Search Market Research Report

Tobacco Packaging Market Size, Share Global Analysis Report, 2024 – 2032

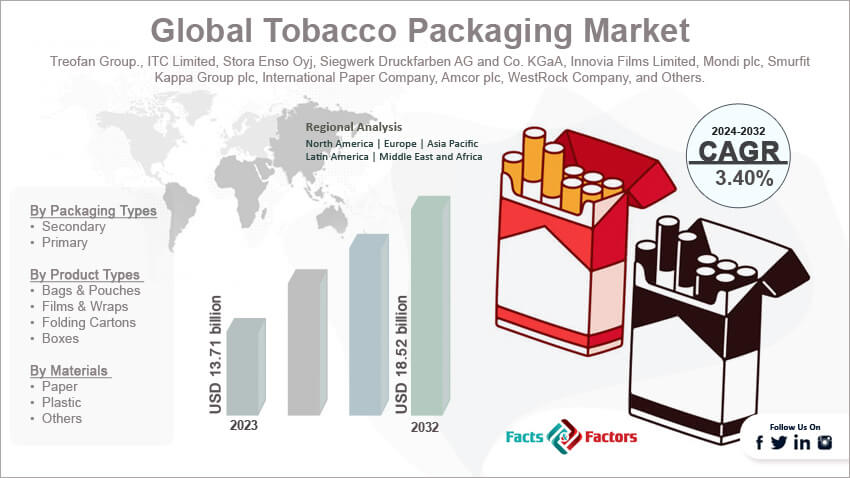

Tobacco Packaging Market Size, Share, Growth Analysis Report By Packaging Types (Secondary And Primary), By Product Types (Bags & Pouches, Films & Wraps, Folding Cartons, Boxes, And Others), By Materials (Paper, Plastic, And Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

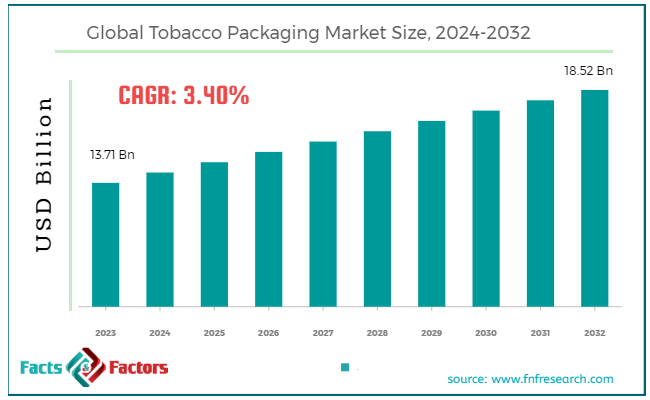

[229+ Pages Report] According to Facts & Factors, the global tobacco packaging market size was valued at USD 13.71 billion in 2023 and is predicted to surpass USD 18.52 billion by the end of 2032. The tobacco packaging industry is expected to grow by a CAGR of 3.40% between 2024 and 2032.

Market Overview

Market Overview

Tobacco packaging refers to the designs and materials used to pack the tobacco content for sales and distribution. This packaging protects the product content from damage and external environmental factors. It helps companies print important information for consumers and also aligns with the legal and regulatory aspects. Tobacco packaging also helps in promoting brand identity. There are different formats available for tobacco packaging solutions, such as flexible packaging, folding cartons, boxes, paper packs, and many others. These packaging solutions also offer convenience to users.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global tobacco packaging market size is estimated to grow annually at a CAGR of around 3.40% over the forecast period (2024-2032).

- In terms of revenue, the global tobacco packaging market size was valued at around USD 13.71 billion in 2023 and is projected to reach USD 18.52 billion by 2032.

- Growing demand for tobacco products is driving the growth of the global tobacco packaging market.

- Based on the packaging types, the secondary packaging segment is growing at a high rate and is projected to dominate the global market.

- Based on the product types, the folding cartons segment is projected to swipe the largest market share.

- Based on materials, the plastic segment is expected to dominate the global market.

- Based on region, Asia Pacific is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing demand for tobacco products is driving the growth of the global market.

Tobacco consumption is increasing in many developing regions because of the high population growth and rising disposable income. It is a primary factor propelling the growth of the global tobacco packaging market. However, the emergence of different varieties of tobacco products like smokeless tobacco, cigars, and cigarettes are further supporting the growth trajectory of the industry.

Also, technological advancements in digital printing are likely to expand the scope of the industry further. Also, advanced technology can make quick changes in packaging designs to comply with the standard, which is also fostering growth opportunities in the market. The emergence of smart packaging is another major factor likely to positively influence the market's growth. The incorporation of QR codes and NFC tags is likely to offer interactive features for consumers.

However, it is further expected to facilitate supply chain transparency, which is further expected to flourish in the market in the coming years. For instance, Siegwerk inaugurated a color-matching center and warehouse at Tauru, Haryana, in 2022. Siegwerk is a leading provider of coatings and printing inks for packaging applications.

Restraints

Restraints

- Declining tobacco consumption in developed markets is restraining the growth of the global market.

Rising health awareness regarding the risks associated with tobacco products is likely to hamper the growth of the tobacco packaging industry during the forecast period. The decline in the smoking rates and anti-smoking campaigns by the government is likely to further negatively impact the market's growth.

Opportunities

Opportunities

- Regulatory compliances are expected to foster growth opportunities in the global market.

Governments all across the globe are imposing strict regulations regarding the requirement of graphic health warnings on the packaging of tobacco products, which is a primary reason for the increasing growth of the global tobacco packaging market. Also, many regulations that focus on reducing counterfeiting or illicit trade activities further demand advanced packaging solutions like QR codes, holograms, and other security features.

However, the rise in the trend towards premium tobacco is boosting the need for aesthetically pleasing packaging solutions to enhance product appeal. Companies are investing heavily in unique packaging designs to stand out in the competitive market.

Therefore, all these factors are likely to open numerous opportunities in the market in the coming years. For instance, WestRock Company extended its consumer packaging facility in Claremont in 2022 by 285,000 square feet. The company is a manufacturer of differentiated paper & packaging solutions.

Challenges

Challenges

- Environmental concerns are a big challenge in the global market.

Plastic waste is deeply impacting environmental health. Also, the use of non-recyclable and non-biodegradable packaging solutions is further a big challenge in the tobacco packaging industry. However, the growing regulatory pressure because of sustainability reasons is further expected to force industries to come up with more expensive and technologically advanced packaging, which is further likely to slow down the growth trajectory.

Segmentation Analysis

Segmentation Analysis

The global tobacco packaging market can be segmented into packaging types, product types, materials, and regions.

On the basis of packaging types, the market can be segmented into secondary and primary. The secondary packaging segment accounts for the largest share of the tobacco packaging industry during the forecast period. Secondary packaging offers required space for regulatory information, health warnings, or tax stamps. There is a high requirement you are complying with regulatory compliance, thereby making the secondary packaging indispensable. Moreover, secondary packaging helps preserve the quality and integrity of the products by offering an extra layer of protection for the content inside.

Also, it offers improved protection for tobacco products during handling, storage, and transportation. Secondary packaging emerges as a key branding tool to showcase marketing messages, product information, and logos. Secondary packaging solutions like multi-packs and cartons facilitate convenience and, therefore, improve the overall customer experience. Secondary packaging solutions like reusable pouches and bags are becoming more popular these days, which in turn is also leading the demand in the market.

On the basis of product type, the market can be segmented into bags & pouches, films & wraps, folding cartons, boxes, and others. Folding cartons is the fastest-growing segment in the global tobacco packaging market. Folding cartons are versatile products that come in different shapes and sizes. They were ideal for different tobacco products like cigars and many others. It helps people cater to different requirements of manufacturers and consumers in the tobacco field. Also, the growing consumer awareness regarding using environmentally friendly packaging is also boosting the demand for paper packaging like boarding cartons in the market.

Additionally, these products offer excellent printability features, thereby easily facilitating all the regulatory information, health warnings and detailed branding information on the product. High-quality printing also increases the appeal to the consumers. Also, advancements in printing technologies are making these packaging much more functional and attractive. Furthermore, digital printing facilitates short lead times and offers more customized designs.

On the basis of material, the market can be segmented into paper, gold, paper, plastic, and others. The plastic segment is expected to dominate the tobacco packaging industry during the forecast period. Plastic materials are durable and flexible, thereby making them ideal packaging solutions. Plastic packaging offers excellent barrier properties, thereby preserving the content inside from external factors. Also, plastic is cost-effective and helps companies maintain profitability in the market.

However, the technological advancements in plastic packaging solutions are further expected to boost the growth of the segment. Manufacturers are coming up with lightweight and reliable plastic packaging solutions that are easy to handle and offer convenience to end users. Moreover, tamper-evident and child-resistant packaging solutions are expected to swipe a large market area in the coming years.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 13.71 Billion |

Projected Market Size in 2032 |

USD 18.52 Billion |

CAGR Growth Rate |

3.40% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Treofan Group., ITC Limited, Stora Enso Oyj, Siegwerk Druckfarben AG and Co. KGaA, Innovia Films Limited, Mondi plc, Smurfit Kappa Group plc, International Paper Company, Amcor plc, WestRock Company, and Others. |

Key Segment |

By Packaging Types, By Product Types, By Materials, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia Pacific to dominate the global market.

Asia Pacific accounts for the largest share of the global tobacco packaging market during the forecast period. The region has a strong base in the tobacco market, particularly in countries like Japan, Indonesia, India, and China. However, the population base in these countries is expected to be a major factor in the high growth rate of the regional market. Also, the economic growth in countries like India and China is leading to higher disposable incomes, which supports the spending on tobacco products.

Additionally, manufacturers in the region are coming up with high-quality packaging solutions to avoid counterfeiting and tampering. The high-quality packaging solution also improves the product appeal, thereby facilitating more sales in the market. Additionally, the manufacturers are coming up with more premium tobacco products to attract a large customer base. A significant shift towards premium products increases the demand for appealing packaging formats like rigid boxes and folding cartons.

Also, the regulatory environment is expected to support the market in the coming years as the government is imposing strict regulations on packaging to promote public health warnings. It will promote the usage of graphic health warnings, plain packaging laws, and many others to further support the growth of the regional market. China is the largest producer and consumer of tobacco products, and therefore, it is expected to positively impact the regional packaging market. India also has a vast consumer base, which is expected to increase demand in the market.

North America is also expected to see significant developments in the coming years. The regulatory environment is a primary reason behind the high growth rate of the regional market. There is growing interest in tobacco products that are considered of higher quality in the region.

Therefore, there is an overall increase in demand for premium packaging solutions. The United States is highly influencing the growth of the regional market because of the federal regulations imposed by the FDA authority regarding graphic warning labels.

Therefore, such a landscape is expected to slow down the regional market's growth. For instance, Mondi Group successfully took over Powerflute in 2022 for around USD 398 million. Powerflute functions on a paper & flute mill in Finland with a capacity of 285 KT.

Competitive Analysis

Competitive Analysis

The key players in the global tobacco packaging market include:

- Treofan Group.

- ITC Limited

- Stora Enso Oyj

- Siegwerk Druckfarben AG and Co. KGaA

- Innovia Films Limited

- Mondi plc

- Smurfit Kappa Group plc

- International Paper Company

- Amcor plc

- WestRock Company

For instance, Stora Enso came up with AvantForte in 2022 to cater to the premium segment, which includes shelf-ready, e-commerce, and fresh food packaging. The product is a 100% virgin fiber-based white top kraft liner.

The global tobacco packaging market is segmented as follows:

By Packaging Types Segment Analysis

By Packaging Types Segment Analysis

- Secondary

- Primary

By Product Types Segment Analysis

By Product Types Segment Analysis

- Bags & Pouches

- Films & Wraps

- Folding Cartons

- Boxes

- Others

By Materials Segment Analysis

By Materials Segment Analysis

- Paper

- Plastic

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Treofan Group.

- ITC Limited

- Stora Enso Oyj

- Siegwerk Druckfarben AG and Co. KGaA

- Innovia Films Limited

- Mondi plc

- Smurfit Kappa Group plc

- International Paper Company

- Amcor plc

- WestRock Company

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors