Search Market Research Report

Clinical Data Analytics Solutions Market Size, Share Global Analysis Report, 2025 – 2034

Clinical Data Analytics Solutions Market Size, Share, Growth Analysis Report By Solution (Platform [Cloud-Based, On-Premise], Services [Consulting Services, Integration and Implementation Services, Support and Maintenance Services]), By Application (Clinical Decision Support, Precision Health, Quality Improvement and Clinical Benchmarking, Regulatory Reporting and Compliance, and Others), By End-Use (Pharmaceutical and Biotechnology Companies, Providers, Payers, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

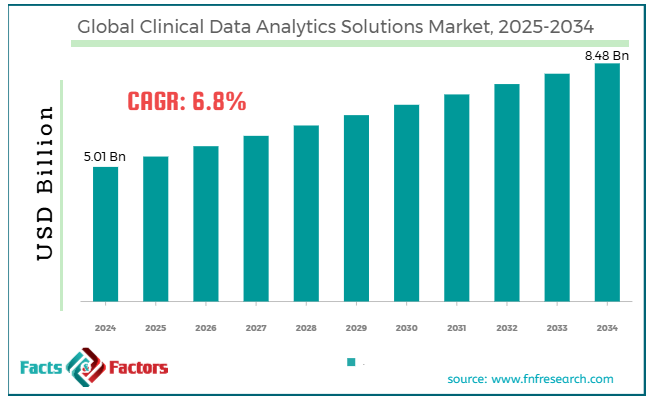

[222+ Pages Report] According to Facts & Factors, the global clinical data analytics solutions market size was worth around USD 5.01 billion in 2024 and is predicted to grow to around USD 8.48 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.8% between 2025 and 2034.

Market Overview

Market Overview

Clinical data analytics solutions are the platforms or tools dedicated to studying clinical and healthcare data to improve patient outcomes, enhance decision-making, and simplify operations. These solutions frequently use AI, ML, and advanced analytics to extract valuable insights from vast datasets like medical imaging, EHR, patient monitoring systems, and lab results.

The worldwide clinical data analytics solutions market will witness remarkable growth over the estimated period owing to the rising healthcare data production, growing adoption of EHR, and rising emphasis on personalized medicine.

The enormous increase in healthcare data has surged the need for strong analytics solutions to understand and leverage this data for better patient care.

As healthcare technologies transition to digital records, incorporating data analytics with EHR tools has become vital for improving patient care and minimizing errors.

Moreover, the inclination towards precision or personalized medicine, which modifies treatments as per patient requirements, is fueling the need for data analytics tools. These tools can potentially study large datasets to inform better treatment plans.

However, the global market is restrained by significant implementation costs and data interoperability issues. The initial cost of implementing these solutions, comprising hardware, software, and training, may be expensive, mainly for smaller institutions or providers in emerging economies.

Also, the lack of interoperability and standardization among diverse healthcare IT solutions makes combining and analyzing data from different sources challenging. This majorly restricts the efficiency of analytics tools, restraining their adoption.

Yet, the market is opportune for the growth of ML and AI and the rise in RPM and telemedicine. ML and AI hold enormous potential to transform clinical data analytics by enhancing the precision of predictions, allowing real-time analytics, and automating processes. This denotes a key opportunity for the industry players to launch more modernized solutions.

Furthermore, with the growth of RPM and telemedicine, there is an opportunity to incorporate these tools with clinical data analytics tools, allowing for better care and enhancing outcomes.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global clinical data analytics solutions market is estimated to grow annually at a CAGR of around 6.8% over the forecast period (2025-2034)

- In terms of revenue, the global clinical data analytics solutions market size was valued at around USD 5.01 billion in 2024 and is projected to reach USD 8.48 billion by 2034.

- The clinical data analytics solutions market is projected to grow significantly owing to the growing demand for evidence-based decision-making, increasing use of EHR systems, and improvements in healthcare technologies.

- Based on the solution, the platform segment is expected to lead the market, while the services segment is expected to register considerable growth.

- Based on application, the clinical decision support segment is the dominating segment among others, while the precision health segment is projected to witness sizeable revenue over the forecast period.

- Based on end use, the providers segment is expected to lead the market compared to the pharmaceutical and biotechnology companies segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Progresses in machine learning and artificial intelligence fuel the clinical data analytics solutions market growth

ML and AI are transforming clinical data analytics by improving predictive analytics, offering precise insights, and automating tasks. The ability to swiftly study massive quantities of data has revolutionized clinical decision-making. This has ultimately improved patient outcomes and accuracy.

Google Health launched AI-based tools for early cancer detection, which use machine learning models to study imaging and clinical data with better accuracy than conventional methods.

IBM Watson Health, a leading player in artificial intelligence healthcare, has lately been associated with Medtronic to use ML and AI algorithms to improve treatment pathways and study medical images.

- Growing incidences of chronic diseases majorly impact the market growth

The global incidences of chronic illnesses like cardiovascular diseases, diabetes, and cancer are fueling the demand for clinical data analytics tools. Healthcare providers need data-based insights to handle these conditions more effectively, enhance patient outcomes, and lessen healthcare costs.

RPM and telemedicine have gained attention, mainly in managing chronic illnesses. Prominent players like Philips and Omron are amalgamating analytics platforms with medical tools to remotely track patients' health parameters.

AI-based predictive models are actively used in managing chronic illnesses, providing caution for hypertension and diabetes, which are connected to the senior population.

Restraints

Restraints

- Security and data privacy concerns unfavorably impact the progress of the clinical data analytics solutions market

One of the key challenges in clinical data analytics is the privacy and security of vital health data. Healthcare data is confidential, and breaches may have significant reputational, financial, and legal consequences.

With strict regulations like GDPR in Europe and HIPAA in the United States, businesses face risks associated with heavy penalties and non-compliance with their data handling tools, which are unsecured.

Cognizant was targeted by ransomware in 2023. This resulted in data breaches for numerous healthcare customers. This underlined the crucial need for strong cybersecurity measures in information technology tools.

Opportunities

Opportunities

- Cloud solutions for cost efficiency and scalability considerably impact the clinical data analytics solutions market growth

The rising adoption of cloud clinical data analytics solutions provides flexibility, scalability, and cost-efficiency for healthcare providers, affecting the growth of the clinical data analytics solutions market. Cloud platforms allow healthcare businesses to preserve large datasets, perform complicated analyses, and scale operations without an expensive on-premise system.

In 2023, Amazon Web Services was associated with Cerner Corporation to develop a cloud platform for clinical data analytics. This platform will help healthcare providers analyze and access real-time data, enhancing patient care and operational efficiencies.

Challenges

Challenges

- Accuracy and data quality issues restrict the growth of the clinical data analytics solutions market

Data quality is essential in clinical data analytics to derive trustworthy insights. Poor quality, such as inaccurate lab results, inconsistent or incomplete patient records, or non-standardized formats, may result in incorrect clinical decisions or faulty analysis.

IBM Watson Health experienced major challenges in the oncology domain in 2023. Its AI models were affected by wrong data, resulting in incorrect advice for cancer therapies. This increased skepticism regarding the consistency of AI-powered healthcare solutions.

In 2023, New York’s Mount Sinai Health System declared that it had commenced cleaning up its Electronic Health Record data with modernized ML techniques to enhance the precision of clinical data for analytics.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 5.01 Billion |

Projected Market Size in 2034 |

USD 8.48 Billion |

CAGR Growth Rate |

6.8% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

IBM Watson Health, Cerner Corporation, McKesson Corporation, Optum (UnitedHealth Group), Allscripts Healthcare Solutions, Medtronic, SAS Institute, GE Healthcare, Siemens Healthineers, Philips Healthcare, Oracle Corporation, Veeva Systems, Qventus, Health Catalyst, Nuance Communications, and others. |

Key Segment |

By Solution, By Application, By End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global clinical data analytics solutions market is segmented based on solution, application, end use, and region.

Based on the solution, the global clinical data analytics solutions industry is divided into platform and services. The platform segment is further fragmented into cloud-based and on-premise, whereas the services segment is split into consulting services, integration and implementation services, and support and maintenance services.

The platform segment registered a notable market share in the previous years and will lead in the future due to technological improvements, efficiency, and scalability. These platforms allow healthcare providers to handle massive data volumes, use advanced analytics, and gain valuable findings from clinical data. Platforms incorporating ML and AI for decision support and predictive analytics are increasing in demand.

Also, cloud platforms offer better solutions for businesses to process and store large data volumes, thus contributing to their prominence.

Based on application, the global clinical data analytics solutions industry is segmented as clinical decision support, precision health, quality improvement and clinical benchmarking, regulatory reporting and compliance, and others.

The clinical decision support (CDS) segment is leading due to rising demand for improved patient outcomes, government incentives and regulations, and integration with improved technologies. CDS systems reduce the cases of medical errors, enhance diagnosis precision, and enhance treatment schedules.

Several governments have adopted policies that fuel the adoption of CDS systems. CDS systems also actively incorporate ML and AI models to provide real-time and precise advice.

Based on end use, the global market is segmented into pharmaceutical and biotechnology companies, providers, payers, and others. The providers segment dominates the market due to improved patient care and significant cost reduction. Providers use clinical data to study patient data simultaneously. This allows personalized treatment strategies, better management of chronic illnesses, and early detection of diseases.

Furthermore, healthcare providers can reduce overall costs by enhancing operational efficiencies, preventing medical errors, and lowering hospital readmission

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America is expected to hold a leading position in the global clinical data analytics solutions market in the forthcoming years, owing to improved healthcare infrastructure, surging demand for enhanced healthcare outcomes, and innovations and technological improvements.

North America, mainly Canada and the U.S., brags about its modernized healthcare systems on a global scale. They are also the leaders in adopting EHR and other advanced health technologies that aid clinical data analytics.

Also, there is a strong demand for enhancing healthcare results and minimizing prices in the region. Clinical data analytics solutions are broadly used for enhancing patient care, decision support, and improving healthcare processes.

In addition, the region is leading in technological improvements, especially in ML, AI, and big data analytics, which are broadly assimilated in clinical data analytics platforms.

Europe holds a second-leading position in the global clinical data analytics solutions industry, among others. This growth is attributed to robust healthcare systems, growing emphasis on personalized medicine, and increasing healthcare expenses.

Europe has a well-developed and strong healthcare system, with top nations offering global healthcare services. This has fueled clinical data analytics solutions and enhanced operational efficiencies in private and public healthcare sectors.

Besides, precision medicine is also gaining attention, with key economies investing in personalized medicine and genomics. This aids clinical data analytics in studying genetic data, modifying treatment plans, and enhancing diagnostics.

Moreover, the region is also witnessing a rise in healthcare spending, impacted by the need for highly efficient healthcare delivery and the growing elderly population. This propels the demand for analytics solutions to handle healthcare costs efficiently.

Competitive Analysis

Competitive Analysis

The global clinical data analytics solutions market is led by players like:

- IBM Watson Health

- Cerner Corporation

- McKesson Corporation

- Optum (UnitedHealth Group)

- Allscripts Healthcare Solutions

- Medtronic

- SAS Institute

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Oracle Corporation

- Veeva Systems

- Qventus

- Health Catalyst

- Nuance Communications

Key Market Trends

Key Market Trends

- Emphasis on interoperability:

With the rising use of healthcare information systems and EHR, there is a growing focus on data interoperability. Ensuring smooth data transfer among systems is vital for enhancing the efficiency and precision of clinical data analytics tools.

- Cloud analytics solutions:

The inclination towards cloud platforms is increasing in clinical data analytics. Cloud solutions offer flexibility, scalability, and cost-efficiency. This permits healthcare providers to process, store, and analyze large volumes of clinical data without requiring enormous on-premises systems.

The global clinical data analytics solutions market is segmented as follows:

By Solution Segment Analysis

By Solution Segment Analysis

- Platform

- Cloud-Based

- On-Premise

- Services

- Consulting Services

- Integration and Implementation Services

- Support and Maintenance Services

By Application Segment Analysis

By Application Segment Analysis

- Clinical Decision Support

- Precision Health

- Quality Improvement and Clinical Benchmarking

- Regulatory Reporting and Compliance

- Others

By End Use Segment Analysis

By End Use Segment Analysis

- Pharmaceutical and Biotechnology Companies

- Providers

- Payers

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- IBM Watson Health

- Cerner Corporation

- McKesson Corporation

- Optum (UnitedHealth Group)

- Allscripts Healthcare Solutions

- Medtronic

- SAS Institute

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Oracle Corporation

- Veeva Systems

- Qventus

- Health Catalyst

- Nuance Communications

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors