15.3. Research Methodology

- 15.3.1. Secondary Research

- 15.3.2. Primary Research

- 15.3.3. Statistical Models

- 15.3.3.1. Company Share Analysis Model

- 15.3.3.2. Revenue Based Modeling

- 15.3.4. Research Limitations

List of Figures

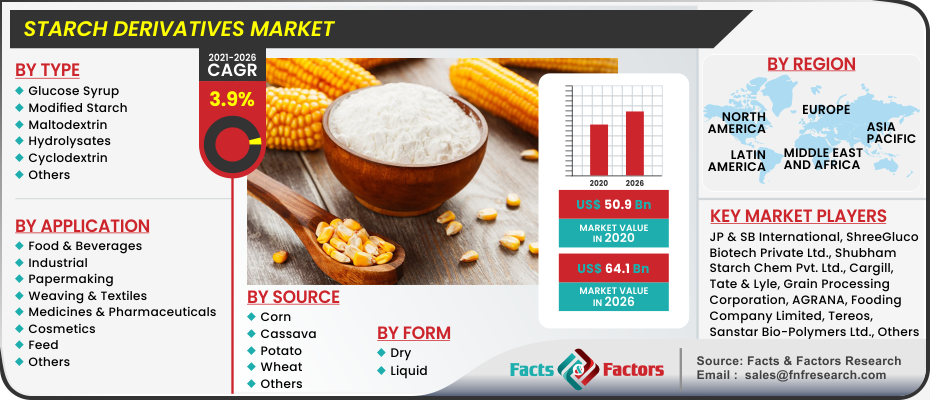

Fig.1 Product Picture of Starch Derivatives

Fig.2 Global Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.3 Global Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.4 Global Starch Derivatives Market Absolute Revenue Opportunity, 2016 – 2026 (USD Million)

Fig.5 Global Starch Derivatives Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

Fig.6 Global Starch Derivatives Market Share, by Type, 2020 & 2026 (USD Million)

Fig.7 Global Starch Derivatives Market Share, by Type, 2020 & 2026 (Kilo Tons)

Fig.8 Global Glucose Syrup Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.9 Global Glucose Syrup Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.10 Global Modified Starch Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.11 Global Modified Starch Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.12 Global Maltodextrin Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.13 Global Maltodextrin Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.14 Global Hydrolysates Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.15 Global Hydrolysates Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.16 Global Cyclodextrin Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.17 Global Cyclodextrin Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.18 Global Others Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.19 Global Others Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.20 Global Starch Derivatives Market Share, by Source, 2020 & 2026 (USD Million)

Fig.21 Global Starch Derivatives Market Share, by Source, 2020 & 2026 (Kilo Tons)

Fig.22 Global Corn Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.23 Global Corn Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.24 Global Cassava Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.25 Global Cassava Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.26 Global Potato Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.27 Global Potato Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.28 Global Wheat Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.29 Global Wheat Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.30 Global Others Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.31 Global Others Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.32 Global Starch Derivatives Market Share, by Form, 2020 & 2026 (USD Million)

Fig.33 Global Starch Derivatives Market Share, by Form, 2020 & 2026 (Kilo Tons)

Fig.34 Global Dry Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.35 Global Dry Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.36 Global Liquid Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.37 Global Liquid Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.38 Global Starch Derivatives Market Share, by Application, 2020 & 2026 (USD Million)

Fig.39 Global Starch Derivatives Market Share, by Application, 2020 & 2026 (Kilo Tons)

Fig.40 Global Food & Beverages Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.41 Global Food & Beverages Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.42 Global Industrial Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.43 Global Industrial Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.44 Global Papermaking Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.45 Global Papermaking Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.46 Global Weaving & Textiles Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.47 Global Weaving & Textiles Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.48 Global Medicines & Pharmaceuticals Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.49 Global Medicines & Pharmaceuticals Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.50 Global Cosmetics Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.51 Global Cosmetics Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.52 Global Feed Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.53 Global Feed Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.54 Global Others Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.55 Global Others Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.56 Global Starch Derivatives Market Share, by Region, 2020 & 2026 (USD Million)

Fig.57 Global Starch Derivatives Market Share, by Region, 2020 & 2026 (Kilo Tons)

Fig.58 North America Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.59 North America Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.60 U.S. Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.61 U.S. Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.62 Canada Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.63 Canada Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.64 Europe Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.65 Europe Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.66 Germany Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.67 Germany Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.68 France Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.69 France Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.70 U.K. Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.71 U.K. Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.72 Italy Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.73 Italy Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.74 Spain Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.75 Spain Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.76 Rest of Europe Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.77 Rest of Europe Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.78 Asia Pacific Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.79 Asia Pacific Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.80 China Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.81 China Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.82 Japan Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.83 Japan Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.84 India Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.85 India Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.86 South Korea Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.87 South Korea Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.88 South-East Asia Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.89 South-East Asia Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.90 Rest of Asia Pacific Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.91 Rest of Asia Pacific Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.92 Latin America Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.93 Latin America Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.94 Brazil Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.95 Brazil Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.96 Mexico Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.97 Mexico Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.98 Rest of Latin America Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.99 Rest of Latin America Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.100 The Middle-East and Africa Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.101 The Middle-East and Africa Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.102 GCC Countries Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.103 GCC Countries Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.104 South Africa Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.105 South Africa Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.106 Rest of Middle-East Africa Starch Derivatives Market, 2016 – 2026 (USD Million)

Fig.107 Rest of Middle-East Africa Starch Derivatives Market, 2016 – 2026 (Kilo Tons)

Fig.108 Global Starch Derivatives Production and Consumption, 2016 – 2026 (Kilo Tons)

Fig.109 North America Starch Derivatives Production and Consumption, 2016 – 2026 (USD Million) (Kilo Tons)

Fig.110 Europe Starch Derivatives Production and Consumption, 2016 – 2026 (USD Million) (Kilo Tons)

Fig.111 Asia Pacific Starch Derivatives Production and Consumption, 2016 – 2026 (USD Million) (Kilo Tons)

Fig.112 Latin America Starch Derivatives Production and Consumption, 2016 – 2026 (USD Million) (Kilo Tons)

Fig.113 The Middle-East and Africa Starch Derivatives Production and Consumption, 2016 – 2026 (USD Million) (Kilo Tons)

Fig.114 Competitor Market Share – Revenue

Fig.115 Competitor Market Share – Volume

Fig.116 Molinos Juan Semino SA Revenue and Growth Rate

Fig.117 Molinos Juan Semino SA Market Share

Fig.118 JP & SB International Revenue and Growth Rate

Fig.119 JP & SB International Market Share

Fig.120 Gujarat Ambuja Export Revenue and Growth Rate

Fig.121 Gujarat Ambuja Export Market Share

Fig.122 ShreeGluco Biotech Private Ltd. Revenue and Growth Rate

Fig.123 ShreeGluco Biotech Private Ltd. Market Share

Fig.124 Varun Industries Revenue and Growth Rate

Fig.125 Varun Industries Market Share

Fig.126 Shubham Starch Chem Pvt. Ltd. Revenue and Growth Rate

Fig.127 Shubham Starch Chem Pvt. Ltd. Market Share

Fig.128 Archer Daniels Midland Company Revenue and Growth Rate

Fig.129 Archer Daniels Midland Company Market Share

Fig.130 Cargill Revenue and Growth Rate

Fig.131 Cargill Market Share

Fig.132 Ingredion Revenue and Growth Rate

Fig.133 Ingredion Market Share

Fig.134 Tate & Lyle Revenue and Growth Rate

Fig.135 Tate & Lyle Market Share

Fig.136 Roquette Frères Revenue and Growth Rate

Fig.137 Roquette Frères Market Share

Fig.138 Grain Processing Corporation Revenue and Growth Rate

Fig.139 Grain Processing Corporation Market Share

Fig.140 Global Sweeteners Holdings Ltd. Revenue and Growth Rate

Fig.141 Global Sweeteners Holdings Ltd. Market Share

Fig.142 AGRANA Revenue and Growth Rate

Fig.143 AGRANA Market Share

Fig.144 Gulshan Polyols Revenue and Growth Rate

Fig.145 Gulshan Polyols Market Share

Fig.146 Fooding Company Limited Revenue and Growth Rate

Fig.147 Fooding Company Limited Market Share

Fig.148 Foodchem International Corporation Revenue and Growth Rate

Fig.149 Foodchem International Corporation Market Share

Fig.150 Tereos Revenue and Growth Rate

Fig.151 Tereos Market Share

Fig.152 Matsutani Chemical Industry Co., Ltd. Revenue and Growth Rate

Fig.153 Matsutani Chemical Industry Co., Ltd. Market Share

Fig.154 Sanstar Bio-Polymers Ltd. Revenue and Growth Rate

Fig.155 Sanstar Bio-Polymers Ltd. Market Share

Fig.156 Jay Sardar Starch & Gum Consultant Revenue and Growth Rate

Fig.157 Jay Sardar Starch & Gum Consultant Market Share

Fig.158 B Food Science Co., Ltd. Revenue and Growth Rate

Fig.159 B Food Science Co., Ltd. Market Share

Fig.160 Tirupati Starch & Chemicals Ltd. Revenue and Growth Rate

Fig.161 Tirupati Starch & Chemicals Ltd. Market Share

Fig.162 Sinofi Ingredients Revenue and Growth Rate

Fig.163 Sinofi Ingredients Market Share

Fig.164 Nagase & Co., Ltd. Revenue and Growth Rate

Fig.165 Nagase & Co., Ltd. Market Share

Fig.166 Market Dynamics

Fig.167 Global Starch Derivatives – Value Chain Analysis

Fig.168 Key Mandates and Regulations

Fig.169 Technology Roadmap and Timeline

Fig.170 Market Attractiveness Analysis – By Type

Fig.171 Market Attractiveness Analysis – By Source

Fig.172 Market Attractiveness Analysis – By Form

Fig.173 Market Attractiveness Analysis – By Application

Fig.174 Market Attractiveness Analysis – By Region

Fig.175 Manufacturing Cost Structure of Starch Derivatives

Fig.176 Starch Derivatives Industrial Chain Analysis

Fig.177 Market Channels

Fig.178 Marketing Channel Development Trend

Fig.179 Growth in World Gross Product, 2008-2018

List of Tables

Table 1 Global Starch Derivatives Market, 2020 & 2026 (USD Million)

Table 2 Global Starch Derivatives Market, by Type, 2016 – 2026 (USD Million)

Table 3 Global Starch Derivatives Market, by Type, 2016 – 2026 (Kilo Tons)

Table 4 Global Starch Derivatives Market, by Source, 2016 – 2026 (USD Million)

Table 5 Global Starch Derivatives Market, by Source, 2016 – 2026 (Kilo Tons)

Table 6 Global Starch Derivatives Market, by Form, 2016 – 2026 (USD Million)

Table 7 Global Starch Derivatives Market, by Form, 2016 – 2026 (Kilo Tons)

Table 8 Global Starch Derivatives Market, by Application, 2016 – 2026 (USD Million)

Table 9 Global Starch Derivatives Market, by Application, 2016 – 2026 (Kilo Tons)

Table 10 Global Starch Derivatives Market, by Region, 2016 – 2026 (USD Million)

Table 11 Global Starch Derivatives Market, by Region, 2016 – 2026 (Kilo Tons)

Table 12 North America Starch Derivatives Market, by Country, 2016 – 2026 (USD Million)

Table 13 North America Starch Derivatives Market, by Country, 2016 – 2026 (Kilo Tons)

Table 14 North America Starch Derivatives Market, by Type, 2016 – 2026 (USD Million)

Table 15 North America Starch Derivatives Market, by Type, 2016 – 2026 (Kilo Tons)

Table 16 North America Starch Derivatives Market, by Source, 2016 – 2026 (USD Million)

Table 17 North America Starch Derivatives Market, by Source, 2016 – 2026 (Kilo Tons)

Table 18 North America Starch Derivatives Market, by Form, 2016 – 2026 (USD Million)

Table 19 North America Starch Derivatives Market, by Form, 2016 – 2026 (Kilo Tons)

Table 20 North America Starch Derivatives Market, by Application, 2016 – 2026 (USD Million)

Table 21 North America Starch Derivatives Market, by Application, 2016 – 2026 (Kilo Tons)

Table 22 Europe Starch Derivatives Market, by Country, 2016 – 2026 (USD Million)

Table 23 Europe Starch Derivatives Market, by Country, 2016 – 2026 (Kilo Tons)

Table 24 Europe Starch Derivatives Market, by Type, 2016 – 2026 (USD Million)

Table 25 Europe Starch Derivatives Market, by Type, 2016 – 2026 (Kilo Tons)

Table 26 Europe Starch Derivatives Market, by Source, 2016 – 2026 (USD Million)

Table 27 Europe Starch Derivatives Market, by Source, 2016 – 2026 (Kilo Tons)

Table 28 Europe Starch Derivatives Market, by Form, 2016 – 2026 (USD Million)

Table 29 Europe Starch Derivatives Market, by Form, 2016 – 2026 (Kilo Tons)

Table 30 Europe Starch Derivatives Market, by Application, 2016 – 2026 (USD Million)

Table 31 Europe Starch Derivatives Market, by Application, 2016 – 2026 (Kilo Tons)

Table 32 Asia Pacific Starch Derivatives Market, by Country, 2016 – 2026 (USD Million)

Table 33 Asia Pacific Starch Derivatives Market, by Country, 2016 – 2026 (Kilo Tons)

Table 34 Asia Pacific Starch Derivatives Market, by Type, 2016 – 2026 (USD Million)

Table 35 Asia Pacific Starch Derivatives Market, by Type, 2016 – 2026 (Kilo Tons)

Table 36 Asia Pacific Starch Derivatives Market, by Source, 2016 – 2026 (USD Million)

Table 37 Asia Pacific Starch Derivatives Market, by Source, 2016 – 2026 (Kilo Tons)

Table 38 Asia Pacific Starch Derivatives Market, by Form, 2016 – 2026 (USD Million)

Table 39 Asia Pacific Starch Derivatives Market, by Form, 2016 – 2026 (Kilo Tons)

Table 40 Asia Pacific Starch Derivatives Market, by Application, 2016 – 2026 (USD Million)

Table 41 Asia Pacific Starch Derivatives Market, by Application, 2016 – 2026 (Kilo Tons)

Table 42 Latin America Starch Derivatives Market, by Country, 2016 – 2026 (USD Million)

Table 43 Latin America Starch Derivatives Market, by Country, 2016 – 2026 (Kilo Tons)

Table 44 Latin America Starch Derivatives Market, by Type, 2016 – 2026 (USD Million)

Table 45 Latin America Starch Derivatives Market, by Type, 2016 – 2026 (Kilo Tons)

Table 46 Latin America Starch Derivatives Market, by Source, 2016 – 2026 (USD Million)

Table 47 Latin America Starch Derivatives Market, by Source, 2016 – 2026 (Kilo Tons)

Table 48 Latin America Starch Derivatives Market, by Form, 2016 – 2026 (USD Million)

Table 49 Latin America Starch Derivatives Market, by Form, 2016 – 2026 (Kilo Tons)

Table 50 Latin America Starch Derivatives Market, by Application, 2016 – 2026 (USD Million)

Table 51 Latin America Starch Derivatives Market, by Application, 2016 – 2026 (Kilo Tons)

Table 52 The Middle-East and Africa Starch Derivatives Market, by Country, 2016 – 2026 (USD Million)

Table 53 The Middle-East and Africa Starch Derivatives Market, by Country, 2016 – 2026 (Kilo Tons)

Table 54 The Middle-East and Africa Starch Derivatives Market, by Type, 2016 – 2026 (USD Million)

Table 55 The Middle-East and Africa Starch Derivatives Market, by Type, 2016 – 2026 (Kilo Tons)

Table 56 The Middle-East and Africa Starch Derivatives Market, by Source, 2016 – 2026 (USD Million)

Table 57 The Middle-East and Africa Starch Derivatives Market, by Source, 2016 – 2026 (Kilo Tons)

Table 58 The Middle-East and Africa Starch Derivatives Market, by Form, 2016 – 2026 (USD Million)

Table 59 The Middle-East and Africa Starch Derivatives Market, by Form, 2016 – 2026 (Kilo Tons)

Table 60 The Middle-East and Africa Starch Derivatives Market, by Application, 2016 – 2026 (USD Million)

Table 61 The Middle-East and Africa Starch Derivatives Market, by Application, 2016 – 2026 (Kilo Tons)

Table 62 North America Starch Derivatives Production, Consumption, Export, Import, 2016 – 2020

Table 63 Europe Starch Derivatives Production, Consumption, Export, Import, 2016 – 2020

Table 64 Asia Pacific Starch Derivatives Production, Consumption, Export, Import, 2016 – 2020

Table 65 Latin America Starch Derivatives Production, Consumption, Export, Import, 2016 – 2020

Table 66 The Middle-East and Africa Starch Derivatives Production, Consumption, Export, Import, 2016 – 2020

Table 67 Global Starch Derivatives Market - Company Revenue Analysis, 2016 – 2020 (USD Million)

Table 68 Global Starch Derivatives Market - Company Revenue Share Analysis, 2016 – 2020 (%)

Table 69 Global Starch Derivatives Market - Company Volume Analysis, 2016 – 2020 (Kilo Tons)

Table 70 Global Starch Derivatives Market - Company Volume Share Analysis, 2016 – 2020 (%)

Table 71 Acquisitions and Mergers

Table 72 Market Drivers – Impact Analysis

Table 73 Market Restraints

Table 74 Market Opportunities

Table 75 Production Base and Market Concentration Rate of Raw Material

Table 76 Key Suppliers of Raw Materials

Table 77 Raw Materials Sources of Starch Derivatives Major Manufacturers

Table 78 Major Buyers of Starch Derivatives

Table 79 Distributors/Traders of Starch Derivatives by Region

Market Overview

Market Overview  Industry Growth Factors

Industry Growth Factors

Segmentation Analysis

Segmentation Analysis Regional Analysis

Regional Analysis Report Scope

Report Scope Competitive Players

Competitive Players  The Global Starch Derivatives Market is segmented and classified as follows:

The Global Starch Derivatives Market is segmented and classified as follows: By Type:

By Type: By Source:

By Source: By Form:

By Form: By Application:

By Application: By Region:

By Region: