Search Market Research Report

Ammunition Market Size, Share Global Analysis Report, 2021 - 2026

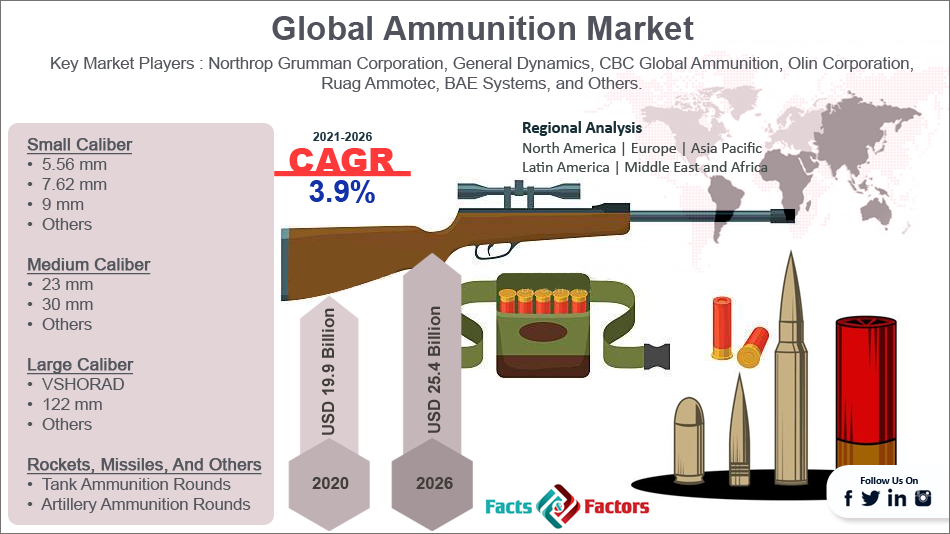

Ammunition Market By Caliber (Small Caliber, Medium Caliber, Large Caliber, & Rockets, Missiles, And Others), By Product (Rimfire & Centerfire), By Application (Civil & Commercial & Defense), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 - 2026

Industry Insights

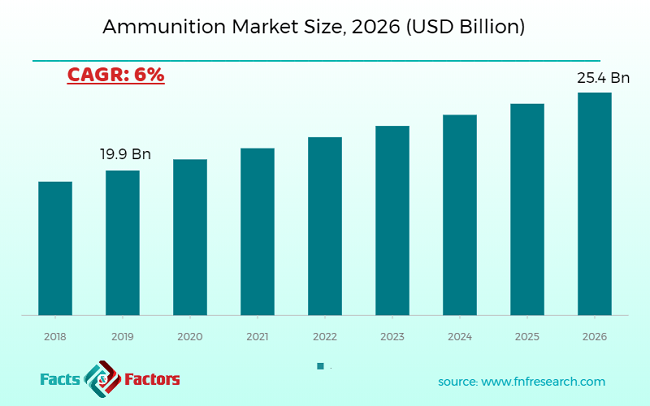

[110+ Pages Report] The latest finding surrounding the Global Ammunition Market published by Facts & Factors offers a neatly packaged and comprehensive read. In the study, the global ammunition market is estimated to reach a projected value of USD 25.4 Billion by 2026 growing at a CAGR of 3.9% from an initial value of USD 19.9 Billion in the year 2020.

Market Overview

Market Overview

Ammunition is the material that is often fired, scattered, dropped, or denoted from any form of weapons in the form of bombs or rockets and is dispersed in the amount of shrapnel, bullets, or shells. Ammunition is often used as an expandable form of weapon and a component of a bigger weapon system that has a tantalizing effect on a target. Oftentimes, there is a variety of ammunition types that has the ability to create various effects on targets such as armor-piercing shells and tracer ammunition.

Key Insights from Primary Research

Key Insights from Primary Research

- As per our primary respondents, the global ammunition market is set to grow annually at a rate of around 3%

- It was established through primary research that the ammunition market was valued at around USD 25,650 Million in 2019

- North America is presently holding the largest revenue share among all the regions and is further expected to maintain its position throughout the forecast period

- The “military” category, on the basis of application segmentation, was the leading revenue-generating category accounting for more than 80% share, in 2019

- On the basis of type segmentation, the “small caliber ammunition” segment held the leading share at more than 30%, in 2019

Key Recommendations from Analysts

Key Recommendations from Analysts

- Consistent rise in spending on the modernization of armed forces is acting as the major driving factor for the ammunitions market

- The strategic and competitive advantage provided by the availability of advanced ammunition in large quantities to a country is anticipated to be the key factor driving the growth of this market globally

- Our team of analysts has identified, the civilian application segment as the fastest-growing category offering potential opportunities for the players operating in this marketplace

- In recent years, the Asia Pacific region is growing with the highest growth rate implying the presence of the most populous as well as militarily strong nations such as China and India.

Industry Growth Factors

Industry Growth Factors

The global ammunition market is likely to attain a high market share during the advent of the forecast period owing to the shifting nature of warfare, increased militarization of police forces, and rising incidence of drug trafficking countermeasures to name a few. Additionally, increasing instances of modernization of armed forces coupled with increasing R&D activities will fuel the growth of the global ammunition market during the advent of the forecast period. Factors pertaining to the rising number of mergers & acquisitions and the increasing number of product launches will increase the footprint of the global ammunition market during the advent of the forecast period.

The global ammunition market is driven by increasing procurement of defense equipment owing to increasing hostilities and terrorist activities coupled with the rising popularity of sports activities utilizing rifles and pistols to name a few. Factors pertaining to technological advancements in terms of polymer-based cases coupled with the rising adoption of online sales media channels will push the existing boundaries of the global ammunition market during the advent of the forecast period. However, increasing legal, economic, and political regulations affecting the production of procurement of ammunition will decrease the market share during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global ammunition market is segmented into caliber, product, application, and region.

On the basis of caliber, the global ammunition market is divided into small caliber, medium caliber, large caliber, and rockets, missiles, and others. The segment pertaining to smaller caliber ammunition is expected to witness the largest market owing to a wider berth of applications in terms of shotgun pistols, assault rifles, rifles, and revolvers coupled with the rising demand for small-caliber ammunition from security forces toward increasing incidences of armed conflicts on a global scale. Based on product, the global ammunition market is classified into rimfire and centerfire.

The segment pertaining to centerfire ammunition is expected to witness the largest market share during the advent of the forecast period owing to the latter product being placed in a viable position of the gun barrel coupled with the added benefit of centerfire rounds being reloadable at a rapid pace to name a few. On the basis of application, the global ammunition market is fragmented into civil & commercial, and defense. The defense segment is expected to witness the largest market share during the advent of the forecast period owing to rising cross-border conflicts around a global purview coupled with increasing geopolitical conflicts in the form of terrorist activities to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 19.9 Billion |

Projected Market Size in 2026 |

USD 25.4 Billion |

CAGR Growth Rate |

3.9% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Northrop Grumman Corporation, General Dynamics, CBC Global Ammunition, Olin Corporation, Ruag Ammotec, BAE Systems, Thales Group, Rheinmetal AG, Nexter KNDS Group, Elbit Systems, Nammo AS, ST Engineering, Remington Arms Company, Sierra Builders, Ruag Corporation |

Key Segments |

By Caliber, Products, Applications, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

North America is expected to witness the largest market share during the advent of the forecast period owing to rising terrorist activities in the region coupled with lenient gun laws in the form of favorable government policies to name a few. Additionally, increased military spending from the United States of America coupled with development and a rapid acquirement process of warfare will increase the footprint of the global ammunition market during the advent of the forecast period.

Asia-Pacific is expected to witness the fastest growing CAGR during the advent of the forecast period owing to the region being the hotbed of increasing geopolitical conflicts and increasing threats of terrorist attacks to name a few. Moreover, increasing factors in terms of reducing the accentuating crime rate coupled with increased procurement of bullets from various government bodies across the region will push the existing boundaries of the ammunition market in the region during the forecast.

Competitive Players

Competitive Players

- Northrop Grumman Corporation

- General Dynamics

- CBC Global Ammunition

- Olin Corporation

- Ruag Ammotec

- BAE Systems

- Thales Group

- Rheinmetal AG

- Nexter KNDS Group

- Elbit Systems

- Nammo AS

- ST Engineering

- Remington Arms Company

- Sierra Builders

- Ruag Corporation

By Caliber Segment Analysis

By Caliber Segment Analysis

- Small Caliber

- 5.56 mm

- 7.62 mm

- 9 mm

- Others

- Medium Caliber

- 23 mm

- 30 mm

- Others

- Large Caliber

- VSHORAD

- 122 mm

- Others

- Rockets, Missiles, And Others

- Tank Ammunition Rounds

- Artillery Ammunition Rounds

By Product Segment Analysis

By Product Segment Analysis

- Rimfire

- Centerfire

By Application Segment Analysis

By Application Segment Analysis

- Civil & Commercial

- Sports & Hunting

- Defense

- Military

- Law Enforcement

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Industry Major Market Players

- Northrop Grumman Corporation

- General Dynamics

- CBC Global Ammunition

- Olin Corporation

- Ruag Ammotec

- BAE Systems

- Thales Group

- Rheinmetal AG

- Nexter KNDS Group

- Elbit Systems

- Nammo AS

- ST Engineering

- Remington Arms Company

- Sierra Bullters

- Ruag Corporation

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors