- Chapter 1. Executive Summary 26

-

- Chapter 2. Truck Video Safety Solutions market - Business Model Analysis 29

- 2.1. Global Truck Video Safety Solutions Market - Business Model Overview 29

- 2.2. Global Truck Video Safety Solutions Market Share, by Business Model, 2018 & 2025 (USD Million) 29

- 2.3. Upfront 31

- 2.3.1. Global Upfront Truck Video Safety Solutions Market, 2016-2026 (USD Million) 31

- 2.4. Subscription 32

- 2.4.1. Global Subscription Truck Video Safety Solutions Market, 2016-2026 (USD Million) 32

-

- Chapter 3. Truck Video Safety Solutions market - Fleet Size Analysis 32

- 3.1. Global Truck Video Safety Solutions Market - Fleet Size Overview 32

- 3.2. Global Truck Video Safety Solutions Market Share, by Fleet Size, 2018 & 2025 (USD Million) 33

- 3.3. Small Fleet 34

- 3.3.1. Global Small Fleet Truck Video Safety Solutions Market, 2016-2026 (USD Million) 34

- 3.4. Larger Fleet 35

- 3.4.1. Global Larger Fleet Truck Video Safety Solutions Market, 2016-2026 (USD Million) 35

-

- Chapter 4. Truck Video Safety Solutions market - Vehicle Type Analysis 35

- 4.1. Global Truck Video Safety Solutions Market - Vehicle Type Overview 35

- 4.2. Global Truck Video Safety Solutions Market Share, by Vehicle Type, 2018 & 2025 (USD Million) 36

- 4.3. Light commercial vehicle 37

- 4.3.1. Global Light commercial vehicle Truck Video Safety Solutions Market, 2016-2026 (USD Million) 37

- 4.4. Medium/heavy commercial vehicles 38

- 4.4.1. Global Medium/heavy commercial vehicles Truck Video Safety Solutions Market, 2016-2026 (USD Million) 38

-

- Chapter 5. Truck Video Safety Solutions market - Recording View Type Analysis 38

- 5.1. Global Truck Video Safety Solutions Market - Recording View Type Overview 38

- 5.2. Global Truck Video Safety Solutions Market Share, by Recording View Type, 2018 & 2025 (USD Million) 39

- 5.3. Drivers and Forward 40

- 5.3.1. Global Drivers and Forward Truck Video Safety Solutions Market, 2016-2026 (USD Million) 40

- 5.4. Others 41

- 5.4.1. Global Others Truck Video Safety Solutions Market, 2016-2026 (USD Million) 41

-

- Chapter 6. Truck Video Safety Solutions market - Application Analysis 41

- 6.1. Global Truck Video Safety Solutions Market - Application Overview 41

- 6.2. Global Truck Video Safety Solutions Market Share, by Application, 2018 & 2025 (USD Million) 42

- 6.3. Logistics 43

- 6.3.1. Global Logistics Truck Video Safety Solutions Market, 2016-2026 (USD Million) 43

- 6.4. Energy and utilities 44

- 6.4.1. Global Energy and utilities Truck Video Safety Solutions Market, 2016-2026 (USD Million) 44

- 6.5. Retail 45

- 6.5.1. Global Retail Truck Video Safety Solutions Market, 2016-2026 (USD Million) 45

- 6.6. FnB 46

- 6.6.1. Global FnB Truck Video Safety Solutions Market, 2016-2026 (USD Million) 46

- 6.7. Oil and Petroleum 47

- 6.7.1. Global Oil and Petroleum Truck Video Safety Solutions Market, 2016-2026 (USD Million) 47

- 6.8. Construction and mining 48

- 6.8.1. Global Construction and mining Truck Video Safety Solutions Market, 2016-2026 (USD Million) 48

- 6.9. Public Sector 49

- 6.9.1. Global Public Sector Truck Video Safety Solutions Market, 2016-2026 (USD Million) 49

-

- Chapter 7. Truck Video Safety Solutions market - Regional Analysis 50

- 7.1. Global Truck Video Safety Solutions Market Regional Overview 50

- 7.2. Global Truck Video Safety Solutions Market Share, by Region, 2018 & 2025 (Value) 50

- 7.3. North America 52

- 7.3.1. North America Truck Video Safety Solutions Market size and forecast, 2016-2026 52

- 7.3.2. North America Truck Video Safety Solutions Market, by Country, 2018 & 2025 (USD Million) 52

- 7.3.3. North America Truck Video Safety Solutions Market, by Business Model, 2016-2026 54

- 7.3.3.1. North America Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 54

- 7.3.4. North America Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 55

- 7.3.4.1. North America Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 55

- 7.3.5. North America Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 56

- 7.3.5.1. North America Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 56

- 7.3.6. North America Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 57

- 7.3.6.1. North America Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 57

- 7.3.7. North America Truck Video Safety Solutions Market, by Application, 2016-2026 58

- 7.3.7.1. North America Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 58

- 7.4. Europe 59

- 7.4.1. Europe Truck Video Safety Solutions Market size and forecast, 2016-2026 59

- 7.4.2. Europe Truck Video Safety Solutions Market, by Country, 2018 & 2025 (USD Million) 59

- 7.4.3. Europe Truck Video Safety Solutions Market, by Business Model, 2016-2026 60

- 7.4.3.1. Europe Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 60

- 7.4.4. Europe Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 61

- 7.4.4.1. Europe Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 61

- 7.4.5. Europe Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 62

- 7.4.5.1. Europe Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 62

- 7.4.6. Europe Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 63

- 7.4.6.1. Europe Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 63

- 7.4.7. Europe Truck Video Safety Solutions Market, by Application, 2016-2026 64

- 7.4.7.1. Europe Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 64

- 7.5. China 65

- 7.5.1. China Truck Video Safety Solutions Market size and forecast, 2016-2026 65

- 7.5.2. China Truck Video Safety Solutions Market, by Country, 2018 & 2025 (USD Million) 65

- 7.5.3. China Truck Video Safety Solutions Market, by Business Model, 2016-2026 66

- 7.5.3.1. China Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 66

- 7.5.4. China Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 67

- 7.5.4.1. China Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 67

- 7.5.5. China Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 68

- 7.5.5.1. China Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 68

- 7.5.6. China Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 69

- 7.5.6.1. China Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 69

- 7.5.7. China Truck Video Safety Solutions Market, by Application, 2016-2026 70

- 7.5.7.1. China Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 70

- 7.6. Japan 71

- 7.6.1. Japan Truck Video Safety Solutions Market size and forecast, 2016-2026 71

- 7.6.2. Japan Truck Video Safety Solutions Market, by Country, 2018 & 2025 (USD Million) 71

- 7.6.3. Japan Truck Video Safety Solutions Market, by Business Model, 2016-2026 72

- 7.6.3.1. Japan Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 72

- 7.6.4. Japan Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 73

- 7.6.4.1. Japan Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 73

- 7.6.5. Japan Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 74

- 7.6.5.1. Japan Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 74

- 7.6.6. Japan Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 75

- 7.6.6.1. Japan Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 75

- 7.6.7. Japan Truck Video Safety Solutions Market, by Application, 2016-2026 76

- 7.6.7.1. Japan Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 76

- 7.7. India 77

- 7.7.1. India Truck Video Safety Solutions Market size and forecast, 2016-2026 77

- 7.7.2. India Truck Video Safety Solutions Market, by Country, 2018 & 2025 (USD Million) 77

- 7.7.3. India Truck Video Safety Solutions Market, by Business Model, 2016-2026 78

- 7.7.3.1. India Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 78

- 7.7.4. India Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 79

- 7.7.4.1. India Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 79

- 7.7.5. India Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 80

- 7.7.5.1. India Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 80

- 7.7.6. India Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 81

- 7.7.6.1. India Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 81

- 7.7.7. India Truck Video Safety Solutions Market, by Application, 2016-2026 82

- 7.7.7.1. India Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 82

- 7.8. Southeast Asia 83

- 7.8.1. Southeast Asia Truck Video Safety Solutions Market size and forecast, 2016-2026 83

- 7.8.2. Southeast Asia Truck Video Safety Solutions Market, by Country, 2018 & 2025 (USD Million) 83

- 7.8.3. Southeast Asia Truck Video Safety Solutions Market, by Business Model, 2016-2026 85

- 7.8.3.1. Southeast Asia Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 85

- 7.8.4. Southeast Asia Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 86

- 7.8.4.1. Southeast Asia Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 86

- 7.8.5. Southeast Asia Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 87

- 7.8.5.1. Southeast Asia Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 87

- 7.8.6. Southeast Asia Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 88

- 7.8.6.1. Southeast Asia Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 88

- 7.8.7. Southeast Asia Truck Video Safety Solutions Market, by Application, 2016-2026 89

- 7.8.7.1. Southeast Asia Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 89

- 7.9. Rest of the World 90

- 7.9.1. Rest of the World Truck Video Safety Solutions Market size and forecast, 2016-2026 90

- 7.9.2. Rest of the World Truck Video Safety Solutions Market, by Country, 2018 & 2025 (USD Million) 90

- 7.9.3. Rest of the World Truck Video Safety Solutions Market, by Business Model, 2016-2026 92

- 7.9.3.1. Rest of the World Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 92

- 7.9.4. Rest of the World Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 93

- 7.9.4.1. Rest of the World Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 93

- 7.9.5. Rest of the World Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 94

- 7.9.5.1. Rest of the World Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 94

- 7.9.6. Rest of the World Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 95

- 7.9.6.1. Rest of the World Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 95

- 7.9.7. Rest of the World Truck Video Safety Solutions Market, by Application, 2016-2026 96

- 7.9.7.1. Rest of the World Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 96

-

- Chapter 8. Truck Video Safety Solutions market - Competitive Landscape 97

- 8.1. Competitor Market Share - Revenue 97

- 8.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 99

- 8.3. Strategic Development 100

- 8.3.1. Acquisitions and Mergers 100

- 8.3.2. New Products 100

- 8.3.3. Research & Development Activities 100

-

- Chapter 9. Company Profiles 101

- 9.1. AB Volvo 101

- 9.1.1. Company Overview 101

- 9.1.2. AB Volvo Revenue and Gross Margin 101

- 9.1.3. Product portfolio 102

- 9.1.4. Recent initiatives 103

- 9.2. Daimler AG 103

- 9.2.1. Company Overview 103

- 9.2.2. Daimler AG Revenue and Gross Margin 103

- 9.2.3. Product portfolio 104

- 9.2.4. Recent initiatives 105

- 9.3. Driverless.global 105

- 9.3.1. Company Overview 105

- 9.3.2. Driverless.global Revenue and Gross Margin 105

- 9.3.3. Product portfolio 106

- 9.3.4. Recent initiatives 107

- 9.4. DuPont 107

- 9.4.1. Company Overview 107

- 9.4.2. DuPont Revenue and Gross Margin 107

- 9.4.3. Product portfolio 108

- 9.4.4. Recent initiatives 109

- 9.5. Goodyear 109

- 9.5.1. Company Overview 109

- 9.5.2. Goodyear Revenue and Gross Margin 109

- 9.5.3. Product portfolio 110

- 9.5.4. Recent initiatives 111

- 9.6. GreenRoad Technologies, Inc. 111

- 9.6.1. Company Overview 111

- 9.6.2. GreenRoad Technologies, Inc. Revenue and Gross Margin 111

- 9.6.3. Product portfolio 112

- 9.6.4. Recent initiatives 113

- 9.7. Intertruck 113

- 9.7.1. Company Overview 113

- 9.7.2. Intertruck Revenue and Gross Margin 113

- 9.7.3. Product portfolio 114

- 9.7.4. Recent initiatives 115

- 9.8. Knorr-Bremse AG 115

- 9.8.1. Company Overview 115

- 9.8.2. Knorr-Bremse AG Revenue and Gross Margin 115

- 9.8.3. Product portfolio 116

- 9.8.4. Recent initiatives 117

- 9.9. LightMetrics 117

- 9.9.1. Company Overview 117

- 9.9.2. LightMetrics Revenue and Gross Margin 117

- 9.9.3. Product portfolio 118

- 9.9.4. Recent initiatives 119

- 9.10. Lytx, Inc. 119

- 9.10.1. Company Overview 119

- 9.10.2. Lytx, Inc. Revenue and Gross Margin 119

- 9.10.3. Product portfolio 120

- 9.10.4. Recent initiatives 121

- 9.11. MiX Telematics 121

- 9.11.1. Company Overview 121

- 9.11.2. MiX Telematics Revenue and Gross Margin 121

- 9.11.3. Product portfolio 122

- 9.11.4. Recent initiatives 123

- 9.12. Netradyne 123

- 9.12.1. Company Overview 123

- 9.12.2. Netradyne Revenue and Gross Margin 123

- 9.12.3. Product portfolio 124

- 9.12.4. Recent initiatives 125

- 9.13. Omnitracs 125

- 9.13.1. Company Overview 125

- 9.13.2. Omnitracs Revenue and Gross Margin 125

- 9.13.3. Product portfolio 126

- 9.13.4. Recent initiatives 127

- 9.14. Ryder System, Inc. 127

- 9.14.1. Company Overview 127

- 9.14.2. Ryder System, Inc. Revenue and Gross Margin 127

- 9.14.3. Product portfolio 128

- 9.14.4. Recent initiatives 129

- 9.15. Safe Fleet 129

- 9.15.1. Company Overview 129

- 9.15.2. Safe Fleet Revenue and Gross Margin 129

- 9.15.3. Product portfolio 130

- 9.15.4. Recent initiatives 131

- 9.16. Scania 131

- 9.16.1. Company Overview 131

- 9.16.2. Scania Revenue and Gross Margin 131

- 9.16.3. Product portfolio 132

- 9.16.4. Recent initiatives 133

- 9.17. SmartDrive Systems, Inc. 133

- 9.17.1. Company Overview 133

- 9.17.2. SmartDrive Systems, Inc. Revenue and Gross Margin 133

- 9.17.3. Product portfolio 134

- 9.17.4. Recent initiatives 135

- 9.18. Teletrac Navman US Ltd 135

- 9.18.1. Company Overview 135

- 9.18.2. Teletrac Navman US Ltd Revenue and Gross Margin 135

- 9.18.3. Product portfolio 136

- 9.18.4. Recent initiatives 137

- 9.19. Trimble 137

- 9.19.1. Company Overview 137

- 9.19.2. Trimble Revenue and Gross Margin 137

- 9.19.3. Product portfolio 138

- 9.19.4. Recent initiatives 139

- 9.20. Verizon 139

- 9.20.1. Company Overview 139

- 9.20.2. Verizon Revenue and Gross Margin 139

- 9.20.3. Product portfolio 140

- 9.20.4. Recent initiatives 141

-

- Chapter 10. Truck Video Safety Solutions ' Industry Analysis 142

- 10.1. Truck Video Safety Solutions Market - Key Trends 142

- 10.1.1. Market Drivers 143

- 10.1.2. Market Restraints 143

- 10.1.3. Market Opportunities 144

- 10.2. Value Chain Analysis 145

- 10.3. Technology Roadmap and Timeline 146

- 10.4. Truck Video Safety Solutions Market - Attractiveness Analysis 147

- 10.4.1. By Business Model 147

- 10.4.2. By Fleet Size 147

- 10.4.3. By Vehicle Type 148

- 10.4.4. By Recording View Type 149

- 10.4.5. By Application 149

- 10.4.6. By Region 151

-

- Chapter 11. Marketing Strategy Analysis, Distributors 152

- 11.1. Marketing Channel 152

- 11.2. Direct Marketing 153

- 11.3. Indirect Marketing 153

- 11.4. Marketing Channel Development Trend 153

- 11.5. Economic/Political Environmental Change 154

-

- Chapter 12. Report Conclusion 155

-

- Chapter 13. Research Approach & Methodology 156

- 13.1. Report Description 156

- 13.2. Research Scope 157

- 13.3. Research Methodology 157

- 13.3.1. Secondary Research 158

- 13.3.2. Primary Research 159

- 13.3.3. Models 160

- 13.3.3.1. Company Share Analysis Model 160

- 13.3.3.2. Revenue Based Modeling 161

- 13.3.3.3. Research Limitations 161

List of Figures

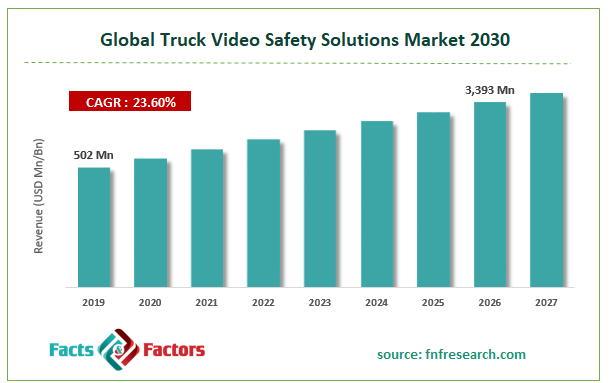

FIG. 1 Global Truck Video Safety Solutions Market, 2016-2026 (USD Million) 28

FIG. 2 Global Truck Video Safety Solutions Market Share, by Business Model, 2018 & 2025 (USD Million) 29

FIG. 3 Global Upfront Truck Video Safety Solutions Market, 2016-2026 (USD Million) 31

FIG. 4 Global Subscription Truck Video Safety Solutions Market, 2016-2026 (USD Million) 32

FIG. 5 Global Truck Video Safety Solutions Market Share, by Fleet Size, 2018 & 2025 (USD Million) 33

FIG. 6 Global Small Fleet Truck Video Safety Solutions Market, 2016-2026 (USD Million) 34

FIG. 7 Global Larger Fleet Truck Video Safety Solutions Market, 2016-2026 (USD Million) 35

FIG. 8 Global Truck Video Safety Solutions Market Share, by Vehicle Type, 2018 & 2025 (USD Million) 36

FIG. 9 Global Light commercial vehicle Truck Video Safety Solutions Market, 2016-2026 (USD Million) 37

FIG. 10 Global Medium/heavy commercial vehicles Truck Video Safety Solutions Market, 2016-2026 (USD Million) 38

FIG. 11 Global Truck Video Safety Solutions Market Share, by Recording View Type, 2018 & 2025 (USD Million) 39

FIG. 12 Global Drivers and Forward Truck Video Safety Solutions Market, 2016-2026 (USD Million) 40

FIG. 13 Global Others Truck Video Safety Solutions Market, 2016-2026 (USD Million) 41

FIG. 14 Global Truck Video Safety Solutions Market Share, by Application, 2018 & 2025 (USD Million) 42

FIG. 15 Global Logistics Truck Video Safety Solutions Market, 2016-2026 (USD Million) 43

FIG. 16 Global Energy and utilities Truck Video Safety Solutions Market, 2016-2026 (USD Million) 44

FIG. 17 Global Retail Truck Video Safety Solutions Market, 2016-2026 (USD Million) 45

FIG. 18 Global FnB Truck Video Safety Solutions Market, 2016-2026 (USD Million) 46

FIG. 19 Global Oil and Petroleum Truck Video Safety Solutions Market, 2016-2026 (USD Million) 47

FIG. 20 Global Construction and mining Truck Video Safety Solutions Market, 2016-2026 (USD Million) 48

FIG. 21 Global Public Sector Truck Video Safety Solutions Market, 2016-2026 (USD Million) 49

FIG. 22 Global Truck Video Safety Solutions Market Share, by Region, 2018 & 2025 50

FIG. 23 North America Truck Video Safety Solutions Market, 2016-2026 52

FIG. 24 Europe Truck Video Safety Solutions Market, 2016-2026 59

FIG. 25 China Truck Video Safety Solutions Market, 2016-2026 65

FIG. 26 Japan Truck Video Safety Solutions Market, 2016-2026 71

FIG. 27 India Truck Video Safety Solutions Market, 2016-2026 77

FIG. 28 Southeast Asia Truck Video Safety Solutions Market, 2016-2026 83

FIG. 29 Rest of the World Truck Video Safety Solutions Market, 2016-2026 90

FIG. 30 Competitor Market Share – Revenue 97

FIG. 31 AB Volvo Revenue and Growth Rate 102

FIG. 32 AB Volvo Market Share 102

FIG. 33 Daimler AG Revenue and Growth Rate 104

FIG. 34 Daimler AG Market Share 104

FIG. 35 Driverless.global Revenue and Growth Rate 106

FIG. 36 Driverless.global Market Share 106

FIG. 37 DuPont Revenue and Growth Rate 108

FIG. 38 DuPont Market Share 108

FIG. 39 Goodyear Revenue and Growth Rate 110

FIG. 40 Goodyear Market Share 110

FIG. 41 GreenRoad Technologies, Inc. Revenue and Growth Rate 112

FIG. 42 GreenRoad Technologies, Inc. Market Share 112

FIG. 43 Intertruck Revenue and Growth Rate 114

FIG. 44 Intertruck Market Share 114

FIG. 45 Knorr-Bremse AG Revenue and Growth Rate 116

FIG. 46 Knorr-Bremse AG Market Share 116

FIG. 47 LightMetrics Revenue and Growth Rate 118

FIG. 48 LightMetrics Market Share 118

FIG. 49 Lytx, Inc. Revenue and Growth Rate 120

FIG. 50 Lytx, Inc. Market Share 120

FIG. 51 MiX Telematics Revenue and Growth Rate 122

FIG. 52 MiX Telematics Market Share 122

FIG. 53 Netradyne Revenue and Growth Rate 124

FIG. 54 Netradyne Market Share 124

FIG. 55 Omnitracs Revenue and Growth Rate 126

FIG. 56 Omnitracs Market Share 126

FIG. 57 Ryder System, Inc. Revenue and Growth Rate 128

FIG. 58 Ryder System, Inc. Market Share 128

FIG. 59 Safe Fleet Revenue and Growth Rate 130

FIG. 60 Safe Fleet Market Share 130

FIG. 61 Scania Revenue and Growth Rate 132

FIG. 62 Scania Market Share 132

FIG. 63 SmartDrive Systems, Inc. Revenue and Growth Rate 134

FIG. 64 SmartDrive Systems, Inc. Market Share 134

FIG. 65 Teletrac Navman US Ltd Revenue and Growth Rate 136

FIG. 66 Teletrac Navman US Ltd Market Share 136

FIG. 67 Trimble Revenue and Growth Rate 138

FIG. 68 Trimble Market Share 138

FIG. 69 Verizon Revenue and Growth Rate 140

FIG. 70 Verizon Market Share 140

FIG. 71 Market Dynamics 142

FIG. 72 Global Truck Video Safety Solutions – Value Chain Analysis 145

FIG. 73 Technology Roadmap and Timeline 146

FIG. 74 Market Attractiveness Analysis – By Business Model 147

FIG. 75 Market Attractiveness Analysis – By Fleet Size 148

FIG. 76 Market Attractiveness Analysis – By Vehicle Type 148

FIG. 77 Market Attractiveness Analysis – By Recording View Type 149

FIG. 78 Market Attractiveness Analysis – By Application 150

FIG. 79 Market Attractiveness Analysis – By Region 151

FIG. 80 Market Channel 152

FIG. 81 Marketing Channel Development Trend 153

FIG. 82 Growth in World Gross Product, 2008-2018 154

List of Tables

TABLE 1 Global Truck Video Safety Solutions Market, 2018 & 2025 (USD Million) 25

TABLE 2 Global Truck Video Safety Solutions market, by Business Model, 2016-2026 (USD Million) 28

TABLE 3 Global Truck Video Safety Solutions market, by Fleet Size, 2016-2026 (USD Million) 32

TABLE 4 Global Truck Video Safety Solutions market, by Vehicle Type, 2016-2026 (USD Million) 35

TABLE 5 Global Truck Video Safety Solutions market, by Recording View Type, 2016-2026 (USD Million) 38

TABLE 6 Global Truck Video Safety Solutions market, by Application, 2016-2026 (USD Million) 41

TABLE 7 Global Truck Video Safety Solutions market, by Region, 2016-2026 (USD Million) 49

TABLE 8 North America Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 53

TABLE 9 North America Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 54

TABLE 10 North America Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 55

TABLE 11 North America Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 56

TABLE 12 North America Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 57

TABLE 13 Europe Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 59

TABLE 14 Europe Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 60

TABLE 15 Europe Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 61

TABLE 16 Europe Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 62

TABLE 17 Europe Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 63

TABLE 18 China Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 65

TABLE 19 China Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 66

TABLE 20 China Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 67

TABLE 21 China Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 68

TABLE 22 China Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 69

TABLE 23 Japan Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 71

TABLE 24 Japan Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 72

TABLE 25 Japan Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 73

TABLE 26 Japan Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 74

TABLE 27 Japan Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 75

TABLE 28 India Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 77

TABLE 29 India Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 78

TABLE 30 India Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 79

TABLE 31 India Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 80

TABLE 32 India Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 81

TABLE 33 Southeast Asia Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 84

TABLE 34 Southeast Asia Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 85

TABLE 35 Southeast Asia Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 86

TABLE 36 Southeast Asia Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 87

TABLE 37 Southeast Asia Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 88

TABLE 38 Rest of the World Truck Video Safety Solutions Market, by Business Model, 2016-2026 (USD Million) 91

TABLE 39 Rest of the World Truck Video Safety Solutions Market, by Fleet Size, 2016-2026 (USD Million) 92

TABLE 40 Rest of the World Truck Video Safety Solutions Market, by Vehicle Type, 2016-2026 (USD Million) 93

TABLE 41 Rest of the World Truck Video Safety Solutions Market, by Recording View Type, 2016-2026 (USD Million) 94

TABLE 42 Rest of the World Truck Video Safety Solutions Market, by Application, 2016-2026 (USD Million) 95

TABLE 43 Global Truck Video Safety Solutions Market - Company Revenue Analysis 2016-2018 (USD Million) 96

TABLE 44 Global Truck Video Safety Solutions Market - Company Revenue Share Analysis 2016-2018 (%) 98

TABLE 45 Acquisitions and Mergers 99

TABLE 46 New Product/Service Launch 99

TABLE 47 Research & Development Activities 99

TABLE 48 Market Drivers 142

TABLE 49 Market Restraints 142

TABLE 50 Market Opportunities 143

Report Scope

Report Scope Competitive Analysis

Competitive Analysis