Search Market Research Report

Electrical Conduit Market Size, Share Global Analysis Report, 2025 - 2034

Electrical Conduit Market Size, Share, Growth Analysis Report By Type (Rigid, Flexible), By Material (Metallic, Non-Metallic), By Application (Energy, Rail Infrastructure, Manufacturing Facilities, Shipbuilding & Offshore Facilities, Process Plants, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

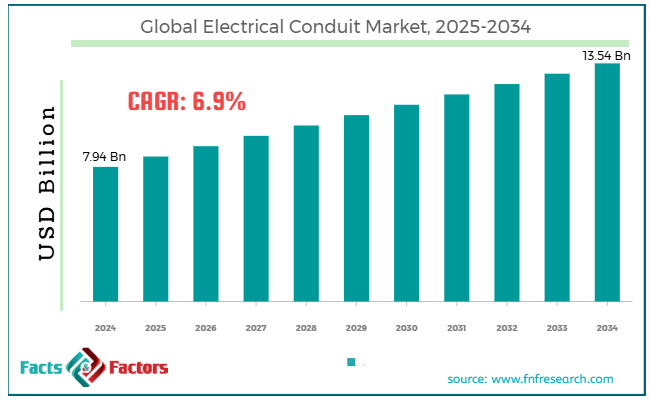

[216+ Pages Report] According to Facts & Factors, the global electrical conduit market size was worth around USD 7.94 billion in 2024 and is predicted to grow to around USD 13.54 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.9% between 2025 and 2034.

Market Overview

Market Overview

An electrical conduit is a guarding channel or tube that encases electrical cables, ensuring they are organized, safe, and secure from damage. It is made with metal or plastic and is available in diverse sizes and shapes. Conduit prevents electric shocks, offers compliance with safety protocols, and reduces the risk of fires. The major drivers of the global electrical conduit market include rising construction activities, stringent electrical safety rules, and technological improvements in manufacturing processes and materials. The rise of the construction industry, primarily commercial, residential, and industrial buildings, fuels the demand for the best quality electrical conduits. With the growing number of infrastructures and buildings, efficient wiring protection solutions are paramount.

Moreover, regulatory bodies and governments enforce electrical safety regulations and codes for commercial and residential installations. These rules are vital for lowering electrical risks, thus fueling the demand for electrical conduits. Furthermore, with the modernization of manufacturing processes and materials, conduits are manufactured to be more flexible, durable, and easy to install. Improvements in fiberglass-like materials, which provide optimal resistance to corrosion, and the emergence of flexible conduits are driving the industry's growth

Nonetheless, the global market is projected to be hampered by the availability of alternatives and variations in the prices of raw materials. Substitutes like open wire or cable trays may be considered cost-efficient and easy to install, particularly in areas where electrical conduit is not required or not regulated. This refrains from using electrical conduits in certain regions. In addition, the cost of materials needed to manufacture conduits is subject to variation. This may result in price fluctuations in the industry, impacting buyers and manufacturers.

Still, the market will progress substantially owing to the IoT integration, the growth of smart cities, and the rise in renewable energy projects. The growth of smart cities and the demand for improved electrical wiring to back IoT devices offer key opportunities for the global market.

Since these cities depend on interconnected systems, superior quality conduits are vital to safeguard these complicated wiring systems. Also, the growing shift towards renewable energy sources is elevating the need for these conduits to protect wind turbines, solar panels, and more wiring systems.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global electrical conduit market is estimated to grow annually at a CAGR of around 6.9% over the forecast period (2025-2034)

- In terms of revenue, the global electrical conduit market size was valued at around USD 7.94 billion in 2024 and is projected to reach USD 13.54 billion by 2034.

- The electrical conduit market is projected to grow significantly owing to increasing construction activities globally, growing urbanization and industrialization, and surging demand for electric safety ethics in infrastructure.

- Based on type, the rigid segment is expected to lead the market, while the flexible segment is expected to register considerable growth.

- Based on material, the metallic segment is the dominating segment among others, while the non-metallic segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the energy segment is expected to lead the market as compared to the manufacturing facilities segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Growth Drivers

Growth Drivers

- Will the manufacturing expansion and industrial growth drive the electrical conduit market growth?

The growth of industries like oil and gas, manufacturing, automotive, and chemicals has surged the demand for electrical conduits. Industries need strong electrical systems for safer operations, mainly in places where electric risks are high.

Electrical conduits are key in protecting and organizing wiring systems in extensive industrial environments.

In 2023, global industrial facilities were accountable for more than 30% of electrical conduit installations. With manufacturing growth in regions like Europe, North America, and the Asia Pacific, there is a rising demand for these systems that can safeguard electrical systems in extreme weather and industrial conditions.

- Regulatory and Safety Compliance remarkably fuels the market growth

With the rising fire risks and electrical hazards, regulatory bodies and governments on a global scale impose stringent safety standards and electrical codes. Electrical conduits offer the best electrical protection, thus lowering the risk of fire, electrical shock, and other hazards. The demand for conduits is linked to the demand for compliance with these rules.

The European Union launched revised regulations for building materials in 2024. This comprised wiring protection for the mandatory installation of electrical conduits in new constructions and large renovation plans. This regulatory inclination has fueled the demand in Europe, mainly for metal conduits like aluminum and steel, offering durability and improved fire resistance.

Restraints

Restraints

- Do the high costs and complexity of retrofitting in present buildings negatively impact the progress of the electrical conduit market?

Retrofitting electrical conduit systems in older construction can be time-consuming and costly. Most older constructions are not built to fit modern conduit systems, and alterations may demand significant changes to ceilings, walls, and floors. This may increase the cost of retrofitting projects, mainly for renovation projects with tight budgets and time constraints.

In the United Kingdom, the Retrofit Academy has identified electrical retrofitting in heritage buildings, where electrical systems must comply with modern standards, presenting significant challenges. The need for compliance may raise the expenses of renovations and time, therefore deterring homeowners and developers from adopting conduit systems.

Opportunities

Opportunities

- How will growth in IoT applications and smart grid positively affect the electrical conduit market growth?

Adopting IoT and smart grids in electrical conduits offers a key opportunity for the global electrical conduit market. Smart grids need a system of meters, sensors, and communication systems that should essentially be protected and securely encased. Electrical conduits are essential in safeguarding and organizing these systems. This demands flexible and advanced conduit systems that can tolerate harsh conditions.

Schneider Electric introduced a novel range of smart grid systems to assist utilities in distributing and managing electricity more effectively. These solutions depend on improved electrical conduit solutions to cover the rising number of communication cables and sensors in smart grid infrastructure.

Challenges

Challenges

- Disturbances in the supply chain restrict the growth of the electrical conduit market

The electrical conduit industry is vulnerable to disruptions in the supply chain that can affect manufacturing schedules, raw material availability, and distribution networks. Global calamities, like natural disasters, COVID-19, and geopolitical stresses, may cause key delays in the delivery and procurement of conduit products.

The existing trade stresses between China and the United States have resulted in supply chain disturbances. Trade and other associated restrictions have resulted in high import costs of raw materials and finished products.

COVID-19 caused disruptions in the global supply chain, resulting in delays in the delivery of raw materials. These delays and labor scarcity contribute to a 20% rise in conduit delivery times.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 7.94 Billion |

Projected Market Size in 2034 |

USD 13.54 Billion |

CAGR Growth Rate |

6.9% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Emtelle, Atkore International, Schneider Electric, Southwire, Carlon (a brand of ABB), Amico, Franklin Electric, Polypipe, General Electric (GE), Cantex, Pipelife, FLEXA (a part of the ABB Group), Legrand, Hawke International, Wheatland Tube, and others. |

Key Segment |

By Type, By Material, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global electrical conduit market is segmented based on type, material, application, and region.

Based on type, the global electrical conduit industry is divided into rigid and flexible. The rigid conduits segment registered a maximum market share, especially in industrial, commercial, and risky environments, where protection against mechanical stress, electrical risks, and extreme conditions is a priority. Rigid conduits, such as materials like aluminum, steel, and PVC, offer better mechanical strength, thus increasing their suitability for extreme environments where cables should be completely protected.

Metal conduits offer optimal fire resistance, which is crucial in commercial and industrial buildings that need compliance with safety codes. These conduits are typically used in applications such as oil and gas factories, power plants, manufacturing plants, and other infrastructure where durability and safety are crucial.

Based on material, the global electrical conduit industry is segmented into metallic and non-metallic. The metallic segment registered a substantial market share in the previous years and is expected to progress considerably in the future. The key growth factors of the segment comprise strength and durability, fire resistance, and corrosion resistance. Metal conduits, mainly made with aluminum and steel, offer excellent impact resistance and mechanical strength. This makes them suitable for safeguarding electrical cables in extreme environments. Conduits offer optimal fire resistance, made with stainless steel and galvanized steel, vital for diverse significant industries.

Additionally, materials like aluminum and stainless steel are highly corrosion-resistant, enhancing their suitability for installations in environments with chemical exposure, as well as in humid or moist conditions.

Based on application, the global market is segmented as energy, rail infrastructure, manufacturing facilities, shipbuilding & offshore facilities, process plants, and others. The energy segment registered a notable market share due to the need for reliable electric infrastructure in transmission, power generation, and distribution systems.

Electrical conduits are broadly used in nuclear, thermal, and hydroelectric power plants, where durability and safety are essential. The growth of renewable energy sources has increased the demand for these conduit systems to promise safe electrical transmission from wind turbines and solar panels to grid systems. Offshore oil and gas platforms need dedicated electrical conduit systems for better integrity and safety of electric systems exposed to corrosive and harsh surroundings.

Regional Analysis

Regional Analysis

- What factors will help North America to witness significant growth in the electrical conduit market over the forecast period?

North America is the leading region in revenue and market share, owing to factors like strong infrastructure and industrial development, energy sector expansion, and innovations in smart building projects. North America, especially the United States, has the most developed commercial and industrial sectors worldwide, which demand quality electrical systems. The region is home to several manufacturing plants, energy facilities, commercial buildings, and construction projects that depend on electrical conduits.

The region's energy industry, like transmission, power generation, and renewable energy, is a leading driver of the global electrical conduit market. North America also leads in smart building solutions, where electrical conduits are vital to support improved wiring systems, thus propelling regional growth.

Asia Pacific progresses as the second-leading region in the global electrical conduit market owing to factors like speedy urbanization and industrialization, construction and infrastructure boom, and supportive government initiatives. The key nations of APAC, like India and China, are witnessing speedy industrialization, leading to elevated demand for electrical systems in manufacturing plants, factories, and industrial facilities.

Electrical conduits are vital components for the management and safety of electrical cables. The Asia Pacific is also experiencing significant construction growth, with economies such as India, China, and Vietnam actively investing in various infrastructure projects. In addition, governments in the region are adopting stringent building codes, electrical standards, and safety rules to enhance the safety and quality of electrical systems, thus propelling the demand for conduits.

Competitive Analysis

Competitive Analysis

The global electrical conduit market is led by players like:

- Emtelle

- Atkore International

- Schneider Electric

- Southwire

- Carlon (a brand of ABB)

- Amico

- Franklin Electric

- Polypipe

- General Electric (GE)

- Cantex

- Pipelife

- FLEXA (a part of the ABB Group)

- Legrand

- Hawke International

- Wheatland Tube

Key Market Trends

Key Market Trends

- Focus on Corrosion-Resistant Materials and Sustainability:

There is a surging preference for non-metallic conduits like HDPE and PVC for their lightweight, corrosion-resistance, and sustainability, mainly in regions with coastal environments and high humidity.

- Technological improvements in conduit design:

The emergence of modular and flexible conduit systems is aiding easy maintenance and faster installations, fueled by the growing need for more adaptable electrical systems and automation in residential projects and industries.

The global electrical conduit market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Rigid

- Flexible

By Material Segment Analysis

By Material Segment Analysis

- Metallic

- Non-Metallic

By Application Segment Analysis

By Application Segment Analysis

- Energy

- Rail Infrastructure

- Manufacturing Facilities

- Shipbuilding & Offshore Facilities

- Process Plants

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Emtelle

- Atkore International

- Schneider Electric

- Southwire

- Carlon (a brand of ABB)

- Amico

- Franklin Electric

- Polypipe

- General Electric (GE)

- Cantex

- Pipelife

- FLEXA (a part of the ABB Group)

- Legrand

- Hawke International

- Wheatland Tube

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors