Search Market Research Report

ATM Security Market Size, Share Global Analysis Report, 2025 – 2034

ATM Security Market Size, Share, Growth Analysis Report By Type (Professional Services, Managed Services, And Support & Maintenance), By Purpose (Video Surveillance, Transaction Security, Access Control, Security Measures, And Others), By Deployment Model (Cloud-Based, On-Premise, And Hybrid Deployments), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

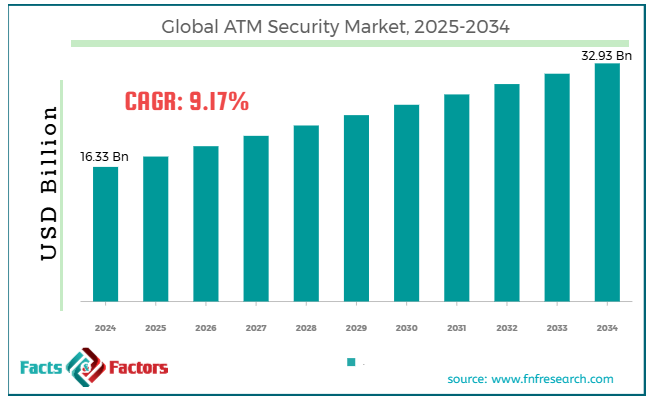

[221+ Pages Report] According to Facts & Factors, the global ATM security market size was valued at USD 16.33 billion in 2024 and is predicted to surpass USD 32.93 billion by the end of 2034. The ATM security industry is expected to grow by a CAGR of 9.17% between 2025 and 2034.

Market Overview

Market Overview

ATM security refers to the collective practice of technologies and strategies used to protect ATMs from potential threats, such as physical damage, hacking, fraud, and unauthorized access. ATM security is essential for the safety of the users and the infrastructure. It also facilitates the confidentiality of user information and the integrity of the financial transactions. End-users are adopting cloud-based monitoring and AI for next-generation ATM security.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global ATM security market size is estimated to grow annually at a CAGR of around 9.17% over the forecast period (2025-2034).

- In terms of revenue, the global ATM security market size was valued at around USD 16.33 billion in 2024 and is projected to reach USD 32.93 billion by 2034.

- A spike in ATM associated crimes is driving the growth of the global ATM security market.

- Based on the types, the managed services segment is growing at a high rate and is projected to dominate the global market.

- Based on purposes, the access control segment is anticipated to grow with the highest CAGR in the global market.

- Based on the deployment models, the on-premise segment is projected to swipe the largest market share.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- How spike in ATM associated crimes will drive the growth of the global ATM security market?

An increase in ATM-related crimes, including black-box attacks, skimming devices, and malware injections, is driving the demand for robust ATM security. The rapid deployment of ATMs in emerging countries, such as China, India, Nigeria, and Indonesia, is expected to revolutionize the market. The rapid rollout of ATMs in these countries is due to government-led financial inclusion programs. Their initiative is to develop Tier 2 and Tier 3 cities with adequate ATM infrastructure. However, these new installations require a surveillance system, biometric access control, and many other integrated alarm systems to eliminate the vulnerabilities.

Additionally, the adoption of NextGen ATMs, which support cardless cash withdrawals, self-service, currency exchange, and other features, is likely to further develop the global ATM security market. These smart ATMs facilitate continuous authentication of protocols and therefore require smart analytics to detect fraudulent transactions.

A strict regulatory landscape requires ATM operators to align with regulatory mandates, such as GDPR, EMV migration, and PCI DSS. These mandates facilitate the need for multi-factor authentication, secure key loading, and encrypted PIN pads, which further creates the demand for ATM security globally. For instance, Red Link signed an agreement with Diebold Nixdorf in 2023 to enable the ATM network to use the DN Series. It will improve the customer experience of Red Link and other partnered banks.

Restraints

Restraints

- Why high capital investment restrains the growth of the global ATM security market?

Installation of these advanced ATM security systems poses a high cost, which is expected to restrain the growth of the global market. Financial institutions with small budgets face constraints and may also delay the security upgrades, which is expected to negatively impact the development of the ATM security industry. For instance, NCR Corporation extended its collaboration with Walgreens in 2023. NCR Corporation will supply ATM services in the US.

Opportunities

Opportunities

- How AI and automation in security will foster growth opportunities in the global ATM security market?

End-users are adopting new technologies to strengthen their ATM security. Manufacturers and service providers, including those utilizing AI for real-time monitoring, analyzing ATM behavior, predicting hardware failures, and detecting suspicious withdrawal patterns. Automation helps block an ATM card instantly on suspicious transactions. Automatic renewal of cards helps users avoid any downtime.

Additionally, leading ATM security vendors are investing heavily in blockchain technology to facilitate secure transactions and promote consumer trust. There is a growing inclination for third-party operators to manage their security dashboards and perform routine checks. Managed services have become necessary for ATM security, as they offer centralized software management, rapid incident response, and real-time fraud alerts, among other benefits. Therefore, all these factors are expected to expand the global ATM security market's scope in the coming years.

Challenges

Challenges

- Does integration with legacy infrastructure become a big challenge in the global ATM security market?

Many ATMs worldwide are still running on legacy hardware and software, making integration with advanced ATM security systems a complex process. Integrating modern security technology is cost-intensive, technically challenging, and also risk-prone. Therefore, it is a big challenge in the ATM security industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 16.33 Billion |

Projected Market Size in 2034 |

USD 32.93 Billion |

CAGR Growth Rate |

9.17% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Guangzhou Yuyin Technology Co. Ltd., Oki Electric Industry Co. Ltd., NCR Atleos, Hitachi Channel Solutions Corp., GRGBanking, G4S Limited, FUJITSU, Diebold Nixdorf, Incorporated, and others. |

Key Segment |

By Type, By Purpose, By Deployment Model, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global ATM security market can be segmented by type, purpose, deployment model, and region.

Based on types, the market can be segmented into professional services, managed services, and support & maintenance. Managed services are expected to be the fastest-growing segment in the ATM security industry during the forecast period. Modern ATMs incorporate a range of technologies, including biometric authentication, encryption, remote key loading, and others. However, managing all services and maintenance internally is expensive and exhausting; therefore, end-users often outsource the expertise to managed service providers.

Additionally, there are increasing incidents of black box attacks, Malware attacks, jackpotting, and other similar threats, necessitating the need for intense monitoring. Managed services provide end-users with comprehensive 24/7 fraud detection and efficient incident response, enabling ATMs to implement effective security measures. These offer software patching, which assures minimum financial losses. Managed services also help in optimizing cost, as in-house operations are capital-intensive. The fast expansion of ATM networks, particularly in the emerging markets, is likely to widen the scope of the segment. The end-users are inclining towards third-party managed service providers for software monitoring, cash logistics, and remote software maintenance.

Based on purposes, the market can be segmented into video surveillance, transaction security, access control, security measures, and others. Access control is likely to dominate the global ATM security market during the predicted period. A surge in ATM-associated cyber threats is one of the primary reasons for the strong requirement for access authentication. Moreover, ATM software is integrated with bank systems through a cloud model; therefore, they have become prime targets for hackers.

Additionally, the security standards are playing an essential role in the high growth rate of the segment. There are specific banking regulations, such as ISO 27001, GLBA, and PCI DSS, that mandate access control. Access control systems are often offered with additional services, such as real-time surveillance and generating log trails, which also aid in compliance auditing. Access control also offers fraud detection, data analytics, skimming technology, surveillance systems, and encrypted data protection, thereby making it an attractive package and a core pillar of ATM security.

Based on deployment models, the market can be segmented into cloud-based, on-premise, and hybrid deployments. The on-premise segment is likely to account for the largest share of the ATM security industry during the forecast period. On-premises deployment offers greater control, as it eliminates the need for third-party management of the ATM infrastructure. Many countries have data localization laws that require all sensitive data to remain within the country.

Additionally, a substantial ATM network remains operational on a legacy core banking system that integrates with legacy payment gateways and CRM systems. The growing demand for customization is also strengthening the demand for on-premise infrastructure. The on-premise model facilitates customized biometric configuration and proprietary fraud detection algorithms.

Regional Analysis

Regional Analysis

- Why does North America dominate the global ATM security market?

North America is expected to account for the largest share of the global ATM security market during the forecast period. The growing incidence of high-frequency ATM frauds in urban and rural areas is driving the requirement for ATM security in the region.

Moreover, a strict regulatory framework governs the North American market, which further enhances the need for a robust security infrastructure. Institutions across the region must adhere to regulatory protocols. Financial institutions are now using biometrics, cardless ATM transactions, and mobile authentication to facilitate identity management and data security.

The United States is the leading market in North America because of the widespread adoption of smart ATM practices. The recent shift to advanced on-premise systems is also likely to contribute to the high growth rate of the regional market. Canada is also witnessing high demand due to regulatory pressures and the rapid deployment of ATMs in retail chains and transit hubs.

Mexico is also evolving fast due to the growing number of ATM installations across the country. Mexico is deploying EMV chips to reduce card-skimming fraud. An increase in tourism-linked crime is also fostering growth opportunities in the regional market.

Asia-Pacific is also likely to witness significant developments in the ATM security industry in the coming years. Governments are expanding ATMs in many rural and underserved regions. The rapid deployment of smart ATMs is driving the demand for biometric authentication, thereby fueling the need for enhanced ATM security. China is leading the market in the APAC region due to the rapid rollout of facial recognition technology in the country. India is also expected to witness significant growth due to the government initiatives to establish a robot ATM network across the country.

South Korea is actively integrating ATMs with advanced technology, which in turn will contribute to the market's growth. Australia is making a significant contribution to the development of the regional market because of the rise of contactless payment trends. For instance, NCR Corporation collaborated with the Member ATM Alliance in 2023. It aims to deliver ATM-as-a-service to credit unions.

Competitive Analysis

Competitive Analysis

The key players in the global ATM security market include:

- Guangzhou Yuyin Technology Co. Ltd.

- Oki Electric Industry Co. Ltd.

- NCR Atleos

- Hitachi Channel Solutions Corp.

- GRGBanking

- G4S Limited

- FUJITSU

- Diebold Nixdorf

- Incorporated

For instance, Diebold Nixdorf collaborated with Bankart in 2024 to revamp its payment processing platform. This strategic step is likely to transform the existing system by introducing a cloud-based solution, thereby strengthening payment capabilities for ATMs, POS terminals, and e-commerce systems.

The global ATM security market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Professional Services

- Managed Services

- Support & Maintenance

By Purpose Segment Analysis

By Purpose Segment Analysis

- Video Surveillance

- Transaction Security

- Access Control

- Security Measures

- Others

By Deployment Model Segment Analysis

By Deployment Model Segment Analysis

- Cloud-Based

- On-Premise

- Hybrid Deployments

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Guangzhou Yuyin Technology Co. Ltd.

- Oki Electric Industry Co. Ltd.

- NCR Atleos

- Hitachi Channel Solutions Corp.

- GRGBanking

- G4S Limited

- FUJITSU

- Diebold Nixdorf

- Incorporated

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors