Search Market Research Report

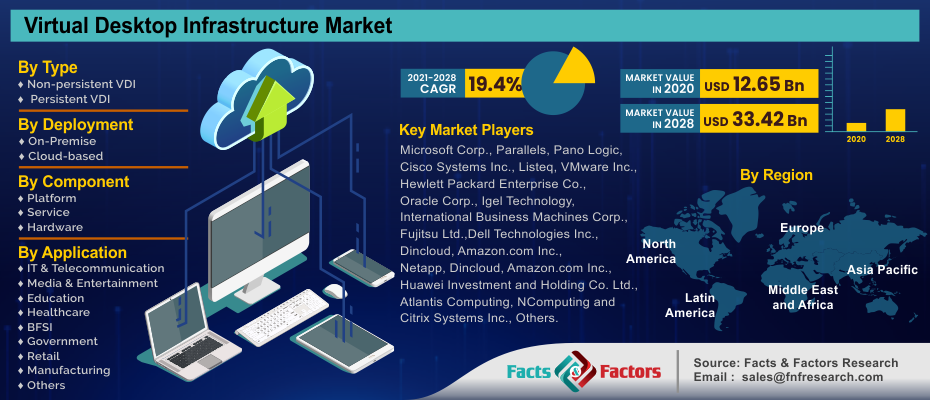

Virtual Desktop Infrastructure Market Size, Share Global Analysis Report, sktop Infrastructure Market By Type (Non-persistent VDI and Persistent VDI), By Deployment (On-Premise and Cloud-based), By Component (Platform, Service and Hardware), and By Application (IT & Telecommunication, Media & Entertainment, Education, Healthcare, BFSI, Government, Retail, Manufacturing and Others): Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast, 2021 – 2028

Virtual Desktop Infrastructure Market By Type (Non-persistent VDI and Persistent VDI), By Deployment (On-Premise and Cloud-based), By Component (Platform, Service and Hardware), and By Application (IT & Telecommunication, Media & Entertainment, Education, Healthcare, BFSI, Government, Retail, Manufacturing and Others): Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast, 2021 – 2028

Industry Insights

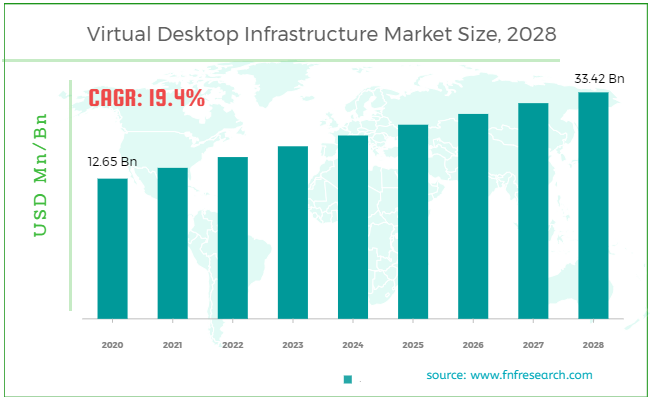

Facts & Factors published the latest report on the global virtual desktop infrastructure (VDI) market is expected to grow from USD 12.65 Billion in 2020 to USD 33.42 Billion by 2028; it is anticipated to grow at a CAGR of 19.4% during 2021 – 2028

Market Overview

Market Overview

Virtual desktop infrastructure is a desktop virtualization technology that allows a data center to run and maintain a desktop operating system. The virtual desktop picture is supplied to an endpoint device over the network, allowing the user to interact with the operating system and its apps as if they were running locally. A standard PC, thin client device, or mobile device can all be used as an endpoint.

Industry Growth Factor

Industry Growth Factor

Bring-your-own-device and corporate-owned personally-enabled devices are driving VDI adoption in the IT and telecom industries. In addition, the demand for VDI is increasing owing to the increase in the mobile workforce. Organizations are increasingly turning to virtual desktop infrastructure (VDI) to manage IT consumerization and cost control. Businesses are attempting to develop advanced virtualized desktop infrastructure. Consumerization of IT and BYOD, combined with mobility, are putting pressure on businesses to adopt advanced virtual technology. Desktop virtualization is gaining attraction owing to improved security, governance, and compliance. Moving to a DaaS platform can benefit a company's security strategy in various ways, as security is one of the top objectives for enterprises.

Various DaaS vendors are now offering security software and services to ensure that businesses use newer, inherently safer devices as soon as possible. Furthermore, by switching to a DaaS service, user data is stored in the DaaS environment, where it is accessible from a wide range of client devices and from practically anywhere. Data is thus securely maintained using the DaaS environment when combined with encryption in transit and encryption at rest. Furthermore, as end-point vulnerabilities grow, enterprises are migrating to virtualized systems, which reduce the perimeter of exposure by storing data in a secure data center rather than on a hard drive on a traditional end-user device. Thus certain benefits provided by VDI are contributing to the market growth.

Despite the COVID 19 epidemic, the worldwide virtual desktop infrastructure (VDI) industry is growing steadily. The increased propensity of employees to work from home is a crucial aspect that is contributing to market growth in this pandemic circumstance. To stop the spread of the virus, the governments of most countries implemented harsh lockdowns and movement restrictions. Most firms have been obliged to establish remote working policies as a result, resulting in a surge in demand for desktop virtualization solutions around the world.

Segmentation Analysis

Segmentation Analysis

The global virtual desktop infrastructure market has been segmented into deployment, component, type, and application. On-premise and cloud-based are the deployment models of the global virtual desktop infrastructure market. Based on the component, the market has been categorized into platform, service, and hardware. In terms of type, the worldwide market is categorized into non-persistent VDI and persistent VDI. The application segment is bifurcated into IT & telecommunication, media & entertainment, education, healthcare, BFSI, government, retail, manufacturing, and others.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 12.65 Billion |

Projected Market Size in 2028 |

USD 33.42 Billion |

CAGR Growth Rate |

19.4% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2028 |

Key Market Players |

Microsoft Corp., Parallels, Pano Logic, Cisco Systems Inc., Listeq, VMware Inc., Hewlett Packard Enterprise Co., Oracle Corp., Igel Technology, International Business Machines Corp., Dell Technologies Inc., Fujitsu Ltd., Netapp, Dincloud, Amazon.com Inc., Huawei Investment and Holding Co. Ltd., Atlantis Computing, NComputing and Citrix Systems Inc. |

Key Segment |

By Type, By Deployment, By Component, By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

North America led the global virtual desktop infrastructure market in terms of revenue in 2020. Increased adoption of cloud technology in numerous industries such as IT, healthcare, education, and telecom industries in the United States is expected to offer the most lucrative revenue potential over the forecast period.

Furthermore, due to BYOD regulations and rising smartphone adoption in the United States, the industry is growing. Due to the rise of cloud computing and the rise of the mobile workforce, the market in the Asia Pacific is predicted to develop at the fastest rate throughout the forecast period. In this region, the concept of bringing your own device to work is gaining traction and cloud computing is becoming more popular.

Competitive Players

Competitive Players

Some of the key players in the virtual desktop infrastructure market are

- Microsoft Corp.

- Parallels

- Pano Logic

- Cisco Systems Inc.

- Listeq

- VMware Inc.

- Hewlett Packard Enterprise Co.

- Oracle Corp.

- Igel Technology

- International Business Machines Corp.

- Dell Technologies Inc.

- Fujitsu Ltd.

- Netapp

- Dincloud

- Amazon.com Inc.

- Huawei Investment and Holding Co. Ltd.

- Atlantis Computing

- NComputing

- Citrix Systems Inc.

By Type

By Type

- Non-persistent VDI

- Persistent VDI

By Deployment

By Deployment

- On-Premise

- Cloud-based

By Component

By Component

- Platform

- Service

- Hardware

By Application

By Application

- IT & Telecommunication

- Media & Entertainment

- Education

- Healthcare

- BFSI

- Government

- Retail

- Manufacturing

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table of Content

Industry Major Market Players

- Microsoft Corp.

- Parallels

- Pano Logic

- Cisco Systems Inc.

- Listeq

- VMware Inc.

- Hewlett Packard Enterprise Co.

- Oracle Corp.

- Igel Technology

- International Business Machines Corp.

- Dell Technologies Inc.

- Fujitsu Ltd.

- Netapp

- Dincloud

- Amazon.com Inc.

- Huawei Investment and Holding Co. Ltd.

- Atlantis Computing

- NComputing

- Citrix Systems Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors