Search Market Research Report

Donor Egg IVF Services Market Size, Share Global Analysis Report, 2022 – 2028

Donor Egg IVF Services Market Size, Share, Growth Analysis Report By Cycle Type (Fresh Donor Egg Cycle and Frozen Donor Egg Cycle), By End User (Direct / Patient, Hospitals, Fertility Clinics & IVF Centers), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

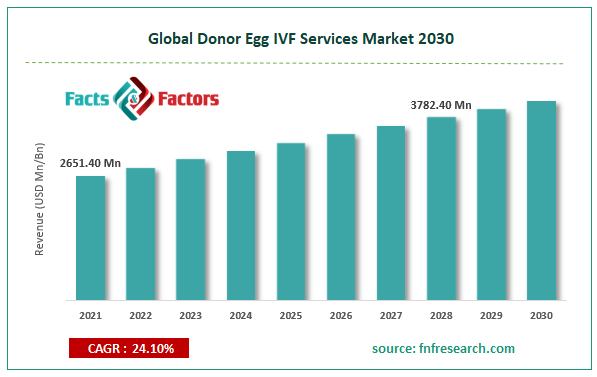

[211+ Pages Report] According to Facts and Factors, the global donor egg IVF services market size was worth USD 2651.40 million in 2021 and is estimated to grow to USD 3782.40 million by 2028, with a compound annual growth rate (CAGR) of approximately 24.10% over the forecast period. The report analyzes the donor egg IVF services market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the donor egg IVF services market.

Market Overview

Market Overview

A woman who is often younger donates her eggs to another person or partner for reproduction so that the recipient of the eggs can have a child. In vitro fertilization (IVF) involves combining sperm and egg outside the body. The procedure is carried out in a lab, where an egg (also known as an ova or an ovum) is removed from the woman's ovaries and allowed to be fertilized by sperm in a liquid medium. Following egg fertilization, the embryo is cultured for 2–6 days before being successfully placed in the uterus of the same or a different mother. IVF with donor eggs has become the best fertility treatment option for assisting infertile couples in conceiving a child with a high success rate. Couples seeking assistance for infertility treatments depend on fertility clinics and specialty hospitals to provide IVF therapies. Due to an increase in the rate of infertility, a rise in the trend of delayed pregnancies, a surge in the success rate of IVF, and an increase in disposable income globally, it is anticipated that the global market for donor egg IVF services will experience significant market growth during the forecast period. The market's expansion is hampered by the high cost of IVF therapy, its complications, and the low awareness about IVF in some developing nations. On the other hand, during the projected period, it is anticipated that a rise in fertility tourism, an increase in the number of fertility clinics, and growth prospects in emerging markets will facilitate market expansion.

COVID-19 Impact:

COVID-19 Impact:

Lockdowns imposed worldwide in response to the COVID-19 epidemic have somewhat constrained several IVF submarkets. The well-being of patients, employees, and society at large is prioritized in many hospitals. The advice and recommendations from various sources, including ASRM (American Society of Reproductive Medicine) 2020, have created a confused image of the impact of COVID-19 on fertility treatments. Until the pandemic crisis is resolved and life returns to normal, some ladies have delayed their IVF consultations, while others have postponed their embryo transfer dates. The explanations included delaying the start of new therapies, switching to an alternative freeze-all strategy when couples have already experienced hCG triggering and considering gamete cryopreservation in urgent fertility preservation cases. The COVID-19 pandemic is thus anticipated to have a significant impact on the development of the industry under consideration.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global donor egg IVF services market value is expected to grow at a CAGR of 24.10% over the forecast period.

- In terms of revenue, the global donor egg IVF services market size was valued at around USD 2651.40 million in 2021 and is projected to reach USD 3782.40 million by 2028.

- Due to an increase in the rate of infertility, a rise in the trend of delayed pregnancies, a surge in the success rate of IVF, and an increase in disposable income globally, it is anticipated that the global market for donor egg IVF services will experience significant market growth during the forecast period.

- By end user, the fertility clinical sector dominated the market in 2021.

- By cycle type, the frozen donor eggs category dominated the market in 2021.

- North America dominated the donor egg IVF services market in 2021.

Growth Drivers

Growth Drivers

- Rising PCOS cases likely to drive the market growth

Over the past few years, there has been a significant increase in polycystic ovary syndrome instances. It is among the leading causes of female infertility worldwide. One of the most popular therapies for women with PCOS is egg donor IVF. The method aids infertile couples in conceiving offspring. People with PCOS choose this approach because of its increased success rate. During the projected period, it is anticipated that the global rise in PCOS instances will hasten the expansion of the global donor egg IVF services market.

Restraints

Restraints

- Limitations on three-parent IVF procedures may hinder the market growth

Three-parent IVF procedures are no longer permitted in the United States due to safety concerns for mothers and embryos. The global market for in vitro fertilization is impacted by this aspect. Restrictions on three-parent IVF treatments have resulted from other significant issues with IVF treatment, such as multiple pregnancies and birth abnormalities.

Segmentation Analysis

Segmentation Analysis

The donor egg IVF services market is segregated based on cycle type, end user, and region.

The market is divided into fresh and frozen donor egg cycles based on the cycle type. In 2021, The market's highest share was held by frozen donor eggs, and this trend is anticipated to last during the projection period. These eggs have already been taken from screened donors and are prepared for transportation, thawing, and usage. Additionally, the process is far more affordable because the recipient does not have to cover the donor's travel costs. These elements will guarantee the segment's consistent growth. Having access to donors, receiving a sizable payment, and people being more aware of these services are a few other high-impact rendering factors.

Based on end-user, the market is divided into direct/patient, hospitals, and fertility clinics & IVF centers. The fertility clinic sector dominated the market for donor egg IVF services in terms of revenue in 2021, and it's expected that this trend will continue during the forecast period. The demand for ART treatments is increasing, which has led to a significant increase in the number of fertility clinics and ART facilities. Licensed fertility clinics provide counseling services to singles and couples experiencing trouble getting pregnant. IVF treatments are planned by doctors and professionals based on the severity of the patient's issues. Modern tools, including non-invasive Radio Frequency Identification (RFID) tagging and micromanipulation, are available at fertility clinics. This aspect is also anticipated throughout the projection period to fuel category growth.

Recent Developments

Recent Developments

- February 2021: To advance innovation, digitization, and infertility treatment, Virtus Health, a major global supplier of assisted reproductive services, and CooperSurgical, a pioneer in women's healthcare solutions, have established a multi-year strategic alliance.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2651.40 Million |

Projected Market Size in 2028 |

USD 3782.40 Million |

CAGR Growth Rate |

24.10% |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

California Cryobank, ConceiveAbilities, Center for Human Reproduction, Growing Generations LLC, Cryos International, Fairfax EggBank, The World Egg Bank, Global Donor Egg Bank, New Life Ukraine, First Egg Bank, MyEggBank, Ovobank, and Others |

Key Segment |

By Cycle Type ,End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the donor egg IVF services market in 2021

The global donor egg IVF services market is divided into geographic regions: North America, Latin America, Europe, Asia Pacific, Middle East, and Africa. North America is predicted to rule the global donor egg IVF services market in 2021 due to healthcare institutions' increasing usage of cutting-edge technology. The expanding trend of delaying parenthood among younger generations, the rise in infertility due to unhealthy lifestyles, and the high success rate of the procedure are some of the major market drivers. In addition to receiving cash for their gift, egg donors in the U.S. also have the option of negotiating the amount of their payout based on how in demand their eggs are. Due to the rise in the occurrence of infertility, the trend of delayed pregnancies, the spike in the success rate of IVF, and the rise in disposable incomes in the Asia-Pacific region, the market is predicted to experience considerable expansion

Competitive Landscape

Competitive Landscape

- California Cryobank

- Conceive Abilities

- Center for Human Reproduction

- Growing Generations LLC

- Cryos International

- Fairfax Egg Bank

- The World Egg Bank

- Global Donor Egg Bank

- New Life Ukraine

- First Egg Bank

- My Egg Bank

- Ovobank .

Global Donor Egg IVF Services Market is segmented as follows:

By cycle type:

By cycle type:

- Fresh Donor Egg Cycle

- Frozen Donor Egg Cycle

By end user:

By end user:

- Direct / Patient

- Hospitals

- Fertility Clinics & IVF Centers

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- California Cryobank

- Conceive Abilities

- Center for Human Reproduction

- Growing Generations LLC

- Cryos International

- Fairfax Egg Bank

- The World Egg Bank

- Global Donor Egg Bank

- New Life Ukraine

- First Egg Bank

- My Egg Bank

- Ovobank

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors