Search Market Research Report

Veterinary Diagnostics Market Size, Share Global Analysis Report, 2023 – 2030

Veterinary Diagnostics Market Size, Share, Growth Analysis Report By End-Users (Research Institutes & Universities, Point Of Care Testing, Veterinary Hospitals And Clinics, And Laboratories) By Disease Type (Structural & Functional Diseases, General Elements, Congenital & Acquired Diseases, Non-Infectious Diseases, And Infectious Diseases), By Testing (Virology, Serology, Parasitology, Immunoassays, Molecular Diagnostics, Pathology, Bacteriology, Diagnostic Imaging, And Analytical Services), By Species (Avian, Porcine, Caprine, Feline, Ovine, Equine, Pine, Canine, Cattle, And Others), By Product (Instruments & Devices, And Consumables, Reagents & Kits), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

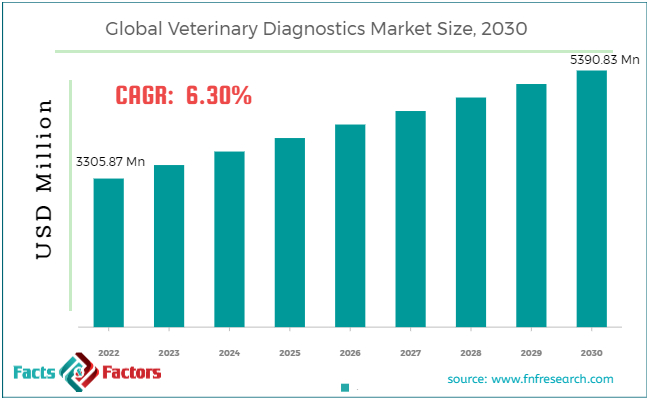

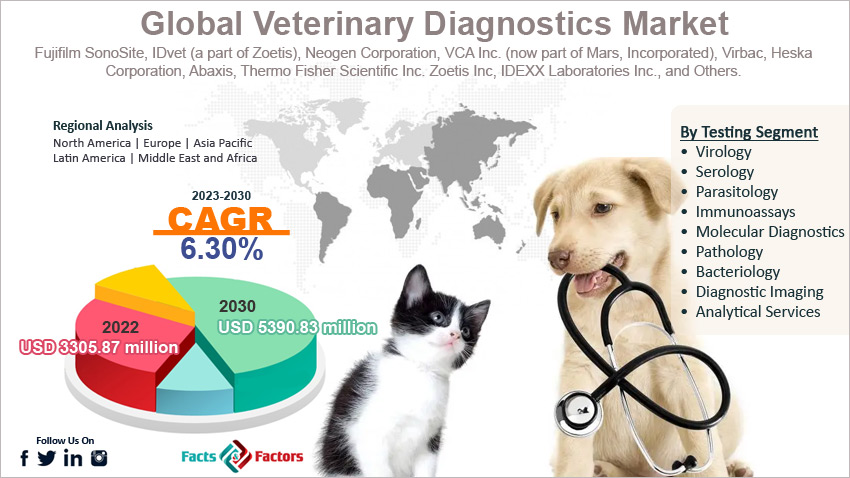

[214+ Pages Report] According to Facts and Factors, the global veterinary diagnostics market size was valued at USD 3305.87 million in 2022 and is predicted to surpass USD 5390.83 million by the end of 2030. The veterinary diagnostics industry is expected to grow by a CAGR of 6.30%.

Market Overview

Market Overview

Veterinary diagnostics refers to the identification and determination of the causes of disease in animals. It is essential to maintain animal health and prevent the spread of diseases in humans. Veterinary diagnosis covers a broad range of techniques & tools, including molecular diagnostics, imaging laboratory tests, and several other clinical examinations.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global veterinary diagnostics market size is estimated to grow annually at a CAGR of around 6.30% over the forecast period (2023-2030).

- In terms of revenue, the global veterinary diagnostics market size was valued at around USD 3305.87 million in 2022 and is projected to reach USD 5390.83 million by 2030.

- Advanced diagnostic technologies are driving the growth of the global veterinary diagnostics market.

- Based on the end users, the laboratory segment is growing at a high rate and is projected to dominate the global market.

- Based on the disease type, the non-infectious diseases segment is projected to swipe the largest market share.

- Based on the testing, the pathology segment is expected to swipe the largest share of the market.

- Based on the species, the canine special segment accounts for the largest share of the global market.

- Based on the product, the consumables, reagents, and kit segment accounts for the largest share of the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Advanced diagnostic technologies are likely to boost the growth of the global market.

The ongoing advancements in diagnostic technologies like next-generation sequencing, molecular diagnostics, and advanced imaging techniques are driving the growth of the global veterinary diagnostics market. These technologies improve the efficiency and accuracy of veterinary diagnostics, thereby assisting in early detection and more targeted treatment.

Moreover, the emerging demand for on-site and rapid diagnostic testing further propels the need for veterinary diagnostics. For instance, Randox Laboratories Ltd. came up with VeraSTAT-V and VeraSTAT in March 2022 in the point-of-care diagnostics portfolio for equine health.

Restraints

Restraints

- Limited access to veterinary care is expected to hamper the growth of the global market.

Certain regions still lack proper veterinary care and diagnostic services, which is expected to slow down the trajectory of the veterinary diagnostics industry. The underserved and rural areas suffer the most because of the lack of veterinary diagnostics and preventive healthcare measures, which is expected to further hinder the industry's growth.

Opportunities

Opportunities

- Rise in companion animal diagnosis is likely to foster growth opportunities in the global market.

The growing trend of pet ownership is increasing the humanization of pets. This substantial growth is increasing the demand for companion animal diagnosis and thereby widening the growth of the global veterinary diagnostics market. People not only look for diagnosis of diseases but also adopt regular preventive care and wellness testing for pets, which in turn is further expected to foster growth opportunities in the industry.

For instance, Idexx laboratory successfully took over ezyVet in June 2021. This acquisition will help expand the company’s world-class software offering to raise the standard care of patients and enable communication with pet owners.

Challenges

Challenges

- Lack of skilled veterinary professionals is a big challenge in the global market.

The lack of trained professionals in the veterinary diagnostic industry is a big challenge in the global veterinary diagnostics market. Staff is not proficient in interpreting the advanced diagnostic results, which further limits the adoption rate of veterinary diagnostics in the market.

Segmentation Analysis

Segmentation Analysis

The global veterinary diagnostics market can be segmented into end-users, disease type, testing, species, product, and region.

By end users, the market can be segmented into research institutes & universities, point-of-care testing, veterinary hospitals & clinics, and laboratories. The laboratory segment accounts for the largest share of the veterinary diagnostics industry.

The advanced utilization of analyzers for diagnostic applications has significantly boosted the demand in the market. Laboratories offer a wide range of diagnostic tests, such as imaging studies, pathology, microbiology, urinalysis, and blood tests. These tests provide comprehensive insights into the health status of animals.

By disease type, the market can be segmented into structural & functional diseases, general elements, congenital & acquired diseases, non-infectious diseases, and infectious diseases. The non-infectious diseases segment is projected to grow with a high CAGR during the forecast period.

An increasing importance and awareness regarding veterinary care has led to a longer lifespan of pets. This longevity is increasing the chances of developing age-related and chronic diseases in animals, which require advanced diagnostics, monitoring, and management procedures. Such a landscape is likely to foster huge development in the segment in the coming years.

By testing, the market can be segmented into virology, serology, parasitology, immunoassays, molecular diagnostics, pathology, bacteriology, diagnostic imaging, and analytical services. The pathology segment is likely to swipe the largest share of the veterinary diagnostics industry during the forecast period. It includes the applications of immunohistochemistry and histopathology diagnostics used to check for changes in animal tissue because of some medical conditions.

These cells are used in biopsy samples for evaluation through specialized training with advanced equipment. Nanotechnology is likely to contribute further to veterinary diagnostics development as it helps screen multiple pathogens in one assay.

By species, the market can be segmented into avian, porcine, caprine, feline, ovine, equine, pine, canine, cattle, and others. The canine special segment is likely to dominate the global market. The major reason behind the high growth rate of the segment is the increasing animal healthcare spending, particularly on the dog species.

Moreover, there are increasing incidences of cancer, diabetes, and obesity, which is another prominent factor driving the growth of the segment. According to a report in 2019, around 57% of the dogs were recorded as obese. Also, the feline segment is likely to grow terribly in the forthcoming years because of the increasing consumption of pork globally. Such a high consumption rate has significantly boosted the requirement for advanced diagnostic procedures.

By product, the market can be segmented into instruments & devices and consumables, reagents & kits. The consumables, reagents, and kits segment is projected to witness significant developments in the global veterinary diagnostics market. The major reason behind the dominant position of the segment is the high demand for products from veterinary clinics, hospitals, and labs.

Moreover, the surging demands for point-of-care diagnostics by pet owners are further propelling the growth of the segment. Also, the widely used point of care diagnostic for animals includes urinalysis strips for pregnancy kits, blood glucose monitors, and others. The surging awareness regarding zoonotic diseases, along with the increasing number of pet adoptions, is further developed in the segment.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 3305.87 Million |

Projected Market Size in 2030 |

USD 5390.83 Million |

CAGR Growth Rate |

6.30% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Fujifilm SonoSite, IDvet (a part of Zoetis), Neogen Corporation, VCA Inc. (now part of Mars, Incorporated), Virbac, Heska Corporation, Abaxis, Thermo Fisher Scientific Inc. Zoetis Inc, IDEXX Laboratories Inc., and Others. |

Key Segment |

By End-Users, By Disease Type, By Testing, By Species, By Product, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America accounts for the largest share of the global veterinary diagnostics market because of the growth in the pet population. Moreover, the growing emphasis on pet healthcare is further contributing to the growth of the market. The companion animal segment, including cats, dogs, and other small pets, is a primary segment boosting the demand for veterinary diagnosis in the regional market. The region is at the forefront of healthcare diagnostic innovation technologies. The increased accuracy and efficiency of veterinary diagnosis have significantly propelled the market's revenue.

Asia Pacific is expected to witness significant growth driven by many factors, such as increasing awareness regarding animal health, rising pet population, and increasing economic development in the region. Moreover, the region is witnessing an increase in the number of exotic pet animals, which is further leading to the high demand for veterinary diagnostic services and products. Economic development has significantly led to the rise in the middle-class population, which in turn is also contributing to the high growth rate of the regional market.

However, the region is expected to witness an increased chance of zoonotic diseases because of the close proximity of animals in agricultural and rural settings, thereby leading to a greater emphasis on veterinary diagnosis. For instance, Companion Animal Health started a strategic agreement in collaboration with HT BioImaging to sell HTVet products, particularly in Canada and the US.

Competitive Analysis

Competitive Analysis

The key players in the global veterinary diagnostics market include:

- Fujifilm SonoSite

- IDvet (a part of Zoetis)

- Neogen Corporation

- VCA Inc. (now part of Mars

- Incorporated)

- Virbac

- Heska Corporation

- Abaxis

- Thermo Fisher Scientific Inc. Zoetis Inc

- IDEXX Laboratories Inc.

For instance, PepiPets came up with a unique mobile diagnostics testing service in August 2022. The service will help companies allow clients to get diagnostic testing in their homes.

The global veterinary diagnostics market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Research Institutes & Universities

- Point Of Care Testing

- Veterinary Hospitals And Clinics

- Laboratories

By Disease Type Segment Analysis

By Disease Type Segment Analysis

- Structural & Functional Diseases

- General Elements

- Congenital & Acquired Diseases

- Non-Infectious Diseases

- Infectious Diseases

By Testing Segment Analysis

By Testing Segment Analysis

- Virology

- Serology

- Parasitology

- Immunoassays

- Molecular Diagnostics

- Pathology

- Bacteriology

- Diagnostic Imaging

- Analytical Services

By Species Segment Analysis

By Species Segment Analysis

- Avian

- Porcine

- Caprine

- Feline

- Ovine

- Equine

- Pine

- Canine

- Cattle

- Others

By Product Segment Analysis

By Product Segment Analysis

- Instruments & Devices And Consumables

- Reagents & Kits

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Fujifilm SonoSite

- IDvet (a part of Zoetis)

- Neogen Corporation

- VCA Inc. (now part of Mars

- Incorporated)

- Virbac

- Heska Corporation

- Abaxis

- Thermo Fisher Scientific Inc. Zoetis Inc

- IDEXX Laboratories Inc.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors