Search Market Research Report

Airport Kiosk Market Size, Share Global Analysis Report, 2025 – 2034

Airport Kiosk Market By Component (Hardware, Software and Services), By Airport Size (Small, Medium, Large), By Application (Automated Passport Control, Common-Use Self Service [CUSS] Kiosk, Information Kiosk, Baggage Check-In Kiosk, Ticketing Kiosk, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 – 2034

Industry Insights

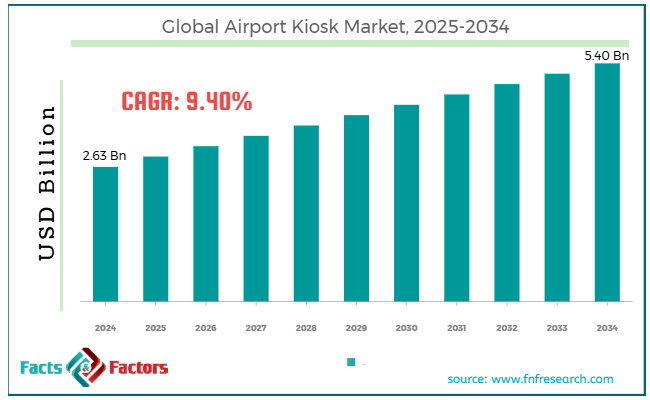

[222+ Pages Report] According to Facts & Factors, the global airport kiosk market size was worth around USD 2.63 billion in 2024 and is predicted to grow to around USD 5.40 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.40% between 2025 and 2034.

Market Overview

Market Overview

An airport kiosk is a DIY machine that is present at airports. It accelerates boarding, check-in, and travel-associated processes. It lets passengers print boarding passes, check-in, choose their flight seats, and tag their baggage. The leading drivers of the global airport kiosk market comprise surging passenger traffic, growing demand for self-service and contactless solutions, and technological improvements in kiosk machines. With the growing air travel, airports are experiencing increased congestion. Kiosk systems help to manage massive passenger volumes efficiently, thus reducing waiting times and enhancing throughput.

Moreover, passengers are actively preferring contactless interactions to minimize physical contact. Kiosk machines help passengers perform tasks like baggage tagging, check-in, and printing boarding passes. Also, novel technologies like biometrics (fingerprint scanning, facial recognition), machine learning, and artificial intelligence make these machines more secure, smarter, and faster. This motivates further adoption by airlines and airports.

Nevertheless, technological integration issues and data privacy and security concerns could hamper the growth of the global market. Kiosks frequently need integration with numerous backend systems like baggage handling, ticketing, and security systems. This integration might be complicated, expensive, and time-consuming. Also, since kiosks manage passengers' confidential and sensitive details, there are key concerns over cyberattacks, data breaches, and more, which may prevent passengers from using the technology.

Yet, the global market is anticipated to be fueled by opportunities like the integration of progressing technologies and multi-functional kiosks. Incorporating biometric technologies and AI in kiosks offers fresh avenues for reducing obstacles, improving passenger security, and enhancing overall efficiency. AI can help kiosk machines customize communications and forecast customer behavior.

Airports actively prefer multi-functional kiosk machines that can efficiently manage multiple jobs. For instance, kiosk machines that offer baggage tagging, check-ins, and security screening functions in a single system are predicted to gain massive attention.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global airport kiosk market is estimated to grow annually at a CAGR of around 9.40% over the forecast period (2025-2034)

- In terms of revenue, the global airport kiosk market size was valued at around USD 2.63 billion in 2024 and is projected to reach USD 5.40 billion by 2034.

- The airport kiosk market is projected to grow significantly owing to advancements in kiosk machines, growing demand for a smooth and personalized travel experience, and rising need for operational efficacy.

- Based on component, the hardware segment is expected to lead the market, while the software and services segment is expected to register considerable growth.

- Based on airport size, the large segment is the dominating segment among others, while the medium segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the Common-Use Self Service (CUSS) kiosk segment is expected to lead the market as compared to the automated passport control segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Will cost reduction and operational efficiency propel the airport kiosk market growth?

Airports are under persistent pressure to reduce costs and improve their operational efficiency. Automated kiosks are vital to this objective since they reduce the need for a human workforce and accelerate routine activities like baggage tagging, check-in, and boarding pass printing. Automated kiosks help airlines and airports save on workforce costs, lessen human errors, and simplify boarding and check-in processes, thus fueling cost savings and operational efficacy and impacting the growth of the airport kiosk industry.

JFKIAT, in 2023, initiated the implementation of Amadeus' Next Generation Kiosk and Auto Bag Drop systems. Installing 42 automated bag-drop stations and 86 kiosks for check-in is projected to decrease passenger wait times and operational costs, thus enhancing overall efficiency. The kiosks present biometric facial recognition, increasing their security and speed.

- Improved passenger experience to drive market growth

Passengers are actively preferring smoother, simpler, and faster travel experiences. Self-service kiosks enable passengers to drop off luggage, check-in, and print a boarding pass without waiting in long queues at counters. This independence enhances the travel experience by giving passengers more control over their journey.

Sydney Airport declared a USD 200 million renovation of its T2 domestic terminal in November 2024. The upgrade comprises the installation of advanced bag-drop solutions and self-service kiosks. These modernizations significantly reduce long wait times and promise the maximum number of passengers to move across the airport from curbside to departure section in 15 minutes.

Restraints

Restraints

- Reliance on consistent internet connectivity unfavorably impacts the progress of the airport kiosk market

Airport kiosks, which offer real-time data processing or biometric authentication, depend heavily on a high-speed and stable internet connection. In places with bad connectivity, kiosks may experience delays or become non-serviceable, thus resulting in poor travel experiences and degraded operational inefficiency.

Airports in emerging or remote regions may witness intricacies with unreliable internet systems, hampering these machines' potential to perform optimally. In regions with an unstable internet connection, kiosk systems may also experience downtime, leading to major passenger dissatisfaction.

Opportunities

Opportunities

- Replacement of outmoded systems contributes to the growth of the market

Several airports are replacing former kiosks with upgraded, ergonomic models to efficiently handle passenger traffic. Upgrading outdated systems allows kiosk producers to supply cutting-edge technologies that improve passenger satisfaction and enhance efficacy. This could positively impact the growth of the airport kiosk market.

- How will developing smart airports spur the airport kiosk industry’s growth?

The idea of smart airports involves utilizing technologies such as artificial intelligence, the internet of things (IoT), and cloud computing to enhance passenger experience and airport operations. Investments in self-service kiosk systems with improved features like wayfinding navigation and location-based promotions are key to this trend. Initiatives for smart airports offer opportunities for kiosk suppliers to deliver modernized technologies that satisfy the growing demands of airport operators and modern travelers.

Challenges

Challenges

- Would integration with existing systems limit the expansion of the airport kiosk market?

Several airports still use outdated systems that may not easily incorporate novel kiosk technologies. Integrating self-baggage drop infrastructure, self-check-in kiosks, and biometric verification machines with outdated models or IT infrastructures can be a time-consuming and complex process. They might need significant customization and possibly slow down the integration process. Upgrading legacy machines is a key challenge in airports like London Heathrow and Frankfurt, where numerous integrations are needed for simplified operations.

An IT survey by SITA denotes that approximately 30% of airports are working to incorporate novel kiosk machines in their current systems, which may result in added implementation costs and delays.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 2.63 Billion |

Projected Market Size in 2034 |

USD 5.40 Billion |

CAGR Growth Rate |

9.40% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

SITA, Diebold Nixdorf, Kiosk Information Systems, Zebra Technologies, Verifone Systems, NCR Corporation, Gunnebo, Embarcadero Technologies, VGI Technology, Aurora Kiosk, Advanced Kiosks, JH Williams, Kisumu Technologies, Moca Systems, Icmatica Technologies, and others. |

Key Segment |

By Component, By Airport Size, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global airport kiosk market is segmented based on component, airport size, application, and region.

Based on component, the global airport kiosk industry is divided into hardware, software, and services. The hardware segment led the market in 2024 and is projected to lead in the future as well. The factors fueling the segmental growth include the rising need for automation, technological improvements, mounting passenger volume, and increasing customization needs. Kiosk machines automate tasks like boarding and baggage drop, enhance operational efficiency, and reduce wait times. Improvements in biometric (fingerprint scanning, facial recognition) and self-baggage drop services have fueled the need for novel and highly advanced kiosk systems.

Moreover, with the rising passenger growth, airports are heavily investing in kiosk systems to efficiently manage the surging number of passengers globally. Airports are also largely installing kiosks that can be personalized to meet local regulatory demands and offer personalized experiences to passengers.

Based on airport size, the global airport kiosk industry is segmented into small, medium, and large. The large airport segment registered a notable market share in 2024, accounting for nearly 2/3 of the global revenue. The segmental growth includes high passenger traffic, improved infrastructure, and exhaustive services.

Leading airports effectively manage high passenger volumes, demanding efficient self-service facilities to reduce congestion and handle the flow. Larger airports are deployed with the essential infrastructure to assist well-developed kiosk performance, comprising CUSS kiosks and automated passport control. The broad range of services offered at larger airports, like dining, retailing, and information dissemination, is precisely facilitated via interactive kiosks.

Based on application, the global market is segmented as automated passport control, common-use self-service (CUSS) kiosk, information kiosk, baggage check-in kiosk, ticketing kiosk, and others. The CUSS kiosks segment is leading the industry owing to its efficiency and versatility.

The segment registered over 26% of the global market revenue in 2023. CUSS kiosk systems enable customers to access a range of functions, thereby increasing the popularity of their features among a broad audience. This boosts their preference among airlines and airports. These kiosk machines also improve operational efficiency and offer flexible self-service options to passengers. This ultimately reduces wait times and enhances the overall experience for passengers.

Regional Analysis

Regional Analysis

- What factors will help North America witness significant growth in the airport kiosk market?

North America registered a substantial share of the global airport kiosk market in 2024 and is projected to lead in the future. This growth is backed by extensive airport infrastructure, technological leadership, and growing passenger experience and demand. The United States has one of the biggest and busiest airport systems, and it demands effective passenger processing technologies.

In 2023, the United States airport interactive kiosk industry was estimated at $ 710.48 million. The airports in the region are early adopters of improved technologies, equipping self-service kiosk systems with key features like touchless interactions and biometric screening to improve passenger satisfaction and operational efficiency.

Also, high passenger expectations and volumes for smooth travel have compelled airports to capitalize on technologies that simplify processes and reduce wait times. In 2023, in Canada, the global airport interactive kiosk industry was estimated at $ 108.06 million.

Europe holds the second-leading position in the global airport kiosk market, backed by improved aviation infrastructure, growing passenger traffic, and supportive regulations and security measures. The region boasts a dense network of key international airports, including Paris Charles de Gaulle, London Heathrow, and Frankfurt Airport, which are crucial hubs requiring effective passenger processing technologies. Europe also experiences greater air travel demand, with most airports aiming to manage the increasing passenger volumes commendably.

In addition, strict regulations and emphasis on passenger safety have increased the use of modernized kiosk machines for expedited processing and identity verification. This is apparent in the United Kingdom market, where airports have capitalized on smart systems and touchless technologies to reduce wait times and improve processing efficacy.

Competitive Analysis

Competitive Analysis

The global airport kiosk market is led by players like:

- SITA

- Diebold Nixdorf

- Kiosk Information Systems

- Zebra Technologies

- Verifone Systems

- NCR Corporation

- Gunnebo

- Embarcadero Technologies

- VGI Technology

- Aurora Kiosk

- Advanced Kiosks

- JH Williams

- Kisumu Technologies

- Moca Systems

- Icmatica Technologies

What key trends can be witnessed in the Airport Kiosk Market?

What key trends can be witnessed in the Airport Kiosk Market?

- Focus on AI integration and data analytics:

Airports increasingly use artificial intelligence and data analytics to enhance operations and improve consumer experiences. For example, Delta launched a novel airport screen using facial recognition and artificial intelligence to simultaneously display personalized flight details to numerous travelers. This ultimately enhances overall travel experiences.

- Assimilation of biometric technologies:

Airports actively adopt biometric systems like facial recognition to simplify passenger processing and improve security. For instance, the Australian Border Force conducted efficacious trials of contactless border clearance with the help of facial recognition at Sydney Airport. They aim to eliminate the passport requirement by 2030.

The global airport kiosk market is segmented as follows:

By Component Segment Analysis

By Component Segment Analysis

- Hardware

- Software and Services

By Airport Size Segment Analysis

By Airport Size Segment Analysis

- Small

- Medium

- Large

By Application Segment Analysis

By Application Segment Analysis

- Automated Passport Control

- Common-Use Self Service (CUSS) Kiosk

- Information Kiosk

- Baggage Check-In Kiosk

- Ticketing Kiosk

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- SITA

- Diebold Nixdorf

- Kiosk Information Systems

- Zebra Technologies

- Verifone Systems

- NCR Corporation

- Gunnebo

- Embarcadero Technologies

- VGI Technology

- Aurora Kiosk

- Advanced Kiosks

- JH Williams

- Kisumu Technologies

- Moca Systems

- Icmatica Technologies

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors