Search Market Research Report

DTC Wellness Testing Market Size, Share Global Analysis Report, 2025 – 2034

DTC Wellness Testing Market Size, Share, Growth Analysis Report By Product (Kits and Consumables, Services), By Type (Genetic Testing, Metabolic Testing, Nutritional Testing, Hormone Testing, and Others), By Technology (Polymerase Chain Reaction [PCR], Microarray, Sequencing, and Others), By Application (Disease Risk Assessment, Ancestry Testing, Fitness and Nutrition, Personalized Medicine, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

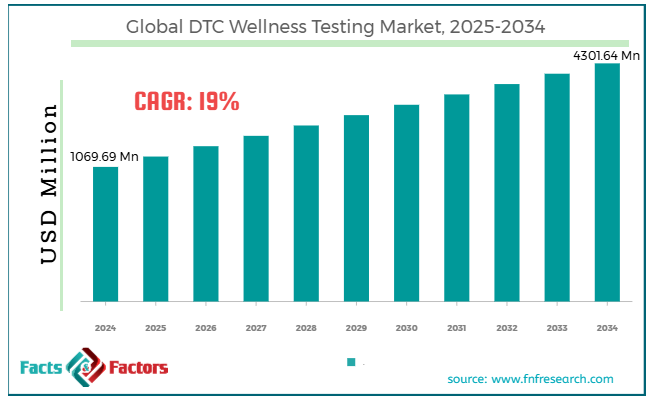

[221+ Pages Report] According to Facts & Factors, the global DTC wellness testing market size was worth around USD 1069.69 million in 2024 and is predicted to grow to around USD 4301.64 million by 2034, with a compound annual growth rate (CAGR) of roughly 19% between 2025 and 2034.

Market Overview

Market Overview

DTC, or direct-to-consumer wellness testing, refers to health-related tests that patients can purchase and use without needing a prescription or engagement from healthcare providers. These tests typically include hormone, genetic, food sensitivity, microbiome, and other wellness examinations and are promoted as tools for gaining better insights into personal fitness, health, and lifestyle.

The global DTC wellness testing market is driven by increasing awareness of preventive health, concerns over privacy, convenience, and home-based care, as well as advancements in genomics and biotechnology. The universal growth in chronic diseases, along with the need to detect health risks at an early stage, is forcing consumers towards self-monitoring solutions. DTC tests provide a proactive and non-clinical approach to monitoring early warning signs, such as inflammation levels and vitamin deficiencies.

Moreover, several individuals are not comfortable with FaceTime or clinic visits. DTC kits enable consumers to collect samples at home with complete privacy. This has gained massive popularity during and post-pandemic.

In addition, advancements in sequencing technologies, microfluidics, and biomarker identification have made wellness examinations more accurate, cost-effective, and efficient. Laboratories can now study multiple parameters from a single sample, propelling the popularity of bundled wellness packages.

Nevertheless, some factors restraining the growth of the global market include the lack of clinical guidance and oversight, as well as test validity and variable quality. Several DTC wellness examinations bypass doctors, which can result in the risk of overreaction or misinterpretation. Individuals may make sudden health decisions, such as supplement regimens or dietary restrictions, based on uncontextualized or unclear results.

Also, several prominent DTC companies offer tests with inconsistent standards or restricted clinical validation. False negatives or false positives may compromise consumer trust and have health implications if not considered seriously in conjunction with a physician's confirmation.

Yet, the global DTC wellness testing industry is expected to make considerable progress due to the incorporation of telehealth for results interpretation and employer-sponsored wellness initiatives. By integrating wellness testing with remote consultations, providers can help users understand their results effectively. This supports better decision-making, improves credibility, and reduces the gap between professional care and DIY health tools.

Moreover, businesses are offering wellness benefits to increase productivity and reduce employee absenteeism. DTC testing can be used in these programs as a cost-effective and non-invasive health initiative.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global DTC wellness testing market is estimated to grow annually at a CAGR of around 19% over the forecast period (2025-2034)

- In terms of revenue, the global DTC wellness testing market size was valued at around USD 1069.69 million in 2024 and is projected to reach USD 4301.64 million by 2034.

- The DTC wellness testing market is projected to grow significantly due to rising health awareness, the growth of e-commerce platforms and digital health programs, and advancements in testing methods.

- Based on product, the kits and consumables segment is expected to lead the market, while the services racks segment is expected to grow considerably.

- Based on type, the genetic testing segment is projected to dominate the market, while the hormone testing segment is anticipated to grow remarkably.

- Based on technology, the sequencing is the dominant segment, while the Polymerase Chain Reaction (PCR) segment is projected to witness substantial revenue growth over the forecast period.

- Based on application, the ancestry testing segment is expected to lead the market, followed by the fitness and nutrition segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Growth Drivers

Growth Drivers

- Demand and personalization for tailored wellness solutions propel the market growth

Consumers are actively seeking personalized wellness plans depending on their unique genetic makeup, health history, and lifestyle. DTC wellness testing enables this by providing actionable insights tailored to diverse profiles, including fitness, personalized nutrition, and skincare recommendations.

In 2025, a leading microbiome wellness company, Viome, introduced a revised version of its DTC testing kit that integrates gut health with individualized dietary advice using AI-based algorithms, capturing major media traction for its personalized approach.

- Reduced testing costs and advancements in technology notably fuel the market growth

The rapid technological advancements in genomics, biotechnology, and data analytics have notably enhanced the speed, accuracy, and affordability of direct-to-consumer wellness tests, thus fueling the growth of the DTC wellness testing market. AI-based data interpretation has made complex health insights available to users without the need for hospital or clinical visits.

In 2025, Helix, a prominent direct-to-consumer (DTC) testing company, announced a partnership with DeepGen, an AI-based company. This partnership enables faster genome studies with 30 percent reduced turnaround costs and times, raising the bar.

Restraints

Restraints

- Health equity issues and limited accessibility negatively impact market progress

Despite its rising popularity, direct-to-consumer wellness testing remains inaccessible to a broader segment of the global population due to limitations in internet access, health literacy, and cost barriers. Wellness testing kits typically retail for $100-$300, further increasing unaffordability for income-restricted groups.

Moreover, several tests are only available in English or online, restricting availability in non-English speaking and non-digital regions. Also, marginalized groups may not find these services reliable because of historical discrimination.

Opportunities

Opportunities

- Development in test types: Microbiome, Hormone Panels, and Epigenetics positively impact market growth

Beyond basic vitamin panels and genetic ancestry, the next frontier in DTC testing lies in advanced biomarkers, including gut microbiota profiles, hormone fluctuations, and epigenetic changes. These enhanced panels provide real-time and dynamic insights into how diet, stress, lifestyle, and environmental factors influence health.

While static DNA-based testing offers valuable information, a majority of consumers are shifting towards tests that indicate their current health condition, helping them to monitor the effects of lifestyle changes over time.

These factors, collectively, are expected to drive the global DTC wellness testing industry.

Challenges

Challenges

- Low retention rates and short product lifecycles limit the market progress

Several DTC wellness kits are still regarded as one-time purchases instead of the current health tools. This presents a key challenge for customer retention and sustained revenue growth, primarily as users seek more advanced, trendy, and innovative offerings.

Without a clear path for retesting, follow-up, or complementary services, firms risk losing consumer trust and experiencing attrition. Additionally, as consumer interest shifts towards new wellness trends, such as biological aging biomarkers or continuous glucose monitoring, the current products may become outdated quickly.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 1,069.69 Million |

Projected Market Size in 2034 |

USD 4,301.64 Million |

CAGR Growth Rate |

19% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

23andMe, Everlywell, LetsGetChecked, myDNA, Thorne HealthTech, Viome, DNAfit, SelfDecode, Circle DNA, Onegevity, Cue Health, Oranum Health, Genetic Direction, Persona Nutrition, Helix, and others. |

Key Segment |

By Product, By Type, By Technology, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global DTC wellness testing market is segmented based on product, type, technology, application, and region.

Based on product, the global DTC wellness testing industry is divided into kits and consumables and services. The kits and consumables segment has registered a notable market share in recent years and is expected to continue leading the market. This growth is attributed to the physical products that users purchase, including test kits for home sample collection (such as stool, urine, blood, and saliva), as well as essential consumables. These kits are the primary revenue-generating units for the majority of DTC wellness companies. They are sold directly via partner retail stores or e-commerce platforms. The segmental growth is remarkably fueled by the volume-driven nature of the industry and the scalability of product sales.

Based on technology, the global DTC wellness testing market is segmented into polymerase chain reaction (PCR), microarray, sequencing, and others. The sequencing segment registered a substantial market share in terms of application and revenue, especially in microbiome and genetic testing. These domains account for the majority of the DTC wellness space. They have wide applications in ancestry, predispositions, fitness, nutrition-associated genes, carrier status, and gut microbiome profiling. The segmental growth is backed by high demand for personalized genomics and rising consumer interest in DNA-based health insights.

Based on application, the global market is segmented as disease risk assessment, ancestry testing, fitness and nutrition, personalized medicine, and others. The ancestry testing segment leads the market due to its broad consumer interest, early commercialization, and wide adoption by the leading players. The key driving factors include massive marketing campaigns and a first-mover advantage, broad consumer curiosity about genetic heritage, and a low perceived medical threat, which increases its accessibility to a wide audience.

By type, the market is divided into genetic testing, metabolic testing, nutritional testing, hormone testing, and others.

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America leads the global DTC wellness testing market, driven by high consumer awareness, increasing adoption of preventive health tools, advanced e-commerce and digital infrastructure, and a focus on biohacking and personalization. North America, primarily the United States, has the largest number of health-conscious consumers on a global scale. A majority of consumers have at-home testing kits. This readiness to invest in personal health drives the demand for wellness diagnostics.

Additionally, the region boasts a sophisticated digital health network characterized by high smartphone and internet penetration. This enables smooth and unified access to multiple online DTC wellness platforms, facilitating the interpretation of test results, expedited ordering, and tracking. Businesses leverage mobile apps and subscription models to scale and retain customers.

Furthermore, consumers in the region, especially the youth, are leading the universal shift towards bio-individual wellness. The region has witnessed progressing trends in fitness DNA applications, personalized nutrition, and quantified-self devices, which align well with direct-to-consumer testing

The Asia Pacific is the second-leading region in the DTC wellness testing industry, driven by a rapidly expanding middle class with increased awareness of health, strong digital health adoption, and growing pressure from lifestyle illnesses. The Asia Pacific is witnessing a rise in its middle-class population, anticipated to reach 3.5 billion by 2030, accompanied by increasing disposable income. This demographic is primarily emphasized on wellness, laying fertile ground for direct-to-consumer testing services.

Users in several major regions are fueling the demand for convenient and affordable health insights. APAC holds over 2.8 billion smartphone users, and nations like India, South Korea, and China are forerunners in mobile-first health solutions. The tech-savvy population is rapidly adopting health applications, telemedicine, and direct-to-consumer (DTC) platforms. This digital infrastructure backs the growth of sample collection guidance, online ordering, and results interpretation for direct-to-consumer testing.

In addition, the region is witnessing a rise in NCDs (non-communicable diseases) by 2030 and is anticipated to register over 75 percent of deaths in APAC, as per the WHO. This has fueled public interest in solutions for metabolic health, tracking genetic risk, hormones, and nutrition that can be comfortably performed at home.

Competitive Analysis

Competitive Analysis

The leading players in the global DTC wellness testing market are:

- 23andMe

- Everlywell

- LetsGetChecked

- myDNA

- Thorne HealthTech

- Viome

- DNAfit

- SelfDecode

- Circle DNA

- Onegevity

- Cue Health

- Oranum Health

- Genetic Direction

- Persona Nutrition

- Helix

Key Market Trends

Key Market Trends

- Comprehensive wellness panels and growth of Multi-Omics:

Users are actively demanding holistic test solutions that perform beyond genetics to comprise hormone, metabolomics, and microbiome analysis. Companies are offering bundled test kits that provide an all-in-one record of the patient's health, allowing better personalization. This multi-omics trend signifies a shift towards longitudinal and integrated health insights rather than single-point diagnostics.

- Expansion into Mental Wellness and Stress Biomarkers:

There is a growing interest in DTC tests focused on stress, mental health, and cognitive wellness related to mood. The leading companies are aiming for anxiety, burnout, and sleep improvement with tests that blend with supplement programs or mindfulness. This trend signifies a broader societal shift towards prioritizing emotional and mental wellness as key aspects of preventive care.

The global DTC wellness testing market is segmented as follows:

By Product Segment Analysis

By Product Segment Analysis

- Kits and Consumables

- Services

By Type Segment Analysis

By Type Segment Analysis

- Genetic Testing

- Metabolic Testing

- Nutritional Testing

- Hormone Testing

- Others

By Technology Segment Analysis

By Technology Segment Analysis

- Polymerase Chain Reaction (PCR)

- Microarray

- Sequencing

- Others

By Application Segment Analysis

By Application Segment Analysis

- Disease Risk Assessment

- Ancestry Testing

- Fitness and Nutrition

- Personalized Medicine

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- 23andMe

- Everlywell

- LetsGetChecked

- myDNA

- Thorne HealthTech

- Viome

- DNAfit

- SelfDecode

- Circle DNA

- Onegevity

- Cue Health

- Oranum Health

- Genetic Direction

- Persona Nutrition

- Helix

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors