Search Market Research Report

Carbon Black Market Size, Share Global Analysis Report, 2024 – 2032

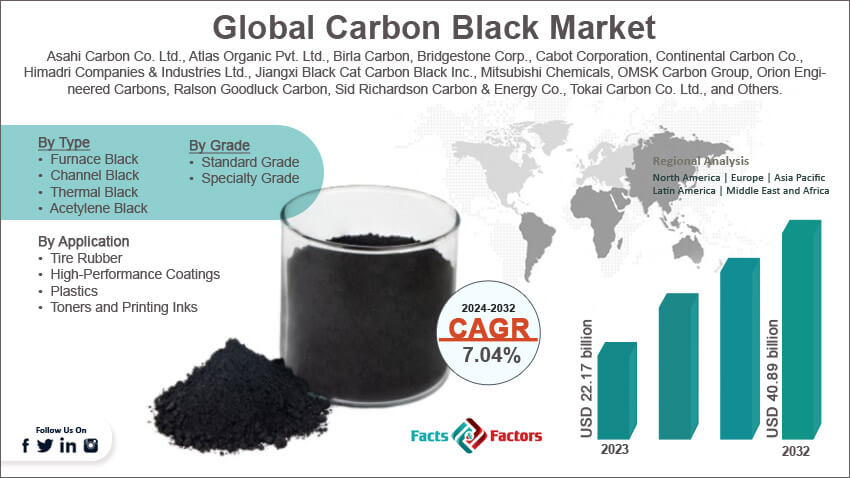

Carbon Black Market Size, Share, Growth Analysis Report By Type (Furnace Black, Channel Black, Thermal Black, Acetylene Black, and Others), By Application (Tire Rubber, High-Performance Coatings, Plastics, Toners and Printing Inks), By Grade (Standard Grade and Specialty Grade), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

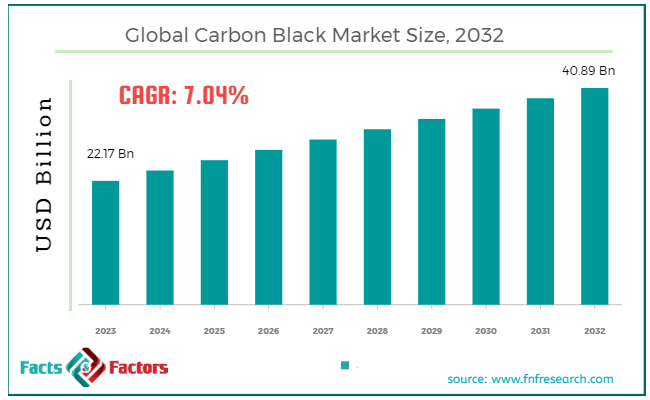

[225+ Pages Report] According to Facts & Factors, the global carbon black market size in terms of revenue was valued at around USD 22.17 billion in 2023 and is expected to reach a value of USD 40.89 billion by 2032, growing at a CAGR of roughly 7.04% from 2024 to 2032. The global carbon black market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Carbon black is a fine black powder made primarily from the incomplete combustion of heavy petroleum products such as FCC tar, coal tar, ethylene cracking tar, and a small amount from vegetable oil. Carbon black is mainly used as a reinforcing filler in tires and other rubber products. In addition, it is used as a pigment, UV stabilizer, and conductive agent in a variety of specialty products such as plastics, electronics, and toners.

The global carbon black market is significant due to its extensive use in the automotive, construction, and manufacturing sectors. The tire industry is the largest consumer of carbon black, utilizing it to provide strength and durability to tires and improve their overall performance and lifespan. The demand for carbon black is closely linked to the global automotive market and industrial rubber product market.

Key Highlights

Key Highlights

- The carbon black market has registered a CAGR of 7.04% during the forecast period.

- In terms of revenue, the global carbon black market was estimated at roughly USD 22.17 billion in 2023 and is predicted to attain a value of USD 40.89 billion by 2032.

- The carbon black market is poised to continue its growth trajectory, supported by increasing demand from the automotive and industrial sectors.

- Environmental regulations and innovations in alternative materials pose challenges that could impact future market dynamics.

- Based on the Type, the Furnace black segment is growing at a high rate and is projected to dominate the global market.

- Based on Application, the Tire rubber segment is projected to swipe the largest market share.

- By region, The Asia-Pacific region dominates the global carbon black market both in terms of volume and growth rate.

Growth Drivers:

Growth Drivers:

- Rising Demand from the Automotive Sector: Carbon black is extensively used as a reinforcing filler in tires and other rubber components in the automotive industry. The growth of the automotive sector directly influences the demand for carbon black, particularly in emerging markets.

- Expansion in Industrial Rubber Products: Beyond tires, carbon black is crucial for the manufacturing of industrial rubber products such as belts, hoses, gaskets, and seals. Industrial growth and infrastructure development projects boost the demand for these products.

- Increasing Usage in Plastics and Coatings: Carbon black serves as a pigment and performance enhancer in plastics and coatings, which are used across various sectors including construction, manufacturing, and consumer goods.

Restraints:

Restraints:

- Environmental Regulations: The production of carbon black involves significant emissions of CO2 and other pollutants, leading to stringent environmental regulations that can increase production costs and operational complexities.

- Volatility in Raw Material Prices: Carbon black is primarily produced from heavy petroleum products; fluctuations in these raw materials prices can affect the stability of carbon black pricing and availability.

Opportunities:

Opportunities:

- Development of Specialty Carbon Blacks: Specialty carbon blacks offer enhanced properties such as UV protection, conductivity, and pigment strength for use in electronics, high-performance coatings, and advanced polymers. Innovations in this area could tap new market segments.

- Advancements in Sustainable Production Techniques: There is a growing focus on sustainable and cleaner production processes for carbon black. Developing recycling technologies for carbon black from end-of-life tires and improving production efficiency are potential growth areas.

Challenges:

Challenges:

- Substitution by Alternatives: The development of alternative fillers and pigments that are more environmentally friendly could pose a competitive threat to the carbon black industry.

- Economic Downturns: Economic recessions can lead to reduced manufacturing output and lower automotive sales, directly impacting the demand for carbon black.

Carbon Black Market: Segmentation Analysis

Carbon Black Market: Segmentation Analysis

The global carbon black market is segmented based on type, application, and grade.

By Type Insights

By Type Insights

Based on Type, the global carbon black market is bifurcated into furnace black, channel black, thermal black, acetylene black, and others. Furnace black dominated the market and captured a market share of around 38.2% in 2023.

Furnace black most widely produced type of carbon black, used primarily in tire and rubber products due to its ability to provide good wear resistance and tensile strength. This segment commands a significant market share due to its extensive use in the automotive sector, particularly in tire manufacturing.

Channel black is produced by the thermal decomposition of natural gas. Offers high purity and electrical conductivity, making it suitable for conductive applications and specialty tires. Though less common today, it still finds niche applications in inks and coating products.

Thermal black is produced by the thermal decomposition of natural gas, this type of carbon black is characterized by large particle sizes and low structure, commonly used in rubber compounds for products such as inner tubes and molding. Preferred for applications requiring high heat stability and low hardness.

Acetylene black is produced specifically from acetylene gas, known for its high purity and conductivity, which is ideal for battery electrodes and high-end electrical cables. It sees significant use in electronics and electrical applications.

By Application Insights

By Application Insights

On the basis of Application, the global carbon black market is categorized into tire rubber, high-performance coatings, plastics, toners and printing inks. Tire rubber segment has held a market share of around 62% in 2023.

Carbon black is crucial for manufacturing tires as it enhances the rubber's durability and strength, and improves its wear resistance under varying road conditions. This is the largest application segment, driven by global vehicle production and aftermarket tire sales.

High-performance coatings are used in the formulation of coatings that require UV protection, conductivity, and stability. It is important for automotive finishes, industrial coatings, and marine paints.

Plastics add pigmentation, UV protection, and conductivity to plastic products. Used in commodities from electronic housings to agricultural films. The growth is driven by demand in consumer electronics, packaging, and agriculture sectors.

Carbon black provides deep black pigmentation and improves the quality of print material. Toners and printing inks are essential in the commercial and newspaper printing industries.

By Grade Insights

By Grade Insights

Based on Grade, the global carbon black market is categorized into standard grade and specialty grade. The standard grade segment accounted for 58% of the total revenue share in 2023. The standard grade of carbon black is projected to dominate the market in the projected period, primarily driven by the increased demand from the end-user industry. Standard grade is predicted to grow because of its wide range of uses in tire rubber, non-tire rubber, inks, coatings, and plastics.

Recent Developments:

Recent Developments:

- In June 2023, Bridgestone Corporation initiated the development of oils and recovered carbon black from old tires using pyrolysis at its Innovation Park in Tokyo. This project is designed to promote chemical recycling technologies that break down worn tires efficiently.

- In April 2023, Orion Engineered Carbons implemented a new cogeneration system at its Ivanhoe plant in Louisiana, USA. This system utilizes waste steam from carbon black production to generate electricity, enhancing energy efficiency.

- In March 2023, Tokai Carbon Co., Ltd. formed a strategic alliance with Sekisui Chemical Co., Ltd. to advance the application of Carbon Capture and Utilization (CCU) technology. This collaboration focuses on creating various carbon products that can capture and store CO2 as solid carbon.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 22.17 Billion |

Projected Market Size in 2032 |

USD 40.89 Billion |

CAGR Growth Rate |

7.04% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Asahi Carbon Co. Ltd., Atlas Organic Pvt. Ltd., Birla Carbon, Bridgestone Corp., Cabot Corporation, Continental Carbon Co., Himadri Companies & Industries Ltd., Jiangxi Black Cat Carbon Black Inc., Mitsubishi Chemicals, OMSK Carbon Group, Orion Engineered Carbons, Ralson Goodluck Carbon, Sid Richardson Carbon & Energy Co., Tokai Carbon Co. Ltd., and Others. |

Key Segment |

By Type, By Application, By Grade, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Carbon Black Market: Regional Analysis

Carbon Black Market: Regional Analysis

The Asia-Pacific region is the largest and fastest-growing market for carbon black, primarily driven by robust industrial growth in countries like China and India. The Asia-Pacific carbon black market is anticipated to expand at a CAGR of 6.25% over the forecast period. The region benefits from increasing tire production, automotive manufacturing, and industrial activities, which extensively use carbon black. This region is expected to have the highest CAGR due to massive industrialization, urbanization, and the expanding automotive sector.

North America, with the United States at the forefront, is a significant market for carbon black, characterized by mature automotive and manufacturing sectors. This region is expanding at a CAGR of 5.82% from 2024 to 2032. The region also shows a growing trend towards sustainable and environmentally friendly carbon black production methods. It’s exhibiting a stable growth rate, driven by technological advancements and a steady demand in the automotive sector.

Europe's carbon black market is driven by stringent environmental regulations, high demand for high-quality and specialty carbon black in automotive, industrial applications, and growing interest in sustainable products. The growth rate is moderate, with sustainability and high-performance applications being key market drivers.

The market in Latin America is growing, supported by the automotive and tire manufacturing sectors in countries like Brazil and Mexico. Economic development and industrial growth are contributing to the demand for carbon black. Though smaller in comparison to Asia-Pacific and North America, Latin America is experiencing steady growth in the carbon black sector.

The Middle East and Africa (MEA) region, while not the largest market, is witnessing growth in the carbon black market due to developing industrial and construction sectors, especially in the Gulf Cooperation Council (GCC) countries. The market is expected to grow at a moderate pace, fueled by infrastructure development and industrial diversification efforts.

Carbon Black Market: Competitive Landscape

Carbon Black Market: Competitive Landscape

Several market companies engaged in the global carbon black market include;

- Asahi Carbon Co. Ltd.

- Atlas Organic Pvt. Ltd.

- Birla Carbon

- Bridgestone Corp.

- Cabot Corporation

- Continental Carbon Co.

- Himadri Companies & Industries Ltd.

- Jiangxi Black Cat Carbon Black Inc.

- Mitsubishi Chemicals

- OMSK Carbon Group

- Orion Engineered Carbons

- Ralson Goodluck Carbon

- Sid Richardson Carbon & Energy Co.

- Tokai Carbon Co. Ltd.

The global carbon black market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

By Application Segment Analysis

By Application Segment Analysis

- Tire Rubber

- High-Performance Coatings

- Plastics

- Toners and Printing Inks

By Grade Segment Analysis

By Grade Segment Analysis

- Standard Grade

- Specialty Grade

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Asahi Carbon Co. Ltd.

- Atlas Organic Pvt. Ltd.

- Birla Carbon

- Bridgestone Corp.

- Cabot Corporation

- Continental Carbon Co.

- Himadri Companies & Industries Ltd.

- Jiangxi Black Cat Carbon Black Inc.

- Mitsubishi Chemicals

- OMSK Carbon Group

- Orion Engineered Carbons

- Ralson Goodluck Carbon

- Sid Richardson Carbon & Energy Co.

- Tokai Carbon Co. Ltd.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors