Search Market Research Report

Pasta and Noodles Market Size, Share Global Analysis Report, 2020–2026

Pasta and Noodles Market By Type (Pasta, and Noodles); By Product Type (Ambient, Dried, and Chilled); By Sales Channel (Hypermarket/Supermarket, Convenience Store, Online Store, and Others): Europe Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

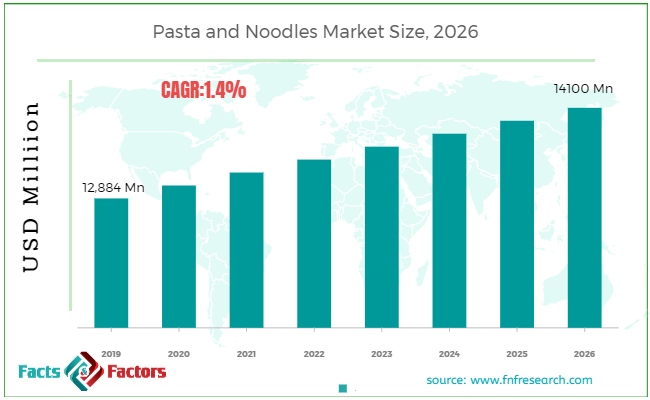

[189+ Pages Report] According to the report published by Facts Factors, the global pasta and noodles market size was worth around USD 12,884 million in 2019 and is predicted to grow to around USD 14100 million by 2026 with a compound annual growth rate (CAGR) of roughly 1.4% between 2020 and 2026. The report analyzes the global pasta and noodles market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the pasta and noodles market.

This specialized expertise oriented industry research report scrutinizes the technical and commercial business outlook of the pasta and noodles market. The report analyzes and declares the historical and current trends analysis of the pasta and noodles industry and subsequently recommends the projected trends anticipated to be observed in the pasta and noodles market in the upcoming years.

The pasta and noodles market report analyzes and notifies the industry statistics at the regional and country levels in order to acquire a thorough perspective of the entire pasta and noodles market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of both volumes (Units) and value (USD Million) from FY 2016 – 2026.

Key Insights from Primary Research

Key Insights from Primary Research

- As per our primary respondents The Europe pasta and noodles market is set to grow annually at a rate of 1.4%. In 2019, the market has accounted USD 12,884 million and expected to reach at around USD 14100 million by 2026.

- On basis of product type segment, ‘dried pasta and noodles’ dominated the Europe pasta and noodles market in 2019. This segment will be the fastest growing segment in next few years.

- On basis of type segment, ‘pasta’ dominated the Europe pasta and noodles market in 2019. Pasta segment will grow at a CAGR rate of 1.5% over the forecast period.

- On basis of sales channel segment, ‘Hypermarket/Supermarket' dominated the Europe pasta and noodles market in 2019. It has accounted USD 9,569.9 Million in 2019 and expected to be the fastest growing segment over the forecast timeline.

- As per our primary respondents, Italy region accounted the highest market share in the Europe pasta and noodles market in 2019. This segment generated revenues worth USD 9569.9 Million in 2019 and expected to reach around USD 10635.76 Million by 2026

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, the Europe pasta and noodles market is expected to grow significantly over the forecast period.

- As per analysts, the recent trend to manufacture healthier varieties of pasta and noodles is anticipated to accelerate the growth of the market during the forecast period.

- The strategic and competitive advantages provided by population growth and rising international tourism are estimated to drive this market.

- As per analysts, growth of e-commerce industry is contributing to the growth of the market.

- Our team of analysts has identified that Italy is expected to be the fastest growing country segment over the forecast period as pasta is the staple food for Italians. Moreover, Italian consumers are now demanding organic food products due to which the production of organic pasta increased significantly in this region. Therefore, all of these factors are projected to drive the growth of the pasta and noodle industry in this country over the forecast period.

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the pasta and noodles industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the pasta and noodles industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the pasta and noodles market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the pasta and noodles industry. The pasta and noodles market report additionally employ SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market position in the pasta and noodles sector. Key strategic developments in the pasta and noodles market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the pasta and noodles market are appropriately highlighted in the report.

Industry participants are continuously coming up with new ideas and trying to add value to create a specific brand experience in the minds of customers. Thereby, the key players are embracing some major developments such as introducing new flavors, healthy ingredients into products, and more packaging variants among others, in order to expand their consumer-base. Moreover, the manufacturers are focusing on producing gluten-free products in this industry owing to the consumer preference towards gluten-free products. For instance, Sapidum d.o.o., a European-based food manufacturer had started producing high-quality gluten-free products in Celje.

Such strategies are gaining prominence in consumer’s lives and thus the companies are creating demand in the market with innovative ideas and new launches which is driving the sales of the pasta and noodles in this region. Furthermore, in recent years, the food industry has undergone a dramatic transition. Consumer awareness has increased, impacting chemically loaded foodstuffs negatively. Thereby, evolving consumers' demand for chemical-free food products is encouraging food manufacturers to produce organic pasta and noodles, which is again projected to drive the demand for the market in the next four to five years in this region.

The pasta and noodles market research report delivers an acute valuation and taxonomy of the pasta and noodles industry by practically splitting the market on the basis of different types, applications, and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 12,884 Million |

Projected Market Size in 2026 |

USD 14100 Million |

CAGR Growth Rate |

1.4% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Nestlé, Barilla, Kraft Heinz Company, ITC, Conagra Brands, Newlat, Nissin Foods, De Cecco, BRF S.A., and Ebro Foods S.A, and Others |

Key Segment |

By Type, Product, Sales, and Region |

Major Regions Covered |

Germany, France, The U.K., Italy, Spain, Rest of Europe |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

The regional segmentation of the pasta and noodles industry includes the complete classification of all the major countries including Germany, France, The U.K., Italy, Spain, and Rest of Europe.

Europe pasta and noodles market has been segmented into type, product type, and sales channel. The type segment has been classified into pasta and noodles. Based on product type, the market has been categorized into ambient, dried, and chilled. Based on the sales channel, the market has been segregated into hypermarket/supermarket, convenience store, online store, and others.

Some of the essential players operating in the Europe pasta and noodles market, but not restricted to include

Some of the essential players operating in the Europe pasta and noodles market, but not restricted to include

- Nestlé

- Barilla

- Kraft Heinz Company

- ITC

- Conagra Brands

- Newlat

- Nissin Foods

- De Cecco

- BRF S.A.

- Ebro Foods S.A

This report segments the Europe pasta and noodles market as follows:

Europe Pasta and Noodles Market: By Type Segmentation Analysis (Customizable)

Europe Pasta and Noodles Market: By Type Segmentation Analysis (Customizable)

- Pasta

- Noodles

Europe Pasta and Noodles Market: By Product Type Segmentation Analysis (Customizable)

Europe Pasta and Noodles Market: By Product Type Segmentation Analysis (Customizable)

- Ambient

- Dried

- Chilled

Europe Pasta and Noodles Market: By Sales Channel Segmentation Analysis (Customizable)

Europe Pasta and Noodles Market: By Sales Channel Segmentation Analysis (Customizable)

- Hypermarket/Supermarket

- Convenience Store

- Online Store

- Others

Europe Pasta and Noodles Market: Regional Segmentation Analysis (Customizable)

Europe Pasta and Noodles Market: Regional Segmentation Analysis (Customizable)

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

Table of Content

Industry Major Market Players

- Nestlé

- Barilla

- Kraft Heinz Company

- ITC

- Conagra Brands

- Newlat

- Nissin Foods

- De Cecco

- BRF S.A.

- Ebro Foods S.A

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors