Search Market Research Report

Shipbroking Market Size, Share Global Analysis Report, 2019–2026

Shipbroking Market By Services (Chartering, Sale and Purchase, Offshore, New Buildings and Salvage & Towage) and By Verticals (Oil and Gas, Manufacturing, Aerospace and Defense, Government and Others): Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

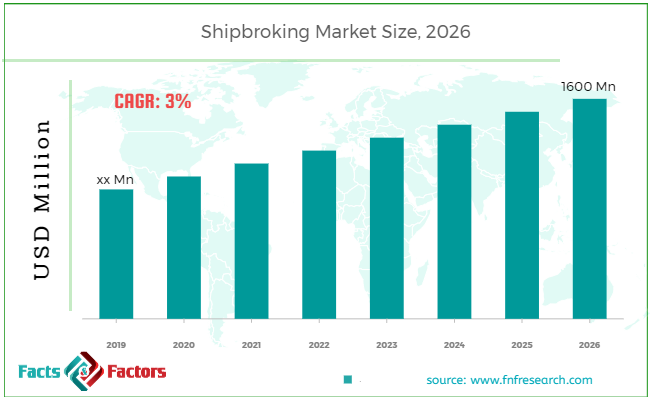

[110+ Pages Report] According to the report published by Facts Factors, the global shipbroking market size was worth around USD 1600 million by 2026 with a compound annual growth rate (CAGR) of roughly 3% between 2020 and 2026. The report analyzes the global shipbroking market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the shipbroking market.

This professional and specialized report study examines the technical and business perspective of the shipbroking industry. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the shipbroking market. The report study analyzes the market statistics at the global as well as the regional levels to gain an in-depth perspective of the overall shipbroking market. The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026.

The quantitative data is provided in terms of value (USD Million) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the shipbroking market in our study.

Key Insights from Primary Research

Key Insights from Primary Research

- Wide ranging interviews with high ranking representatives of major shipbroking companies provided factual qualitative and quantitative insights of shipbroking market. The overallinsights obtained from the interviews projects for steadygrowth of shipbroking marketin vicinity of 3% CAGR during forecast period of 2020 to 2026.

- The intervieweesanticipate the global shipbroking market value to surpass the figure of USD 1600 Million. The market projections of primary respondents were validated after comparison with our secondary researchundertaken by experienced analyst team.

- The chartering service is expected to remain most sought after service by contributing for more than 50 % of total market share. The respondents also believe in offshore services to register steady growth while continuing to remain second most shipbroking service in demand.

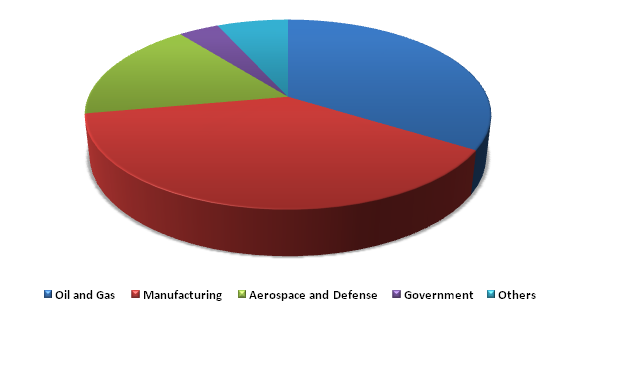

- The manufacturing sector and the oil and gas sector are anticipated to remain major source of revenue contribution among the verticals. These verticals are anticipated to hold more than 70 % segmental market share.

- Regionally, Asia-Pacific region is expected to exhibit highest growth among regions. European region is projected to be second largest market for shipbroking industry.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Primary insights garnered through regional analysis suggests for greater business potential in Asia Pacific market especially in major manufacturing like China, Japan and Korea. Additionally, India is also expected to see an up rise in manufacturing sector.

- Establishing shipbroking offices in APAC countries will provide opportunities in early holding and expansion of business.

- Shipbroking partners are expected to remain key contributors in business growth in new regions. The marketing expertise and client relations will drive the business growth. Additionally, quantity will also play important role as more number of shipbrokers will help in increasing the customer base.

- Modern technology adoption is expected to act as key factor in competitive environment wherein major shipbroking companies are increasing incorporating new technologies in improving market monitoring and analytics.

Market Attractiveness – By Verticals 2026

Market Attractiveness – By Verticals 2026

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the shipbroking market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the shipbroking market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the shipbroking market.

The research study provides a critical assessment of the shipbroking industry by logically segmenting the market on the basis of services, verticals and regions. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026. The regional segmentation of the shipbroking industry includes the holistic bifurcation of all the five major continents including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Major transportation across the globe is conducted by sea route in terms of volume and value. The global shipping volume has been increasing year on year in parallel with the increase in seaborne trade across globe. Furthermore, digitization has been enhancing the communications on various digital platforms. The combination of rising seaborne trade and digitization in the shipbroking industry has been the primary driver for the growth of the shipbroking market.

Additionally, shipbrokers are playing an important role in providing consultation services. These shipbrokers through modern technologies are providing wide-ranging statistical inputs and expertise of the freight market to clients. Shipbrokers have also been in demand for providing professional legal assistance in resolving disputes raised in legal matters. The advantages gained through hiring shipbrokers have increased the demand for shipbroking services which in turn have propelled the growth of the shipbroking market.

The shipbroking market is segmented based on services and verticals. On the basis of services segmentation, the market is classified into chartering, sale and purchase, offshore, new buildings and salvage & towage. In terms of verticals segmentation, the market is bifurcated into oil and gas, manufacturing, aerospace and defense, government and others.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD XX Billion |

Projected Market Size in 2026 |

USD 1600 Million |

CAGR Growth Rate |

3% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Barry RoglianoSalles International S.A, Braemar Shipping Services PLC, Bright Cook & Co (S&P) Limited, Charles R. Weber Company, Inc., CLARKSON PLC, Compass Maritime Services, LLC, E.A. Gibson Shipbrokers Ltd, Howe Robinson Partners, INTEROCEAN SHIPPING COMPANY, Maersk Broker K/S, McQuilling Partners, Inc., Poten and Partners Group, Inc., Simpson Spence Young, SPI Marine, and Velian Ship Brokers. |

Key Segment |

By Services, By Verticals, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the essential players operating in the shipbroking market, but not restricted to include

Some of the essential players operating in the shipbroking market, but not restricted to include

- Barry RoglianoSalles International S.A

- Braemar Shipping Services PLC

- Bright Cook & Co (S&P) Limited

- Charles R. Weber Company Inc.

- CLARKSON PLC

- Compass Maritime Services

- LLC

- E.A. Gibson Shipbrokers Ltd

- Howe Robinson Partners

- INTEROCEAN SHIPPING COMPANY

- Maersk Broker K/S

- McQuilling Partners Inc.

- Poten Partners Group Inc.

- Simpson Spence Young

- SPI Marine

- Velian Ship Brokers.

The taxonomy of the shipbroking industry by its scope and segmentation is as follows:

By ServicesSegmentation Analysis

By ServicesSegmentation Analysis

- Chartering

- Sale and Purchase

- Offshore

- New Buildings

- Salvage and Towage

By Verticals Segmentation Analysis

By Verticals Segmentation Analysis

- Oil and Gas

- Manufacturing

- Aerospace and Defense

- Government

- Others

By Regional Segmentation Analysis

By Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- Barry RoglianoSalles International S.A

- Braemar Shipping Services PLC

- Bright Cook & Co (S&P) Limited

- Charles R. Weber Company Inc.

- CLARKSON PLC

- Compass Maritime Services

- LLC

- E.A. Gibson Shipbrokers Ltd

- Howe Robinson Partners

- INTEROCEAN SHIPPING COMPANY

- Maersk Broker K/S

- McQuilling Partners Inc.

- Poten Partners Group Inc.

- Simpson Spence Young

- SPI Marine

- Velian Ship Brokers.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors