Search Market Research Report

Airport Logistic System Market Size, Share Global Analysis Report, 2022 – 2028

Airport Logistic System Market Size, Share, Growth Analysis Report By Product (Airport Baggage Handling Systems, Sorting Devices, Scanners, Conveyors, Destination Coded Vehicles, Aviation Cargo Management Systems, Warehouse and Operation Management System, Freight Information System, Aviation Cargo Screening System), By Service (Maintenance and Support, Integration and Deployment and Consulting), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

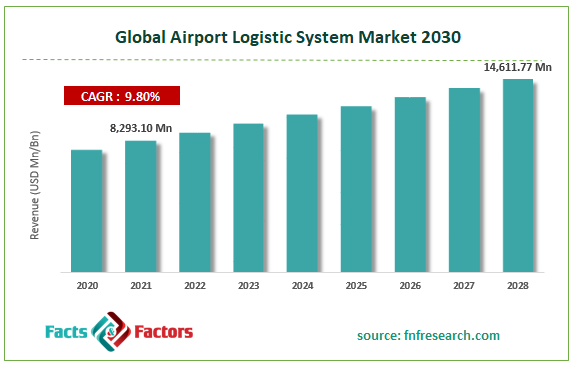

[201+ Pages Report] According to Facts and Factors, the global airport logistics system market size was worth USD 8,293.10 million in 2021 and is estimated to grow to USD 14,611.77 million by 2028, with a compound annual growth rate (CAGR) of approximately 9.80% over the forecast period. The report analyzes the airport logistics system market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the airport logistics system market.

Market Overview

Market Overview

The organization and management of information and resources that add value for airport users are known as airport logistics. Systems for managing airport logistics include software, air cargo systems, and freight information systems. It includes a wide range of services that aid in enhancing and streamlining the effectiveness of airport services. The term "customers" in this study refers widely to passengers and users of cargo services and airlines, diners, shoppers, and other airport entities. Airports are a crucial component of the air transportation system, which involves the transportation of people, luggage, cargo, and mail via aircraft. The purpose of logistics is to coordinate all operations, not just those at airports, by looking at and improving the procedures in each subsystem of the integrated logistics system of the airport.

Global airport logistics systems market growth is being fueled by factors like globalization and rapid expansion of international trade; improvements in freight security, safety, and transportation solutions; entry of low-cost airlines; expansion of communication technologies; and adoption of the Internet of Things (IoT). In addition, green freight, blockchain in freight management, cloud computing, and big data analytics are the main drivers of growth for the major industry participants.

COVID-19 Impact:

COVID-19 Impact:

Major changes have been made to the Airport Logistics Systems sector as a result of the COVID-19 outbreak. Globally, the industry showed signs of recovery in the second quarter, but long-term recovery is still uncertain because of the ongoing increase in COVID-19 cases, notably in Asian nations like India. The sector has experienced a number of setbacks and shocks since the pandemic started. The epidemic has caused numerous shifts in consumer behavior and thought. The result is increased pressure on the sector. As a result, it is projected that the market's growth will be limited.

Key Insights

Key Insights

- Due to increased worldwide trade, the market for airport logistics systems is anticipated to develop in terms of revenue at a CAGR of more than 10.2% over the forecast period.

- The growing use of cutting-edge technologies, which increases operational effectiveness, is a factor supporting market expansion.

- Airports now need to set more sophisticated logistics systems due to the increasing number of passengers and air freight, which is assisting the market's rapid expansion.

- Government regulatory initiatives that encourage increased trade and air freight transit are promoting the expansion of the international market for airport logistics systems.

Growth Drivers

Growth Drivers

- Increase in the world trading activities to boost the market expansion

The market for advanced logistics systems at airports is expected to have tremendous growth over the course of the projected period due to booming trade activities and quick globalization.

Additionally, the availability of affordable airline services has increased the number of travelers by air. In addition, the increase in air freight has compelled airport administration to set up cutting-edge logistical systems. The adoption of IoT, the introduction of new security and transportation systems for air freight, and the expansion of communication technologies will all further accelerate market growth patterns. The demand for green freight, the usage of blockchain technology in freight management, and the introduction of technologies like cloud computing and big data analytics are all expected to expand the market's potential over the projected period. However, high deployment, maintenance, and operational expenses may restrain the market growth over the projection period.

Restraints

Restraints

- High installation costs

Airport logistics system adoption may be hampered by high installation and maintenance costs of security solutions. In addition, a surge in supplier privacy concerns among airport regulatory agencies may make it more difficult to implement logistics systems.

Opportunities

Opportunities

- Mobile robots – strong opportunity in cargo handling

Currently, there is very little use of mobile robots in airports; most applications are in the form of trial projects. The market size in 2020 was $33 million (including both AGVs and AMRs). However, airports and installers are open to adopting mobile robots in the long run if they believe the technology has proven itself.

Given the obvious parallels to the warehouse business, where mobile robots have experienced extensive adoption, a significant long-term opportunity is predicted for the deployment of mobile robots in particular.

Challenges

Challenges

- Long-term thinking

Since this is a slower-moving market, it is crucial to take a long-term perspective while analyzing automation trends. For example, passengers who use the reclaim on-demand system get a notification on their phone when their bag is prepared for pickup. This could be from a secure place where the traveler requires a code to access their luggage or from the baggage carousel. Such solutions are likely to be commonplace in 10 to 15 years.

The software also shows promise. We anticipate software, which is already the second-largest market segment in the airport logistics automation market, to become increasingly significant, especially when it comes to data analytics and simulations. In this sense, airports will follow other industries, with the importance of predictive maintenance solutions set to grow. Again, this is a long-term trend, so the hardware/software revenue ratio won't change much in the near future.

Segmentation Analysis

Segmentation Analysis

The airport logistics systems market is segmented into Products and Services.

The market is divided into airport baggage handling systems, sorting equipment, scanners, conveyors, destination-coded vehicles, warehouse and operation management systems, freight information systems, and aviation cargo screening systems based on the kind of product. Sorting devices held the biggest market share for airport baggage handling systems globally in terms of the product category in 2017. This market sector is expanding as a result of the rising demand for sorting technology used in airport baggage handling. However, conveyors are predicted to grow at the quickest rate due to expanding airport traffic, automation in conveyor belt technology, modernization of airports, and rising digitization.

The market is divided into consultation, integration, and deployment as well as maintenance and support. In terms of service type, the market for airport logistics systems worldwide was dominated by the maintenance and support services sector in 2017. However, due to rising digitization and advancements in I.T. solutions, the integration and deployment category will experience the greatest increase during the projection period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 8,293.10 Million |

Projected Market Size in 2028 |

USD 14,611.77 Million |

CAGR Growth Rate |

9.80% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Daifuku Co. Ltd., Siemens AG, Vanderlande Industries Holding B.V., China International Marine Containers (Group) Co. Ltd. (Pteris Global), Champ Cargosystems S.A. (A Subsidiary of SITA), Beumer Group GmbH & Co. Kg, Unisys Corporation, IBS Software Services Private Limited, Kale Logistics Solutions, ALS Logistics Solutions, and Others |

Key Segment |

By Product, Service, Application, End-Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In September 2020, Enterprise Engineering Services LLC and the Federal Aviation Administration (FAA) Airport Technology Research and Development Branch agreed to a USD 2.4 million contract (EES). The deal covers database maintenance, support, programming, system engineering, and database development.

- Geneva Airport and Thales Group agreed to a deal in June 2019 for the delivery of a centralized supervision system. The technology is made to gather and examine operational data and quickly spot any anomalies.

Regional Landscape

Regional Landscape

- Rising advancements in technology are likely to help Asia dominate the global market

During the projection period, the Asia Pacific, which consists of China, India, Korea, Japan, and the Rest of Asia Pacific (RoAPAC), would have the fastest increase. The market for airport logistics systems in this region is anticipated to rise as a result of factors such as expanding international trade, rapid expansion in industrial manufacturing, and low-cost original equipment manufacturing. This region is anticipated to have upbeat growth in the next years as a result of the AAPC countries' swiftly increasing industrialization.

The Association of Asia Pacific Airlines (AAPA) claims that the persistent growth in international trade in consumer and intermediary goods is the primary cause of airlines' APAC air cargo boom. Other factors supporting the expansion of air freight in the APAC region include company digitization, how one conducts business with suppliers and other supply chain partners and international trade from APAC countries to Western and Latin American countries.

Competitive Landscape

Competitive Landscape

Key players within the global Airport Logistic System market include

- Daifuku Co. Ltd.

- Siemens AG

- Vanderlande Industries Holding B.V.

- China International Marine Containers (Group) Co. Ltd. (Pteris Global)

- Champ Cargosystems S.A. (A Subsidiary of SITA)

- Beumer Group GmbH & Co. Kg

- Unisys Corporation

- IBS Software Services Private Limited

- Kale Logistics Solutions

- ALS Logistics Solutions

The airport logistics system market is segmented as follows:

Market By Product

Market By Product

- Airport Baggage Handling Systems

- Sorting Devices

- Scanners

- Conveyors

- Destination Coded Vehicles

- Aviation Cargo Management Systems

- Warehouse and Operation Management System

- Freight Information System

- Aviation Cargo Screening Systems

Market By Service

Market By Service

- Maintenance and Support

- Integration and Deployment

- Consulting

Market By Region

Market By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Daifuku Co. Ltd.

- Siemens AG

- Vanderlande Industries Holding B.V.

- China International Marine Containers (Group) Co. Ltd. (Pteris Global)

- Champ Cargosystems S.A. (A Subsidiary of SITA)

- Beumer Group GmbH & Co. Kg

- Unisys Corporation

- IBS Software Services Private Limited

- Kale Logistics Solutions

- ALS Logistics Solutions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors