Search Market Research Report

Security Assurance Market Size, Share Global Analysis Report, 2020 – 2026

Security Assurance Market By Application (Business Applications, System & Network Infrastructure, and Mobility Solutions) by Organization Size (Large Sized Enterprises and Small and Medium-Sized Enterprises) for Industry Verticals (BFSI, Telecommunications, Government, Healthcare, Retail, Manufacturing, and Others) -Global Industry Perspective, Comprehensive Analysis and Forecast 2020 – 2026

Industry Insights

The security assurance market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire security assurance market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of value (USD Million) from FY 2016 – 2026.

This specialized and expertise-oriented industry research report scrutinizes the technical and commercial business outlook of the security assurance industry. The report analyzes and declares the historical and current trends analysis of the security assurance industry and subsequently recommends the projected trends anticipated to be observed in the security assurance market during the upcoming years.

Key Insights from Primary Research

Key Insights from Primary Research

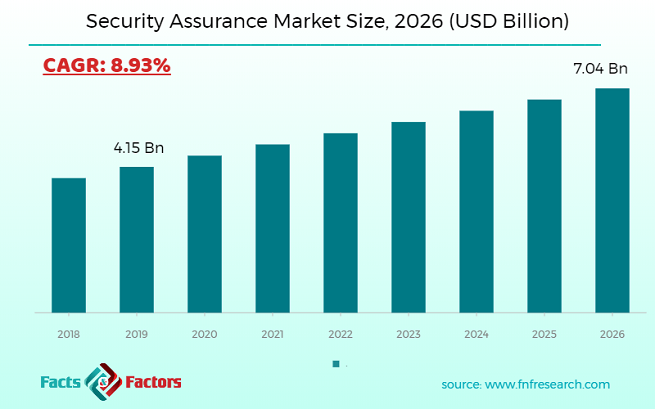

- As per our primary analysis, the global security assurance market is expected to reach around USD 7 billion in 2026

- North America emerged as a leading regional market for global security assurance market in 2019 and accounted for over 49% of the revenue share. Most of the primary respondents told us that, growing cyber-attack, paired with the availability of various cloud-based security solutions will be key factors predicted to shape the growth of the North American security assurance market in coming years

- BFSI accounted for the largest revenue share in the global security assurance market the last year.

- According to our respondent, Europe is also expected to contribute significantly to the global security assurance market in the near future, owing to rising government and private enterprises' investments in data security. In addition, the new regulation which is the EU General Data Protection Regulation (GDPR) is expected to drive numerous enterprises to increase spending on information security.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, the security assurance market revenue was around USD 28 billion in 2019.

- The healthcare industry vertical is emerged as the fastest-growing security assurance market and is estimated to grow at a CAGR of 10.84% in the analysis period.

- Based on industry verticals, the BFSI segment accounted for the largest revenue and contribute around 26% of revenue share in the global security assurance market

- Our analysts believe that Asia Pacific is expected to be the fastest-growing region in the global security assurance market in the coming years, owing to the requirement to reduce IT security risks and the growing adoption of security assurance services among small and medium-sized enterprises in the region. The enterprises in Asia-Pacific have experienced being targeted by hackers as likened to other regions, due to unsuccessful cyber laws and lack of awareness. The rising digital transformation and the advent of IoT, are leading to current network infrastructure rising susceptible to cyber-attacks.

- Microsoft, IBM, Oracle, Micro Focus, SAS, Infosys, and Accenture are among the major market participant in the global security assurance marketplace

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the security assurance industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the security assurance industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the security assurance market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the security assurance industry. The security assurance market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market position in the security assurance sector. Key strategic developments in the Security Assurance market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the security assurance market are appropriately highlighted in the report.

North America has been particularly responsive to adopting advanced technologies, including cloud computing, artificial intelligence, and IoT. The growing adoption of security assurance solutions in large-sized enterprises in the region is expected to support North America to continue its dominance in the global security assurance market in the near future. In addition, avoidance of rising security breaches and threats is also expected to act as a driving strength for the growth of the market. The U.S. and Canada are the major contributing countries in this region. For instance, the adoption of advanced technologies by large-sized enterprises in Canada, including IoT devices, like connected networked sensors and baby monitors for municipal services. These technologies are adopted to protect confidential information or data. In addition, the presence of major IT players such as Microsoft, IBM, Oracle, SAP, and others in the U.S. also provides security assurance solutions to the various verticals in the region and also plays a supporting role in the growth of the market.

The security assurance market research report delivers an acute valuation and taxonomy of the security assurance industry by practically splitting the market on the basis of different detection, end-use, and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026. The regional segmentation of the security assurance industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa. Further, country-wise data for the security assurance industry is provided for the leading economies of the world.

The global security assurance market is segmented on the basis of application, organization size, industry verticals, and region. On the basis of application, the market is classified into mobility solutions, business applications, and systems and network infrastructure. The growth of the mobility solutions segment has been accelerated over the years. With the growing use and demand for mobile devices and connectivity, the networks are more vulnerable to cyber-attacks which are expected to further boost the growth of the mobility solutions segment in the coming period. By organization size, the global security assurance market is divided into large-sized enterprises and small and medium-sized enterprises. On the basis of industry verticals, the market is fragmented into BFSI, healthcare, government, manufacturing, retail, telecommunications, and others.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 4.15 billion |

Projected Market Size in 2026 |

USD 7.04 billion |

CAGR Growth Rate |

8.93% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Accenture, Signature Consulting Group, Avaya, Aura, BizCarta, IBM, Infosys, Micro Focus, Telos, Microsoft, OpenText, NETSCOUT, SAS, Sogeti, Cipher, CRITICAL Software, Content Security, Radix Security, Spirent, Happiest Minds, Oracle, Tenable, and Wipro among others. |

Key Segment |

By Application, By Organization Size, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

The taxonomy of the security assurance industry by its scope and segmentation is as follows:

Some of the major players operating in the security assurance market include

Some of the major players operating in the security assurance market include

- Accenture

- Signature Consulting Group

- Avaya

- Aura

- BizCarta

- IBM

- Infosys

- Micro Focus

- Telos

- Microsoft

- OpenText

- NETSCOUT

- SAS

- Sogeti

- Cipher

- CRITICAL Software

- Content Security

- Radix Security

- Spirent

- Happiest Minds

- Oracle

- Tenable

- Wipro

Application Segment Analysis

Application Segment Analysis

- Business Applications

- System & Network Infrastructure

- Mobility Solutions

Organization Size Segment Analysis

Organization Size Segment Analysis

- Large Sized Enterprises

- Small and Medium-Sized Enterprises

Industry Verticals Segment Analysis

Industry Verticals Segment Analysis

- BFSI

- Telecommunications

- Government

- Healthcare

- Retail

- Manufacturing

- Others

Regional Segmentation Analysis (Customizable)

Regional Segmentation Analysis (Customizable)

- North America

- The U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table of Content

Industry Major Market Players

- Accenture

- Signature Consulting Group

- Avaya

- Aura

- BizCarta

- IBM

- Infosys

- Micro Focus

- Telos

- Microsoft

- OpenText

- NETSCOUT

- SAS

- Sogeti

- Cipher

- CRITICAL Software

- Content Security

- Radix Security

- Spirent

- Happiest Minds

- Oracle

- Tenable

- Wipro

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors