Search Market Research Report

Electric Vehicle Supply Equipment (EVSE) Market Size, Share Global Analysis Report, 2024 – 2032

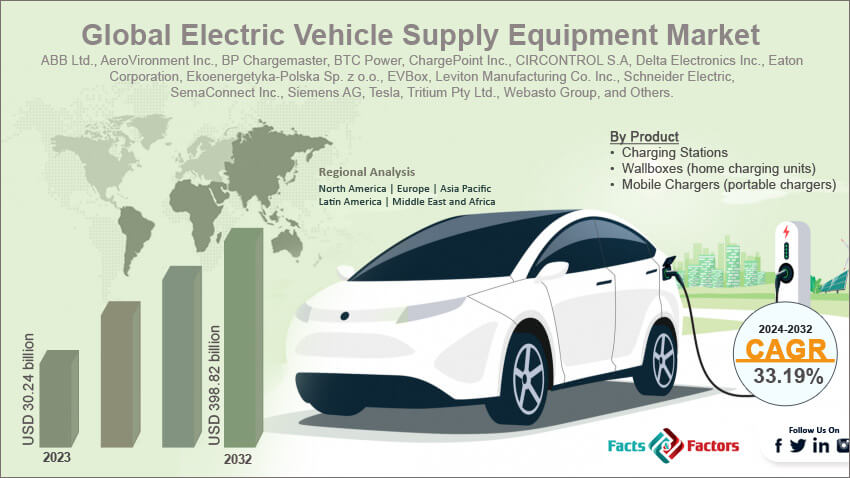

Electric Vehicle Supply Equipment (EVSE) Market Size, Share, Growth Analysis Report By Power Type (AC Power [Level 1, Level 2, Level 3], DC Power), By Product (Charging Stations, Wallboxes, Mobile Chargers), By Application (Public Charging, Private Charging), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

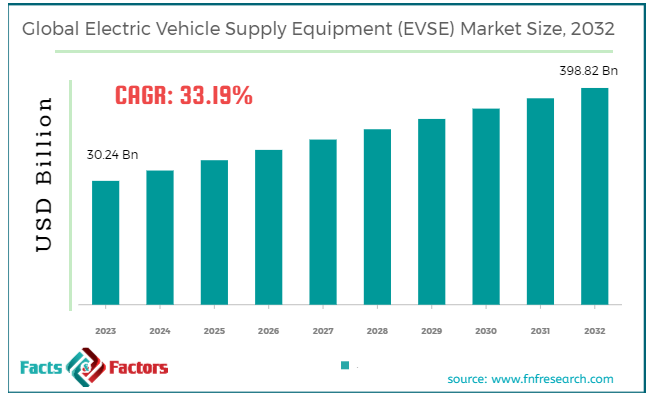

[222+ Pages Report] According to Facts & Factors, the global electric vehicle supply equipment market size in terms of revenue was valued at around USD 30.24 billion in 2023 and is expected to reach a value of USD 398.82 billion by 2032, growing at a CAGR of roughly 33.19% from 2024 to 2032. The global electric vehicle supply equipment market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Electric Vehicle Supply Equipment (EVSE) refers to the hardware required to deliver electrical energy from an electricity source to charge electric vehicles (EVs). Commonly known as EV charging stations or electric vehicle chargers, EVSE is an essential component of the infrastructure supporting the adoption and use of electric vehicles. Key Components of EVSE are Charging Station, Power Output & Connectors and Plugs. Charging Station is the physical unit provided at the location where electricity is transferred to the EV. It includes various safety and communication measures to ensure efficient and secure charging.

EVSE units vary in terms of the speed of charging they offer, which is defined by their power output. This can range from Level 1 charging (standard 120V household outlet) providing slow charging, to Level 2 charging (240V outlet similar to those used for heavy appliances) which offers faster charging, up to Level 3 or DC fast charging, providing extremely rapid charging at high voltages and currents.

Different types of EVSEs use different connectors. The most common in the U.S. are the SAE J1772 for AC charging and the Combined Charging System (CCS) for DC fast charging. Other types include CHAdeMO (common in Japan) and Tesla’s proprietary connector.

EVSE safely communicates the electricity from the power grid to the vehicle, ensuring that the correct charging current is supplied and that there are no faults or risks during the connection. It also allows for communication between the vehicle and the charging station to verify compatibility and safety.

EVSE includes several safety features to protect both the user and the electrical grid. These include ground fault protection, which protects against electric shock, and connectivity verification before the flow of electricity is allowed.

Electric vehicle supply equipment is a pivotal part of the ecosystem for electric vehicles, ensuring that vehicles are charged safely, efficiently, and swiftly. As the adoption of electric vehicles grows, the development and deployment of EVSE will be crucial for providing the necessary infrastructure to support this transition.

Key Highlights

Key Highlights

- The electric vehicle supply equipment market has registered a CAGR of 33.19% during the forecast period.

- In terms of revenue, the global electric vehicle supply equipment market was estimated at roughly USD 30.24 billion in 2023 and is predicted to attain a value of USD 398.82 billion by 2032.

- The growth of the electric vehicle supply equipment market is being propelled by increasing adoption of Electric Vehicles (EVs), government incentives and supportive policies and innovations in charging technologies.

- On the basis of Power Type, the AC power segment is growing at a high rate and is projected to dominate the global market.

- Based on the Product, the charging stations segment is projected to swipe the largest market share.

- Based on the Application, the public charging segment is experiencing rapid growth due to government investments and private sector initiatives.

- By region, Asia-Pacific is poised to overtake other regions in terms of growth rate due to aggressive expansion policies by governments, especially in China and India, aimed at curbing pollution.

To know more about this report | Request Free Sample Copy Key Growth Drivers:

- Increasing Adoption of Electric Vehicles (EVs): The global surge in EV purchases due to environmental concerns, improvement in EV infrastructure, and supportive government policies significantly boost the demand for EVSE.

- Technological Advancements: Innovations in fast charging technologies and the integration of smart and connected features in charging equipment enhance user convenience and efficiency, propelling market growth.

- Government Incentives and Regulations: Many governments worldwide offer financial incentives for EVSE installations and have imposed regulations mandating the installation of EV charging stations, driving their deployment.

Key Restraints:

Key Restraints:

- High Initial Investment and Installation Costs: The cost associated with purchasing and installing EVSE can be prohibitive for new users and businesses, which may slow market expansion.

- Grid Infrastructure Challenges: Inadequate electrical grid capacity to support high-volume, fast-charging stations can restrict the deployment of advanced EVSE systems.

Opportunities:

Opportunities:

- Rising Demand for Fast Charging Stations: As EV technology evolves, there is a growing consumer preference for fast charging, which offers significant market opportunities for new and existing players to innovate and scale up.

- Expansion in Emerging Markets: Developing countries are increasingly focusing on reducing vehicle emissions. As these regions invest in EV infrastructure, there is considerable potential for market expansion.

- Integration with Renewable Energy Sources: Integrating EVSE with solar or wind installations to create greener charging solutions presents new business models and opportunities for sustainable growth.

Challenges:

Challenges:

- Technological Compatibility and Standardization: The lack of standardized connectors and charging protocols can complicate the infrastructure and limit the universal use of EVSE across different EV brands.

- Cybersecurity Concerns: As EVSEs become more connected, the risk of cyber-attacks increases, necessitating robust cybersecurity measures which can be costly and complex to implement.

Overall, the EVSE market is poised for significant growth driven by the global shift towards electric vehicles and sustainable energy solutions. However, addressing the high costs and technological challenges will be crucial for realizing the full potential of this burgeoning market.

Electric Vehicle Supply Equipment (EVSE) Market: Segmentation Analysis

Electric Vehicle Supply Equipment (EVSE) Market: Segmentation Analysis

The global electric vehicle supply equipment market is segmented based on power type, product, application and region.

By Power Type Insights

By Power Type Insights

Based on Power Type, the global electric vehicle supply equipment market is bifurcated into AC power, DC power. AC chargers are the predominant type and come in different power levels, including Levels 1, Level 2, and Level 3. They are commonly used for residential and commercial charging because of their cost-effectiveness and straightforward installation process. Level 1 charging is the slowest method and is frequently used at home overnight. Level 2 charging is characterized by a higher charging speed, making it well-suited for business environments.

On the other hand, Level 3 charging offers the quickest charging speed and is particularly suitable for public charging stations. The extensive adoption of AC Power is likely to dominate the overall market due to its reduced installation costs and compatibility with most electric vehicles (EVs). DC chargers deliver direct current directly to the EV battery, enabling much faster charging times. They are primarily used in public charging stations for long-distance travel.

By Product Insights

By Product Insights

Based on Product, the global electric vehicle supply equipment market is categorized into charging stations, wallboxes (home charging units), and mobile chargers (portable chargers). Charging stations are complete units with integrated chargers, user interfaces, and safety features. They are ideal for public locations and workplaces. Wallboxes are mounted on walls for convenient home charging. They come in various power levels (AC Levels 1 & 2) and are becoming increasingly popular. Charging stations are the go-to option for public and commercial locations, but wallboxes are gaining traction for home charging due to their convenience and growing power capabilities.

By Application Insights

By Application Insights

Based on Application, the global electric vehicle supply equipment market is categorized into public charging and private charging. Public charging infrastructure is crucial for widespread EV adoption, allowing drivers to charge on the go. Governments and private companies are heavily investing in this segment. Private charging includes home and workplace charging stations. This segment is expected to grow significantly as EV ownership increases.

Recent Developments

Recent Developments

- May 2023: TurnOnGreen, a provider of EV charging solutions, expanded its network by installing charging stations at 18 hotels across North America. These stations use high-power, networked chargers and offer convenient activation methods via app, RFID cards, or QR code. This caters to the growing demand for EV charging options, especially for travelers.

- May 2023: EnergyHub, a DERMS (distributed energy resource management systems) specialist, partnered with Emporia, a smart home energy management company. This collaboration aims to develop faster and more affordable EV charging technology compatible with various EV models. This benefits both consumers with wider options and utilities with grid stability and cost savings for customers.

- February 2023: EverCharge, a manufacturer of large-scale EV charging equipment, launched a comprehensive suite of services. This includes cost analysis, deployment assistance, and maintenance for their charging systems. This one-stop shop approach simplifies the process for customers, eliminating the need to cobble together services from different providers and ensuring seamless data integration.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 30.24 Billion |

Projected Market Size in 2032 |

USD 398.82 Billion |

CAGR Growth Rate |

33.19% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

ABB Ltd., AeroVironment Inc., BP Chargemaster, BTC Power, ChargePoint Inc., CIRCONTROL S.A, Delta Electronics Inc., Eaton Corporation, Ekoenergetyka-Polska Sp. z o.o., EVBox, Leviton Manufacturing Co. Inc., Schneider Electric, SemaConnect Inc., Siemens AG, Tesla, Tritium Pty Ltd., Webasto Group, and Others. |

Key Segment |

Power Type, By Product, By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Electric Vehicle Supply Equipment (EVSE) Market: Regional Analysis

Electric Vehicle Supply Equipment (EVSE) Market: Regional Analysis

The Electric Vehicle Supply Equipment (EVSE) market has seen significant growth across various regions, fueled by the accelerating adoption of electric vehicles (EVs). The market dynamics and growth rates vary from one region to another based on factors such as government policies, infrastructure development, and consumer preferences. Here's a regional analysis highlighting the key areas:

- The Asia-Pacific region is expected to exhibit the fastest growth in the EVSE market, particularly in China, Japan, South Korea, and India. The growth in this region is propelled by substantial government initiatives in terms of both incentives and regulation, a rapidly expanding base of EV manufacturers, and increasing environmental awareness among consumers. China leads the market in Asia-Pacific, thanks to its massive manufacturing capabilities, government support for EV technologies, and the presence of a large number of EV users.

- North America, particularly the United States and Canada, is a leading market for EVSE. This is driven by robust governmental support, including incentives for EV purchases and infrastructure development, stringent environmental regulations, and a high level of consumer awareness and acceptance. The region benefits from well-established manufacturers, a growing network of public charging stations, and significant investments from both private and public sectors.

- Europe is another strong player in the EVSE market, with countries like Norway, Germany, Sweden, and the Netherlands leading in EV adoption. The European market is supported by comprehensive government policies that promote EVs through subsidies and mandates for charging infrastructure, as well as ambitious carbon emission reduction targets. Strong regulatory support and high consumer readiness are pivotal. The integration of EV charging stations with renewable energy sources is also more pronounced in Europe.

- Markets in the Middle East, Africa, and Latin America are in the nascent stages compared to the above regions. However, these regions are gradually adopting EV technologies with the introduction of government policies aimed at reducing vehicle emissions. Although growth is slower, increasing oil prices and the introduction of strict environmental laws are expected to drive the adoption of EVSE in these areas.

Electric Vehicle Supply Equipment (EVSE) Market: Competitive Landscape

Electric Vehicle Supply Equipment (EVSE) Market: Competitive Landscape

Some of the main competitors dominating the global electric vehicle supply equipment market include;

- ABB Ltd.

- AeroVironment Inc.

- BP Chargemaster

- BTC Power

- ChargePoint, Inc.

- CIRCONTROL S.A

- Delta Electronics, Inc.

- Eaton Corporation

- Ekoenergetyka-Polska Sp. z o.o.

- EVBox

- Leviton Manufacturing Co., Inc.

- Schneider Electric

- SemaConnect, Inc.

- Siemens AG

- Tesla

- Tritium Pty Ltd.

- Webasto Group

The global electric vehicle supply equipment market is segmented as follows:

By Power Type

By Power Type

- AC Power

- Level 1

- Level 2

- Level 3

- DC Power

By Product

By Product

- Charging Stations

- Wallboxes (home charging units)

- Mobile Chargers (portable chargers)

By Application

By Application

- Public Charging

Private Charging

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- ABB Ltd.

- AeroVironment Inc.

- BP Chargemaster

- BTC Power

- ChargePoint, Inc.

- CIRCONTROL S.A

- Delta Electronics, Inc.

- Eaton Corporation

- Ekoenergetyka-Polska Sp. z o.o.

- EVBox

- Leviton Manufacturing Co., Inc.

- Schneider Electric

- SemaConnect, Inc.

- Siemens AG

- Tesla

- Tritium Pty Ltd.

- Webasto Group

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors