Search Market Research Report

Cell Based Assays Market Size, Share Global Analysis Report, 2025 - 2034

Cell Based Assays Market Size, Share, Growth Analysis Report By Products & Services (Reagents, Assay Kits, Microplates, Probes & Labels, Instruments & Software, Cell Lines), By Application (Basic Research, Drug Discovery, and Others), By End Use (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations [CROs]), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

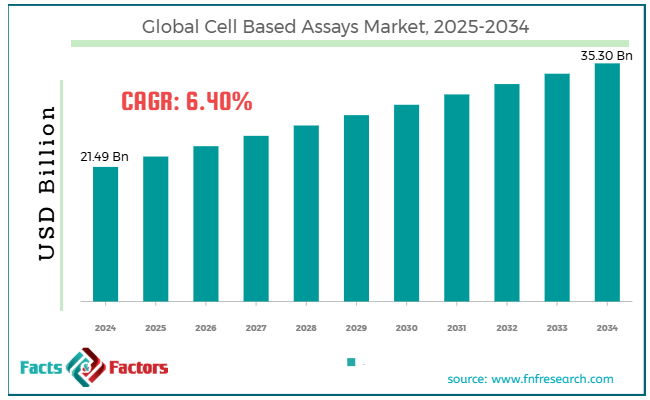

[218+ Pages Report] According to Facts & Factors, the global cell based assays market size was worth around USD 21.49 billion in 2024 and is predicted to grow to around USD 35.30 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.40% between 2025 and 2034.

Market Overview

Market Overview

Cell-based assays are laboratory methods to study the reactions of living cells to different stimuli, including chemicals, drugs, and genetic alterations. These assays offer a more physiologically related model than biochemical assays, as they study complicated cellular processes like cell proliferation, signal transduction, cytotoxicity, and apoptosis. The global cell based assays market is expected to grow substantially over the coming years owing to improvements in cell culture technologies, the growing demand for drug development and discovery, and mounting cases of infectious and chronic illnesses. The development of 3D cell cultures, induced pluripotent stem cells, and organ-on-chip systems has notably enhanced the physiological significance of assays. These platforms imitate in vivo conditions more precisely than conventional 2D cultures, which improves predictive accuracy for drug toxicity and efficacy.

Moreover, pharmaceutical companies are forced to simplify drug pipelines. Biological assays provide early insights into pharmacokinetics and pharmacodynamics, thereby lowering the risk of speeding up and late-stage failures in decision-making.

In addition, diseases like cardiovascular illnesses, diabetes, cancer, and rising viral infections like coronavirus are increasing the significance and demand for novel therapies. Cell-based assays aid in screening compounds that may point to illness mechanisms at a cellular level.

However, the global market is constrained by the significant cost of machinery and advanced assays, the intricacy of biological systems, and regulatory and ethical challenges. Solutions like automated platforms and high-content imaging may prevent smaller institutions or laboratories from adopting them. Furthermore, the most modernized automated assays lack complete replication of human biology, thus resulting in translational barriers in clinical results and in vitro outcomes. Using specific cell forms like human primary cells and stem cells is highly controlled, and passing ethical concerns could be challenging in a few economies.

Yet, the cell-based assays market is opportune for the emergence of organs-on-chip and organoid technologies, the integration of AI, and the development of tailored assay services. The miniaturized biological systems carefully imitate human organ functions, offering next-generation toxicity examination and drug screening platforms. ML and AI are widely used to study assay data, enhancing drug repositioning, pattern recognition, and result prediction. Besides, CROs also offer execution services and modified assay design, thus offering fresh avenues for biotechnology companies with fewer in-house R&D competencies.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global cell based assays market is estimated to grow annually at a CAGR of around 6.40% over the forecast period (2025-2034)

- In terms of revenue, the global cell based assays market size was valued at around USD 21.49 billion in 2024 and is projected to reach USD 35.30 billion by 2034.

- The cell based assays market is projected to grow significantly owing to the increasing demand for drug development and discovery, rising incidences of chronic illnesses, and surging investments from private enterprises and governments.

- Based on products & services, the assay kits segment is expected to lead the market, while the reagents segment is expected to grow considerably.

- Based on application, the drug discovery segment is the dominating segment among others, while the basic research segment is projected to witness sizeable revenue over the forecast period.

- Based on end-use, the pharmaceutical & biotechnology companies segment is expected to lead the market as compared to the contract research organizations (CROs) segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Growth Drivers

Growth Drivers

- Technological improvements in assay platforms to drive the global market growth

The recent cell-based assay platforms are progressively high-content, automated, and incorporated with AI analytics. These solutions enable quantitative imaging and multi-parametric readouts, which enhance decision-making. Some examples include HCS systems or High-Content Screening, like Thermo Fisher’s CellInsightTM.

In addition, incorporating AI image analysis technologies to comprehend complex phenotypic responses is yet another example, impacting the growth of the cell based assays market.

Businesses increasingly adopting AI-based platforms and HCS state that they experience nearly 40% amplified assay optimization and around 50% cost reduction in screening stages.

- Will the rising emphasis on personalized medicine spur the cell based assays market growth?

The pressure for personalized therapies in immunology, oncology, and rare genetic diseases needs tools to examine patient-specific drug reactions. Cell-based assays, mainly the ones using PDCs, are a vital foundation of this method.

Lately, Roche has heavily invested in using cell-based assays with PDCs for their individualized oncology pipeline.

Moreover, CAR-T therapy designers use T cell-based functional assays to examine immune response and cytotoxicity prior to the administration of the therapy.

The worldwide personalized medicine industry is anticipated to surpass USD 800 billion in the coming 3 years, and cell-based assays are fundamental to this domain.

Restraints

Restraints

- High machinery and operational costs restrain the market progress

Cell-based assays, including advanced solutions such as high-throughput screening, high-content screening, and 3D cell culture, offer key benefits in drug discovery. Nonetheless, these expensive solutions may disallow smaller businesses from using them.

Recently, Thermo Fisher Scientific introduced an ‘Automated High-Content Screening Device for drug discovery, which decreases costs by enhancing throughput. Nevertheless, the price for these devices still surpasses $1,00,000, which may restrict their adoption by small laboratories.

Research indicates that 3D cell culture assays, although providing more costly biological models, require well-developed instruments that are up to 15 times more expensive than conventional 2D assays.

Opportunities

Opportunities

- How does the rise of Organ-on-a-Chip (OoC) platforms contribute to the cell based assays market progress?

Organ-on-chip devices are microfluidic chips ruled with living human cells. They are capable of imitating complicated organ-level physiology, transforming preclinical examination. This presents a significant opportunity, as it offers more ethical and predictive alternatives to animal models. It also facilitates multi-organ integration analyses, such as liver-kidney or heart-liver toxicity studies.

In addition, it amplifies early-stage drug development with high costs and reduced accuracy, fueling the progress of the cell based assay industry.

Emulate Incorporation associated with the FDA in 2024 to validate a liver-on-chip model as a substitute for a few preclinical toxicity tests.

CN Bio Innovations introduced a commercial system named 'Multi-Organ Microphysiological Device’ to imitate drug response and human metabolism.

Challenges

Challenges

- Does labor-intensive and time-consuming processes limit the cell based assays industry's growth?

Cell-based assays are biologically vibrant, needing comprehensive preparation time, multi-step protocols, and extended culture periods, especially in organoid-based or 3D assays. With this, long turnaround times reduce the speed of the drug discovery pipeline, and labor intensiveness deters laboratories from using cell-based assays for bigger diagnostics or screening.

Beckman Coulter Life Sciences introduced a novel automated plate handler to simplify complicated cell screening workflows in 2024.

New entrants, such as CytoReason, are developing machine learning tools to reduce manual data processing steps; however, laboratories are still lagging behind.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 21.49 Billion |

Projected Market Size in 2034 |

USD 35.30 Billion |

CAGR Growth Rate |

6.40% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Thermo Fisher Scientific, Promega Corporation, Bio-Rad Laboratories, Merck KGaA, Agilent Technologies, Lonza Group, Corning Incorporated, GE Healthcare, Becton, Dickinson and Company (BD), Qiagen, Sartorius AG, Enzo Biochem Inc., Waters Corporation, Abbott Laboratories, Danaher Corporation, and others. |

Key Segment |

By Products & Services, By Application, By End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global cell based assays market is segmented based on products & services, application, end-use, and region.

Based on products & services, the global market is divided into reagents, assay kits, microplates, probes & labels, instruments & software, and cell lines. The assay kits segment registered a notable market share in terms of revenue due to their consistency, ease of use, and broad application in toxicity testing, disease research, and drug screening. These kits are pre-formulated with enhanced protocols and reagents, allowing researchers to perform reproducible and reliable assays, mainly in high-throughput screening environments. Their prominence has grown significantly with the development of personalized medicine and the increasing complexity of cellular models, such as iPSC-based systems and 3D cultures.

Based on application, the global cell based assays industry is segmented into basic research, drug discovery, and others. The drug discovery segment led the market in 2024 and is expected to continue its dominance. The rising demand supports this growth in efficient in vitro models to examine the efficacy, pharmacokinetics, and toxicity of test drugs. Cell-based assays are vital for screening larger compound libraries, assessing cellular responses to novel drugs, and validating targets, especially in immunology, oncology, and neurology.

Based on end use, the global cell based assays industry is segmented as pharmaceutical & biotechnology companies, academic & research institutes, and contract research organizations (CROs). The pharmaceutical and biotechnology companies held a maximum market share in the previous years. These companies largely depend on cell-based assays for biomarker development, target validation, drug discovery, and toxicity testing. The rising emphasis on tailored medicine and the intricacy of drug pipelines have fueled the adoption of these assays in the pharmaceutical sector.

Regional Analysis

Regional Analysis

- What factors will help North America witness significant growth in the cell based assays market?

North America dominated the worldwide cell based assays market in 2024. It will continue to lead in the future, backed by factors like strong infrastructure and significant investments in R&D. The presence of major biotechnology and pharmaceutical companies in the region fuels the demand for cell-based assays in toxicity testing, drug discovery, and disease modeling. The region also boasts its well-developed research laboratories and institutions that facilitate superior scientific examinations, contributing to the growing adoption of cell-based assays.

In addition, significant investments in R&D, especially in domains like neurology, oncology, and immunology, fuel the need for cell-based assays. Moreover, the regional market growth is spurred by supportive funding initiatives and regulatory policies in economies like the U.S. These regulations and policies motivate the adoption and development of cell-based assays.

Asia Pacific is the second-leading region in the global cell based assays industry, and it presents speedy growth. The key factors contributing to the remarkable growth include growing biotechnology and pharmaceutical investments, rising cases of chronic diseases, improvements in healthcare infrastructure, and technological advancements. Economies like India, China, South Korea, and Japan are experiencing significant investments in drug development and discovery, resulting in high demand for cell-based assays. Enhanced healthcare facilities and research systems in the Asia Pacific are aiding the adoption of innovative technologies, such as cell-based assays.

Moreover, the rising cases of chronic illnesses are significantly impacting the need for personalized medicine solutions and effective drug discovery. Funding initiatives and supportive government policies motivate the adoption and development of advanced research tools. Nonetheless, the emergence of technologies, such as CRISPR/Cas9, has improved the efficiency and precision of these assays, increasing their appeal for R&D applications.

Competitive Analysis

Competitive Analysis

The global cell based assays market is led by players like:

- Thermo Fisher Scientific

- Promega Corporation

- Bio-Rad Laboratories

- Merck KGaA

- Agilent Technologies

- Lonza Group

- Corning Incorporated

- GE Healthcare

- Becton

- Dickinson and Company (BD)

- Qiagen

- Sartorius AG

- Enzo Biochem Inc.

- Waters Corporation

- Abbott Laboratories

- Danaher Corporation

Key Market Trends

Key Market Trends

- Higher adoption of 3D cell culture models:

3D cell culture systems are gaining traction because they offer more relevant surroundings than conventional 2D cultures, thereby improving toxicology testing results and drug discovery.

- Incorporation of AI and Automation:

Machine learning and artificial intelligence algorithms are incorporated into cell-based assay platforms to enhance assay workflow data analysis and streamline drug development processes, particularly in high-throughput screening.

The global cell based assays market is segmented as follows:

By Products & Services Segment Analysis

By Products & Services Segment Analysis

- Reagents

- Assay Kits

- Microplates

- Probes & Labels

- Instruments & Software

- Cell Lines

By Application Segment Analysis

By Application Segment Analysis

- Basic Research

- Drug Discovery

- Others

By End Use Segment Analysis

By End Use Segment Analysis

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Thermo Fisher Scientific

- Promega Corporation

- Bio-Rad Laboratories

- Merck KGaA

- Agilent Technologies

- Lonza Group

- Corning Incorporated

- GE Healthcare

- Becton

- Dickinson and Company (BD)

- Qiagen

- Sartorius AG

- Enzo Biochem Inc.

- Waters Corporation

- Abbott Laboratories

- Danaher Corporation

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors