Search Market Research Report

Carbon Capture Utilization and Storage Market Size, Share Global Analysis Report, 2022 – 2028

Carbon Capture Utilization and Storage Market Size, Share, Growth Analysis Report By Service (Capture, Transportation, Utilization, and Storage), By Technology (Pre-Combustion Capture, Oxy-Fuel Combustion Capture, and Post-Combustion Capture), By End Use (Oil & Gas, Power Generation, Iron & Steel, Chemical & Petrochemical, Cement, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

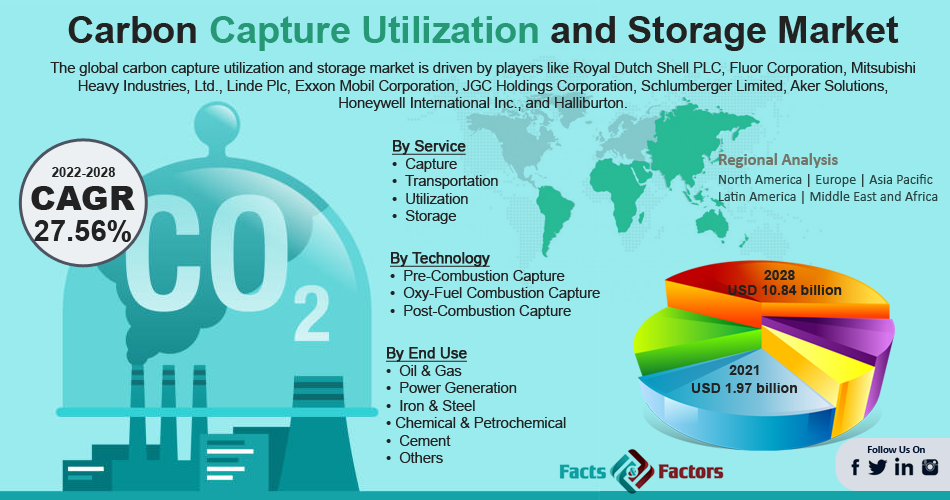

[222+ Pages Report] According to Facts and Factors, the global carbon capture utilization and storage market size was worth around USD 1.97 billion in 2021 and is predicted to grow to around USD 10.84 billion by 2028 with a compound annual growth rate (CAGR) of roughly 27.56% between 2022 and 2028. The report analyzes the global carbon capture utilization and storage market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Global Carbon Capture Utilization and Storage market.

Market Overview

Market Overview

Carbon capture, utilization, and storage is the process of capturing carbon dioxide from fuel combustion or industrial processes, the transport of this CO2 via ship or pipeline, and either its use as a resource to create valuable products or services or its permanent storage deep underground in geological formations. CCUS technologies also provide the foundation for carbon removal or "negative emissions" when the CO2 comes from bio-based processes or directly from the atmosphere.

The primary aid in the market for carbon capture, utilization, and storage is capture administration, which also commands the largest market share. The first step in the process of carbon capture, use, and storage is capture. Either before combustion or after burning, the carbon is separated. To get it ready for shipping, the isolated CO2 is dried out and brought to a high-virtue state. Power plants, industries that handle petroleum gas, and businesses that produce concrete are examples of high emanation sources where carbon capture, utilization, and storage technologies are typically introduced. The cost of CO2 capture is highly dependent on specialized, financial, and financial factors associated to the strategy and operations of CO2 capture innovation.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global carbon capture utilization and storage market is estimated to grow annually at a CAGR of around 27.56% over the forecast period (2022-2028).

- In terms of revenue, the global carbon capture utilization and storage market size was valued at around USD 1.97 billion in 2021 and is predicted to grow to around USD 10.84 billion by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on service segmentation, capture was predicted to show maximum market share in the year 2021

- Based on technology segmentation, the post-combustion capture was predicted to show maximum market share in the year 2021.

- Based on end user segmentation, oil & gas was predicted to show maximum market share in the year 2021.

- On the basis of region, North America was the leading revenue generator in 2021.

Covid-19 Impact

Covid-19 Impact

The COVID-19 epidemic is anticipated to cause a fall in the market for carbon capture, utilization, and storage in 2020. The entire world has been negatively impacted by this terrible illness, particularly North America and Europe. Business have stopped operating and shut down their factories, and the government has banned construction work in order to stop the virus from spreading further. As a result, carbon capture, utilization, and storage have been used less frequently across all end-use industries. The production of end-use industries has been slowed down by COVID-19 and pre-existing regulatory difficulties such as drawn-out permitting procedures, which have decreased demand for carbon capture, utilization, and storage. However, it is anticipated that in 2021, demand for carbon capture, utilization, and storage would increase. China was the first nation to be impacted by COVID-19, which led to a disruption in the worldwide supply chain for carbon capture, utilization, and storage as well as decreased manufacturing activity in a number of end-use industries. The need for carbon capture, utilization, and storage has increased because a number of end-use sectors have resumed operations and are soon anticipated to recover from the damage.

Growth Drivers

Growth Drivers

- Growing focus on reducing CO2 emissions to augment the market growth

By using a variety of techniques, carbon capture, utilization, and storage prevent CO2 from being released into the atmosphere. The primary cause of CO2 emissions worldwide is the production of electricity using fossil fuels and natural gas. By using carbon capture, utilization, and storage, greenhouse gases can be kept out of the atmosphere. Therefore, the adoption of carbon capture, utilization, and storage to minimize emissions is rising as a result of increased worries about climate change. For instance, President Joe Biden signed an executive order stating that America would create 100% carbon-free power by 2035 in response to the rise in carbon emissions caused by burning fossil fuels for energy, which is a factor in global warming. Furthermore, governments from different nations are providing a number of benefits to reach net-zero emissions to encourage the adoption of carbon capture, utilization, and storage. Tax credits and government subsidies that assist plant owners are just a few of the benefits provided by public institutions.

Restraints

Restraints

- High cost to restrain the market growth

The cost of carbon capture and storage is higher than the cost of non-carbon capture and storage when utilizing the same fuel and net energy output, including all original costs and continuing operational & maintenance costs of the carbon capture and storage facility. All elements of the value chain—CO2 capture at the plant, transportation, and storage—are included in the cost of carbon capture and storage. The main cost factors of the CO2 capture process are the efficiency losses brought on by the energy consumed in the capture processes and the inclusion of capture-specific equipment. Costs associated with storage are determined by taking into account variables including early investigation, site evaluation, and site preparation. The plant makers are unable to incorporate carbon capture, utilization, and storage because of monitoring costs as well.

Opportunity

Opportunity

- Increasing demand for CO2 – EOR techniques to bring up market growth prospects

In many different industries, including food and beverage, manufacturing, and metal production, CO2 is frequently employed. In the past, naturally existing reservoirs were where the majority of the CO2 utilized for EOR procedures was extracted. However, in situations where naturally existing reserves are not available, new technologies are being developed to manufacture CO2 from industrial applications, such as ethanol, fertilizer, hydrogen plants, and natural gas processing. Thermal recovery, gas injection, and chemical injection are examples of EOR approaches. The employment of CO2-EOR techniques aids in the production of 30–60% or more oil from reservoirs, the restoration of reservoir pressure, the reduction of viscosity and oil density, and the improvement of carbonate formations’ permeability.

Challenges

Challenges

- Transportation to pose challenges for market expansion

In addition to the high price of capture technologies, transporting CO2 after it has been caught presents some difficulties. The pipes themselves are expensive to build, and they demand a lot of energy to compress and chill CO2, maintain high pressure, and keep temperatures low.

Segmentation Analysis

Segmentation Analysis

- The global Carbon Capture Utilization and Storage market is segmented based on service, technology, end-user, and region

Based on services, the market is segmented into capture, transportation, utilization, and storage. In 2021, the market for carbon capture, utilization, and storage was dominated by the capture service segment. The first step in the CCUS process, carbon capture, involves removing CO2 from its emission source. Any large-scale emission process, including coal-fired power stations, the production of gas and oil, and manufacturing sectors like cement, iron, and steel, can use it. The design and operation of the production process, as well as the design and operation of the CO2 capture equipment, are major technical, economic, and financial aspects that affect the cost of CO2 capture.

Based on technology, the market is segmented into pre-combustion capture, oxy-fuel combustion capture, and post-combustion capture. The post-combustion capture segment dominated the growth of the market. In the post-burning process, CO2 is extracted from the flue gas produced by the combustion of fuels like coal or natural gas. According to the National Energy Technology Laboratory, which offers integrated solutions to support the transition to a sustainable energy future, out of the 4 trillion kilowatt hours of power produced in the United States in 2019, 38% came from natural gas and 23% from coal. The use of post-combustion capture technologies is essential to reducing CO2 emissions as more than 60% of electricity is produced by fossil fuel power plants.

Based on end-user, the market is segmented into oil & gas, power generation, iron & steel, chemical & petrochemical, cement, and others. The oil & gas segment dominates the market growth. The technology for carbon capture, utilization, and storage is widely utilized in the oil and gas sector to stop the release of greenhouse gases into the atmosphere. For use in deep, offshore, or onshore geological formations for increased oil recovery, the oil and gas sector stores carbon dioxide. For instance, the oil and gas industry captured, stored, and used about 24 million tons of CO2 in 2019, primarily from natural gas processing facilities. According to the Energy Information Administration (EIA), which provides official U.S. energy statistics, natural gas generation is predicted to increase by about 2.7% year between 2012 and 2040. By 2040, this is anticipated to produce 30% of the world's energy. As a result, it is predicted that in the years to come, demand for carbon capture, utilization, and storage will increase due to the use of captured CO2 in the oil and gas industry.

Recent Developments:

Recent Developments:

- In October 2021, ExxonMobil Corporation signed an expression of interest to capture, transport, and store CO2 from its Fife Ethylene Plant. It increased its participation in the Acorn carbon capture project in Scotland to achieve this.

- In September 2020, Mitsubishi Shipbuilding Co., Ltd., a part of Mitsubishi Heavy Industries, Ltd. (MHI), worked with Nippon Kaiji Kyokai (Japan) and Kawasaki Kisen Kaisha, Ltd. (Japan) to conduct test operations and measurements for a small-scale ship-based CO2 capture demonstration plant. This technology is being tested to verify the equipment’s use as a marine-based CO2 capture system.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1.97 Billion |

Projected Market Size in 2028 |

USD 10.84 Billion |

CAGR Growth Rate |

27.56% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Royal Dutch Shell PLC, Fluor Corporation, Mitsubishi Heavy Industries Ltd., Linde Plc, Exxon Mobil Corporation, JGC Holdings Corporation, Schlumberger Limited, Aker Solutions, Honeywell International Inc., Halliburton, C-Capture Ltd., Tandem Technical, Carbicrete, Hitachi Ltd., Siemens AG, General Electric, Total S.A., Equinor ASA, and others. |

Key Segment |

By Service, Technology, End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead the market growth during the projection period

Due to the rising demand for clean technology and the expanding usage of CO2 in enhanced oil recovery techniques, North America held a significant portion of the global carbon capture utilization and storage market in 2021. These nations include the United States and Canada. The United States employs roughly 30 metric tons annually, or 75.0% of the world's carbon capture capacity, in enhanced oil recovery operations.

In order to provide incentives for capturing the carbon dioxide produced by industrial and power sources to be used in enhanced oil recovery, the nation introduced the FUTURE Act (Furthering Capital Carbon Capture, Utilization, Technology, Underground storage, and Reduced Emissions) under 45Q section. The market for carbon capture, utilization, and storage (CCUS) is predicted to grow at a moderate rate in the nation as shale gas techniques advance and the new government shows less interest in carbon capturing. This will increase North America's market share in the global market for carbon capture utilization and storage.

Competitive Analysis

Competitive Analysis

- Royal Dutch Shell PLC

- Fluor Corporation

- Mitsubishi Heavy Industries Ltd.

- Linde Plc

- Exxon Mobil Corporation

- JGC Holdings Corporation

- Schlumberger Limited

- Aker Solutions

- Honeywell International Inc.

- Halliburton

- C-Capture Ltd.

- Tandem Technical

- Carbicrete

- Hitachi Ltd.

- Siemens AG

- General Electric

- Total S.A.

- Equinor ASA.

The global carbon capture utilization and storage market is segmented as follows:

By Service

By Service

- Capture

- Transportation

- Utilization

- Storage

By Technology

By Technology

- Pre-Combustion Capture

- Oxy-Fuel Combustion Capture

- Post-Combustion Capture

By End Use

By End Use

- Oil & Gas

- Power Generation

- Iron & Steel

- Chemical & Petrochemical

- Cement

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Royal Dutch Shell PLC

- Fluor Corporation

- Mitsubishi Heavy Industries Ltd.

- Linde Plc

- Exxon Mobil Corporation

- JGC Holdings Corporation

- Schlumberger Limited

- Aker Solutions

- Honeywell International Inc.

- Halliburton

- C-Capture Ltd.

- Tandem Technical

- Carbicrete

- Hitachi Ltd.

- Siemens AG

- General Electric

- Total S.A.

- Equinor ASA.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors