Search Market Research Report

Fertilizer Additives Market Size, Share Global Analysis Report, 2022 – 2028

Fertilizer Additives Market Size, Share, Growth Analysis Report By Form (Granular, Prilled, Powdered), By Type (Anti-caking Agents, Antifoam Agents, Dust Control Coatings, Coloring Agents, Granulation Aids, Corrosion Inhibitors, Hydrophobic Additive, Others), By Application (Urea, Diammonium Phosphate, Ammonium Nitrate, Triple Superphosphate, Monoammonium Phosphate, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

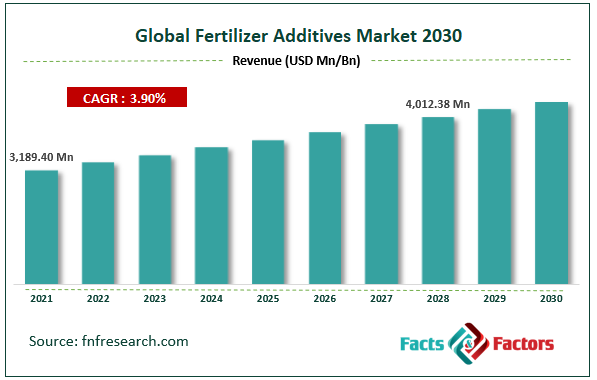

[227+ Pages Report] According to the report published by Facts Factors, the global fertilizer additives market size was worth USD 3,189.40 million in 2021 and is estimated to grow to USD 4,012.38 million by 2028, with a compound annual growth rate (CAGR) of approximately 3.90 percent over the forecast period. The report analyzes the fertilizer additives market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the fertilizer additives market.

Market Overview

Market Overview

Fertilizer additives are chemical additives incorporated into fertilizers such as urea, ammonium nitrate, calcium ammonium nitrate, and others to improve the quality and ensure the stability of the fertilizer. Furthermore, they also control the loss of nutrients in the soil and impart anti-caking & anti-foaming properties to the fertilizer. In addition, the increasing demand for key nutrients and high-quality fertilizers has also increased the demand for increased agricultural productivity. These factors are driving the demand for fertilizer additives across all regions. Additionally, the demand for fertilizer additives highly depends on fertilizer consumption in the agrochemical industry. Thus, these factors are expected to drive the global fertilizer additives market during the forecast period.

COVID-19 Impact:

COVID-19 Impact:

The fertilizer additive market is experiencing little impact due to the outbreak of the COVID-19 pandemic due to disruptions in the supply chain of various agrochemicals. According to a report by the Organization for Economic Co-operation and Development (OECD), falling consumer demand has put downward pressure on prices and the production of fertilizer additives.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global fertilizer additives market value is expected to grow at a CAGR of 3.90% over the forecast period.

- In terms of revenue, the global fertilizer additives market size was valued at around USD 3,189.40 million in 2021 and is projected to reach USD 4,012.38 million by 2028.

- The increasing demand for key nutrients and high-quality fertilizers has also led to increased demand for agricultural productivity across the globe, which are the major factors driving the market growth.

- By form, the granular category dominated the market in 2021.

- By application, the urea category dominated the market in 2021.

- Asia-Pacific dominated the global fertilizer additives market in 2021.

Growth Drivers

Growth Drivers

- Increasing demand for fertilizers is expected to drive market growth

The rising demand for fertilizers is the major factor fueling the market for fertilizer additives. Additionally, the demand for fertilizer additives is driven by increased demand for boosting agricultural yields due to the increased requirement for primary nutrients and high-quality fertilizers. Additionally, there is a growing market for fertilizer additives due to the popularity of nitrogen fertilizers. Throughout the forecast period, it is anticipated that the skyrocketing demand for fertilizers and growing fertilizer prices would significantly contribute to the global fertilizer additives market's expansion.

Restraints

Restraints

- Lack of awareness in underdeveloped countries anticipated to hinder the market growth

Lack of awareness is especially evident in less developed countries like Africa and Asia-Pacific countries such as Bangladesh, Nepal, and Bhutan. Countries with traditional agricultural methods are also the cause of the lack of understanding of fertilizer additives. Increased government attention to the losses associated with the storage and transportation of fertilizers is expected to impact the market. These factors are likely to create barriers to the growth of the global fertilizer additives market.

Opportunity

Opportunity

- An increasing population with rising disposable income presents market opportunities

The demand for crops is growing rapidly due to population growth, rising disposable income, and ongoing urbanization. These factors are key features of emerging economies such as Brazil, Russia, India, and China. These economies are also making firm commitments to address issues related to population growth. The presence of a diverse agricultural sector in these countries supports the efforts of local governments.

Segmentation Analysis

Segmentation Analysis

The global fertilizer additives market has been segmented into form, type, application, and region.

Based on form, the market is segmented into granular, prilled, and powdered. In 2021, the granular segment was the largest revenue-generating industry. Granular fertilizers look like a granule or small granules. Some properties that determine grain quality are particle size, bulk density, shape, crushing strength, fluidity, and coefficient of friction. These characteristics help farmers evaluate the quality of fertilizers. In addition, fertilizer additives are added to the tablets to protect them from the external environment and improve their shelf life.

Based on type, the market is classified into anti-caking agents, antifoam agents, dust control coatings, coloring agents, granulation aids, corrosion inhibitors, hydrophobic additives, and others. In 2021, the anti-caking agent segment was the largest revenue generator. The anti-caking agent is used as a fertilizer additive, which helps to prevent clumping during storage. Due to salt bridge formation and capillary adhesion, clumping occurs in the fertilizer during storage. Various factors lead to clumping formation in fertilizers, such as the chemical composition of fertilizer, moisture, grain structure, temperature, pressure, storage time, etc. Controlled storage, better packaging, and the addition of anti-caking agents in fertilizers are different methods to prevent clumping in fertilizers. The most effective is the addition of an anti-clotting agent. Anti-caking agents include strong surfactants, surface tension modifiers, dissociation agents, and crystal habit modifiers.

Based on application, the global fertilizer additives market is segmented into urea, diammonium phosphate, ammonium nitrate, triple superphosphate, monoammonium phosphate, and others. In 2021, the urea segment was the largest revenue generator. Urea is a naturally occurring organic compound that contains large amounts of nitrogen. It can be synthesized in the laboratory, known as synthetic urea, and is widely used worldwide as a nitrogen fertilizer. This is one of the cheap fertilizers available on the market. The production of urea is done by combining ammonia and carbon dioxide. Both granular and granular urea are commercially available. Granular urea is harder than granular urea, so less dust is generated during transportation and handling. Granulated urea is made by passing liquid urea through a fluidized bed granulation system to produce uniform-sized, hard urea granules.

Recent Developments

Recent Developments

- January 2021: Phospholutions, a Pennsylvania-based startup, has raised $10.3 million in Series A funding from venture capitalists. Phospholutions offers a fertilizer additive product called “RhizoSorb,” which can be applied with phosphates or added to phosphate fertilizers during manufacturing.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 3,189.40 Million |

Projected Market Size in 2028 |

USD 4,012.38 Million |

CAGR Growth Rate |

3.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

ArrMaz Products Inc., CHEMIPOL S.A., Clariant AG, Emulchem, KAO Corporation, LignoStar, Michelman Inc., Novochem Group, Solvay, Tolsa SA., and others. |

Key Segment |

By Form, Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia pacific dominated the fertilizer additives market in 2021

The Asia-Pacific market dominated the global fertilizer additives market in 2021. Growth in the agricultural sector in emerging economies such as China and India will drive additive demand during the forecast period. Agriculture is the main industry and a major determinant of the GDP of economies in this region, such as India, China, Bangladesh, and Sri Lanka. Population growth has reduced the amount of land available for agriculture, increasing pressure on farmers and available land. These factors have increased the demand for fertilizers, driving the additive market to grow. The agricultural industry in China has seen innovations and technological developments in recent years. Due to the population explosion, China’s amount of arable land has decreased significantly in the past two decades. This factor has increased the demand for fertilizers, driving the growth of the additives market.

Competitive Landscape

Competitive Landscape

- ArrMaz Products Inc.

- CHEMIPOL S.A.

- Clariant AG

- Emulchem

- KAO Corporation

- LignoStar

- Michelman Inc.

- Novochem Group

- Solvay

- Tolsa SA.

Global Fertilizer Additives Market is segmented as follows:

By Form

By Form

- Granular

- Prilled

- Powdered

By Type

By Type

- Anti-caking Agents

- Antifoam Agents

- Dust Control Coatings

- Coloring Agents

- Granulation Aids

- Corrosion Inhibitors

- Hydrophobic Additive

- Others

By Application

By Application

- Urea

- Diammonium Phosphate

- Ammonium Nitrate

- Triple Superphosphate

- Monoammonium Phosphate

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- ArrMaz Products Inc.

- CHEMIPOL S.A.

- Clariant AG

- Emulchem

- KAO Corporation

- LignoStar

- Michelman Inc.

- Novochem Group

- Solvay

- Tolsa SA.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors