Search Market Research Report

Insurance Broker And Agents Market Size, Share Global Analysis Report, 2022 – 2028

Insurance Broker And Agents Market Size, Share, Growth Analysis Report By Type (Insurance Agencies, Insurance Brokers, Bancassurance, Other Intermediaries), By End User (Corporate, Individual), By Mode (Online, Offline), By Insurance (Life Insurance, Property And Casualty Insurance, Health And Medical Insurance), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

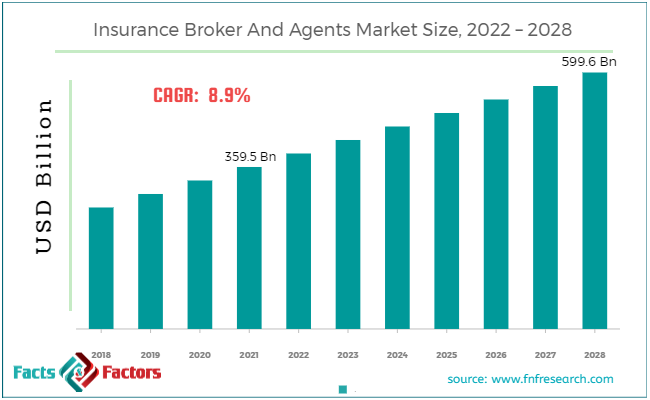

[212+ Pages Report] According to Facts and Factors, the global insurance broker and agents market size was worth USD 359.5 million in 2021 and is estimated to grow to USD 599.6 million by 2028, with a compound annual growth rate (CAGR) of roughly 8.9% over the forecast period. The report analyzes the insurance broker and agents market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the insurance broker and agents market.

Market Overview

Market Overview

A person who works with several insurers to sell, seek, or negotiate insurance products on behalf of their clients is known as an insurance broker. An insurance broker acts as a liaison between policyholders and insurers and is therefore essential to the growth of the business's economics. Insurance brokers offer their clients specialized, technical insurance advice. Brokers offer a variety of insurance products, including health insurance, property and casualty insurance, and medical insurance. Insurance brokers work closely with their customers to ensure their clients' coverage needs are met. The market is expanding due to the rising demand for insurance products and various government insurance policy initiatives.

The market for insurance brokers and agents is expected to expand significantly throughout the projection period due to its numerous advantages to the end user, including guaranteed income, a strong return on investment, death benefits, tax advantages, and others. However, it could be challenging for the insurance agent or insurance broker to help the customer if he is unfamiliar with the technology employed (for example, cloud computing and artificial intelligence). This may limit market expansion during the anticipated period.

COVID-19 Impact:

COVID-19 Impact:

The insurance brokerage business has shown rapid expansion in recent years, but it is anticipated to experience a slight decline in 2020 due to the COVID-19 pandemic. This is because most governments have put their citizens on lockdown and have closed down companies, public and private organizations, and educational institutions worldwide to stop the virus from spreading. Additionally, the owners of publicly traded insurance broker companies are withdrawing their investment from the business to raise money for their basic necessities.

With a projected drop in the volume of auto and house claims during COVID-19, insurance companies have seen a considerable increase in demand for insurance brokers. Additionally, it is anticipated that after COVID-19, insurance brokers will emphasize different insurance services, such as comprehending customers' needs for insurance coverage, streamlining the insurance distribution process, and providing accurate policy comparison services.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global insurance broker and agent's market value is expected to grow at a CAGR of 8.9% over the forecast period.

- In terms of revenue, the global insurance broker and agents market size was valued at around USD 359.5 million in 2021 and is projected to reach USD 599.6 million by 2028.

- Expanding demand for insurance policies, incorporating IT and analytic solutions, and providing professional solutions and services are the primary drivers of the industry's growth.

- By type, the bancassurance category dominated the market in 2021.

- By insurance, the health and medical insurance category dominated the market in 2021.

- North America dominated the global insurance broker and agents market in 2021

Growth Drivers

Growth Drivers

- The growth of the insurance brokerage market is anticipated to be fueled by rising technology in this sector

Insurance agents and brokers invest in digital technologies to offer assistance online and boost sales and profits. Digitalization is the process of turning information into digital representations. This includes offering knowledge and skills in digital formats to agents and brokers through insurance websites, digital distribution methods, and online interactions. These online tools and other mobile programs streamline business operations and cut costs. Technology integration into current services is thought to accelerate market expansion.

Restraints

Restraints

- Lack of technological knowledge among insurance brokers could limit market expansion

The availability of different platforms for purchasing insurance products and customers' direct purchase of insurance plans may restrict the market growth. For instance, technologies like location analytics and cloud computing provide information about their clients. With the considerable data and knowledge these technologies give insurance brokerage firms about their consumers, they can offer timely, pertinent coverage based on those needs. It could be challenging for salesmen, insurance agents, or brokers to promote their products to customers if they are unaware of current technological trends.

Opportunity

Opportunity

- Government initiatives in the area of insurance policies are anticipated to expand market opportunities

People can now access a wide range of services thanks to big initiatives launched by several governmental entities in the insurance plans sector. Governments also educate prospective clients about the many options, risk coverages, and assets that an insurance plan can secure. In addition, the government is implementing several programs to help the insurance business serve people from all walks of life with insurance plans. Therefore, it is anticipated that these government initiatives will present lucrative prospects for the sector in the upcoming years.

Segmentation Analysis

Segmentation Analysis

The global insurance broker and agents market has been segmented into type, end user, mode, and insurance.

Based on types, the worldwide insurance broker and agents market is segmented into insurance agencies, insurance brokers, bancassurance, and other intermediaries. The bancassurance segment dominated the market in 2021. A financial arrangement between a bank and an insurance provider is called bancassurance. The market is anticipated to continue to increase in value due to consumer behaviors and purchase patterns influenced by increased internet penetration and technological improvements.

Based on end-user, the worldwide insurance broker and agents market is segmented into corporate and individual. With 51.7 percent of the market's revenue in 2021, the individual segment dominated the healthcare insurance market. Since personalized health plans can be customized, many people purchase them. Additionally, it does not depend on your work status and allows you more control over your deductibles, copays, and benefit caps.

Based on mode, the worldwide insurance broker and agents market is segmented into online and offline. In 2021, the online sector will control the market. As more people utilize the internet and mobile devices, their preferences are shifting since they are accustomed to doing their online purchase research. Even though traditional insurance purchasing is still the most popular, it was discovered that internet life insurance research has been tracking an upward trend.

Based on insurance, the worldwide insurance broker and agents market is segmented into life insurance, property and casualty insurance, and health and medical insurance. In 2021, health and medical insurance dominated the market. The high cost of healthcare, rising rates of chronic diseases, and increased disposable income contribute to the segment's growth. With more people beginning to invest in healthcare plans, COVID-19 has favorably affected the healthcare insurance market. Service providers are concentrating on providing tailored policies to the fiercer industry competition and the need to draw in the younger generation to maintain their market share.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 359.5 Million |

Projected Market Size in 2028 |

USD 599.6 Million |

CAGR Growth Rate |

8.9% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Chubb Limited, Marsh & McLennan, Arthur J. Gallagher & Co., Jardine Matheson, Toyota Motor Corp, Hub International, Bank of China, Brown & Brown, Willis Towers Watson, BB&T Insurance Holdings Inc., and Others |

Key Segment |

By Type, End User, Mode, Insurance, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the insurance broker and agents market in 2021

In 2021, North America will dominate the insurance brokerage business, and it is predicted that it will do so for the duration of the prediction. One of the key factors fueling the market's expansion in this area is the existence of large companies that help consumers locate affordable home insurance, travel insurance, and health insurance. Many insurance brokers in the United States and Canada invest in cutting-edge technology to grow their market share and retain customers. In addition, North America, particularly the United States, has the region's most developed public healthcare system, making it the largest market for health insurance in the region.

Competitive Landscape

Competitive Landscape

Key players within the global insurance broker and agents market include;

- Chubb Limited

- Marsh & McLennan

- Arthur J. Gallagher & Co.

- Jardine Matheson

- Toyota Motor Corp

- Hub International

- Bank of China

- Brown & Brown

- Willis Towers Watson

- BB&T Insurance Holdings Inc.

The global insurance broker and agents market is segmented as follows:

By Type

By Type

- Insurance Agencies

- Insurance Brokers

- Bancassurance

- Other Intermediaries

By End User

By End User

- Corporate

- Individual

By Mode

By Mode

- Online

- Offline

By Insurance

By Insurance

- Life Insurance

- Property And Casualty Insurance

- Health And Medical Insurance

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Chubb Limited

- Marsh & McLennan

- Arthur J. Gallagher & Co.

- Jardine Matheson

- Toyota Motor Corp

- Hub International

- Bank of China

- Brown & Brown

- Willis Towers Watson

- BB&T Insurance Holdings Inc.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors