Search Market Research Report

North America Bin Liners Market Size, Share Global Analysis Report, 2019–2026

North America Bin Liners Market By Product Type (LDPE, HDPE, Paper, and Others) and By Application (Retail & Consumer, Jan/San, Oil & Gas Industry, and Other Industry): Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

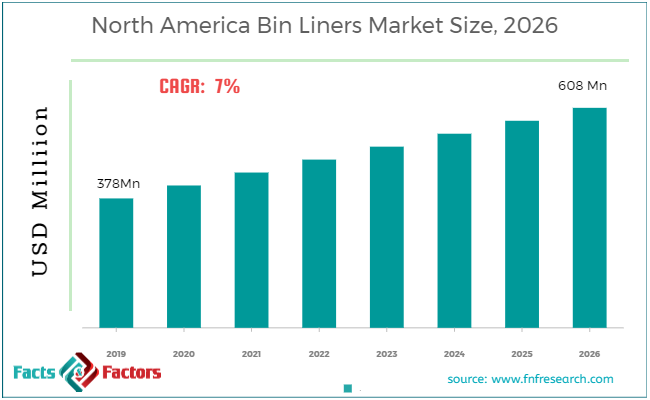

According to the report published by Facts Factors, the North American bin liners market size was worth around USD 378 million in 2019 and is predicted to grow to around USD 608 million by 2026 with a compound annual growth rate (CAGR) of roughly 7% between 2020 and 2026. The report analyzes the North America bin liners market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the North American bin liners market.

The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of both volume (Units) and value (USD Million) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

Key Insights from Primary Research

Key Insights from Primary Research

- As per our primary respondents, the North American bin liners market is set to grow annually at a rate of around 7%

- It was established through primary research that the North American bin liners market was valued at around USD 350 Million in 2018

- The “HDPE” category, on the basis of product type segmentation, was the leading revenue-generating category accounting for around USD 140 Million, in 2018

- On the basis of application segmentation, the “retail & consumer” category generated the leading revenue of about USD 135 Million in 2018

- The United States generated a major revenue of around USD 280 Million in 2018.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, awareness regarding the cleanliness and hygienic environment coupled with high investments from the government in terms of the same has fueled the target market in North America.

- Growing at a CAGR of around 7%, North American bin liners market provides numerous opportunities for all of the involved stakeholders across the entire value chain

- Our analysts have identified “HDPE” and “retail & consumer” categories as the leading investment pockets for the North American bin liners market in terms of product type and application segmentations respectively

- The United States in North America is anticipated to generate revenue of about USD 490 Million in 2026

- The North American bin liners market is expected to generate revenue of around USD 607 Million in 2026.

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the North America Bin Liners market in our study.

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the North America Bin Liners market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the North America Bin Liners market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and country-wise expansion of key players of the North America Bin Liners market.

The research study provides a critical assessment of the North America Bin Liners industry by logically segmenting the market on the basis of product type, application, and country. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026.

Awareness regarding dumping garbage and maintenance of a hygienic environment has compelled the usage of bin liners in North America. Moreover, government initiatives, investments as well as policies in terms of cleanliness have been boosting the target market growth in the region. Individuals in North America have been majorly focusing on liners that are recyclable and that can be reused. This has propelled the target market in the region as well. However, bans on plastics in some parts of North America are expected to hamper the target market in the region.

Companies in North America are making bin liners from recycled LDPE plastics, which are recyclable. Moreover, the companies are making liners that include an extensive range of thicknesses and sizes. These factors together are anticipated to further enhance and create lucrative growth opportunities for the target market in North America over the forecast.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 378 Million |

Projected Market Size in 2026 |

USD 608 Million |

CAGR Growth Rate |

7% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Glad (Clorox), Berry Plastics, Poly-America, Novolex, Inteplast Group (W. Ralston), North American Plastics and Chemicals, Colonial Bag Corp., Hymopack Ltd., and others. |

Key Segment |

By Product Type, Application, and Country |

Major Country Covered |

North America,( The U.S., Canada, and Mexico) |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

The North America Bin Liners market is segmented based on Product Type and Application. On the basis of product type segmentation, the market is classified into LDPE, HDPE, paper, and others. In terms of application segmentation, the market is bifurcated as retail & consumer, Jan/san, oil & gas industry, and other industry.

Some of the essential players operating in the North America Bin Liners market, but not restricted to include:

Some of the essential players operating in the North America Bin Liners market, but not restricted to include:

- Glad (Clorox)

- Berry Plastics

- Poly-America

- Novolex

- Inteplast Group (W. Ralston)

- North American Plastics Chemicals

- Colonial Bag Corp.

- Hymopack Ltd.

The taxonomy of the North America Bin Liners Market by its scope and segmentation is as follows:

By Product Type Segmentation Analysis

By Product Type Segmentation Analysis

- LDPE

- HDPE

- Paper

- Others

By Application Segmentation Analysis

By Application Segmentation Analysis

- Retail & Consumer

- Jan/San,

- Oil & Gas Industry

- Other Industry

By Country Segmentation Analysis

By Country Segmentation Analysis

- North America

- The U.S.

- Canada

- Mexico

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising a dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- Glad (Clorox)

- Berry Plastics

- Poly-America

- Novolex

- Inteplast Group (W. Ralston)

- North American Plastics Chemicals

- Colonial Bag Corp.

- Hymopack Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors