Search Market Research Report

Bio-Butanol Market Size, Share Global Analysis Report, 2022 – 2028

Bio-Butanol Market By Raw Material (Cereal Crops, Sugarcane Bagasse, Waste Biomass, Others) By Application (Acrylates, Acetates, Glycol Ethers, Biofuel, Others), By End-Use Industry (Transportation, Construction, Medical, Power Generation, Others), and By Region - Global Industry Insights, Growth, Size, Share, Comparative Analysis, Trends and Forecast 2022 – 2028

Industry Insights

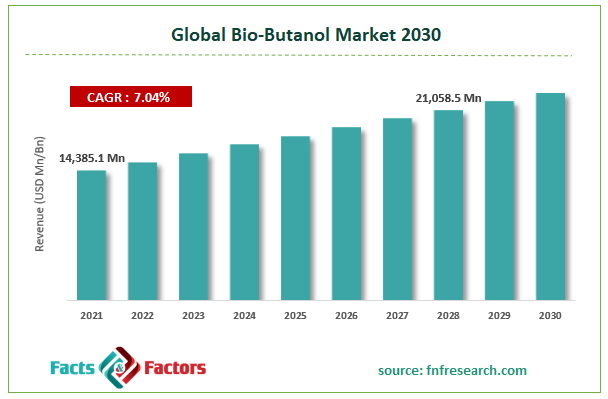

[227+ Pages Report] According to Facts and Factors, the global Bio-Butanol Market was valued at USD 14,385.1 million in 2021 and is predicted to increase at a CAGR of 7.04% to USD 21,058.5 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries. The report analyses the global bio-butanol market’s drivers and restraints, as well as the impact they have on demand throughout the projection period. In addition, the report examines global opportunities in the bio-butanol market.

Market Overview

Market Overview

Biobutanol, also known as bio-based butanol fuel, is a second-generation alcoholic fuel with a better energy density and lower volatility than ethanol, and it is also an essential raw material in the production of glycol ethers. Furthermore, biobutanol is commonly utilized as a plasticizer to enhance the chemical intermediate for butyl esters or butyl ethers in plastic materials. Growing environmental worries over the discharge of excessive greenhouse gases (GHG) in recent years have led to an increase in demand for bio-based goods.

Growth Drivers

Growth Drivers

Rising demand for alternative fuels and renewable energy as a result of the negative environmental impacts of synthetic fuels, particularly global warming, is predicted to drive bio-butanol development during the next seven years. It is also used as a precursor in the production of acetates, acrylates, glycol ethers, and solvents. Bio-butanol is an important raw element in the manufacture of paints, coatings, plasticizers, and adhesives. In practically all applications, it is utilized as a direct replacement for petroleum-based butanol. With its potential to be utilized as an addition, it is in high demand in the pharmaceutical business. It can be combined into gasoline to make bio-fuel, which is predicted to be one of its most popular commercial uses in the near future. Demand for green paints and coatings is predicted to increase throughout the forecast period. The depletion of petroleum supplies, along with variable oil prices, has contributed to its growing demand.

One of the primary market restraints is the detrimental impact of solvent-based systems on human and environmental health. Acute health risks associated with solvent-based systems include headaches, dizziness, and light-headedness, which can escalate to unconsciousness and seizures. Other side effects of working with these systems include nasal, eye, and throat irritation. VOCs included in paint systems are hazardous to both the environment and humans. During the drying or curing process, paints emit VOCs. VOCs have a deteriorating impact on the body, causing anything from headaches to allergies and asthmatic symptoms. Furthermore, this might put a strain on essential organs such as the heart and lungs.

COVID – 19 Impact

COVID – 19 Impact

COVID-19 has had a significant influence on these industries. Lockdowns in numerous nations, as well as logistical constraints, have had a negative influence on the sectors. Supply chain interruptions, personnel unavailability, logistical constraints, restricted component availability, demand reduction, poor corporate cash, and factory halt due to lockout in several nations have all harmed the sector. During this era of crisis, raw material suppliers and other connected firms are being pushed to rethink their tactics in order to cater to this industry. Due to the epidemic, residential and commercial building has come to a standstill. During the crisis, bio-butanol demand from this industry is predicted to be low to medium.

A severe concern would be a delay in order shipments, a constraint in the supply chain, a scarcity of people and equipment, and a shortage of materials. Following the end of the crisis, the market is projected to recover, and demand for bio-Butanol is predicted to rise. Even where no shutdowns have been implemented, limitations on the movement of personnel and materials have caused operations to be delayed. Countries increasingly eased limitations and began business activities in numerous industries in the second half of 2020. Even when the lockdown is lifted, it will be difficult for bio-Butanol factories to resume normal operations. This will have an impact on the bio-Butanol market.

Segmentation Analysis Analysis

Segmentation Analysis Analysis

The global Bio-Butanol market is segregated based on Raw Material, Application, and End-Use Industry.

The acrylates category led the worldwide market in terms of Application throughout the predicted period. Biobutanol is used as an intermediary in the manufacture of butyl acrylates, which are used to make paints & coatings, adhesives, and textiles, among other things. Over the projected period, the increasing usage of acrylate polymer and co-polymer as an adhesive in construction and pressure-sensitive applications is likely to fuel market expansion. Acrylate is employed as a chemical intermediate due to its chemical structure and capabilities, and it is expected to drive the market.

In terms of the End-Use Industry, the automotive industry was the key market for Bio-Butanol, and it is predicted to increase. Consumption of bio-butanol as a transport fuel in automotive applications is increasing as a result of an increase in global middle-class expenditure and as an effective alternative to fossil fuels. Because a substantial portion of bio-butanol is utilized for blending in gasoline, there is a high demand for them in the fuel industry. As a result, as the number of fuel cars increases across the world, so does the bio-butanol industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 14,385.1 Million |

Projected Market Size in 2028 |

USD 21,058.5 Million |

CAGR Growth Rate |

7.04% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Abengoa, Biocleave Limited, Bioenergy International, Butalco GmBH (Lesaffre), Butamax Advanced Biofuels LLC (BP and Corteva), Eastman Chemical Company, Gevo Inc., Metabolic Explorer SA, Solvay S.A., W2 Energy Inc., and Others |

Key Segment |

By Raw Material, Application, End-Use Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

APAC is expected to dominate the bio-butanol market in the forecast period. The economic dynamics of nations such as China and India have a significant impact on the APAC economy. The expanding construction and automotive industries in this area are propelling the bio-butanol market forward. With the increased need for automobiles, the bio-butanol market will eventually rise throughout the aforementioned timeframe.

In India, the logistics sector is increasing at a rapid pace every year. As a result of India's booming construction sector, demand for paints and coatings, adhesives, and other materials is predicted to climb, as is the bio-butanol market.

Competitive Landscape

Competitive Landscape

The report contains qualitative and quantitative research on the global Bio-Butanol Market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts. The study examines, among other things, each company's global presence, competitors, service offers, and standards.

List of Key Players in the Global Bio-Butanol Market:

List of Key Players in the Global Bio-Butanol Market:

- Abengoa

- Biocleave Limited

- Bioenergy International

- Butalco GmBH (Lesaffre)

- Butamax Advanced Biofuels LLC (BP and Corteva)

- Eastman Chemical Company

- Gevo Inc.

- Metabolic Explorer SA

- Solvay S.A.

- W2 Energy Inc.

The global bio-butanol market is segmented as follows:

By Raw Material Segment Analysis

By Raw Material Segment Analysis

- Cereal Crops

- Sugarcane Bagasse

- Waste Biomass

- Others

By Application Segment Analysis

By Application Segment Analysis

- Acrylates

- Acetates

- Glycol Ethers

- Biofuel

- Others

By End-Use Industry Segment Analysis

By End-Use Industry Segment Analysis

- Transportation

- Construction

- Medical

- Power Generation

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Abengoa

- Biocleave Limited

- Bioenergy International

- Butalco GmBH (Lesaffre)

- Butamax Advanced Biofuels LLC (BP and Corteva)

- Eastman Chemical Company

- Gevo Inc.

- Metabolic Explorer SA

- Solvay S.A.

- W2 Energy Inc.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors