Search Market Research Report

Fiber Cement Market Size, Share Global Analysis Report, 2022 – 2028

Fiber Cement Market Size, Share, Growth Analysis Report By Raw Material (Portland Cement, Silica, Cellulosic Fiber, Others), By Construction Type (Siding, Roofing, Molding & Trim, Others), By End-Use (Residential, Non-Residential), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

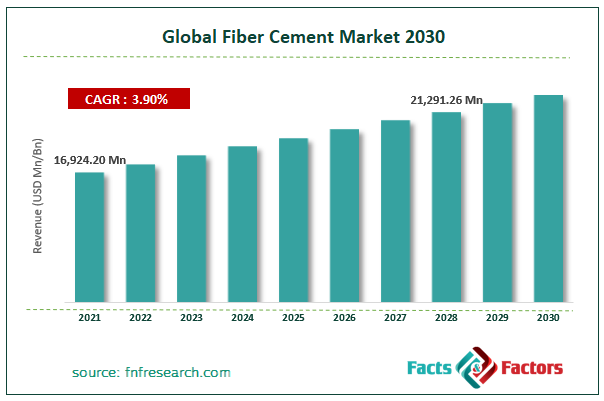

[230+ Pages Report] According to the report published by Facts Factors, the global fiber cement market size was worth USD 16,924.20 million in 2021 and is estimated to grow to USD 21,291.26 million by 2028, with a compound annual growth rate (CAGR) of approximately 3.90 percent over the forecast period. The report analyzes the fiber cement market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the fiber cement market.

Market Overview

Market Overview

Another name for fiber cement is reinforced fiber cement. It is an engineering and construction composite material that offers exceptional physical qualities like great toughness and durability. Its main uses are in facade and roofing materials. Boards, panels, and partitions made of fiber cement are frequently used in residential and commercial construction because of their fire and impact resistance. Partitions, ceilings, and aesthetic applications use fiber cement panels for exterior wall cladding. The market is expanding due to the rapid urbanization and industrialization of developing nations, the burgeoning construction sector, the high production of fiber cement products, and the ban on asbestos-containing cement products. Additionally, greater infrastructure investment creates market entry chances for businesses. However, the growth of the worldwide fiber cement market is being hampered by the lack of competent personnel in developing nations.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic has had a huge impact on the global fiber cement market. The coronavirus pandemic has significantly impacted global construction activity, affecting the entire fiber cement market. The building materials industry has experienced a significant trade decline due to government restrictions on the international movement of goods in major regions, resulting in a significant drop in product consumption. However, in the post-COVID scenario, the fiber cement market is expected to be significantly impacted due to increased construction activity and the re-establishment of cross-border trade.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global fiber cement market value is expected to grow at a CAGR of 3.90% over the forecast period.

- In terms of revenue, the global fiber cement market size was valued at around USD 16,924.20 million in 2021 and is projected to reach USD 21,291.26 million by 2028.

- The growing need to reduce overall carbon emissions from the buildings and construction sector is expected to drive the use of the product.

- By raw material, the Portland cement category dominated the market in 2021.

- By construction type, the siding category dominated the market in 2021.

- Asia-Pacific dominated the global fiber cement market in 2021.

Growth Drivers

Growth Drivers

- Rising construction activities expected to drive market growth

Rising demand for private housing and investment in housing projects is driving the growth of fiber cement in residential construction. In addition, developing countries, including India, China, South Africa, Thailand, and others, are expected to help the players due to the boom of the fiber-cement market owing to the construction sector and proactive government initiatives resulting in increased infrastructure investment. Thus, these factors are expected to drive the global fiber cement market growth during the forecast period.

Restraints

Restraints

- The availability of alternatives is anticipated to hinder the market growth

Alternatives to fiber cement partitions and high installation costs: vinyl, wood, and steel are all popular siding materials and alternatives to fiber cement siding. Vinyl siding is a popular choice due to its variety of styles and cost. Wood siding is more likely to be used in custom homes because it is expensive, requires regular maintenance, and is susceptible to insects. On the other hand, steel siding is widely used as an alternative to fiber cement siding in industrial and commercial buildings and residential partitions.

Opportunity

Opportunity

- The rising demand for energy-efficient buildings presents market opportunities

Global warming is seriously affecting the environment. Energy efficiency in construction is one of the best ways to alleviate this problem. Significant GHG emissions can be seen by reducing the number of natural resources, land, raw materials, and energy used to create buildings. Energy efficient buildings are high-performance buildings and structures that respect the environment. Fiber cement board, also known as V-panel, is a cost-effective and time-saving drywall construction solution.

Segmentation Analysis

Segmentation Analysis

The global fiber cement market has been segmented into raw material, construction type, end-use, and region.

Based on raw material, the market is segmented into Portland cement, silica, cellulosic fiber, and others. Portland cement dominated the fiber cement market in value and volume in 2021. Portland cement is the most widely used cement to make concrete and mortar. The main chemical components of Portland cement are calcium, silica, alumina, and iron. It is a reasonably priced and readily available material, making it one of the world's most widely used building materials.

Based on construction type, the market is classified into siding, roofing, molding & trim, and others. The siding segment is expected to be the largest market for fiber cement. Siding is the main application of fiber cement in residential and non-residential construction. In this application, fiber cement is applied to the exterior of the walls to protect them from the effects of extreme weather conditions. Fiber cement panels also help to increase the aesthetics of the works. Fiber cement partitions are affordable and best suited for areas with extreme weather conditions.

Based on end use, the worldwide fiber cement market is segmented into residential and non-residential. The non-residential segment is expected to be the largest in the fiber cement market. The non-residential segment includes fiber cement industrial, commercial, and agricultural buildings. Fiber cement is commonly used in industrial buildings, such as factories and warehouses, as some governments such as the UK, the US, and Canada enforce laws that prohibit the use of asbestos in these workplaces.

Recent Developments

Recent Developments

- January 2020: James Hardie Building Products Inc. introduced fiber cement with 700 ColorPlus Technology finishes to the James Hardie Dream Collection, expanding its fiber cement product portfolio to a wide range of colors.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 16,924.20 Million |

Projected Market Size in 2028 |

USD 21,291.26 Million |

CAGR Growth Rate |

3.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

James Hardie Industries PLC, Etex Group NV, Evonik Industries AG, Toray Industries Inc., Compagnie De Saint Gobain SA, CSR Limited, Nichiha Corporation, The Siam Cement Public Company Limited, Plycem Corporation, Cembrit Holding A/S. Marley Eternit Ltd., Elementia, S.A.B de C.V., Thai Olympic Fibre-cement Co. Ltd., Everest Industries Ltd., Mahaphant Fibre Cement Co. Ltd., Equitone, Allura USA, Swisspearl, Beijing Hocreboard Building Materials Co. Ltd., Fry Reglet., and others. |

Key Segment |

By Raw Material, Construction Type, End-Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia-Pacific dominated the fiber cement market in 2021

The Asia-Pacific region accounted for the largest global fiber cement market share in 2021. Factors such as the improving global economy, the growing construction industry, especially in fast-developing countries such as China and India, huge foreign investment, and growing awareness of the harmful effects of asbestos use are expected to drive the fiber cement market. In addition, stricter standards regarding using asbestos cement in residential and commercial buildings have forced builders and relevant authorities to look for alternatives. These factors, in turn, boost demand for fiber cement in the Asia-Pacific market.

Competitive Landscape

Competitive Landscape

- James Hardie Industries PLC

- Etex Group NV

- Evonik Industries AG

- Toray Industries Inc.

- Compagnie De Saint Gobain SA

- CSR Limited

- Nichiha Corporation

- The Siam Cement Public Company Limited

- Plycem Corporation

- Cembrit Holding A/S. Marley Eternit Ltd.

- Elementia

- S.A.B de C.V.

- Thai Olympic Fibre-cement Co. Ltd.

- Everest Industries Ltd.

- Mahaphant Fibre Cement Co. Ltd.

- Equitone

- Allura USA

- Swisspearl

- Beijing Hocreboard Building Materials Co. Ltd.

- Fry Reglet.

Global Fiber Cement Market is segmented as follows:

By Raw Material

By Raw Material

- Portland Cement

- Silica

- Cellulosic Fiber

- Others

By Construction Type

By Construction Type

- Siding

- Roofing

- Molding & Trim

- Others

By End-Use

By End-Use

- Residential

- Non-Residential

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- James Hardie Industries PLC

- Etex Group NV

- Evonik Industries AG

- Toray Industries Inc.

- Compagnie De Saint Gobain SA

- CSR Limited

- Nichiha Corporation

- The Siam Cement Public Company Limited

- Plycem Corporation

- Cembrit Holding A/S. Marley Eternit Ltd.

- Elementia

- S.A.B de C.V.

- Thai Olympic Fibre-cement Co. Ltd.

- Everest Industries Ltd.

- Mahaphant Fibre Cement Co. Ltd.

- Equitone

- Allura USA

- Swisspearl

- Beijing Hocreboard Building Materials Co. Ltd.

- Fry Reglet.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors