Search Market Research Report

Specialty Chemicals Market Size, Share Global Analysis Report, 2024 – 2032

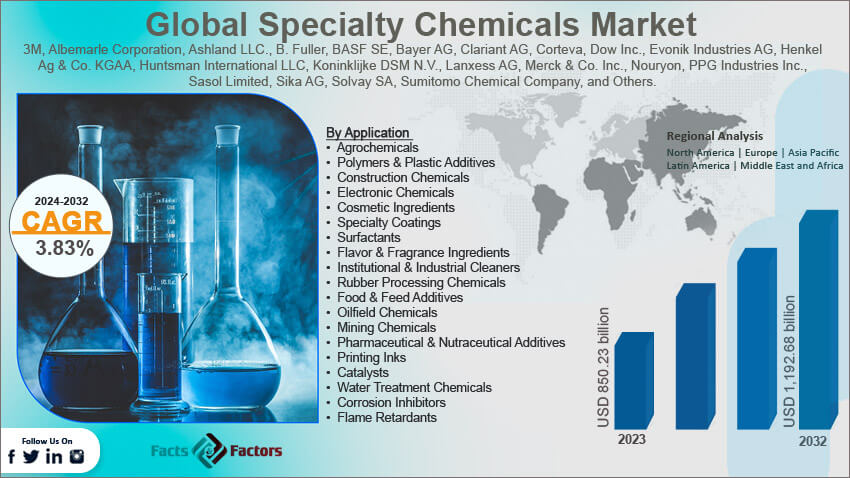

Specialty Chemicals Market Size, Share, Growth Analysis Report By Application (Agrochemicals, Polymers & Plastic Additives, Construction Chemicals, Electronic Chemicals, Cosmetic Ingredients, Specialty Coatings, Surfactants , Flavor & Fragrance Ingredients, Adhesives, Sealants and Elastomers (CASE), Institutional & Industrial Cleaners, Rubber Processing Chemicals, Food & Feed Additives, Oilfield Chemicals, Mining Chemicals, Pharmaceutical & Nutraceutical Additives, Printing Inks, Catalysts, Water Treatment Chemicals, Corrosion Inhibitors, Flame Retardants, and Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

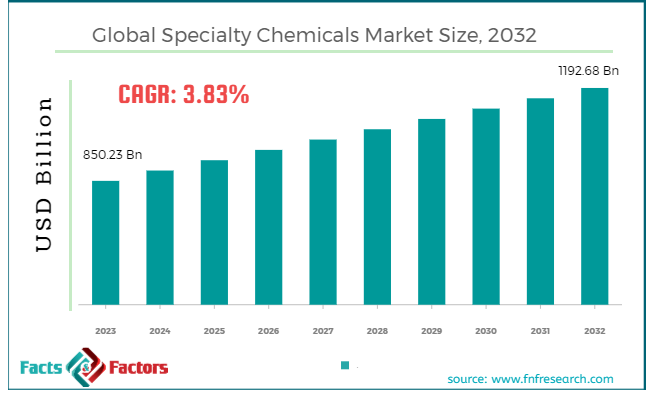

[225+ Pages Report] According to Facts & Factors, the global specialty chemicals market size in terms of revenue was valued at around USD 850.23 billion in 2023 and is expected to reach a value of USD 1,192.68 billion by 2032, growing at a CAGR of roughly 3.83% from 2024 to 2032. The global specialty chemicals market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Specialty chemicals are particular chemical products that provide a wide range of effects on which many industries depend. Unlike commodity chemicals, which are primarily produced in large quantities and have fairly standard specifications, specialty chemicals are characterized by their performance-enhancing properties and are tailored for specific applications or uses. These chemicals are crucial in the development of innovative products and technologies and are typically used in small quantities but command higher prices due to their specialized nature.

The specialty chemicals sector encompasses a diverse range of chemical products including adhesives, agrichemicals, cleaning materials, cosmetic additives, construction chemicals, elastomers, flavors, food additives, fragrances, industrial gases, lubricants, polymers, surfactants, and textile auxiliaries among others. These chemicals are integral to various industries, including automotive, aerospace, food, cosmetics, agriculture, manufacturing, and textiles.

Key Highlights

Key Highlights

- The specialty chemicals market has registered a CAGR of 3.83% during the forecast period.

- In terms of revenue, the global specialty chemicals market was estimated at roughly USD 850.23 billion in 2023 and is predicted to attain a value of USD 1,192.68 billion by 2032.

- The growth of the specialty chemicals market is being propelled by rising demand from end-use industries, growing technological advancements and rising environmental concerns.

- Based on Application, the polymers & plastic additives segment is growing at a high rate and is projected to dominate the global market at a CAGR of around 7.3%.

- By region, the Asia-Pacific region dominates the global specialty chemicals market in terms of growth rate due to its large-scale industrial expansion and increasing local demand for high-performance chemicals.

Growth Drivers:

Growth Drivers:

- Rising Demand from End-Use Industries: Sectors like automotive, electronics, construction, and pharmaceuticals increasingly require high-performance materials. Specialty chemicals are crucial for enhancing product features and functionalities in these industries.

- Innovation Focus: Specialty chemical companies constantly develop novel products with improved properties. This focus on innovation ensures they cater to ever-evolving industry needs and stay ahead of the curve.

- Growing Environmental Concerns: Sustainability is a growing priority. The development of eco-friendly specialty chemicals is gaining traction, driven by stricter environmental regulations and consumer preferences for environmentally conscious products.

Restraints:

Restraints:

- Fluctuating Raw Material Prices: Specialty chemicals rely on various raw materials. Price volatility in these materials can significantly impact production costs and profitability for manufacturers.

- Stringent Regulations: Stringent regulations regarding safety, environmental impact, and product composition can pose challenges for specialty chemical companies. Ensuring compliance often requires significant investments in research, development, and reformulation of products.

- Intense Competition: The specialty chemicals market is highly competitive. Companies constantly strive to differentiate themselves through innovation, cost-effectiveness, and brand reputation.

Opportunities:

Opportunities:

- Emerging Markets: Developing economies in Asia and Africa present significant growth potential for specialty chemicals due to rapid industrialization and rising consumer spending.

- Focus on Green Technologies: The growing demand for sustainable solutions opens doors for specialty chemicals that can enhance energy efficiency, reduce environmental impact, and support the development of green technologies like renewable energy.

- Advancements in Manufacturing Processes: Technological advancements in manufacturing processes can lead to increased efficiency, reduced waste, and potentially lower production costs, making specialty chemicals more accessible to a wider range of applications.

Challenges:

Challenges:

- Consolidation in the Industry: The specialty chemicals market is witnessing consolidation, with mergers and acquisitions occurring. This can lead to reduced competition and potentially higher prices for certain specialty chemicals.

- Geopolitical Uncertainties: Global trade tensions and political instability can disrupt supply chains and raw material availability, impacting production and pricing in the specialty chemicals market.

- Skilled Workforce Shortage: The specialty chemicals industry requires a skilled workforce with expertise in chemistry, engineering, and regulatory compliance. Addressing this potential talent gap is crucial for sustained growth.

Specialty Chemicals Market: Segmentation Analysis

Specialty Chemicals Market: Segmentation Analysis

The global specialty chemicals market is segmented based on application and function.

By Application Insights

By Application Insights

On the basis of Application, the global specialty chemicals market is categorized into agrochemicals, polymers & plastic additives, construction chemicals, electronic chemicals, cosmetic ingredients, specialty coatings, surfactants, and flavor & fragrance ingredients. Agrochemicals include pesticides, insecticides, herbicides, and fungicides used in agriculture to enhance crop yield and quality. This segment shows moderate growth driven by the increasing global demand for food and advancements in farming practices. Polymers & plastic additives consist of chemicals added to polymers and plastics to modify their properties for specific uses, such as plasticizers, flame retardants, and stabilizers. Expected to grow significantly due to the expanding use of plastics in various industries like packaging, automotive, and construction.

Construction chemicals are used to enhance the performance of construction materials and include concrete admixtures, waterproofing chemicals, and adhesives & sealants. Rapid growth is anticipated, fueled by global infrastructure development and urbanization. Electronic chemicals are used in the manufacture and processing of electronic components such as semiconductors and printed circuit boards (PCBs). This segment has a high growth potential, especially with the increasing demand for electronic devices and components. Cosmetic ingredients are specialty chemicals that are used in the formulation of personal care products, including active ingredients for skincare and haircare formulations. Growing consumer interest in advanced cosmetic products is driving the demand for innovative and high-quality ingredients.

Specialty coatings are engineered to provide superior performance and durability for various industrial and consumer products. Steady growth is driven by technological advancements and the increasing demand for environmentally friendly coatings. Surfactants are compounds that lower the surface tension between two substances, such as those found in detergents and emulsifiers. Expected to experience robust growth due to their widespread use in household and industrial cleaning products. Flavor & fragrance ingredients are used to enhance flavor and aroma in food and beverage products, as well as in personal and household care products. Consistent growth is anticipated, propelled by consumer preferences for more sophisticated sensory experiences.

Recent Developments:

Recent Developments:

- In December 2023, Brandt, a prominent US-based company, introduced its new biostimulant, Fenglihui Anjiachun, to the Chinese market. This product, which is rich in sugar alcohol and amino acids, is now distributed by Beijing Xinhefeng Agricultural Materials, enhancing its accessibility to local consumers.

- In April 2023, GELITA AG launched CONFIXX, a fast-setting gelatin specifically designed for the starch-free production of fortified gummies. This product development marks a significant innovation in gummy manufacturing, allowing for enhanced sensory profiles, cost reductions, and more efficient production processes, which are particularly beneficial for supplement producers looking to integrate various active ingredients seamlessly.

- In February 2023, MEGGLE GmbH & Co. KG broadened its distribution capabilities by forming partnerships with key distributors such as Barents for its PGM catalyst products in the U.S. This expansion is part of MEGGLE's strategy to strengthen its presence in the western European PGM catalyst market and to enhance service delivery and market reach.

- In December 2022, Dow introduced the SILASTIC SA 994X Liquid Silicone Rubber (LSR) series. These new offerings demonstrate Dow's commitment to innovation in materials technology, focusing on safety, environmental sustainability, and efficiency. The SILASTIC SA 994X series features a range of products, including primerless, self-adhesive, general-purpose, and self-lubricating LSRs, all designed to meet diverse needs in the mobility and transportation sectors with a convenient one-to-one mix ratio.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 850.23 Billion |

Projected Market Size in 2032 |

USD 1192.68 Billion |

CAGR Growth Rate |

3.83% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

3M, Albemarle Corporation, Ashland LLC., B. Fuller, BASF SE, Bayer AG, Clariant AG, Corteva, Dow Inc., Evonik Industries AG, Henkel Ag & Co. KGAA, Huntsman International LLC, Koninklijke DSM N.V., Lanxess AG, Merck & Co. Inc., Nouryon, PPG Industries Inc., Sasol Limited, Sika AG, Solvay SA, Sumitomo Chemical Company, and Others. |

Key Segment |

By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Specialty Chemicals Market: Regional Insights

Specialty Chemicals Market: Regional Insights

Asia-Pacific region dominated the global specialty chemicals market with the highest revenue share of 48.21% in 2023. China and India are the predominant markets, due to rapid industrialization, growing middle-class populations, and increasing domestic consumption. The region benefits from competitive manufacturing costs and favorable government policies. Asia-Pacific is expected to have the highest CAGR, propelled by strong economic growth, expanding industrial sectors, and significant foreign investment.

North America is a major player in the specialty chemicals market, because of its advanced industrial infrastructure and significant investments in research and development. The United States leads in the region, driven by robust manufacturing sectors and substantial technological advancements. The market in North America is characterized by a strong CAGR of around 4.82% during the forecast period, supported by innovation in chemical products and a stringent regulatory environment that pushes for high-performance and environmentally friendly chemicals.

Europe is known for its strict environmental and safety regulations, which have shaped a highly innovative specialty chemicals market. Countries like Germany, the UK, France, and the Netherlands are key contributors, focusing on high-value, low-volume chemicals that are critical to various industrial applications. The European market will exhibit a stable growth rate at a CAGR of 3.71% by 2032, with a particular emphasis on sustainability and green chemistry, driving the development of novel specialty chemicals.

Latin America’s specialty chemicals market is expanding at a CAGR of 3.17% by the end of 2032, driven by growth in agricultural, manufacturing, and extractive industries. Brazil and Mexico are the leading markets, leveraging abundant natural resources and growing industrial bases. While smaller than the other major regions, Latin America shows promising growth potential, particularly in agrochemicals and mining-related chemicals.

The market in the Middle East and Africa is developing, with a focus on diversifying economies away from oil dependence. This region is investing in construction and infrastructure, which boosts the demand for various specialty chemicals. The growth rate in this region is increasing, thanks to economic diversification efforts and investment in local chemical manufacturing.

Specialty Chemicals Market: List of Key Players Profiled

Specialty Chemicals Market: List of Key Players Profiled

Some of the main competitors dominating the global specialty chemicals market include;

- 3M

- Albemarle Corporation

- Ashland LLC.

- B. Fuller

- BASF SE

- Bayer AG

- Clariant AG

- Corteva

- Dow, Inc.

- Evonik Industries AG

- Henkel Ag & Co. KGAA

- Huntsman International LLC

- Koninklijke DSM N.V.

- Lanxess AG

- Merck & Co., Inc.

- Nouryon

- PPG Industries Inc.

- Sasol Limited

- Sika AG

- Solvay SA

- Sumitomo Chemical Company

The global specialty chemicals market is segmented as follows:

By Application

By Application

- Agrochemicals

- Polymers & Plastic Additives

- Construction Chemicals

- Electronic Chemicals

- Cosmetic Ingredients

- Specialty Coatings

- Surfactants

- Flavor & Fragrance Ingredients

- Adhesives, Sealants and Elastomers (CASE)

- Institutional & Industrial Cleaners

- Rubber Processing Chemicals

- Food & Feed Additives

- Oilfield Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- Printing Inks

- Catalysts

- Water Treatment Chemicals

- Corrosion Inhibitors

- Flame Retardants

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- 3M

- Albemarle Corporation

- Ashland LLC.

- B. Fuller

- BASF SE

- Bayer AG

- Clariant AG

- Corteva

- Dow, Inc.

- Evonik Industries AG

- Henkel Ag & Co. KGAA

- Huntsman International LLC

- Koninklijke DSM N.V.

- Lanxess AG

- Merck & Co., Inc.

- Nouryon

- PPG Industries Inc.

- Sasol Limited

- Sika AG

- Solvay SA

- Sumitomo Chemical Company

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors