Search Market Research Report

B2B2C Insurance Market Size, Share Global Analysis Report, 2020–2026

B2B2C Insurance Market By Type (Vehicle Insurance, Home Insurance, Personal Insurance, Travel Insurance, Mobile Insurance & Warranty Extension, Employee Assistance Programs, and Others), By Distribution Channel (Channel Sales and Online Platform), and By Application (Individuals and Corporate): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

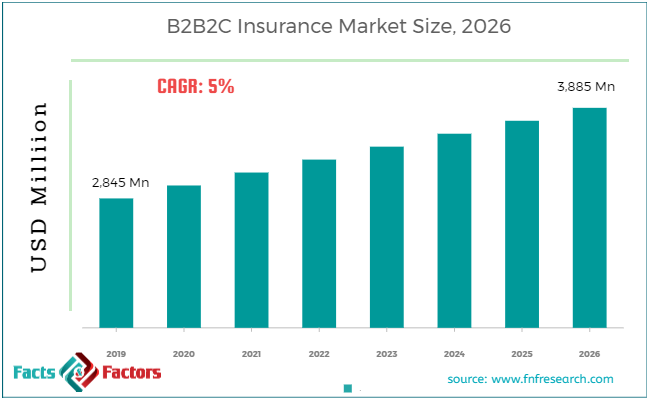

[220+ Pages Report] According to the report published by Facts & Factors, the global B2B2C Insurance market size was worth around USD 2845 million in 2019 and is predicted to grow around USD 3885 million by 2026 with a compound annual growth rate (CAGR) of roughly 5% between 2020 and 2026. The report analyzes the global B2B2C Insurance market drivers, restraints, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the B2B2C Insurance market.

The B2B2C Insurance market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire B2B2C Insurance market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of value (USD Million) from FY 2016 – 2026.

This specialized and expertise-oriented industry research report scrutinizes the technical and commercial business outlook of the B2B2C Insurance industry. The report analyzes and declares the historical and current trends analysis of the B2B2C Insurance industry and subsequently recommends the projected trends anticipated to be observed in the B2B2C Insurance market during the upcoming years.

Key Insights from Primary Research

Key Insights from Primary Research

- According to the interview with industry participants, the rising usage of digitalization is influencing expectations and customer behavior. This has driven the target market growth

- The target market generated revenue of around USD 2,730 Million in 2018

- Asia Pacific was the leading region in 2018, generating revenue of around USD 755 Million

- Personal insurance, channel sales, and corporate categories were the leading ones of type, distribution channel, and application segments respectively

- In addition, the interest of consumers in financial product distribution has increased which has fueled the target market growth

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analyst, advancements in digital technology such as mobile banking and online shopping are boosting the target market growth

- The target market is projected to grow at a CAGR of around 5% in 2026

- The target market is anticipated to generate revenue of around USD 3,885 Million in 2026

- The Asia Pacific is expected to continue its dominance associated with revenue generation in the target market till 2026

- Personal insurance, channel sales, and corporate categories are estimated to lead the type, distribution channel, and application segments respectively

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the B2B2C Insurance industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the B2B2C Insurance industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the B2B2C Insurance market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the B2B2C Insurance industry. The B2B2C Insurance market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market positions in the B2B2C Insurance sector. Key strategic developments in the B2B2C Insurance market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the B2B2C Insurance market are appropriately highlighted in the report.

Augmented interest in the financial product distribution of consumers has propelled the target market growth over the forecast period. In addition, technological advancements and regulations associated with B2B2C insurance have boosted the target market growth. However, the lack of affordability for low-income countries may harm the target market growth over the forecast period.

Digital technology is driving change in user experience as well across industries via mobile banking, online shopping, and ride-sharing. Additionally, other digitally-enabled services have transformed the customer’s expectations as well as have set the new meaning of speed, convenience, experience, and value

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 2,845 Million |

Projected Market Size in 2026 |

USD 3,885 Million |

CAGR Growth Rate |

5% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

AssicurazioniGeneraliS.p.A., Allianz, AXA Equitable Life Insurance Company, BNP Paribas Cardif, insurance GmbH, China Life Insurance, Japan Post Holding Co., Ltd., Munich Re, PORTO SEGURO, Prudential Financial, Inc., Swiss Re, United HealthCare Services, Inc., Zurich Insurance Group, and others. |

Key Segment |

By Type, Distribution Channel, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Overview:

Regional Overview:

The B2B2C Insurance market research report delivers an acute valuation and taxonomy of the B2B2C Insurance industry by practically splitting the market on the basis of different types, distribution channels, applications, and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026.

The regional segmentation of the B2B2C Insurance industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa. Further, country-wise data for the B2B2C Insurance industry is provided for the leading economies of the world.

The B2B2C Insurance market is segmented based on Type, Distribution Channel, and Application. On the basis of type segmentation, the market is classified into vehicle insurance, home insurance, personal insurance, travel insurance, mobile insurance & warranty extension, employee assistance programs, and others. in terms of distribution channel segmentation, the market is bifurcated into channel sales and online platforms. in terms of application segmentation, the market is bifurcated into individuals and corporate.

Some of the essential players operating in the B2B2C Insurance market, but not restricted include

Some of the essential players operating in the B2B2C Insurance market, but not restricted include

- AssicurazioniGeneraliS.p.A.

- Allianz

- AXA Equitable Life Insurance Company

- BNP Paribas Cardif

- bsuranceGmbH

- China Life Insurance

- Japan Post Holding Co.

- Munich Re

- PORTO SEGURO

- Prudential Financial Inc

- Swiss Re

- nited HealthCare Services Inc

- Zurich Insurance Group

The taxonomy of the B2B2C Insurance Market by its scope and segmentation is as follows:

By Type Segmentation Analysis

By Type Segmentation Analysis

- Vehicle Insurance

- Home Insurance

- Personal Insurance

- Travel Insurance

- Mobile Insurance & Warranty Extension

- Employee Assistance Programs

- Others

By Distribution Channel Segmentation Analysis

By Distribution Channel Segmentation Analysis

- Channel Sales

- Online Platform

By Application Segmentation Analysis

By Application Segmentation Analysis

- Individuals

- Corporate

By Regional Segmentation Analysis

By Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Industry Major Market Players

- AssicurazioniGeneraliS.p.A.

- Allianz

- AXA Equitable Life Insurance Company

- BNP Paribas Cardif

- bsuranceGmbH

- China Life Insurance

- Japan Post Holding Co.

- Munich Re

- PORTO SEGURO

- Prudential Financial Inc

- Swiss Re

- nited HealthCare Services Inc

- Zurich Insurance Group

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors