Search Market Research Report

Aramid Fiber Market Size, Share Global Analysis Report, 2022 – 2028

Aramid Fiber Market By End Use Industry (Aerospace and Defense, Automotive, Electronics and Telecommunication, Sports Goods, Others), By Product Type (Meta-Aramid Fiber, Para-Aramid Fiber, Others), By Application (Protective Fabrics, Frictional Materials, Optical Fibers, Tire Reinforcement, Rubber Reinforcement, Composites, Others), and By Region – Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast 2022 – 2028

Industry Insights

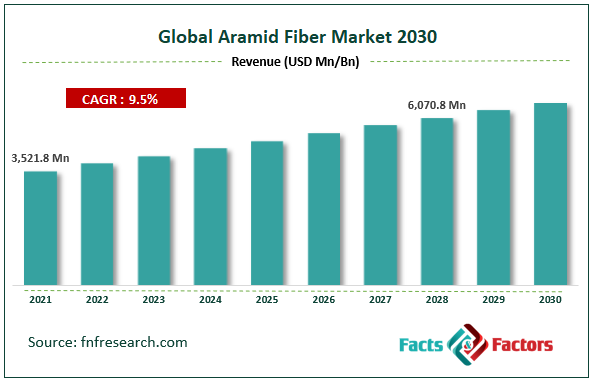

[221+ Pages Report] According to Facts and Factors, the global aramid fiber market was worth around USD 3,521.8 million in 2021 and is estimated to grow to about USD 6,070.8 million by 2028, with a compound annual growth rate (CAGR) of approximately 9.5% over the forecast period. The report analyzes the aramid fiber market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the aramid fiber market.

Market Overview

Market Overview

Aramid fibers have gained massive popularity over the past few years owing to the rise in demand for lightweight materials in multiple end-use industries is expected to majorly boost aramid fiber market potential over the forecast period. Increasing demand for lightweight components in automotive industries and defense applications is expected to majorly influence the aramid fiber market growth through 2028.

Rising research and development activity for new materials and increasing focus on creating new lightweight solutions is anticipated to majorly influence the aramid fiber market growth in a positive manner through 2028. However, the high costs of research and development of this aramid fiber are expected to prove to be a major restraining factor for the aramid fiber market growth on a global level.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic had a significantly adverse impact on the aramid fiber market and this was majorly due to a drop in industrial activity on a global scale. Lockdown restrictions led to the closure of multiple facilities which utilized aramid fiber and hence lapses in the logistic chain, shortage of raw materials, and hampered research and development activities were other factors that hindered the aramid fiber market potential in 2020 and led to major losses for aramid fiber manufacturers.

As the lockdown restrictions are lifted and the world returns to normal, the aramid fiber market is expected to make a good comeback in the post-pandemic era. Increasing spending in the defense sector is expected to provide lucrative opportunities for aramid fiber manufacturers over the forecast period.

Growth Drivers

Growth Drivers

- Increasing demand for Lightweight Materials

Advancements in technology have called for more lightweight materials and this trend is expected to favor the aramid fiber market growth over the forecast period. Increasing demand for electric vehicles and demand for reduction of weight of multiple vehicles has led to a substantial increase in demand for lightweight materials such as aramid fiber and this is expected to exclusively propel aramid fiber market growth in the long run. Increasing demand from defense applications will also help boost the sales of aramid fiber through the forecast period. Reducing weight to reduce emissions is also favoring the demand for aramid fiber in the forecast period.

Restraints

Restraints

- Extremely High Research Costs for Aramid fiber

Aramid fibers have excellent structural composition and these fibers are very expensive to manufacture due to their high research and development costs. High costs of raw materials to manufacture this aramid fiber are also expected to hinder the global aramid fiber market potential through 2028. Increasing the use of these fibers for inexpensive applications also increases their cost as they need to be highly compatible and well developed which incurs additional research and development costing.

Segmentation Analysis

Segmentation Analysis

The global aramid fiber market is segregated based on end-use industry, product type, application, and region.

By Product Type, the market is divided into Meta-Aramid Fiber, Para-Aramid Fiber, and Others. The para-aramid segment is anticipated to be the most lucrative segment in the global aramid fiber market landscape and is expected to maintain this stance through the forecast period. The rising use of this fiber in protective clothing and increased demand for protective clothing is anticipated to boost the aramid fiber market growth through 2028.

By end-use industry, the aramid fiber market is segmented into Aerospace and Defense, Automotive, Electronics and Telecommunication, Sports Goods, and Others. The aerospace and defense industry will hold a major market share in the global aramid fiber industry landscape through 2028.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 3,521.8 Million |

Projected Market Size in 2028 |

USD 6,070.8 Million |

CAGR Growth Rate |

9.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Teijin, DuPont de Nemours Inc., Yantai Tayho Advanced Materials Company, Hyosung Corporation, Toray Chemical Korea, Kolon Industries, Huvis, China National BlueStar Group Company, Taekwang Industrial, JSC Kamenskvolokno, Guangdong Charming Company., and Others |

Key Segment |

By End-Use Industry, Product Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

The Europe region leads the global aramid fiber market in terms of revenue and volume share and is anticipated to maintain this stance through the forecast period. Stringent regulations requiring reducing emissions and creating more efficient systems are anticipated to be the major driver for the aramid fiber market in this region. Increasing spending on defense and aerospace research activity will also further bolster the aramid fiber market potential over the forecast period.

The market for aramid fiber in the Asia Pacific region is expected to have lucrative opportunities owing to low production and research costs in this region which promotes aramid fiber manufacturers to establish their facilities in this region.

Recent Developments

Recent Developments

- In 2020 – Tejin Ltd. a Japanese multinational giant specializing in chemical and aramid manufacturing announced the development of new high-performance aramid fibers that were manufactured by using green raw material and have a wide scope of application in car tires, aerospace, etc.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the global aramid fiber market include –

- Teijin

- DuPont de Nemours Inc.

- Yantai Tayho Advanced Materials Company

- Hyosung Corporation

- Toray Chemical Korea

- Kolon Industries

- Huvis

- China National BlueStar Group Company

- Taekwang Industrial

- JSC Kamenskvolokno

- Guangdong Charming Company.

The global aramid fiber market is segmented as follows:

By End-Use Industry Segment Analysis

By End-Use Industry Segment Analysis

- Aerospace and Defense

- Automotive

- Electronics and Telecommunication

- Sports Goods

- Others

By Product Type Segment Analysis

By Product Type Segment Analysis

- Meta-Aramid Fiber

- Para-Aramid Fiber

- Others

By Application Segment Analysis

By Application Segment Analysis

- Protective Fabrics

- Frictional Materials

- Optical Fibers

- Tire Reinforcement

- Rubber Reinforcement

- Composites

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Teijin

- DuPont de Nemours Inc.

- Yantai Tayho Advanced Materials Company

- Hyosung Corporation

- Toray Chemical Korea

- Kolon Industries

- Huvis

- China National BlueStar Group Company

- Taekwang Industrial

- JSC Kamenskvolokno

- Guangdong Charming Company

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors