Industry Insights

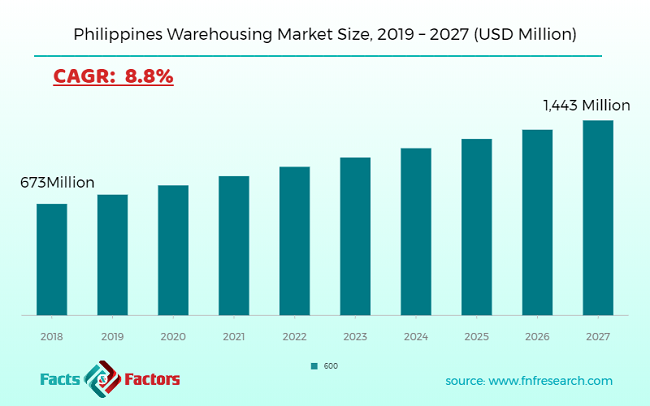

[160+ Pages Report] According to the report published by Facts and Factors, the global philippines warehousing market size was valued around USD 673 million in 2018 and is expected to grow to around USD 1,443 million by 2027 with a compound annual growth rate (CAGR) of roughly 8.8% between 2019 and 2027. The report analyzes the global philippines warehousing market drivers, challenges, and the impact they have on the demands during the forecast period. In addition, the report explores emerging opportunities in the philippines warehousing market.

To know more about this report | Request Free Sample Copy The report covers a forecast and an analysis of the Philippines warehousing market. The study provides historical data from 2013 to 2018 along with a forecast from 2019 to 2027 based on revenue (USD Million) and volume (Sq. Meter). The study includes drivers and restraints of the philippines warehousing market along with their impact on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the Philippines warehousing market.

The major growth driver of the Philippines warehousing market is the growing adoption of technology, such as automated guided vehicles, voice-directed picking, and pick to light, particularly for large enterprises and their warehouses. In addition, the escalating trend of same-day delivery by e-commerce giants has revolutionized the entire concept of traditional to technologically-advanced and automated warehouses, which is likely to further boost the Philippines warehousing market in the years ahead.

In order to give the users of this report a comprehensive view of the Philippines warehousing market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion.

The type segment of the market is categorized into agriculture, cold storage, container freight, general warehousing, and others. By the end-user, the market is fragmented into consumer durables, food and beverages, electronics, chemicals and materials, pharmaceutical, and others.

Report Attribute

Details

Market Size in 2018

USD 673 million

Projected Market Size in 2027

USD 1,443 million

CAGR Growth Rate

8.8%

Base Year

2018

Forecast Years

2019-2027

Key Market Players

Acuity Management Solutions, Elevate, LexisNexis, BusyLamp, THOMSON Reuters, doeLEGAL, SimpleLegal, Onit, MITRATECH, and Wolters Kluwer ELM Solutions, among others.

Key Segment

By Product Type, by End-User, By Region

Major Regions Covered

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

Purchase Options

Request customized purchase options to meet your research needs. Explore purchase options

The study provides a decisive view of the Philippines warehousing market by segmenting it based on type, end-user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2019 to 2027. The region segment includes the current and forecast demand for NCR, Bulacan, Cebu, Davao, Pampanga, Batangas, Cavite, Metro Iloilo, Bacolod, and Rest of Philippines.

Acuity Management Solutions,

Elevate,

LexisNexis,

BusyLamp,

THOMSON Reuters,

doeLEGAL,

SimpleLegal,

Onit,

MITRATECH,

Wolters Kluwer ELM Solutions

This report segments the Philippines warehousing market as follows:

General Warehousing

Container Freight

Cold Storage

Agriculture

Others

Food and Beverages

Chemicals and Materials

Electronics

Pharmaceutical

Consumer Durables

Others

NCR

Bulacan

Cebu

Davao

Pampanga

Batangas

Cavite

Metro Iloilo

Bacolod

Rest of Philippines

Table of Content

Chapter 1. Executive Summary 18 Chapter 2. Philippines Warehousing market - Regional Coverage Analysis 21

2.1. Philippines Warehousing Market - Regional Coverage Overview 21

2.2. Philippines Warehousing Market Share, by Regional Coverage, 2018 & 2025 (USD Million) 21

2.3. International 23

2.3.1. International Philippines Warehousing Market, 2013-2027 (USD Million) 23

2.4. Domestic 24

2.4.1. Domestic Philippines Warehousing Market, 2013-2027 (USD Million) 24

Chapter 3. Philippines Warehousing market - Type Analysis 24

3.1. Philippines Warehousing Market - Type Overview 24

3.2. Philippines Warehousing Market Share, by Type, 2018 & 2025 (USD Million) 25

3.3. General Warehousing 26

3.3.1. General Warehousing Philippines Warehousing Market, 2013-2027 (USD Million) 26

3.4. Container Freight 27

3.4.1. Container Freight Philippines Warehousing Market, 2013-2027 (USD Million) 27

3.5. Cold Storage 28

3.5.1. Cold Storage Philippines Warehousing Market, 2013-2027 (USD Million) 28

3.6. Agriculture 29

3.6.1. Agriculture Philippines Warehousing Market, 2013-2027 (USD Million) 29

3.7. Others 30

3.7.1. Others Philippines Warehousing Market, 2013-2027 (USD Million) 30

Chapter 4. Philippines Warehousing market - End User Analysis 30

4.1. Philippines Warehousing Market - End User Overview 30

4.2. Philippines Warehousing Market Share, by End User, 2018 & 2025 (USD Million) 31

4.3. Food & Beverage 32

4.3.1. Food & Beverage Philippines Warehousing Market, 2013-2027 (USD Million) 32

4.4. Chemicals & Materials 33

4.4.1. Chemicals & Materials Philippines Warehousing Market, 2013-2027 (USD Million) 33

4.5. Electronics 34

4.5.1. Electronics Philippines Warehousing Market, 2013-2027 (USD Million) 34

4.6. Pharmaceutical 35

4.6.1. Pharmaceutical Philippines Warehousing Market, 2013-2027 (USD Million) 35

4.7. Consumer Durables 36

4.7.1. Consumer Durables Philippines Warehousing Market, 2013-2027 (USD Million) 36

4.8. Others 37

4.8.1. Others Philippines Warehousing Market, 2013-2027 (USD Million) 37

Chapter 5. Philippines Warehousing market - Regional Analysis 38

5.1. Philippines Warehousing Market Regional Overview 38

5.2. Philippines Warehousing Market Share, by Region, 2018 & 2025 (Value) 38

5.3. Philippines 39

5.3.1. Philippines Philippines Warehousing Market size and forecast, 2013-2027 39

5.3.2. Philippines Philippines Warehousing Market, by Country, 2018 & 2025 (USD Million) 39

5.3.3. Philippines Philippines Warehousing Market, by Regional Coverage, 2013-2027 41

5.3.3.1. Philippines Philippines Warehousing Market, by Regional Coverage, 2013-2027 (USD Million) 41

5.3.4. Philippines Philippines Warehousing Market, by Type, 2013-2027 42

5.3.4.1. Philippines Philippines Warehousing Market, by Type, 2013-2027 (USD Million) 42

5.3.5. Philippines Philippines Warehousing Market, by End User, 2013-2027 43

5.3.5.1. Philippines Philippines Warehousing Market, by End User, 2013-2027 (USD Million) 43

5.3.6. NCR 44

5.3.6.1. NCR Market size and forecast, 2013-2027 (USD Million) 44

5.3.7. Bulacan 45

5.3.7.1. Bulacan Market size and forecast, 2013-2027 (USD Million) 45

5.3.8. Cebu 46

5.3.8.1. Cebu Market size and forecast, 2013-2027 (USD Million) 46

5.3.9. Davao 47

5.3.9.1. Davao Market size and forecast, 2013-2027 (USD Million) 47

5.3.10. Pampanga 48

5.3.10.1. Pampanga Market size and forecast, 2013-2027 (USD Million) 48

5.3.11. Batangas 49

5.3.11.1. Batangas Market size and forecast, 2013-2027 (USD Million) 49

5.3.12. Cavite 50

5.3.12.1. Cavite Market size and forecast, 2013-2027 (USD Million) 50

5.3.13. Metro Iloilo 51

5.3.13.1. Metro Iloilo Market size and forecast, 2013-2027 (USD Million) 51

5.3.14. Bacolod 52

5.3.14.1. Bacolod Market size and forecast, 2013-2027 (USD Million) 52

5.3.15. Rest of Philippines 53

5.3.15.1. Rest of Philippines Market size and forecast, 2013-2027 (USD Million) 53

Chapter 6. Philippines Warehousing market - Competitive Landscape 54

6.1. Competitor Market Share - Revenue 54

6.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 56

6.3. Strategic Development 57

6.3.1. Acquisitions and Mergers 57

6.3.2. New Products 57

6.3.3. Research & Development Activities 57

Chapter 7. Company Profiles 58

7.1. F2 Logistics Philippines Inc. 58

7.1.1. Company Overview 58

7.1.2. F2 Logistics Philippines Inc. Revenue and Gross Margin 58

7.1.3. Product portfolio 59

7.1.4. Recent initiatives 60

7.2. ICTSI 60

7.2.1. Company Overview 60

7.2.2. ICTSI Revenue and Gross Margin 60

7.2.3. Product portfolio 61

7.2.4. Recent initiatives 62

7.3. Kintetsu World Express 62

7.3.1. Company Overview 62

7.3.2. Kintetsu World Express Revenue and Gross Margin 62

7.3.3. Product portfolio 63

7.3.4. Recent initiatives 64

7.4. LBC Express Corporation 64

7.4.1. Company Overview 64

7.4.2. LBC Express Corporation Revenue and Gross Margin 64

7.4.3. Product portfolio 65

7.4.4. Recent initiatives 66

7.5. Li & Fung Limited 66

7.5.1. Company Overview 66

7.5.2. Li & Fung Limited Revenue and Gross Margin 66

7.5.3. Product portfolio 67

7.5.4. Recent initiatives 68

7.6. Metro Alliance Holdings & Equities Corp. 68

7.6.1. Company Overview 68

7.6.2. Metro Alliance Holdings & Equities Corp. Revenue and Gross Margin 68

7.6.3. Product portfolio 69

7.6.4. Recent initiatives 70

7.7. Metro Combined Logistics Solutions Inc. 70

7.7.1. Company Overview 70

7.7.2. Metro Combined Logistics Solutions Inc. Revenue and Gross Margin 70

7.7.3. Product portfolio 71

7.7.4. Recent initiatives 72

7.8. MMG INTEGRATED LOGISTICS PHILIPPINES 72

7.8.1. Company Overview 72

7.8.2. MMG INTEGRATED LOGISTICS PHILIPPINES Revenue and Gross Margin 72

7.8.3. Product portfolio 73

7.8.4. Recent initiatives 74

7.9. NIPPON EXPRESS (PHILIPPINES) CORPORATION 74

7.9.1. Company Overview 74

7.9.2. NIPPON EXPRESS (PHILIPPINES) CORPORATION Revenue and Gross Margin 74

7.9.3. Product portfolio 75

7.9.4. Recent initiatives 76

7.10. Orient Freight 76

7.10.1. Company Overview 76

7.10.2. Orient Freight Revenue and Gross Margin 76

7.10.3. Product portfolio 77

7.10.4. Recent initiatives 78

7.11. Philippine Postal Corporation 78

7.11.1. Company Overview 78

7.11.2. Philippine Postal Corporation Revenue and Gross Margin 78

7.11.3. Product portfolio 79

7.11.4. Recent initiatives 80

7.12. Royal Cargo 80

7.12.1. Company Overview 80

7.12.2. Royal Cargo Revenue and Gross Margin 80

7.12.3. Product portfolio 81

7.12.4. Recent initiatives 82

7.13. YUSEN LOGISTICS CO, LTD. 82

7.13.1. Company Overview 82

7.13.2. YUSEN LOGISTICS CO, LTD. Revenue and Gross Margin 82

7.13.3. Product portfolio 83

7.13.4. Recent initiatives 84

7.14. AAI Worldwide Logistics 84

7.14.1. Company Overview 84

7.14.2. AAI Worldwide Logistics Revenue and Gross Margin 84

7.14.3. Product portfolio 85

7.14.4. Recent initiatives 86

7.15. Afreight 86

7.15.1. Company Overview 86

7.15.2. Afreight Revenue and Gross Margin 86

7.15.3. Product portfolio 87

7.15.4. Recent initiatives 88

7.16. Airfreight 2100 Inc 88

7.16.1. Company Overview 88

7.16.2. Airfreight 2100 Inc Revenue and Gross Margin 88

7.16.3. Product portfolio 89

7.16.4. Recent initiatives 90

7.17. All Systems Logistics, Inc. 90

7.17.1. Company Overview 90

7.17.2. All Systems Logistics, Inc. Revenue and Gross Margin 90

7.17.3. Product portfolio 91

7.17.4. Recent initiatives 92

7.18. ATN 92

7.18.1. Company Overview 92

7.18.2. ATN Revenue and Gross Margin 92

7.18.3. Product portfolio 93

7.18.4. Recent initiatives 94

7.19. Chelsea Logistics Holdings Corp. 94

7.19.1. Company Overview 94

7.19.2. Chelsea Logistics Holdings Corp. Revenue and Gross Margin 94

7.19.3. Product portfolio 95

7.19.4. Recent initiatives 96

7.20. Expeditors International of Washington, Inc. 96

7.20.1. Company Overview 96

7.20.2. Expeditors International of Washington, Inc. Revenue and Gross Margin 96

7.20.3. Product portfolio 97

7.20.4. Recent initiatives 98

Chapter 8. Philippines Warehousing ' Industry Analysis 99

8.1. Philippines Warehousing Market - Key Trends 99

8.1.1. Market Drivers 100

8.1.2. Market Restraints 100

8.1.3. Market Opportunities 101

8.2. Value Chain Analysis 102

8.3. Technology Roadmap and Timeline 103

8.4. Philippines Warehousing Market - Attractiveness Analysis 104

8.4.1. By Regional Coverage 104

8.4.2. By Type 104

8.4.3. By End User 105

8.4.4. By Region 107

Chapter 9. Marketing Strategy Analysis, Distributors 108

9.1. Marketing Channel 108

9.2. Direct Marketing 109

9.3. Indirect Marketing 109

9.4. Marketing Channel Development Trend 109

9.5. Economic/Political Environmental Change 110

Chapter 10. Report Conclusion 111 Chapter 11. Research Approach & Methodology 112

11.1. Report Description 112

11.2. Research Scope 113

11.3. Research Methodology 113

11.3.1. Secondary Research 114

11.3.2. Primary Research 115

11.3.3. Models 116

11.3.3.1. Company Share Analysis Model 116

11.3.3.2. Revenue Based Modeling 117

11.3.3.3. Research Limitations 117

List of Figures

FIG. 1 Philippines Warehousing Market, 2013-2027 (USD Million) 20

List of Tables

TABLE 1 Philippines Warehousing Market, 2018 & 2025 (USD Million) 19

Report Scope

Report Scope Some of the leading players in the global market include

Some of the leading players in the global market include

By Type Analysis

By Type Analysis By End-User Analysis

By End-User Analysis By Region Analysis

By Region Analysis