preferred choice of fuel efficiency among fleet operators because of the cost factor.

However, technological advancements have led to sophisticated exhaust systems that could improve fuel efficiency, lower emissions, and enhance performance, which in turn are further expected to see significant growth in the coming years. Additionally, the integration of IoT and smart technology to manage exhaust systems is further expected to widen its scope in the future.

On the basis of vehicle type, the market can be segmented into commercial vehicles and passenger cars. The passenger car segment is likely to dominate the exhaust system industry. Passenger cars are leading the demand for exhaust systems across the world. However, the steady growth of the automotive sector is further expected to speed up the demand for passenger cars in the coming years.

However, the implementation of strict emission regulations like Euro 6 and BS VI standards is further fueling the demand for advanced exhaust systems. Also, the growing awareness among people to lower carbon footprints released from passenger vehicles is further fostering demand for exhaust systems in the market.

Additionally, the development of emission control technologies like diesel particulate filters, selective catalytic reduction, and catalytic converters is further expected to widen the scope of the segment. Advanced materials like titanium are likely to reduce weight and improve the performance & durability of exhaust systems.

Additionally, consumers are demanding vehicles with better fuel efficiency and engine performance, which is also expected to support the growth of the segment. The emergence of hybrid vehicles is another major factor likely to propel the growth of the segment. However, EVs do not need exhaust systems, but there is still a growing demand for hybrid vehicle exhaust systems.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 31.65 Billion |

Projected Market Size in 2032 |

USD 43.90 Billion |

CAGR Growth Rate |

3.70% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Sejong Industrial Co. Ltd., Harbin Airui Automotive Exhaust Systems Co. Ltd., Bosal International NV, Yutaka Giken Co. Ltd., Benteler International AG, Friedrich Boysen GmbH & Co. KG, Eberspächer Group, Tenneco Inc., Faurecia SA, and Others. |

Key Segment |

By Sales Channels, By Fuel, By Vehicle Type, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America will account for the largest share of the global exhaust system market during the forecast period. Strict emission regulations in the region are the major factor propelling the growth of the industry. The Environmental Protection Agency came up with strict emission regulations in the US to lower pollution levels.

Also, the California Air Resources Board came up with more strict emission standards, which is expected to foster the adoption of high-performance exhaust systems in the region. The region is home to many big manufacturers like Tesla, Ford, and General Motors, which is another major factor driving the high demand for exhaust systems in the region.

Additionally, the region leads the market in terms of sales of passenger cars, SUVs, and commercial vehicles, which is another factor positively impacting the growth trajectory of the regional market. Also, there is a growing demand for aftermarket exhaust systems to improve the aesthetic, performance, and sound of vehicles. The replacement market is also driving huge demand for exhaust systems. All these factors together are likely to contribute immensely towards the growth of the regional market in the coming years.

Asia Pacific is another major region in the exhaust system industry anticipated to witness significant growth in the coming years. However, the growing industrialization and urbanization in APAC are the primary factors driving the growth of the regional market. Rapid economic development in countries like India and China is also driving the growth of the regional market. Strict regulatory standards are being implemented to curb the growing pollution.

However, there is a significant shift towards hybrid vehicles, which is another major factor likely to support the growth of the industry in the region. Manufacturers are coming up with specialized systems that are ideal for hybrid vehicles.

Also, manufacturers are using lightweight materials to reduce the weight of exhaust systems in order to improve fuel efficiency. Countries like China and Japan are developing new design techniques to optimize exhaust systems according to the requirements of current consumers.

Therefore, such a landscape is expected to foster growth opportunities in the regional market. For instance, Milltek Sport came up with an advanced exhaust system for BMW in 2023. It is likely to improve the new model's capabilities for the M2 coupe.

Competitive Analysis

Competitive Analysis

The key players in the global exhaust system market include:

- Sejong Industrial Co. Ltd.

- Harbin Airui Automotive Exhaust Systems Co. Ltd.

- Bosal International NV

- Yutaka Giken Co. Ltd.

- Benteler International AG

- Friedrich Boysen GmbH & Co. KG

- Eberspächer Group

- Tenneco Inc.

- Faurecia SA

For instance, Faurecia is said to have acquired Hella in 2021. This acquired company is a German supplier specializing in the production of lighting and electronics automotive products. Combining the expertise of both companies, together they will be the 7th largest automotive supplier.

The global exhaust system market is segmented as follows:

By Sales Channels Segment Analysis

By Sales Channels Segment Analysis

- OEM

- Aftermarket

By Fuel Segment Analysis

By Fuel Segment Analysis

- Gasoline

- Diesel

By Vehicle Type Segment Analysis

By Vehicle Type Segment Analysis

- Commercial Vehicles

- Passenger Cars

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Sejong Industrial Co. Ltd.

- Harbin Airui Automotive Exhaust Systems Co. Ltd.

- Bosal International NV

- Yutaka Giken Co. Ltd.

- Benteler International AG

- Friedrich Boysen GmbH & Co. KG

- Eberspächer Group

- Tenneco Inc.

- Faurecia SA

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors