Search Market Research Report

Textile Chemicals Market Size, Share Global Analysis Report, 2021 - 2026

Textile Chemicals Market By Product (Coating & Sizing Chemicals, Colorant & Auxiliaries, Finishing Agents, Surfactants, De-Sizing Agents, & Others), By Application (Apparel, Home Furnishing, & Technical Textiles), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 - 2026

Industry Insights

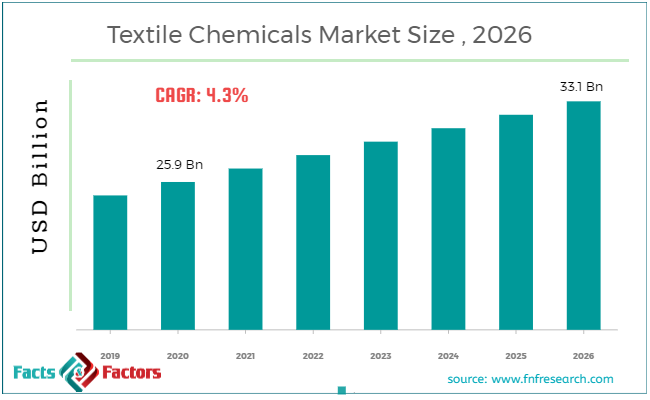

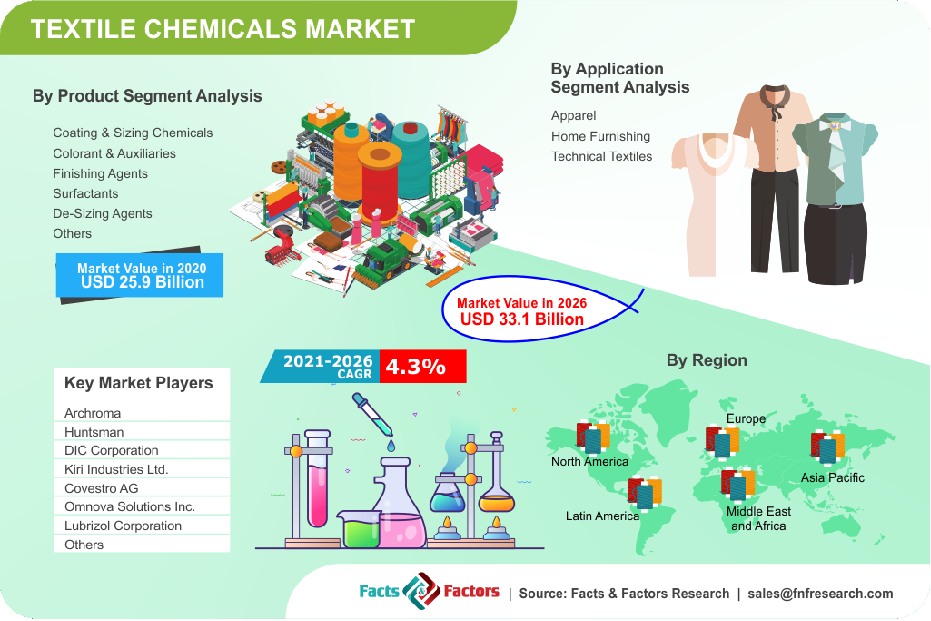

[213+ Pages Report] We at Facts & Factors have recently published a report titled “Textile Chemicals Market” that encompasses the spectacle of the market in an analytical and comprehensive manner. In this report, the global textile chemicals market is estimated to reach USD 33.1 Billion in the year 2026 from an initial value of USD 25.9 Billion in the year 2020 growing at a CAGR value of 4.3%.

Market Overview

Market Overview

Textile chemicals are a highly specialized group of chemicals that belong to the groups such as biocides, flame retardants, water repellents, and warp sizes to chemical bonds such as bleaches, emulsified oils, and greases, starch, sulfonated oils, waxes, and some forms of surfactants. Because of the nature of the chemicals that are involved, textile chemicals are extremely difficult to process and often require intense distilling measures to safely dissipate.

Key Insights from Primary Research

Key Insights from Primary Research

- The textile chemicals market is set to grow annually at a rate of around 5.5% as per our primary research

- It was established through primary research that the textile chemicals market was valued at around USD 27 billion in 2019

- Asia-Pacific held the largest market share of the textile chemicals market

- The “Synthetic fiber” category, on the basis of fiber type segmentation, was the leading revenue-generating with a market share of 67%

- The “Coating and sizing” category, on the basis of product type segmentation, was the leading revenue-generating with 30% market share

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, the major application of textile chemicals is anticipated to be the manufacturing of apparels

- The growing demand for apparels globally is boosting the textile chemicals market

- The growing industrialization in countries like India and China has given the textile chemical industry a huge impetus.

- Thriving growth of the apparel industry on account of implementing innovative strategies by textile chemical manufacturers with significant support from the government has led to the prominent development of the textile chemical market in the Middle East and Africa region

- Stringent environmental regulations regarding the disposal of textile effluents are pulling back the textile chemicals market

Industry Growth Factors

Industry Growth Factors

The primary driving factors for the significant growth of the global textile chemicals market are the rising demand in technical textiles coupled with the rising adoption of low-grade VOC and biodegradable materials for textile manufacturing to name a few. Additionally, factors pertaining to unique and exclusive characteristics offered by chemical textiles coupled with added benefits such as mechanical resistance, anti-dust, insulation from fire and thermal resistance, and resistive properties toward UV and IR is expected to increase the footprint of the global textile chemicals market during the advent of the forecast period. Moreover, increased consumption of technical textiles due to a rising demand from various applications coupled with rising innovations owing to increasing attractiveness and adaptability will fuel the growth of the global textile chemicals market during the advent of the forecast duration.

The global textile chemicals market is expected to be driven by increased usage of chemical textiles toward the manufacturing sector coupled with rising consumer demands in terms of texture and apparel subsidizing to name a few. Rising demand for the sustainability of products coupled with the increased imposition of restricted substance lists (RSLs) will increase the consumer base for the global textile chemicals market during the forecast period. However, stringent environmental regulation regarding disposal means coupled with rising consumer awareness toward human health upon increases usage is expected to decrease the market share of the global textile chemicals market during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global textile chemicals market is segmented into product, application, and region.

On the basis of product, the global textile chemicals market is divided into coating & sizing chemicals, colorant & auxiliaries, finishing agents, surfactants, de-sizing agents, and others. The segment pertaining to colorant & auxiliaries is expected to witness the largest market share during the advent of the forecast period owing to the ability of the latter toward preparing and modifying substrate for the process of coloration coupled with the increased functionality in terms of increasing fastness ability of dyeing to name a few. Additionally, factors pertaining to a wider range of forms of availability of products such as dispersing agents, carriers, sequestering agents, peroxide killer, anti-foaming agents, and anti-pilling agents will further cement the dominant market position of the latter segment during the advent of the market period. On the basis of application, the global textile chemicals market is classified into apparel, home furnishing, and technical textiles. The apparel segment is expected to witness the largest market share during the advent of the forecast period due to a rising number of products such as shirts, t-shirts, suits, jackets, trousers, skirts, and swimwear coupled with the rising production of apparel due to an increasing demand to name a few. Additionally, a rapid shift of the key market players toward adopting increasing consumer demands coupled with increasing disposable income among consumers will help cement the dominant market position of the latter segment during the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 25.9 Billion |

Projected Market Size in 2026 |

USD 33.1 Billion |

CAGR Growth Rate |

4.3% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Archroma, Huntsman, DIC Corporation, Kiri Industries Ltd., Covestro AG, Omnova Solutions Inc., Lubrizol Corporation, Solvay S.A., Evonik Industries, Tanatext Chemicals, Rudolf GmbH, NICCA Chemical Co. Ltd., Kemin Industries Inc., JINTEX Ltd., Dow, Wacker Chemie AG, Huntsman International Inc., and Sarex Chemicals, among others. |

Key Segments |

Products, Applications, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Asia-Pacific is expected to witness the largest market share during the advent of the forecast period owing to the region is the home to a global hub for textile production and exports coupled with rising demand for textile from emerging economies such as China and India to name a few. Additionally, the rising availability of bulk material required for production coupled with lowering labor costs is expected to increase the footprint of the textile chemicals market during the advent of the forecast period. Rapid industrialization measures coupled with increasing government support in the form of rising incentives will further push the existing boundaries of the textile chemicals market in the region during the advent of the forecast period. North America is expected to witness a substantial market share after the latter region in terms of generated revenue due to rising sale of fiber, textiles, and apparel coupled with rising investments toward research and development to name a few.

Competitive Players

Competitive Players

The key market participants for the global textile chemicals market are

- Archroma

- Huntsman

- DIC Corporation

- Kiri Industries Ltd.

- Covestro AG

- Omnova Solutions Inc.

- Lubrizol Corporation

- Solvay S.A.

- Evonik Industries

- Tanatext Chemicals

- Rudolf GmbH

- NICCA Chemical Co. Ltd.

- Kemin Industries Inc.

- JINTEX Ltd.

- Dow

- Wacker Chemie AG

- Huntsman International Inc.

- Sarex Chemicals

By Product Segment Analysis

By Product Segment Analysis

- Coating & Sizing Chemicals

- Colorant & Auxiliaries

- Finishing Agents

- Surfactants

- De-Sizing Agents

- Others

By Application Segment Analysis

By Application Segment Analysis

- Apparel

- Home Furnishing

- Technical Textiles

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Archroma

- Huntsman

- DIC Corporation

- Kiri Industries Ltd.

- Covestro AG

- Omnova Solutions Inc.

- Lubrizol Corporation

- Solvay S.A.

- Evonik Industries

- Tanatext Chemicals

- Rudolf GmbH

- NICCA Chemical Co. Ltd.

- Kemin Industries Inc.

- JINTEX Ltd.

- Dow

- Wacker Chemie AG

- Huntsman International Inc.

- Sarex Chemicals

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors