Search Market Research Report

U.S. & Europe IV Bags Market Size, Share Global Analysis Report, 2019–2026

U.S. & Europe IV Bags Market By Container Type (PVC Bag, Non-PVC Bag, Semi-rigid IV Bags, Glass Bottle), By Usage (Hydration,, Compounding, Other Preparations), By Diluent (Saline, Dextrose 5%, Dextrose + Saline, Ringer lactate, Others) and By End-user (Hospitals, Clinics, Plasma Collection Centers, Blood Banking, Renal, Home Therapy, Others): The U.S. & Europe Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

This professional and specialized report study examines the technical and business perspective of the IV Bags industry. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the IV Bags Market. The report study analyzes the market statistics in the U.S. & Europe as well as the regional levels to gain an in-depth perspective of the overall IV Bags Market. The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of both volumes (Million Units) and value (USD Million) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

Key Insights from Primary Research

Key Insights from Primary Research

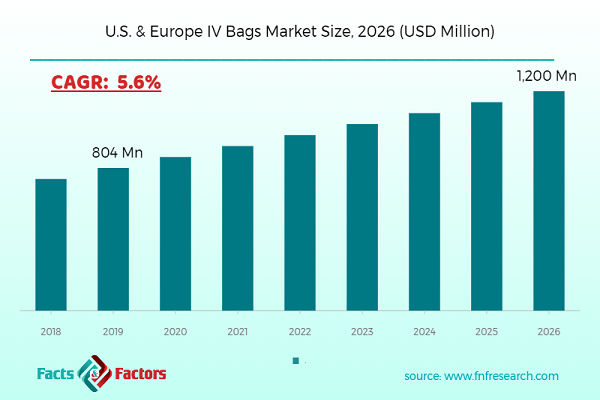

- Our primary respondents believe the market to witness a stable growth of 5.6% over the forecast period on account of rising awareness healthcare concerns across the U.S. and European regions.

- Some of the CXOs predict the hospital's segment to maintain its dominance throughout 2026 due to suitable treatment diagnosis and prescription of IV Bags by healthcare professionals. Furthermore, the manufacturers operating in this market are focused on mergers and acquisitions to increase their goodwill in the ever-competitive market ecosystem.

- Some of the industry experts interviewed in Japan revealed that the non-PVC bags segment is expected to generate considerable revenues for the IV Bags industry owing to rising safety measures adopted by hospitals and clinics across the U.S. and European countries.

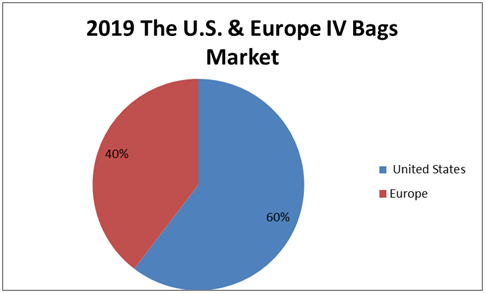

- Regionally, The U.S. region is expected to contribute largely to the global IV Bags market. Some of the interviewees said that their future plans are to focus majorly on developing sustainable and safe IV Bags across the country.

- The information & technology subject matter experts suggest investing in R&D activities to come up with more efficient IV Bags. They believe advanced technology in the medical and healthcare industry will witness widespread acceptance across the value chain of the IV Bags market.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Our analysts recommend focusing on the U.S. IV Bags market since their calculations revealed that this region turned out to be the top investment pocket owing to rising innovation and advancement in medical and healthcare sector in the U.S.

- The major reason behind the up surge growth and lucrative opportunities underlying in this region is the adoption of IV Bags by to treat severe diseases such as chemotherapy, injecting antibiotics through IV and others.

- Europe, on the other hand, is expected to foresee a robust growth of around 5.8% per annum. This is majorly attributed to rising medical and healthcare manufacturers in countries such as Germany and France.

- The strategic mergers and acquisitions by key industry players and high demand across end-use industries is anticipated to fuel the market growth

- The executive summary of the report reads the total incremental opportunity underlying in the global IV Bags market is nearly USD 1,200 million between 2020 and 2026.

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the IV Bags Market in our study.

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the IV Bags Market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the IV Bags Market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the IV Bags Market.

The research study provides a critical assessment of the IV Bags industry by logically segmenting the market on the basis of product type, connectivity, port, distribution channel, and regions. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026. The regional segmentation of the IV Bags industry includes the holistic bifurcation of the United States of America and major countries of Europe.

Medical and healthcare facilities in the U.S. and European countries have witnessed robust growth over recent years. Intravenous therapy (IV) is one of the methods of injecting fluids directly into veins through IV tubes; the containers used to store fluids to inject into veins are IV bags. Most of the medications that require continuous monitoring and injection of additional fluids in the body during treatment need IV bags to store the fluid to be injected into the vein.

Several government agencies have specified a set of rules and regulations concerning the quality, packaging, and safety of IV Bags to avoid any potential hospital-infected diseases. Manufacturers of IV bags across the globe follow these regulations to manufacture IV bags and reach to a wide network of hospitals, clinics, and healthcare centers across the map. This is expected to be one of the primary reasons for the growth of the IV Bags market in The U.S. & Europe.

On the basis of container type, the market is divided into PVC bags, Non-PVC bags, Semi-rigid IV Bags, and Glass bottles. By usage type the market is further classified into Hydration, Compounding, and Other Preparations. Furthermore, by Diluent type the market is divided into Saline, Dextrose 5%, Dextrose + Saline, Ringer lactate, and others. By the end-user, the market is segmented into Hospitals, Clinics, Plasma Collection Centers, Blood Banking, Renal, Home Therapy, and Others.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 804 Million |

Projected Market Size in 2026 |

USD 1,200 Million |

CAGR Growth Rate |

5.6% CAGR |

Base Year |

2019 |

Forecast Years |

2019-2026 |

Key Market Players |

B. Braun Melsungen AG, Baxter International Inc., Pfizer Inc., West Pharmaceutical Services Inc., Wipak Group, Technoflex, Fresenius SE & Co. KGaA, Sippex, Polycine GmbH, Kraton Corporation, and others. |

Key Segment |

By Container Type, By Usage, By Diluent, By End-users, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the key players operating in the IV Bags Market around the globe include:

Some of the key players operating in the IV Bags Market around the globe include:

- B. Braun Melsungen AG

- Baxter International Inc.

- Pfizer Inc.

- West Pharmaceutical Services Inc.

- Wipak Group

- Technoflex

- Fresenius SE & Co. KGaA

- Sippex

- Polycine GmbH

- Kraton Corporation

The taxonomy of the IV Bags industry by its scope and segmentation is as follows:

The U.S. & Europe IV Bags Market: By Container type Segmentation Analysis

The U.S. & Europe IV Bags Market: By Container type Segmentation Analysis

- PVC Bag

- Non-PVC Bag

- Semi-rigid IV Bags

- Glass Bottle

The U.S. & Europe IV Bags Market: By Usage Segmentation Analysis

The U.S. & Europe IV Bags Market: By Usage Segmentation Analysis

- Hydration

- Compounding

- Other Preparations

The U.S. & Europe IV Bags Market: By Diluent Segmentation Analysis

The U.S. & Europe IV Bags Market: By Diluent Segmentation Analysis

- Saline

- Dextrose 5%

- Dextrose + Saline

- Ringer lactate

- Others

The U.S. & Europe IV Bags Market: By End-User Segmentation Analysis

The U.S. & Europe IV Bags Market: By End-User Segmentation Analysis

- Hospitals

- Clinics

- Plasma Collection Centres

- Blood Banking

- Renal

- Home Therapy

- Others

The U.S. & Europe IV Bags Market: Regional Segmentation Analysis

The U.S. & Europe IV Bags Market: Regional Segmentation Analysis

- The U.S.

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- B. Braun Melsungen AG

- Baxter International Inc.

- Pfizer Inc.

- West Pharmaceutical Services Inc.

- Wipak Group

- Technoflex

- Fresenius SE & Co. KGaA

- Sippex

- Polycine GmbH

- Kraton Corporation

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors