Search Market Research Report

Halal Foods Market Size, Share Global Analysis Report, 2025 – 2034

Halal Foods Market Size, Share, Growth Analysis Report By Product Types (Grain Products, Fruits & Vegetables, Milk & Milk Products, Meat & Alternatives, And Others), By Distribution Channels (Online, Departmental Store, Hypermarket & Supermarkets, And Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

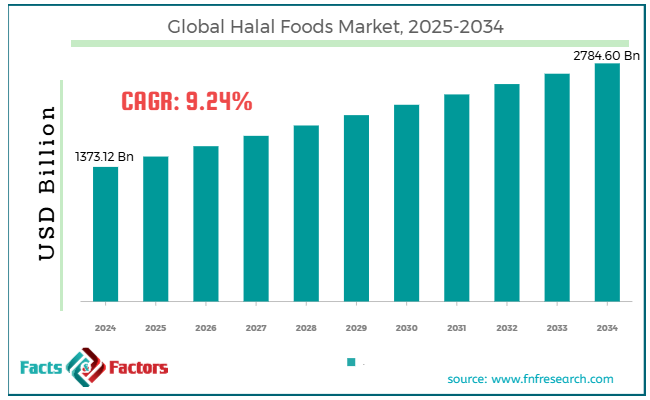

[219+ Pages Report] According to Facts & Factors, the global halal foods market size was valued at USD 1373.12 billion in 2024 and is predicted to surpass USD 2784.60 billion by the end of 2034. The halal foods industry is expected to grow by a CAGR of 9.24% between 2025 and 2034.

Market Overview

Market Overview

Halal foods are the food and beverage items that are considered legal and permissible according to Islamic law. These laws or principles are derived from the Quran, Hadith, and Islamic jurisprudence. Dairy products, fruit, vegetable greens, fish & seafood, meat from halal-slaughtered animals, and plant-based foods are some of the permitted ingredients, according to Islamic law.

Pork & its derivatives, alcohols & intoxicants, carnivorous animals, etc., are some of the forbidden or haram ingredients according to Islamic law. Halal certification from authorized bodies ensures that proper slaughtering, handling, and labeling practices are followed. It also helps ensure that the food items comply with halal standards. Some of the popular halal-certified agencies are HFA (UK), MUIS (Singapore), Halal India, IFANCA (USA), and JAKIM (Malaysia).

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global halal foods market size is estimated to grow annually at a CAGR of around 9.24% over the forecast period (2025-2034).

- In terms of revenue, the global halal foods market size was valued at around USD 1373.12 billion in 2024 and is projected to reach USD 2784.60 billion by 2034.

- The rising awareness of food origins is driving the growth of the global halal foods market.

- Based on the product types, the meat & alternatives segment is growing at a high rate and is projected to dominate the global market.

- Based on distribution channel, the hypermarket & supermarket segment is anticipated to grow with the highest CAGR in the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- How will the rising awareness of food origins drive the growth of the global halal foods market?

Growing awareness and education among people about the source of meat products and other food items are driving the demand for halal foods globally. Halal food products assure clean slaughter and humane treatment of animals. Moreover, the rapid growth in the Muslim population globally is also increasing the demand for halal products, particularly in countries like Bangladesh, India, Pakistan, China, Egypt, and Nigeria.

Moreover, the non-Muslim community in countries like China, the US, UK, France, and also inclining towards halal food because of its clean and ethical nature. Additionally, there is a surge in demand for healthier food alternatives with halal certifications. Halal food certification assures that the food items are free from hormones, antibiotics, and other harmful additives. Halal food is gaining immense traction among consumers with high morals.

Government halal policies across many countries are also encouraging halal SMEs and exporters, which is likely to further boost the growth of the global halal foods market. For instance, Nigeria witnessed a public-private partnership with OneAgrix to access the halal market under the AFCFTA in 2021. This strategic step is expected to use OneAgrix's trading platform to access the market.

Restraints

Restraints

- A lack of global standardization is likely to restrain the growth of the global market.

The global market is facing inconsistencies in halal products because there is no universally accepted authority to certify them as such. Different countries follow different rules and standards, which creates fragmentation and complications in exports. Moreover, non-Muslim majority countries are facing backlash against halal products on the grounds of animal welfare, which is expected to further slow down the growth of the halal foods industry.

Opportunities

Opportunities

- Will product diversification foster growth opportunities in the global halal foods market?

People are looking beyond meat and poultry products, which is likely to further expand the market. People are now looking forward to halal snacks, halal functional foods, halal-certified beverages, halal dairy products, and many other options. However, there are many leading brands, such as Saffron Road and Nestlé Halal, that are leading the market with innovative products to capture a significant market share. However, the premiumization and branding of products are likely to further evolve the market. Lifestyle upgradation is a crucial factor positively influencing the market's growth.

Moreover, celebrity endorsements and digital marketing are expanding awareness among the target audience, such as Gen Z and millennial Muslims. The fast expansion of e-commerce across the globe is further popularizing halal products, particularly in tier two and tier three cities.

Advancements in cold chain and logistic infrastructure are likely to enhance the quality of halal meat and dairy products, which in turn is expected to foster numerous growth opportunities in the global halal foods market. For instance, Chicken Cottage unveiled its strategy to extend its operations in East Africa through a partnership with Express Kitchen in 2022. The partnered company is a subsidiary of AAH.

Challenges

Challenges

- How will high certification costs pose a big challenge for the global halal food market?

A significant cost is incurred in obtaining halal certification, as it involves ingredient traceability, facility inspection, and validation of the slaughter method. It also leads to procedural delays because of the complex process. Therefore, it is emerging as a big challenge in the halal food industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 1,373.12 Billion |

Projected Market Size in 2034 |

USD 2,784.60 Billion |

CAGR Growth Rate |

9.24% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Rosen's Diversified Inc., QL Foods, Midamar Corporation, One World Foods Inc., Prima Agri-Products, Al-Falah Halal Foods, American Halal Company Inc., Unilever, Cargill, Incorporated, Nestlé S.A., and others. |

Key Segment |

By Product Types, By Distribution Channels, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global halal foods market can be segmented into product types, distribution channels, and regions.

Based on product types, the market can be segmented into grain products, fruits & vegetables, milk & milk products, meat & alternatives, and others. Meat and alternatives are the fastest-growing segment in the halal foods industry. Muslim and non-Muslim consumers adopt halal meat because of the hygiene, as these align with strict protocols and have a low risk of infection. Meat and meat-based foods are the core dishes in the Islamic diet. Products such as halal poultry, lamb, and beef are consumed on a daily basis.

However, the rising disposable income of people has significantly spiked the consumption of packaged meat products globally. Moreover, ready-to-eat and processed halal meats, such as frozen chicken nuggets and kebabs, are gaining immense popularity among modern consumers due to their convenience and ease of use.

However, the non-Muslim community and young Muslim demographic are focusing on health-conscious diets and, therefore, are looking forward to plant-based green label alternatives. Halal products, such as vegan burgers, nuggets, and sausages, are attracting these consumers. Many halal-certified authorities are working on the alcohol and animal fats trend. The recent trend of lab-grown and cultured meat is likely to be a transformative force in the market.

However, lab-grown and cultured meat have numerous advantages, including a lower environmental impact and higher scalability. Additionally, the growing Muslim population in countries such as Pakistan, India, Bangladesh, and Indonesia is expected to further drive growth in the segment.

Based on distribution channel, the market can be segmented into online, departmental store, hypermarket & supermarkets, and others. The hypermarket & supermarket segment accounts for the largest share of the global halal foods market. Hypermarket offers a full range of halal products, including halal-certified ready-to-eat meals, dairy beverages, processed meats, and fresh meats.

For instance, Lulu Hypermarket offers over 10,000 halal products across various categories in countries such as Indonesia, India, and the UAE. People tend to have more trust in products that visibly carry halal certification in markets. There are many hypermarkets, such as Carrefour, that dedicate a complete unit to halal products. Moreover, the increasing number of Muslims in urban areas is boosting the sales of halal products in modern retail formats.

Additionally, the rising trend of dual-income families is promoting the culture of hypermarket shopping. Furthermore, retail modernization is expected to revolutionize the market. Governments are also supporting halal-certified products for food safety. Hypermarkets and supermarkets offer family-size halal products, which is also a significant factor driving the growth of the segment. Discounts and festive offers at supermarkets and hypermarkets are also fueling the sales revenue of the segment. Additionally, many retail chains offer halal-certified store brands specifically to value-conscious consumers.

Regional Analysis

Regional Analysis

- What factors will help Asia-Pacific dominate the global halal food market?

Asia-Pacific holds the largest market share in the global halal foods market. One of the primary reasons for the market's high growth rate is its high Muslim population. APAC is home to around 70% of the global Muslim population. High birth rates in countries like Bangladesh, Pakistan, India, and Indonesia are contributing to the growing Muslim population.

Moreover, the fast-growing middle-class population is fueling the demand for halal products. Governments are also extending support by offering halal certification and branding. Indonesia has strict halal laws and the largest Muslim population, which is contributing to its substantial presence in APAC.

Moreover, the fast-growing export demand is also fostering growth opportunities in the market. Malaysia is emerging as a global hub for halal education. Furthermore, product innovation in the meat and dairy category is also expected to positively influence the regional market's growth.

Africa is also the leading region in the halal foods industry. This region has a high Muslim population, but even the non-Muslim community prefers halal products for their quality. South African National Authority (SANA) plays a critical role in fostering growth opportunities in the regional market. Egypt is also likely to emerge as a significant market for halal food due to the growing trade potential of the Middle East.

Nigeria is likely to witness significant developments in the coming years because it has a substantial number of Muslim and Christian populations who prefer halal foods. Ghana and Cameroon are other emerging regions that are likely to expand the scope of the regional market. Strong distribution channels across Africa are also fostering growth opportunities in the market. For instance, Crescent Foods introduced a turkey foodservice program for educational institutions nationwide in 2021. The offerings include turkey, hand-cut beef, lamb, etc.

Competitive Analysis

Competitive Analysis

The key players in the global halal foods market include:

- Rosen's Diversified Inc.

- QL Foods

- Midamar Corporation

- One World Foods Inc.

- Prima Agri-Products

- Al-Falah Halal Foods

- American Halal Company Inc.

- Unilever

- Cargill

- Incorporated

- Nestlé S.A.

For instance, Saffron Road introduced four new frozen items in 2024, namely Korean Fire-Roasted Chicken, Fire-Roasted Adobo Chicken, Drunken Noodles, and Vegetable Bibimbap. The company stated that it must comply with the current standard for halal products.

The global halal foods market is segmented as follows:

By Product Types Segment Analysis

By Product Types Segment Analysis

- Grain Products

- Fruits & Vegetables

- Milk & Milk Products

- Meat & Alternatives

- Others

By Distribution Channels Segment Analysis

By Distribution Channels Segment Analysis

- Online

- Departmental Store

- Hypermarket & Supermarkets

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Rosen's Diversified Inc.

- QL Foods

- Midamar Corporation

- One World Foods Inc.

- Prima Agri-Products

- Al-Falah Halal Foods

- American Halal Company Inc.

- Unilever

- Cargill

- Incorporated

- Nestlé S.A.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors