Search Market Research Report

India Electric Insulator Market Size, Share Global Analysis Report, 2024 – 2032

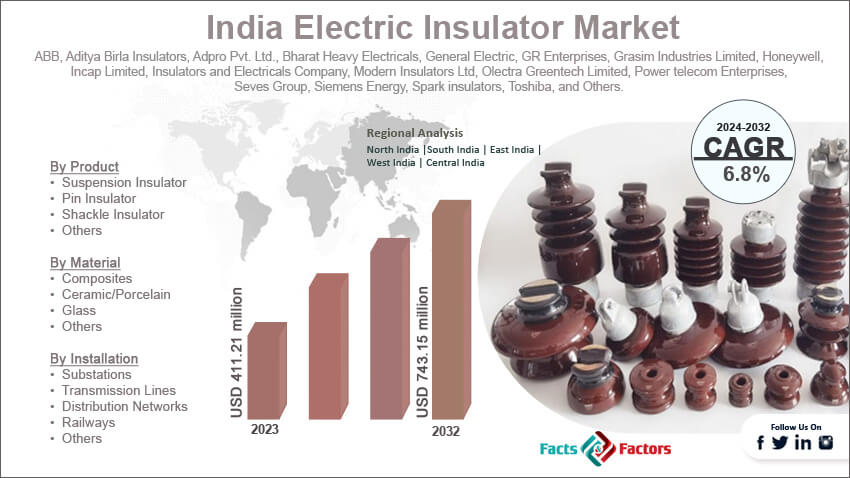

India Electric Insulator Market Size, Share, Growth Analysis Report By Product (Suspension Insulator, Pin Insulator, Shackle Insulator, and Others), By Material (Composites, Ceramic/Porcelain, Glass, and Others), By Voltage (Low, Medium, and High), By Installation (Substations, Transmission Lines, Distribution Networks, Railways, and Others), By Rating (<11 kV, 11 kV, 22 kV, 33 kV, 72.5 kV, 145 kV and above), By Application (Switchgear, Cable, Transformer, Surge Protection Device, Busbar, and Others), By End-User (Residential, Industrial, Utilities, and Others), and By Region - Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

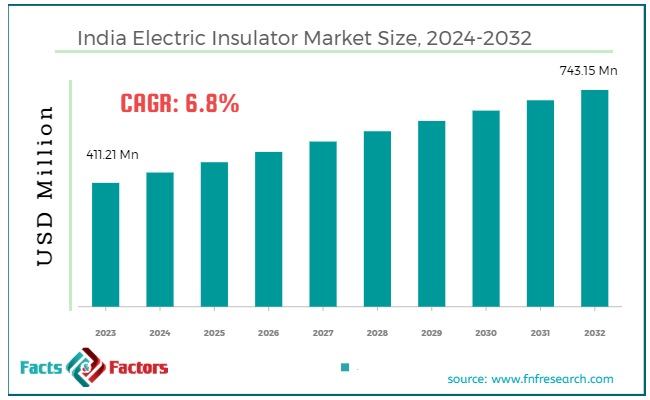

[226+ Pages Report] According to Facts & Factors, the India electric insulator market size in terms of revenue was valued at around USD 411.21 million in 2023 and is expected to reach a value of USD 743.15 million by 2032, growing at a CAGR of roughly 6.8% from 2024 to 2032. The India electric insulator market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

India's electric insulator market is a critical component of the country's expanding power infrastructure, playing a vital role in ensuring the reliability and efficiency of electrical transmission and distribution systems. Electric insulators are essential for preventing unwanted flow of current to the earth from their supporting points in electrical systems. These are essential for maintaining the integrity and safety of electrical systems, from power generation to consumption. The market is driven by increasing electricity demand, government initiatives to upgrade and expand the power grid, and the integration of renewable energy sources.

Key segments include ceramic, glass, and composite insulators, each serving various applications in high-voltage, medium-voltage, and low-voltage networks. The market is characterized by the presence of both domestic and international manufacturers, with a focus on enhancing product quality and performance to meet the stringent standards required for modern power systems. With ongoing investments in power infrastructure and rural electrification, the electric insulator market in India is poised for steady growth.

Key Highlights

Key Highlights

- The India electric insulator market has registered a CAGR of 6.8% during the forecast period.

- In terms of revenue, the India electric insulator market was estimated at roughly USD 411.21 million in 2023 and is predicted to attain a value of USD 743.15 million by 2032.

- The growth of the India electric insulator market is being propelled by [content].

- Based on the product, the suspension insulators segment is growing at a high rate and is projected to dominate the market.

- On the basis of material, the composites segment is projected to swipe the largest market share.

- Based on the application, the switchgear segment is expected to dominate the market.

- Regionally, South India, particularly Tamil Nadu, stands out as the most dominant during the forecast period.

Key Growth Drivers

Key Growth Drivers

- Expanding Power Grid Infrastructure: India's growing economy, coupled with the government's ambitious electrification plans, is driving a rapid expansion of the power grid. This necessitates a substantial increase in insulator demand to support the transmission and distribution of electricity across the country.

- Renewable Energy Integration: The nation's strong emphasis on renewable energy sources, such as solar and wind power, is fueling the construction of new power generation facilities. These projects require extensive electrical infrastructure, including insulators, to connect them to the grid.

- Rapid Urbanization and Industrialization: The increasing concentration of population and industries in urban areas is leading to a surge in electricity demand. This, in turn, is driving the need for robust power distribution networks, which rely heavily on insulators.

- Government's Infrastructure Push: The Indian government's significant investments in infrastructure development, including power sector reforms, are creating a conducive environment for the growth of the insulator market.

Restraints

Restraints

- Substantial Capital Investment: The manufacturing process of high-quality insulators is capital-intensive, requiring substantial upfront investments in machinery, equipment, and technology. This can be a significant barrier for new entrants and smaller players in the market.

- Volatile Raw Material Prices: The cost of raw materials, such as porcelain, glass, and composite materials, is subject to fluctuations due to various factors, including global commodity prices and supply chain disruptions. This volatility can impact the profitability of insulator manufacturers.

- Technological Complexity: Developing advanced insulator technologies that meet the evolving demands of the power sector requires significant research and development efforts. Overcoming these technological challenges can be time-consuming and resource-intensive.

Opportunities

Opportunities

- Technological Innovation: Advancements in materials science and engineering offer opportunities to develop novel insulator designs with enhanced performance characteristics, such as improved insulation strength, durability, and resistance to environmental factors.

- Smart Grid Integration: The growing adoption of smart grid technologies presents new avenues for insulator manufacturers to develop products that can integrate seamlessly with advanced power systems.

- Global Export Potential: India's cost-competitive advantage in manufacturing, coupled with the increasing demand for insulators in global markets, offers significant export opportunities for domestic players.

- Focus on R&D: Investing in research and development can help insulator manufacturers stay ahead of the competition by developing innovative products and solutions.

Challenges

Challenges

- Fierce Competitive Landscape: The Indian electric insulator market is characterized by intense competition from both domestic and international players, leading to price pressures and margin erosion.

- Supply Chain Vulnerabilities: The global nature of the supply chain for raw materials and components exposes insulator manufacturers to risks such as supply shortages, price fluctuations, and geopolitical uncertainties.

- Environmental Regulations: Increasingly stringent environmental regulations can impose additional costs on insulator manufacturers and limit the use of certain materials, thereby impacting product development and production processes.

- Skilled Labor Scarcity: The availability of skilled labor with expertise in insulator manufacturing and technology can be a challenge, affecting production efficiency and product quality.

Segmentation Analysis

Segmentation Analysis

The India electric insulator market is segmented based on product, material, voltage, installation, rating, application, end-user, and region.

- By Product Insights

Based on Product, the India electric insulator market is divided into suspension insulator, pin insulator, shackle insulator, and others.

Suspension insulators are primarily used in high-voltage transmission lines. They consist of one or more disc-shaped insulators connected in series to form a string. Suspension insulators are preferred for their flexibility, ease of installation, and ability to handle higher mechanical loads and voltages. They are widely used in both AC and DC transmission lines.

Pin insulators are typically used in low to medium voltage distribution networks. They are mounted on cross-arms of poles and directly support the overhead conductors. Pin insulators are simple in design, easy to install, and cost-effective, making them suitable for rural and semi-urban power distribution networks. They are commonly made of ceramic or composite materials, which provide good electrical insulation and mechanical strength.

Shackle insulators, also known as spool insulators, are used in low voltage distribution lines. They are typically mounted horizontally on poles and are designed to support conductors in tight spaces or areas with limited pole height. Shackle insulators are compact, robust, and capable of withstanding mechanical stress and environmental conditions. They are often used in areas with limited space or in installations where other types of insulators are not feasible.

- By Material Insightsdc

On the basis of Material, the India electric insulator market is bifurcated into composites, ceramic/porcelain, glass, and others.

Composite insulators are made from polymeric materials, often comprising a fiberglass core and a polymeric housing. They are known for their lightweight, high mechanical strength, and resistance to contamination and vandalism. Composite insulators are particularly advantageous in areas with high pollution levels, coastal regions, and areas prone to extreme weather conditions. They offer excellent performance under mechanical stress and have a longer service life due to their resistance to moisture and UV radiation. The increasing adoption of composite insulators is driven by their superior performance characteristics and lower maintenance requirements compared to traditional materials.

Ceramic or porcelain insulators are the most traditional type of insulators used in power transmission and distribution. They are known for their excellent electrical insulating properties, durability, and thermal stability. Ceramic insulators are widely used in both low and high voltage applications, including transmission lines, distribution lines, and substations. Despite being heavier and more brittle compared to composite and glass insulators, ceramic insulators remain popular due to their proven reliability and cost-effectiveness.

Glass insulators are made from toughened glass and are known for their high mechanical strength, dielectric properties, and aesthetic appeal. They are used primarily in high-voltage transmission lines due to their ability to maintain mechanical and electrical integrity under various environmental conditions. Glass insulators are self-cleaning, as the smooth surface reduces the accumulation of dirt and contaminants, making them ideal for areas with high pollution.

- By Installation Insights

Based on Installation, the India electric insulator market is categorized into substations, transmission lines, distribution networks, railways, and others.

Substations are critical nodes in the power grid where voltage levels are adjusted for transmission and distribution. Insulators used in substations must withstand high voltages, mechanical stresses, and environmental conditions. They are typically found in applications such as bus bars, switchgear, transformers, and other high-voltage equipment. The demand for high-performance insulators in substations is driven by the need for reliable and efficient power flow, as well as the ongoing expansion and upgrading of substation infrastructure to support the growing electricity demand.

Transmission Lines Transmission lines carry high-voltage electricity over long distances from power plants to substations. Insulators in transmission lines must provide robust electrical insulation and mechanical support to the conductors. They need to be highly durable and capable of withstanding various environmental conditions such as wind, rain, and pollution. Suspension and strain insulators are commonly used in transmission lines to ensure the safe and efficient transmission of electricity.

Distribution networks distribute electricity from substations to end-users, typically at lower voltages. Insulators in distribution networks need to be reliable and cost-effective, suitable for urban, semi-urban, and rural areas. Pin insulators, shackle insulators, and spool insulators are commonly used in these networks. The growth of the distribution network insulator market is driven by the need to expand and modernize the distribution infrastructure to ensure reliable electricity supply and support rural electrification initiatives.

Railways in India use electrified lines for train operations, requiring specialized insulators for overhead traction systems. These insulators must provide reliable insulation and mechanical support to the catenary wires that deliver power to the trains. The insulators used in railway applications are designed to withstand the mechanical vibrations and environmental conditions specific to railway operations.

- By Application Insights

Based on Application, the India electric insulator market is divided into switchgear, cable, transformer, surge protection device, busbar, and others.

Switchgear is used to control, protect, and isolate electrical equipment in the power system. Insulators in switchgear applications need to withstand high voltages and mechanical stresses while providing reliable insulation and arc-quenching capabilities. These insulators are critical for the safe operation of circuit breakers, disconnectors, and other switchgear components. The demand for high-quality insulators in switchgear is driven by the need to ensure operational safety and reliability in both high-voltage and medium-voltage applications.

Insulators in cable applications are essential for insulating conductors and preventing electrical faults. These insulators must offer high dielectric strength, thermal stability, and resistance to environmental factors such as moisture and chemicals. In power transmission and distribution, cable insulators are used in underground and overhead cables to ensure efficient and safe electricity flow. The growth of the cable insulator market is driven by the increasing demand for reliable power distribution systems, urbanization, and the need to replace aging infrastructure.

Transformers are crucial components in the power grid, and insulators play a vital role in ensuring their safe and efficient operation. Transformer insulators must withstand high voltages, thermal stresses, and mechanical loads while providing excellent electrical insulation. They are used in various parts of transformers, including bushings, windings, and cores. The demand for transformer insulators is driven by the need for reliable and efficient voltage regulation in the power transmission and distribution network.

Surge protection devices (SPDs) protect electrical equipment from voltage spikes and surges. Insulators used in SPDs must provide high dielectric strength and fast response times to effectively absorb and dissipate surge energy. They are critical for protecting sensitive electrical and electronic equipment in residential, commercial, and industrial settings. The increasing use of electronic devices and the need to protect them from power surges drive the growth of the SPD insulator market.

Busbars are used in electrical power distribution systems to distribute power from a supply point to multiple output circuits. Insulators for busbars must offer high mechanical strength, thermal stability, and electrical insulation to prevent short circuits and ensure efficient power distribution. Busbar insulators are used in various applications, including substations, switchgear, and distribution panels.

Recent Developments:

Recent Developments:

- In April 2023, Siemens Limited, in partnership with Rail Vikas Nigam Limited as part of a consortium, secured two separate contracts from Gujarat Metro Rail Corporation Limited (GMRCL). The total value of Siemens' share in these contracts exceeds USD 82.4 million.

- In February 2022, Recticel Insulation, a global manufacturer, announced that their multilayer thermal insulation products have been awarded the PEFC sustainability certification. This achievement highlights a shift towards eco-friendly materials within the insulation industry, a trend that could potentially impact Indian manufacturers.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 411.21 Million |

Projected Market Size in 2032 |

USD 743.15 Million |

CAGR Growth Rate |

6.8% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

ABB, Aditya Birla Insulators, Adpro Pvt. Ltd., Bharat Heavy Electricals, General Electric, GR Enterprises, Grasim Industries Limited, Honeywell, Incap Limited, Insulators and Electricals Company, Modern Insulators Ltd, Olectra Greentech Limited, Power telecom Enterprises, Seves Group, Siemens Energy, Spark insulators, Toshiba, and Others. |

Key Segment |

By Product, By Material, By Voltage, By Installation, By Rating, By Application, By End-User, and By Region |

Regions Covered in India |

North India, South India, East India, West India, and Central India |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- South India leads the India electric insulator market

South India, a key player in the market, benefits from major industrial hubs in states such as Tamil Nadu, Karnataka, Andhra Pradesh, and Telangana. High industrial activity and extensive rural electrification programs contribute significantly to market growth, with Tamil Nadu dominating the region. This is driven by the state's robust industrial base and extensive renewable energy projects.

North India, including states like Uttar Pradesh, Haryana, Punjab, and Delhi, sees substantial demand due to extensive urbanization, infrastructure projects, and industrialization. Uttar Pradesh leads this region, supported by government policies aimed at improving power infrastructure and increasing electrification rates.

West India, comprising Maharashtra and Gujarat, is crucial for the electric insulator market due to significant industrialization, urbanization, and infrastructure development. Maharashtra, particularly the Mumbai-Pune industrial belt leads the market, driven by its extensive industrial network and infrastructure projects.

East India, including West Bengal, Odisha, and Jharkhand, is gradually emerging as a notable market due to its rich natural resources and significant industrial activity in mining and metallurgy, which require substantial power infrastructure. West Bengal, especially Kolkata, leads the region propelled by investments in power generation and transmission projects.

Northeast India, with its unique geographical conditions, focuses on improving its power distribution network and rural electrification. Assam is emerging as a key player in this region driven by government initiatives to enhance the power infrastructure.

List of Key Players

List of Key Players

The analysis-intensive report provides key insights into companies and organizations operating in the India electric insulator market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, business overviews, product offerings, segment-based market share, operational strategies, and SWOT analysis. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Some of the main competitors dominating the India electric insulator market include;

- ABB

- Aditya Birla Insulators

- Adpro Pvt. Ltd.

- Bharat Heavy Electricals

- General Electric

- GR Enterprises

- Grasim Industries Limited

- Honeywell

- Incap Limited

- Insulators and Electricals Company

- Modern Insulators Ltd

- Olectra Greentech Limited

- Power telecom Enterprises

- Seves Group

- Siemens Energy

- Spark insulators

- Toshiba

The India electric insulator market is segmented as follows:

By Product

By Product

- Suspension Insulator

- Pin Insulator

- Shackle Insulator

- Others

By Material

By Material

- Composites

- Ceramic/Porcelain

- Glass

- Others

By Voltage

By Voltage

- Low

- Medium

- High

By Installation

By Installation

- Substations

- Transmission Lines

- Distribution Networks

- Railways

- Others

By Rating

By Rating

- <11 kV

- 11 kV

- 22 kV

- 33 kV

- 72.5 kV

- 145 kV and above

By Application

By Application

- Switchgear

- Cable

- Transformer

- Surge Protection Device

- Busbar

- Others

By End-User

By End-User

- Residential

- Industrial

- Utilities

- Others

By Region

By Region

- North India

- South India

- East India

- West India

- Central India

Industry Major Market Players

- ABB

- Aditya Birla Insulators

- Adpro Pvt. Ltd.

- Bharat Heavy Electricals

- General Electric

- GR Enterprises

- Grasim Industries Limited

- Honeywell

- Incap Limited

- Insulators and Electricals Company

- Modern Insulators Ltd

- Olectra Greentech Limited

- Power telecom Enterprises

- Seves Group

- Siemens Energy

- Spark insulators

- Toshiba

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors