Search Market Research Report

Direct Carrier Billing Market Size, Share Global Analysis Report, 2022–2028

Direct Carrier Billing Market By Type (Limited DCB, Pure DCB, MSISDN Forwarding, PIN or MO Base Window), By Platform (iOS, Android, Other Platforms), By End-User (Apps and Games, Online Media, Other End-Users), and By Region - Global Industry Overview, Market Size, Share, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends and Forecast 2022–2028

Industry Insights

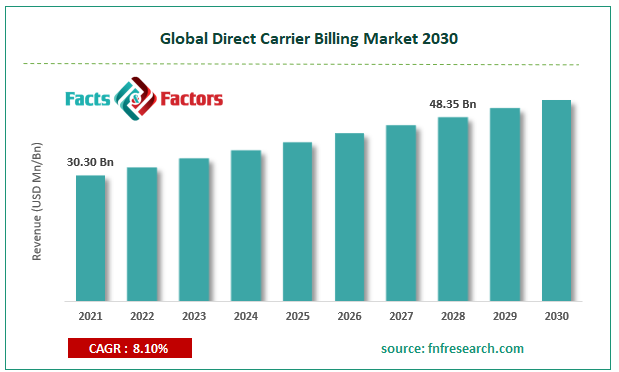

[217+ Pages Report] According to Facts and Factors, the global direct carrier billing market was valued at USD 30.30 billion in 2021 and is predicted to increase at a CAGR of 8.10 % to USD 48.35 billion by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries.

Market Overview

Market Overview

The direct carrier billing platform is an internet-based payment system in which the payment is made via the internet. The direct carrier billing technology allows customers to pay for their goods quickly and easily. It is compatible with all cellphones running Windows, Android, and iOS. The direct carrier billing platform industry is seeing a lot of growth thanks to the rise of digital content and OTT platforms. The value of the direct carrier billing platform market will continue to rise as cloud computing technologies become more widely adopted. Another factor promoting the growth of this industry is the slow penetration rate of credit cards in underdeveloped economies, along with fast digitization. The low internet penetration rate in developing economies, on the other hand, will offer a significant impediment to the expansion of the direct carrier billing platform industry. Alternative payment channels, such as mobile wallets, payment systems, credit and debit cards, and internet banking, will stymie industry expansion.

The low internet penetration rate in developing countries is likely to offer a significant impediment to the direct carrier billing platform market's growth. Alternative payment channels, such as mobile wallets, payment systems, credit and debit cards, and internet banking, will stymie industry expansion. Despite the fact that mobile gaming and in-app games have shown to have significant operational benefits when paid for via direct carrier e-billing, many businesses are hesitant to deploy them for a variety of reasons.

Impact of COVID - 19

Impact of COVID - 19

Some areas, such as e-commerce, video-conferencing, and mobile payments, grew as a result of the COVID-19 problem. The demand for digital services, particularly video and audio streaming, has exploded in recent months. Similarly, due to most individuals working from home and remaining indoors to restrict the spread of COVID-19, online app and game purchases have skyrocketed. The decline in business activities such as collaborations to enhance the adoption of direct carrier billing in various countries, on the other hand, is expected to have a negative influence on the direct billing platform and service providers' expanding growth. As a result, there will be a mixed impact, with growth slowing slightly in 2020 and 2021.

The complete research study looks at both the qualitative and quantitative aspects of the global direct carrier billing market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply-side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global direct carrier billing market is segregated based on type, platform, end-user, and region.

In terms of platforms, in 2020, Android accounted for the biggest share of the global direct carrier billing market. Android platforms are expected to remain the most popular, with a value CAGR of 9.7% from 2022 to 2032. Because low-cost Android phones are becoming more affordable, big market participants such as Google and others have been investing in providing such billing choices across Android platforms. Furthermore, many Android-based games only allow access and downloads through the purchase of game programmers via online payments, creating strong demand for the direct carrier billing market. Because Android devices are more popular, activities like paying for games, entertainment, and retail purchases are more efficient, prompting investments in direct carrier billing systems within Android servers.

In terms of type, the pure DCB will be having the largest share. Because it allows customers to make purchases by charging payments to their mobile phone carrier bill, the pure DCB type of direct carrier billing market is predicted to develop at a value CAGR of 10.1 percent from 2022 to 2028. Furthermore, the slow adoption of credit cards in emerging areas is expected to increase demand for pure direct carrier billing systems. Smartphone customers can buy digital content from these service providers and pay for subscriptions through the same channels as their phone bills, assisting the market's pure direct carrier billing type.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 30.30 Billion |

Projected Market Size in 2028 |

USD 48.35 Billion |

CAGR Growth Rate |

8.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BangoPLC, Boku, Inc., Centili, Comviva Technologies Limited, DIMOCO, Fortumo, Infomedia Services Limited, NTH Mobile, TELECOMING S.A., txtNation Limited, and Others |

Key Segment |

By Type, Platform, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

Demand for Direct Carrier Billing services in the United States is expected to grow at a 10.2% value CAGR until 2028, resulting in a US$ 21.5 billion opportunity. By the conclusion of the projected period, demand is expected to be valued at US$ 34.5 billion. The boost in demand for popular digital content across the country is credited with the growth. The enormous rise of the direct carrier billing market in the United States has been fueled by rising demand for digital content platforms.

Platforms like YouTube, Netflix, and a slew of others have exploded in popularity as digital media has grown in popularity across the country. Because these platforms include premium options and other services that provide additional benefits to consumers, online payment methods are becoming increasingly popular.

Competitive Landscape

Competitive Landscape

List of Key Players in the Global Direct Carrier Billing Market:

- BangoPLC

- Boku, Inc.

- Centili

- Comviva Technologies Limited

- DIMOCO

- Fortumo

- Infomedia Services Limited

- NTH Mobile

- TELECOMING S.A.

- txtNation Limited

The Global Direct Carrier Billing Market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Limited DCB

- Pure DCB

- MSISDN Forwarding

- PIN or MO Base Window

By Platform Segment Analysis

By Platform Segment Analysis

- iOS

- Android

- Other Platforms

By End-User Segment Analysis

By End-User Segment Analysis

- Apps and Games

- Online Media

- Other End-Users

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Bango PLC

- Boku Inc.

- Centili

- Comviva Technologies Limited

- DIMOCO

- Fortumo

- Infomedia Services Limited

- NTH Mobile

- TELECOMING S.A.

- txtNation Limited

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors