Search Market Research Report

Automotive Knock Sensor Market Size, Share Global Analysis Report, 2025 - 2034

Automotive Knock Sensor Market Size, Share, Growth Analysis Report By Type (Linear Frequency Sensor and Wide Range Frequency Sensor), By End User (Passenger Vehicles, Medium Commercial Vehicles, Heavy Duty Commercial Vehicles and Light Duty Commercial Vehicles) And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

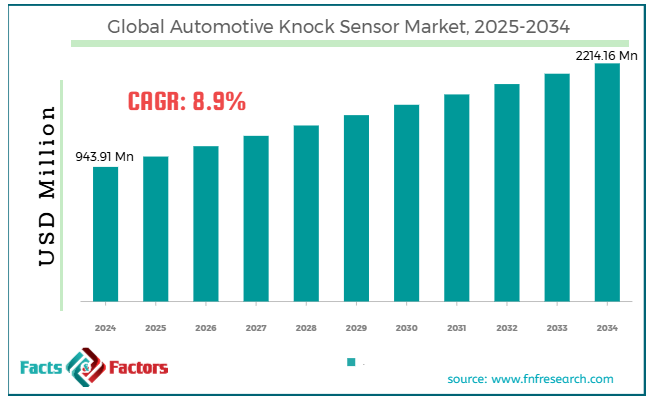

[221+ Pages Report] According to Facts & Factors, the global automotive knock sensor market size was worth around USD 943.91 million in 2024 and is predicted to grow to around USD 2214.16 million by 2034 with a compound annual growth rate (CAGR) of roughly 8.9% between 2025 and 2034.

Market Overview

Market Overview

An internal combustion engine's cylinder head or engine block is where the automotive knock sensor is mounted. It is employed to identify knocking sounds coming from an automobile engine's combustion chamber. Piezoelectric components, which make up knock sensors, provide an electric signal in response to detonation-induced vibrations. Whenever there is a spark knock, the engine uses this signal to delay timing. To detect vibrations brought on by engine knock or detonation, the automotive knock sensor is housed in the intake manifold, cylinder head, or lower engine block.

The engine's life cycle is shortened by engine knocking, which can occasionally result in engine failure. The engine's longevity will be enhanced with the detection and mitigation of knocking. The automotive knock sensor market is expected to be driven by rising demand from passenger cars and commercial vehicles during the projected period.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global automotive knock sensor market is estimated to grow annually at a CAGR of around 8.9% over the forecast period (2025-2034).

- In terms of revenue, the global automotive knock sensor market size was valued at around USD 943.91 million in 2024 and is projected to reach USD 2214.16 million, by 2034.

- The rising vehicle production is expected to drive market growth over the forecast period.

- Based on the type, the wide range frequency sensor segment is expected to dominate the market over the forecast period.

- Based on the end user, the passenger vehicles segment is expected to capture the largest market share over the projected period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Growth Drivers

Growth Drivers

- Increasing government initiatives drive market growth

To ensure public safety when operating a motor vehicle, the government is pushing for the use of sensors. Furthermore, with the growing demand for electric vehicles, buyers are requesting advanced engine technology to increase the vehicle's reliability, a desire that is being met by new government policies. The use of these cutting-edge technologies by manufacturers and individuals is being encouraged by the governments of several developing nations, which is expected to have a positive impact on the automotive passenger vehicle sensor market throughout the forecast period.

Restraints

Restraints

- Rising demand for the electrification of powertrains hinders market growth

Due to increased safety features like driver assistance systems (DAS) and regulations requiring the installation of onboard diagnostics (OBD) to lower greenhouse gas (GHG) emissions, the cost of an automobile is rising by 45% to 50% as a result of electrification. The market has seen a rise in the sales of electric and hybrid vehicles as a result of automakers' increasing emphasis on electrifying automobile powertrains. Modern cars with internal combustion engines (IC engines) use a lot of automotive sensors in their powertrains because automakers are putting more emphasis on making IC engines run more smoothly and efficiently. The majority of the components in an IC engine's powertrain are knock sensors.

However, because the powertrain of an electric car is electrified, sensors such as air intake pressure, knock, pressure, MAP, BAP, and pressure utilized in the exhaust system would not be needed. Consequently, during the projection period, the growing electrification of the powertrain will pose a hurdle to market growth.

Opportunities

Opportunities

- The development of an affordable autonomous vehicle sensor provides a lucrative opportunity for market growth

A pricing war between rival manufacturers in the market has resulted in the development of a more reasonably priced product. It is anticipated that sales will be countered by the introduction of less expensive radar sensors. Cost-effective and cutting-edge automotive knock sensors have been developed as a result of the intense R&D efforts spurred by these pricing wars. These sensors are becoming more widely used, which is fueling the market's expansion throughout the projected period due to their low cost.

Challenges

Challenges

- The complexity of integration poses a major challenge to market expansion

It might be technically challenging to integrate knock sensors into contemporary engine control units (ECUs) and make sure they function flawlessly with other engine management parts. The number of manufacturers capable of supplying high-quality knock sensors may be restricted due to the requirement for specific engineering expertise in the design, implementation, and maintenance of these systems.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 943.91 Million |

Projected Market Size in 2034 |

USD 2214.16 Million |

CAGR Growth Rate |

8.9% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Continental AG, Robert Bosch GmbH, NGK Spark Plugs Inc., HYUNDAI KEFICO Corporation, NGK Spark Plugs (U.S.A.) Inc., Denso Corporation, Delphi Automotive PLC, Hitachi Ltd., and others. |

Key Segment |

By Type, By End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global automotive knock sensor industry is segmented based on type, end user and region.

Based on the type, the global automotive knock sensor market is bifurcated into linear frequency sensors and wide range frequency sensors. The wide range frequency sensor segment is expected to dominate the market over the forecast period. Compared to conventional sensors, these are made to detect a wider range of knock frequencies. They can more precisely detect and distinguish between different kinds of engine knocks because of the use of sophisticated piezoelectric materials and signal processing techniques.

Manufacturers of automobiles and sensors make ongoing investments in R&D, which results in cutting-edge goods with improved capabilities and increases market demand. The use of ECUs in high-performance, contemporary automobiles has increased due to the development of complex models that can handle data from wide-range frequency sensors.

Based on the end user, the global automotive knock sensor industry is bifurcated into passenger vehicles, medium commercial vehicles, heavy duty commercial vehicles and light duty commercial vehicles. The passenger vehicles segment is expected to capture the largest market share over the projected period. The automotive knock sensor market's revenue growth is largely driven by passenger cars. The need for knock sensors in passenger cars is being shaped by several factors, including aftermarket opportunities, regulatory compliance, technology improvements, consumer preferences for safety and performance, and worldwide market expansion. Suppliers and manufacturers who prioritize quality, innovation, and market expansion tactics will be well-positioned to profit from this segment's ongoing growth.

Regional Analysis

Regional Analysis

- The Asia Pacific is expected to dominate the market during the forecast period

The Asia Pacific is expected to capture the largest revenue share of the market during the forecast period. The regional market growth is attributed to the rapid growth in the automotive industry. With nations like China, Japan, South Korea, and India dominating the world in vehicle production, Asia-Pacific is a significant hub for the automobile industry. The demand for passenger vehicles in the region has been driven by factors such as rapid urbanization, rising disposable incomes, and growing urban mobility needs.

For instance, as per the data published by Invest India, in 2022–2023 the total number of autos exported was 47,61,487, with two-wheelers making up around 77% of the total. Passenger vehicle exports rose by 14.7% between April 2022 and March 2023, from 5,77,875 to 6,62,891 units. Similarly, the Society of Indian Automobile Manufacturers estimated that the total number of passenger vehicles sold rose from 30,69,523 to 38,90,114.

In comparison to the prior year, sales of passenger cars grew from 14,67,039 to 17,47,376, utility vehicles from 14,89,219 to 20,03,718, and vans from 1,13,265 to 1,39,020 units in FY-2022–2023. The total number of sales of commercial vehicles rose from 7,16,566 to 9,62,468 units. In comparison to the prior year, sales of Light Commercial Vehicles climbed from 4,75,989 to 6,03,465 units, while Sales of Medium and Heavy Commercial Vehicles increased from 2,40,577 to 3,59,003 units in FY-2022–2023. Thus, the aforementioned stats drive the market growth in the region.

Competitive Analysis

Competitive Analysis

The global automotive knock sensor market is dominated by players:

- Continental AG

- Robert Bosch GmbH

- NGK Spark Plugs Inc.

- HYUNDAI KEFICO Corporation

- NGK Spark Plugs (U.S.A.) Inc.

- Denso Corporation

- Delphi Automotive PLC

- Hitachi Ltd.

The global automotive knock sensor market is segmented as follows:

By Type

By Type

- Linear Frequency Sensor

- Wide Range Frequency Sensor

By End User

By End User

- Passenger Vehicles

- Medium Commercial Vehicles

- Heavy Duty Commercial Vehicles

- Light Duty Commercial Vehicles

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Continental AG

- Robert Bosch GmbH

- NGK Spark Plugs Inc.

- HYUNDAI KEFICO Corporation

- NGK Spark Plugs (U.S.A.) Inc.

- Denso Corporation

- Delphi Automotive PLC

- Hitachi Ltd.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors