Search Market Research Report

Jewelry Market Size, Share Global Analysis Report, 2024 – 2032

Jewelry Market Size, Share, Growth Analysis Report By Product Type (Necklaces, Bracelets, Rings, Earrings, Others), By Material (Gold, Silver, Platinum, Diamond, Gemstones, Others), By End Users (Men and Women), By Distribution Channel (Online and Offline), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

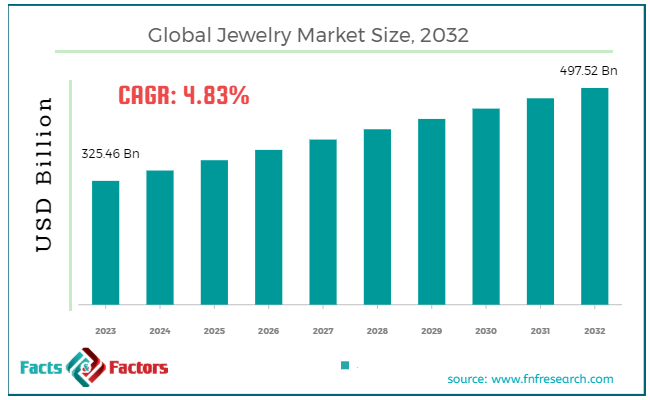

[223+ Pages Report] According to Facts & Factors, the global jewelry market size in terms of revenue was valued at around USD 325.46 billion in 2023 and is expected to reach a value of USD 497.52 billion by 2032, growing at a CAGR of roughly 4.83% from 2024 to 2032. The global jewelry market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Jewelry refers to decorative items worn for personal adornment, including necklaces, rings, bracelets, earrings, brooches, and more. These items can be crafted from a variety of materials, such as precious metals (gold, silver, platinum) and gemstones (diamonds, rubies, emeralds, sapphires).

In addition to their aesthetic appeal, jewelry often carries significant cultural, symbolic, and sentimental value. Historically, jewelry has been used to signify social status, wealth, and personal milestones. It can also serve as a form of artistic expression and personal identity.

Jewelry has evolved over time, influenced by changes in fashion, technology, and cultural trends. Today, the industry encompasses both traditional handcrafted pieces and modern designs produced using advanced techniques like 3D printing. Customization and personalization have become increasingly popular, allowing individuals to create unique pieces that reflect their personal style and preferences. The market for jewelry is diverse, catering to a wide range of tastes and budgets, from affordable fashion jewelry to high-end luxury items.

The global jewelry market continues to grow, driven by factors such as rising disposable incomes, the popularity of branded jewelry, and the expansion of online retail. Sustainability and ethical sourcing have also become important considerations for consumers, influencing their purchasing decisions and prompting the industry to adopt more responsible practices.

Key Highlights

Key Highlights

- The jewelry market has registered a CAGR of 4.83% during the forecast period.

- In terms of revenue, the global jewelry market was estimated at roughly USD 325.46 billion in 2023 and is predicted to attain a value of USD 497.52 billion by 2032.

- The jewelry market is shaped by various dynamics, including rising disposable incomes, cultural significance, technological advancements, and the expansion of e-commerce.

- By product type, the rings segment is projected to swipe the largest market share.

- Based on the material, the gold segment is growing at a high rate and is projected to dominate the global market.

- Based on the end users, the women's segment is expected to dominate the global market driven by traditional cultural significance, fashion trends, and the wide variety of products available.

- Regionally, Asia-Pacific leads the market with the highest growth rate, driven by cultural importance and rising incomes.

Key Growth Drivers

Key Growth Drivers

- Rising Disposable Incomes: As disposable incomes increase, particularly in emerging markets, more consumers can afford luxury and high-quality jewelry, driving market growth?.

- Cultural and Social Significance: Jewelry plays a crucial role in cultural traditions and social rituals, such as weddings and festivals, sustaining consistent demand??.

- E-commerce Expansion: The growth of online retail has made jewelry more accessible, providing a convenient shopping experience and a wider selection to consumers globally?.

- Innovation in Design and Materials: Advances in design technology and the use of new materials are attracting a broader range of customers and encouraging more frequent purchases?.

Restraints

Restraints

- High Raw Material Costs: Fluctuating prices of precious metals and gemstones can increase production costs, affecting pricing strategies and profit margins??.

- Market Saturation: In mature markets, high competition among established brands can limit growth opportunities for new entrants?.

- Economic Uncertainty: Economic downturns can reduce consumer spending on luxury items, impacting jewelry sales??.

Opportunities

Opportunities

- Sustainability and Ethical Sourcing: Increasing consumer demand for ethically sourced and sustainable jewelry presents opportunities for brands to differentiate themselves and attract eco-conscious customers??.

- Customization and Personalization: Offering customized and personalized jewelry allows brands to meet specific consumer preferences, enhancing customer loyalty and driving sales??.

- Emerging Markets: Rapid economic growth in countries like India and China is creating new opportunities for market expansion and increased sales??.

Challenges

Challenges

- Fluctuations in Economic Conditions: Economic downturns and uncertainties can significantly impact consumer spending on luxury goods, including jewelry.

- Counterfeiting and Fraud: The jewelry market faces issues with counterfeit products and fraudulent practices, which can damage brand reputation and consumer trust.

Jewelry Market: Segmentation Analysis

Jewelry Market: Segmentation Analysis

The global jewelry market is segmented by product type, material, distribution channel, end users, and region.

By Product Type Insights

By Product Type Insights

Based on Product Type, the global jewelry market is divided into necklaces, bracelets, rings, earrings, and others. Necklaces are one of the most popular types of jewelry, ranging from simple chains to elaborate designs featuring gemstones, pearls, and precious metals. They are often worn as a statement piece or as a part of traditional attire.

The demand for necklaces is driven by their versatility and the cultural significance attached to them in many regions. Innovations in design and the popularity of personalized and customized pieces further fuel their demand.

Bracelets are ornamental bands or chains worn around the wrist. They come in various forms, including bangles, cuffs, charm bracelets, and link bracelets, often made from metals, leather, or woven materials. The appeal of bracelets lies in their ability to complement both casual and formal outfits. Customizable options, such as charm bracelets, are particularly popular among younger consumers. The bracelets segment is projected to grow at a CAGR of about 4.8% during the forecast period, driven by the trend of stackable and personalized bracelets?.

Rings segment has held a market share of around 34.2% in 2023. Rings are circular bands worn on the fingers, commonly made from precious metals and adorned with gemstones. They are significant in various cultural and social contexts, often symbolizing marriage, engagement, or status. Rings hold a substantial market share due to their cultural significance, particularly engagement and wedding rings. The trend of using alternative materials and unique designs has also boosted their popularity.

Earrings are jewelry pieces worn on the earlobes, available in various styles such as studs, hoops, dangles, and chandeliers. They can be made from metals, gemstones, and other materials. Earrings are highly popular due to their wide range of styles and affordability. They are often bought as fashion accessories and gifts. The earrings segment is projected to grow at a CAGR of about 5.9%, supported by the continuous introduction of new designs and the increasing trend of multiple ear piercings?.

By Material Insights

By Material Insights

By Material, the global jewelry market is bifurcated into gold, silver, platinum, diamond, gemstones, and others. Gold jewelry segment accounted for 53.8% of revenue share in 2023. Gold is one of the most traditional and valued materials used in jewelry. It is prized for its luster, durability, and malleability, which allow it to be crafted into a variety of intricate designs. Gold jewelry includes items such as rings, necklaces, bracelets, and earrings, often alloyed with other metals to enhance its strength and color. The demand for gold jewelry is driven by its cultural significance, particularly in countries like India and China, where gold is a symbol of wealth and status. Additionally, gold jewelry is often purchased as an investment.

Silver is a popular material for jewelry due to its affordability compared to gold and its versatility in design. Silver jewelry includes items such as rings, bracelets, necklaces, and earrings. Sterling silver, an alloy of 92.5% silver with 7.5% other metals, is commonly used for its enhanced durability. The affordability and modern appeal of silver jewelry make it popular among younger consumers. The increasing trend of everyday fashion jewelry also supports the demand for silver. The silver jewelry segment is projected to grow at a CAGR of around 10.5%, supported by trends in fashion jewelry and the increasing popularity of silver among budget-conscious consumers?.

Platinum is a precious metal known for its rarity, strength, and naturally white luster, which does not tarnish or fade over time. Platinum is commonly used in high-end jewelry, including engagement rings, wedding bands, and luxury watches. The high value and durability of platinum make it a preferred choice for significant jewelry pieces. The metal's hypoallergenic properties also make it suitable for individuals with sensitive skin??.

Diamonds are highly sought-after gemstones used primarily in engagement rings, wedding bands, and other fine jewelry. Known for their brilliance and hardness, diamonds are often seen as a symbol of eternal love and are graded based on the four Cs: carat, cut, color, and clarity. The demand for diamond jewelry is driven by their association with special occasions and milestones.

Innovations in lab-grown diamonds are also expanding the market by offering more affordable and sustainable options. The diamond jewelry segment is projected to grow at a CAGR of approximately 5.2% from 2024 to 2032, fueled by the continuous demand for engagement and wedding rings and the growing popularity of lab-grown diamonds??.

Gemstones include a wide variety of precious and semi-precious stones such as rubies, sapphires, emeralds, and opals. These stones are used to add color and uniqueness to jewelry pieces, often set in rings, necklaces, bracelets, and earrings. The appeal of gemstone jewelry lies in its variety and the personalization it offers. Consumers are increasingly looking for unique and colorful pieces that reflect their individual style.

By End Users Insights

By End Users Insights

Based on End Users, the global jewelry market is categorized into men and women. The men’s jewelry segment includes items such as watches, bracelets, rings, cufflinks, and necklaces. Historically, jewelry for men was limited to watches and wedding bands, but the modern market has seen an expansion into more diverse and stylish options. The growing acceptance of fashion and jewelry among men is driving the demand in this segment. Increased exposure to fashion trends through social media and the influence of celebrities and athletes who wear jewelry have contributed to this shift. Jewelry brands are now focusing on creating more masculine and fashionable designs to cater to this growing market.

The women’s jewelry segment remains the largest, encompassing a wide variety of items such as rings, necklaces, earrings, bracelets, and brooches. Jewelry for women has traditionally been a significant aspect of personal adornment and fashion. The demand in this segment is driven by factors such as rising disposable incomes, the desire for fashionable and trendy accessories, and the cultural importance of jewelry in many societies. Women’s jewelry is also frequently purchased for special occasions and as gifts.

By Distribution Channel Insights

By Distribution Channel Insights

On the basis of Distribution Channel, the global jewelry market is divided into online and offline. The online distribution channel for jewelry includes e-commerce platforms, brand-specific websites, and online marketplaces. This channel has gained significant traction in recent years due to the convenience it offers consumers, allowing them to browse, compare, and purchase jewelry from the comfort of their homes. The rise of digital marketing, social media influence, and advancements in e-commerce technology have driven the growth of online jewelry sales. The ability to offer a wide variety of products, detailed descriptions, customer reviews, and secure payment options enhances the consumer experience.

The offline distribution channel includes traditional brick-and-mortar stores such as jewelry retailers, specialty stores, department stores, and brand showrooms. This channel remains vital due to the tangible experience it offers, allowing customers to physically inspect and try on jewelry before making a purchase. Despite the growth of online sales, the offline channel continues to be significant due to factors such as the trust and personalized service provided by physical stores.

Jewelry purchases, especially high-value items like engagement rings and luxury pieces, often require the assurance that comes from seeing and handling the product in person. Furthermore, physical stores can offer services like custom fitting, repairs, and personalized consultations that enhance customer loyalty.

Recent Developments:

Recent Developments:

- In January 2023, Vrai & Oro, LLC unveiled the VRAI x Brides fine jewelry collection, featuring an array of engagement rings, wedding bands, earrings, necklaces, and bracelets. This launch highlights the brand's commitment to offering elegant and timeless pieces for brides-to-be.

- Also in January 2023, Tanishq, a jewelry brand owned by Titan Ltd., made its entry into the U.S. market by opening its first store in New Jersey. This new store boasts a collection of over 6,500 designs in 18 and 22-karat gold and diamond, showcasing the brand's extensive range and craftsmanship.

- In October 2022, Brilliant Earth, LLC introduced its Cocktail Ring Collection. This exclusive 21-ring collection features unique, limited-edition pieces crafted with brightly colored lab-grown and natural gemstones set in recycled precious metals, reflecting the brand's dedication to sustainability and innovative design.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 325.46 Billion |

Projected Market Size in 2032 |

USD 497.52 Billion |

CAGR Growth Rate |

4.83% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Chow Tai Fook, GRAFF, H. Stern, Louis Vuitton SE, Malabar Gold & Diamonds, Pandora, Richemont, Signet Jewelers Limited, Swarovski AG, Tata Sons Private Ltd, Tiffany & Co., and Others. |

Key Segment |

By Product Type, By Material, By End Users, By Distribution Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Jewelry Market: Regional Analysis

Jewelry Market: Regional Analysis

Asia Pacific holds the largest share of the global jewelry market, accounting for approximately 60.4% of the total market revenue in 2023. This dominance is primarily due to high demand in countries like India and China, where jewelry, especially gold, is deeply embedded in cultural and traditional practices.

These markets are also driven by increasing disposable incomes and urbanization. China and India are the leading markets within the Asia Pacific region. Both countries have significant consumer bases that highly value jewelry for cultural, investment, and aesthetic reasons. The China jewelry market is projected to grow at a CAGR of around 4.8% from 2024 to 2032, reflecting robust growth driven by rising incomes and urbanization?.

North America is a significant market for jewelry, with a strong emphasis on luxury and personalized jewelry. The market is characterized by high consumer spending on luxury goods and a growing trend towards ethically sourced and sustainable jewelry. The United States leads the North American market, driven by a high demand for luxury jewelry and significant investments in marketing and retail infrastructure?.

Europe is known for its high-quality craftsmanship and established luxury brands. The market is driven by the demand for both traditional and contemporary designs, with a growing emphasis on customization and theme-based jewelry. Major markets within Europe include the UK, France, and Italy, each with a rich history of jewelry craftsmanship and strong luxury brands. The European jewelry market is projected to grow at a CAGR of 4.7% during the forecast period, driven by the rising popularity of customized jewelry and the growth of e-commerce?.

The jewelry market in Latin America is emerging, with significant growth potential driven by increasing tourism and the rising spending power of consumers. Brazil is a key market in this region, benefiting from a growing number of tourists and an expanding middle class. The jewelry market in Latin America is projected to grow at a moderate rate, with a focus on expanding retail networks and adopting modern jewelry trends?.

Jewelry Market: List of Key Players

Jewelry Market: List of Key Players

Some of the main competitors dominating the global jewelry market include;

- Chow Tai Fook

- GRAFF

- H. Stern

- Louis Vuitton SE

- Malabar Gold & Diamonds

- Pandora

- Richemont

- Signet Jewelers Limited

- Swarovski AG

- Tata Sons Private Ltd

- Tiffany & Co.

The global jewelry market is segmented as follows:

By Product Type Segment Analysis

By Product Type Segment Analysis

- Necklaces

- Bracelets

- Rings

- Earrings

- Others

By Material Segment Analysis

By Material Segment Analysis

- Gold

- Silver

- Platinum

- Diamond

- Gemstones

- Others

By End Users Segment Analysis

By End Users Segment Analysis

- Men

- Women

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Online (e-commerce platforms)

- Offline (retail stores, specialty stores)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Chow Tai Fook

- GRAFF

- H. Stern

- Louis Vuitton SE

- Malabar Gold & Diamonds

- Pandora

- Richemont

- Signet Jewelers Limited

- Swarovski AG

- Tata Sons Private Ltd

- Tiffany & Co.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors