Search Market Research Report

Automotive Torque Converter Market Size, Share Global Analysis Report, 2025 - 2034

Automotive Torque Converter Market Size, Share, Growth Analysis Report By Type (Automatic Transmission, Continuously Variable Transmission, and Dual-Clutch Transmission), By Vehicle Type (Passenger Vehicle and Commercial Vehicle), By Electric Vehicle (Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle, and Hybrid Electric Vehicle), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

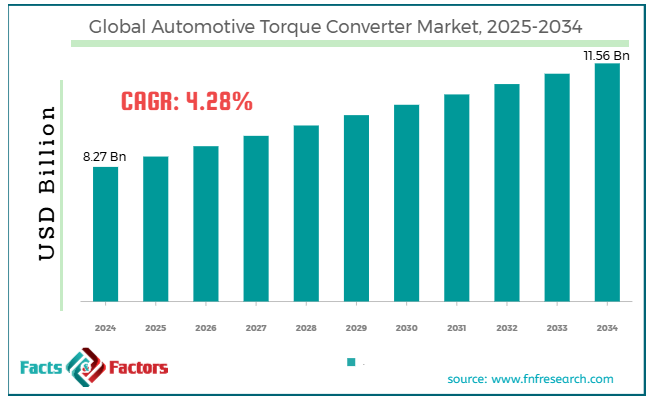

[219+ Pages Report] According to Facts & Factors, the global automotive torque converter market size was worth around USD 8.27 billion in 2024 and is predicted to grow to around USD 11.56 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.28% between 2025 and 2034.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global automotive torque converter market is estimated to grow annually at a CAGR of around 4.28% over the forecast period (2025-2034)

- In terms of revenue, the global automotive torque converter market size was valued at around USD 8.27 billion in 2024 and is projected to reach USD 11.56 billion by 2034.

- The automotive torque converter market is projected to grow significantly owing to the increasing demand for automatic transmissions, automotive industry progress, and torque converter solutions improvements.

- Based on type, the dual-clutch transmission segment is expected to lead the market, while the automatic transmission segment is expected to grow considerably.

- Based on vehicle type, the passenger vehicle segment is the dominating segment among others, while the commercial vehicle segment is projected to witness sizeable revenue over the forecast period.

- Based on electric vehicles, the hybrid electric vehicle segment is expected to lead the market as compared to the plug-in hybrid electric vehicle segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Market Overview

Market Overview

An automotive torque converter is the fluid coupling instrument used in automatic transmissions to transfer and increase engine torque to the diffusion input channel without a direct motorized connection. It links the engine to the transmission and enables the vehicle to stop smoothly without hedging the engine. The key drivers of the global automotive torque converter market are the mounting demand for automatic transmissions, technological developments, and progress in the automotive industry. The growing preference for automatic transmission vehicles, mainly in passenger vehicles, is one of the leading drivers. Automatic transmissions offer enhanced fuel efficiency and ease of driving, resulting in an increased adoption rate.

Moreover, constant research and development efforts fuel the emergence of enhanced torque converter solutions like lock-up converters, which offer better performance and improved fuel efficiency. The global automotive industry is witnessing substantial growth, impacted by the increasing disposable income of consumers, urbanization, and growing population. This development ultimately increases the demand for automobile torque converters.

Nevertheless, despite improvements and progress, the global market is witnessing drawbacks like the high cost of improved torque converters and a rising trend towards direct drive systems. Improved torque converters integrating smart technologies may have significant manufacturing prices. This may notably limit the adoption of automotive torque converters, mainly in low-income regions or price-conscious markets.

Moreover, the rising trend towards direct drive systems offers a key challenge for the automotive torque converter sector. Direct drive systems remove the need for a torque converter by fetching the engine directly, restricting the adoption of torque converters.

Yet, the global automotive torque converter industry will grow progressively in the coming years due to the integration of electric and hybrid vehicle systems. Expanding in the developing market with progressing automotive industries may produce notable growth. In addition, incorporating torque converters with electric and hybrid vehicle systems to improve efficiency and performance may offer new industry opportunities.

The global market is also opportune for materials innovations and improved torque converters' development. Improvements in materials like enhanced composites may help improve performance and reduce costs. With reduced emissions and higher efficacy, the industry offers opportunities to develop enhanced torque converters.

Growth Drivers

Growth Drivers

- The growing vehicle ownership and rising spending power fuel the market growth

In regions like APAC, especially in nations like India, increasing consumer spending and vehicle ownership boost the demand for automotive torque converters. India's automotive industry is witnessing notable growth, with automobile production touching 284.2 million in 2024 from 263.5 million in 2020. This growth directly impacts the elevated demand for torque converters, thus impacting the development of the automotive torque converter market. This surged demand is expected to grow considerably as automatic transmissions gain prominence in the commercial and passenger segments.

- Integration with electric and hybrid powertrains remarkably drives market growth

With the growing shift of the automotive industry towards electrification, torque converters are increasingly adapted to assimilate with electric and hybrid drivetrains. This comprises modernizations like torque converters that can smoothly incorporate with hybrid systems and electric motors to enhance efficacy and overall performance. The HEV sector holds a larger revenue share, fueled by environmental regulations and government subsidies to lower carbon emissions.

Restraints

Restraints

- Growing competition from alternative transmission solutions unfavorably impacts market progress

Torque converters experience strong competition from other transmission systems like (CVTs) continuously variable transmissions and (DCTs) dual-clutch transmissions. DCTs offer quick gear changes and enhanced fuel efficacy, while CVTs offer smooth acceleration with no different shift points from conventional transmissions. These substitutes are actively adopted by hybrid vehicles and internal combustion engines, decreasing dependency on torque converters.

Opportunities

Opportunities

- Enhancements in torque converter technology contribute to the market growth

Technological improvements are noticeably transforming the global automotive torque converter industry. Manufacturers constantly spend and capitalize on research and developments to enhance torque converter efficacy, improve performance, and reduce power loss. The emergence of lock-up torque converters, offering direct mechanical coupling at hi-speeds, has gained prominence because of its fuel-efficiency advantages.

Moreover, incorporating improved torque converters and electronic control system sensors allows better adaptability and responsiveness to diverse operating conditions.

Challenges

Challenges

- Move towards electric vehicles restricts the growth of market

The automotive industry's shift towards electric vehicles offers a challenge. Unlike conventional internal combustion engine vehicles, electric vehicles use electric motors for ignition, representing the traditional transmission components, comprising torque converters, greatly outmoded. As the adoption of electric cars increases, the demand for torque converters in newer vehicles drops.

For example, estimations indicate that by 2030, electric vehicles may register 40% of worldwide vehicle sales, majorly affecting the market progress.

- Supply chain disruptions may limit the industry's progress

The automotive industry is vulnerable to supply chain disturbances because of natural disasters, geopolitical stresses, and global health crises. These disturbances may delay the availability of vital components, comprising those used to make torque converters. For example, the COVID-19 epidemic resulted in the scarcity of semiconductors, impacting the manufacturing timelines and increasing costs in the automotive sector.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 8.27 Billion |

Projected Market Size in 2034 |

USD 11.56 Billion |

CAGR Growth Rate |

4.28% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

ZF Friedrichshafen AG, BorgWarner Inc., Schaeffler AG, Valeo SA, Aisin Corporation, EXEDY Corporation, Eaton Corporation, Sonnax Transmission Company, Raybestos Powertrain, Transtar Industries, Dynamic Manufacturing Inc., Allomatic Products Company, SuperFlow Technologies Group, RevMax Performance Torque Converters, Hughes Performance, and others. |

Key Segment |

By Type, By Vehicle Type, By Electric Vehicle, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global automotive torque converter market is segmented based on type, vehicle type, electric vehicle, and region.

Based on type, the global automotive torque converter industry is divided into automatic transmission, continuously variable transmission, and dual-clutch transmission. The dual-clutch transmission segment registered a majority market share in the past years and is expected to lead in the future. DCTs use two different clutches for even and odd gears, enabling more efficient and faster gear shifts than conventional automatic gearboxes. This design improves fuel efficiency and performance, increasing the suitability of DCT in high-end passenger vehicles.

On the basis of vehicle type, the global automotive torque converter industry is segmented into passenger and commercial vehicles. The passenger vehicle category held a notable market share, with maximum revenue. The growing demand for driving ease and comfort in urban areas pushes buyers towards automatic transmission-embedded vehicles. Technological improvements in torque converters are boosting passenger vehicles' performance and fuel economy. The growing sales of SUVs, mid-size sedans, and XUVs, mainly in APAC and North America, drive the demand. Also, hybrid vehicles, which utilize torque converters in powertrains, are adding to the segment's growth as governments enforce reduced emissions rules.

Based on electric vehicle, the global market is segmented as battery electric vehicle, plug-in hybrid electric vehicle, and hybrid electric vehicle. Hybrid electric vehicles are the leading consumers of torque converters among EV types. They assimilate electric motors and internal combustion engines, demanding torque converters to enhance fuel economy and handle power delivery. Government programs and ecological regulations promoting clean transport solutions are fueling the segment’s growth. Moreover, consumer preference for cars with extended driving ranges, without requiring repeated charging, is impacting the growth.

Regional Analysis

Regional Analysis

- Asia Pacific to witness significant growth over the forecast period

Asia Pacific has dominated the global automotive torque converter market in the past few years and is expected to lead due to its expansive automotive industrial base, growing vehicle demand, and increasing preference for automotive transmissions. Asia Pacific holds a larger manufacturing base than other regions, especially Japan, South Korea, and China, home to prominent component suppliers and automakers. These nations have well-established broad networks for supply chains and vehicle production, supporting the large-scale manufacturing of cars embedded with torque converters and automatic transmissions.

Moreover, the region's growing urbanization and middle-class population have increased ownership of vehicles. For example, China's automotive market has witnessed speedy growth, impacted by the growing government initiatives and surging consumer demand to encourage domestic automotive production.

Also, consumer demand in the Asia Pacific is moving towards automatic transmission cars because of their ease of use and convenience, mainly in dense areas with heavy traffic. This trend adds to the elevated demand for torque converters in the APAC.

North America is expected to progress remarkably in the automotive torque converter market after the Asia Pacific owing to the well-established automotive sector, strict emission and fuel economy regulations, and innovations. North America, especially the United States, brags about its well-developed automotive market with improved manufacturing facilities, leading automotive original equipment manufacturers, and a strong supply chain. This automotive infrastructure facilitates widespread research and development, nurturing innovation in automotive technologies like torque converters.

In addition, the region enforces emission and fuel economy standards, forcing automobile manufacturers to implement effective torque converters to comply with these parameters. These standards fuel the integration and development of improved torque converter technologies that improve fuel efficiency and vehicle performance.

Furthermore, North America is leading in integrating improved solutions in automotive components. The use of electronically-controlled torque converters has been fueled by 35% in the newer cars in the past few years, impacted by the OEM's emphasis on improving performance and vehicle efficacy.

Competitive Analysis

Competitive Analysis

The prominent players in the global automotive torque converter market include:

- ZF Friedrichshafen AG

- BorgWarner Inc.

- Schaeffler AG

- Valeo SA

- Aisin Corporation

- EXEDY Corporation

- Eaton Corporation

- Sonnax Transmission Company

- Raybestos Powertrain

- Transtar Industries

- Dynamic Manufacturing Inc.

- Allomatic Products Company

- SuperFlow Technologies Group

- RevMax Performance Torque Converters

- Hughes Performance

Key Market Trends

Key Market Trends

- Rising adoption of lock-up torque converters:

Lock-up torque converters occupy a mechanical clutch to remove the slip between the transmission and the engine, leading to direct drive mode. This mechanism reduces engine pressure and enhances fuel efficiency, increasing its significance with the growing sternness of fuel efficiency on a global scale.

- Growth of electrification and EV impact:

With the rising adoption of EVs, which do not use conventional torque converters because of direct-drive systems, the need for torque converters in the widespread automotive industry is impacted. Nonetheless, hybrids are still dependent on torque converters, and most automakers are expanding their offerings to satisfy both EV makers and hybrid markets.

The global automotive torque converter market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Automatic Transmission

- Continuously Variable Transmission

- Dual-Clutch Transmission

By Vehicle Type Segment Analysis

By Vehicle Type Segment Analysis

- Passenger Vehicle

- Commercial Vehicle

By Electric Vehicle Segment Analysis

By Electric Vehicle Segment Analysis

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Hybrid Electric Vehicle

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- ZF Friedrichshafen AG

- BorgWarner Inc.

- Schaeffler AG

- Valeo SA

- Aisin Corporation

- EXEDY Corporation

- Eaton Corporation

- Sonnax Transmission Company

- Raybestos Powertrain

- Transtar Industries

- Dynamic Manufacturing Inc.

- Allomatic Products Company

- SuperFlow Technologies Group

- RevMax Performance Torque Converters

- Hughes Performance

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors